Wallet Security: Protect Your Crypto from Scams, Hacks, and Loss

When you hold crypto, wallet security, the practice of safeguarding your digital assets from theft, loss, or unauthorized access. Also known as crypto asset protection, it’s not optional—it’s the foundation of everything you do in crypto. No matter how smart your trades are or how big your gains, if your wallet is compromised, it’s all gone. And unlike banks, there’s no customer service to reverse a mistake or recover your funds.

Your private key, the secret code that gives you full control over your crypto holdings is the only thing standing between your coins and a thief. If someone gets it—through a phishing site, a malware-infected device, or a careless screenshot—they own your wallet. That’s why hardware wallet, a physical device designed to store crypto offline and resist remote hacking attempts is the gold standard for anyone holding more than a few hundred dollars. Devices like Ledger and Trezor keep your keys away from online threats, so even if your computer gets hacked, your crypto stays safe.

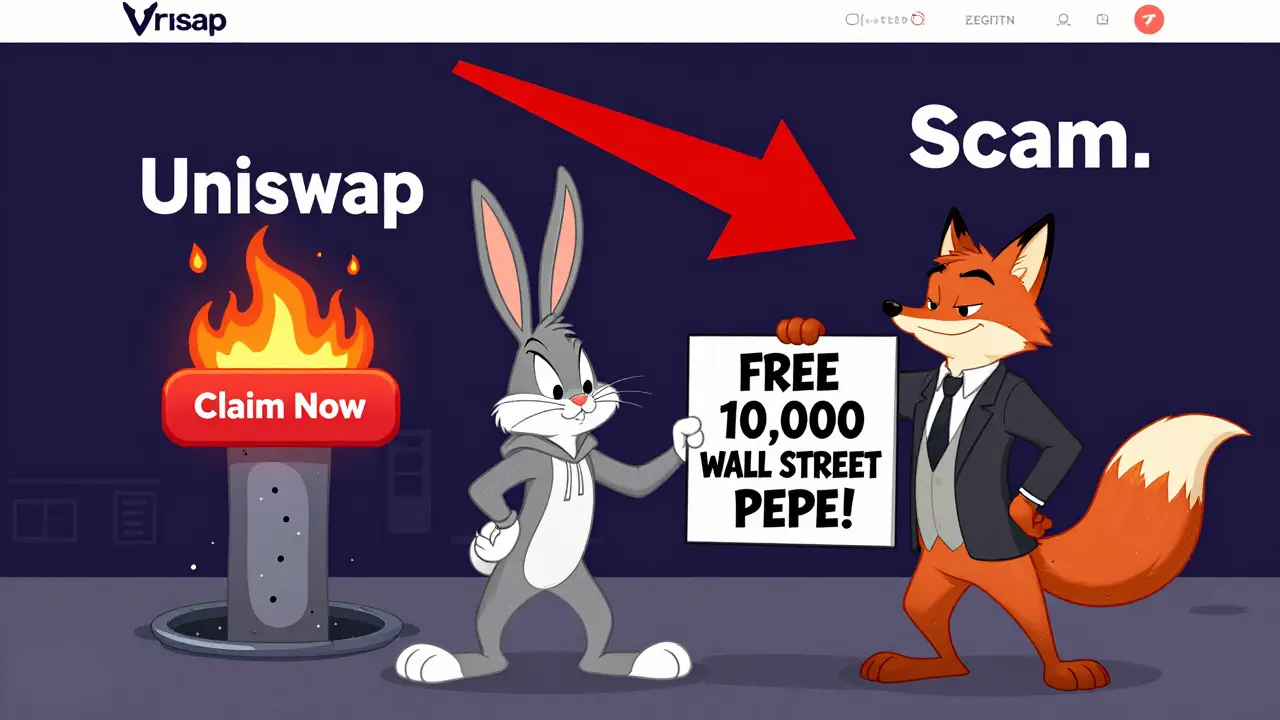

But wallet security isn’t just about tools—it’s about behavior. Most crypto losses come from people trusting fake websites, falling for airdrop scams, or clicking links that look real but lead to phishing pages. Look at the posts below: IMOEX, EvmoSwap, and VLX GRAND airdrop are all fake platforms designed to steal your login details or private keys. The SUNI and POLYS airdrops? They don’t exist. These aren’t just bad deals—they’re traps built to look like real opportunities. If a site asks for your seed phrase to "claim" tokens, close it. That’s like giving someone the key to your house and asking them to "help you lock it."

Even when you use a real exchange like Binance or MEXC, your wallet security starts the moment you withdraw to your own wallet. Keeping funds on an exchange is like leaving cash in a hotel room—you’re trusting someone else to protect it. With wallet security, you control everything. That means backing up your recovery phrase on paper, storing it in a fireproof safe, never typing it into a website, and avoiding public Wi-Fi when signing transactions.

And don’t forget: phishing scams, fraudulent attempts to trick users into revealing sensitive information like passwords or private keys are getting smarter. Fake Telegram channels, cloned exchange login pages, and even AI-generated customer support bots now mimic real brands perfectly. The only way to stay safe is to verify every URL, double-check official social accounts, and never rush a transaction.

Below, you’ll find real-world examples of how wallet security fails—and how to avoid the same mistakes. From scams pretending to be airdrops to exchanges with no regulation and zero proof of reserves, these posts show exactly what to watch for. You won’t find fluff here. Just clear, practical lessons from people who lost money because they skipped the basics. If you’re holding crypto, you need to know this stuff. Not tomorrow. Not next week. Today.