Sweden Energy Tax: How It Works and Why It Matters

When dealing with Sweden energy tax, a levy on electricity and fuel consumption designed to curb emissions and fund green initiatives, it helps to see the bigger picture. This tax is a form of carbon pricing that directly influences household bills and industrial costs. In practice, the tax rate varies by energy source, reflecting the government’s goal to push consumers toward cleaner options.

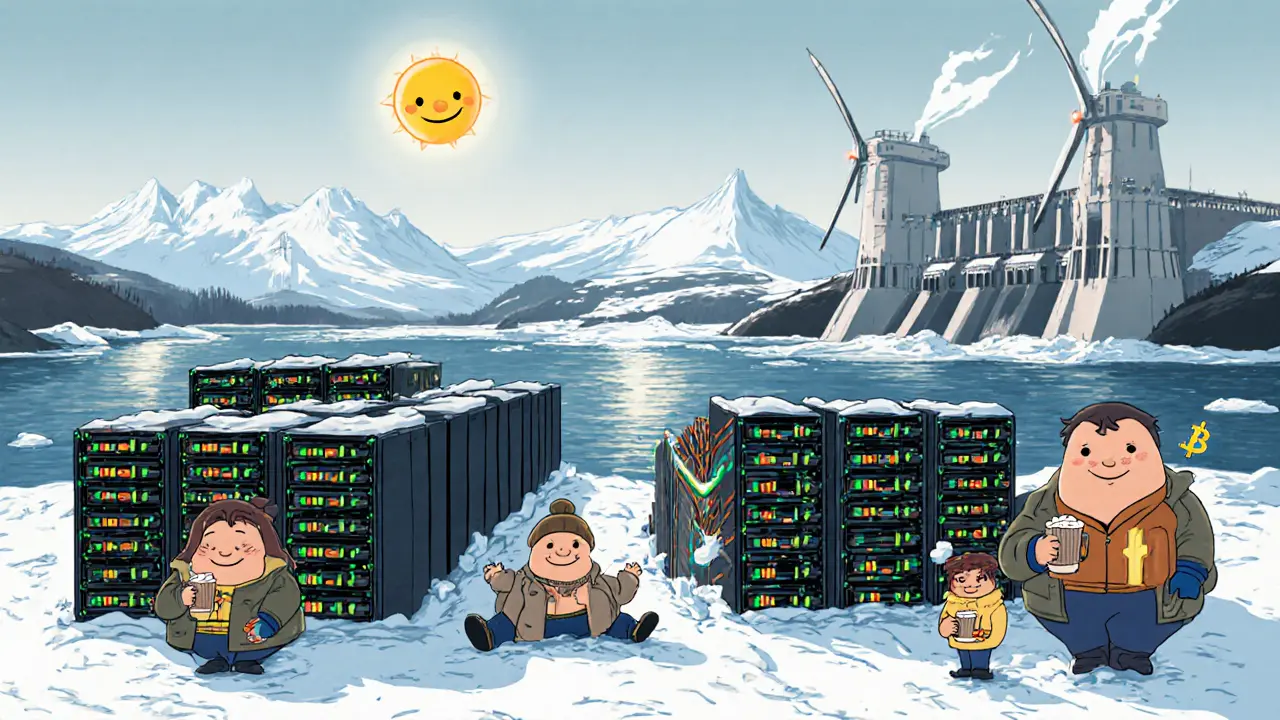

Related concepts shape how the tax operates. Carbon tax, a broader tax on CO₂ emissions applied across the EU sets the baseline for Sweden's own levy. Renewable energy subsidies, financial incentives that lower the cost of wind, solar, and hydro power interact with the tax by making greener choices more affordable. Electricity market regulation, rules governing how power is generated, traded, and priced in Sweden determines how the tax is passed on to end‑users. Finally, EU energy policy, the continent‑wide framework that guides national energy taxes and climate goals provides the overarching standards that Sweden follows.

Key Implications for Households and Businesses

The Sweden energy tax directly raises the price of electricity and gasoline, but it also funds projects that lower long‑term costs, like expanding the grid for renewables. For households, the tax means a higher monthly bill, yet many can offset this through government rebates tied to energy‑efficient appliances. Businesses face higher operating expenses, especially in energy‑intensive sectors, but they gain opportunities to invest in cleaner technologies that qualify for subsidies and tax credits.

Understanding these connections lets you see why the tax is more than just a charge—it’s a tool that pushes the market toward sustainability. Below you’ll find articles that break down the tax’s technical details, compare it with other European schemes, and offer practical tips on minimizing its impact on your budget.