Crypto Mining Profitability Calculator

Enter Your Mining Details

Use the latest Swedish energy tax rate (SEK 0.36/kWh) to calculate profitability.

Profitability Analysis

Electricity cost:

Estimated hourly revenue:

Break-even Bitcoin price:

When Sweden announced it was pulling the plug on its crypto‑mining tax breaks, the world took notice. The move turned a once‑friendly Nordic hub into what many now call the toughest jurisdiction for Bitcoin miners in Europe. Below you’ll find the full story, why it matters, and what miners should do next.

Quick Takeaways

- The 98% data‑center tax reduction introduced in 2017 is now fully withdrawn.

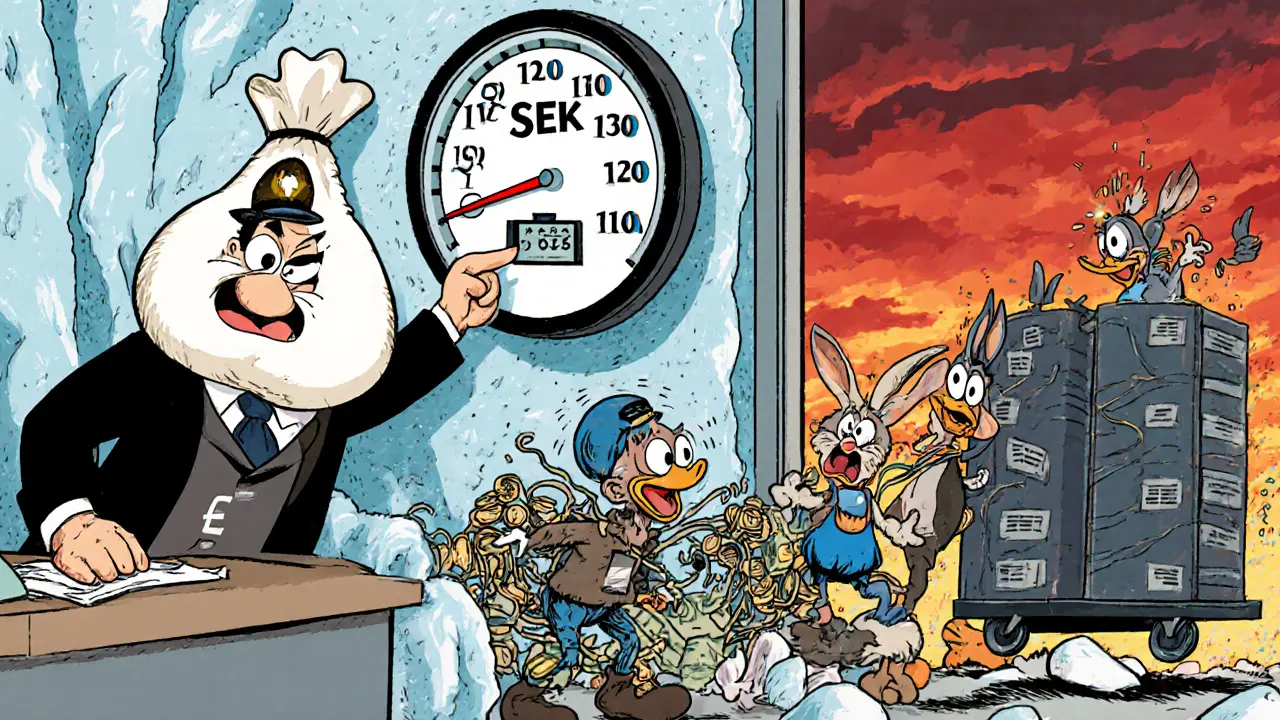

- Effective July2023, the energy tax jumped from SEK0.006 to SEK0.36 per kWh - a 6,000% increase.

- Sweden’s 150MW of crypto‑mining capacity has mostly vanished or relocated.

- New taxes make most ASIC rigs unprofitable unless Bitcoin prices triple.

- Other regions (Kazakhstan, US states, Canada) are seeing an influx of displaced miners.

What the Policy Change Looks Like

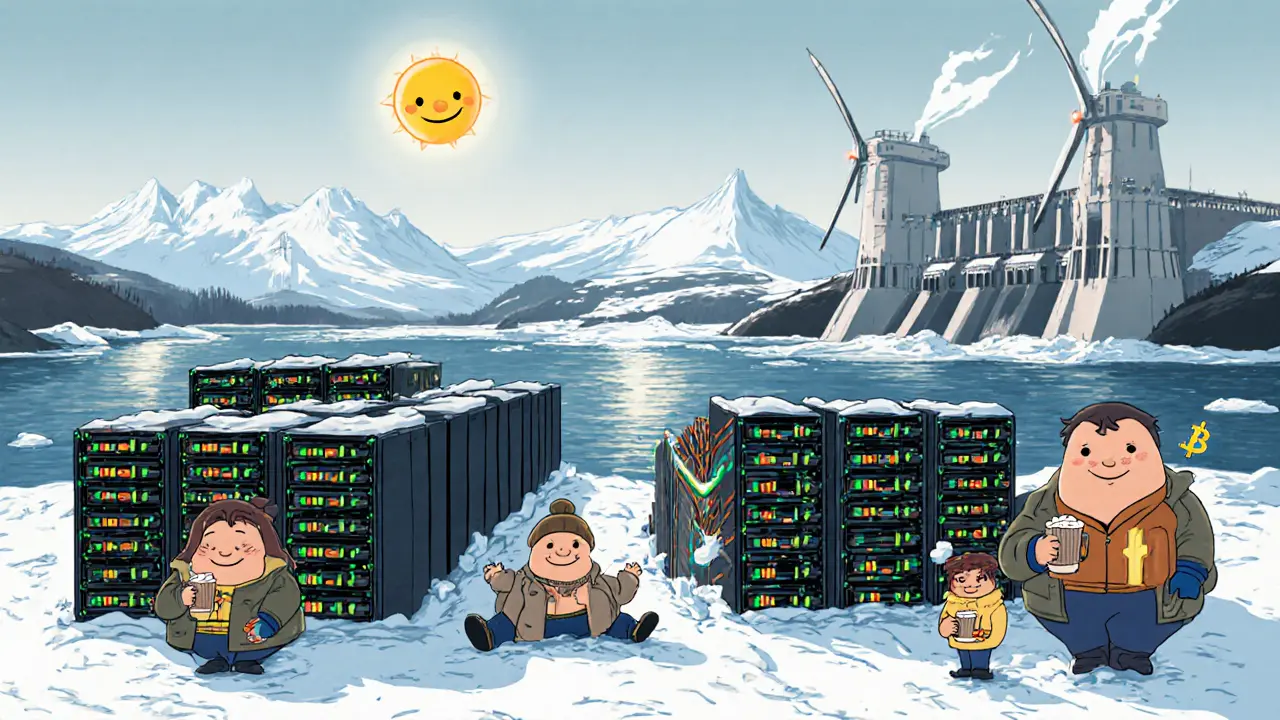

In 2017 Sweden rolled out a generous tax incentive that slashed corporate tax on data‑center electricity use by 98%. The lure of cheap hydroelectric power and a naturally cool climate attracted giants like Microsoft, Amazon, and Facebook, as well as dozens of smaller crypto farms. By 2022, roughly 150megawatts of mining equipment was humming in the north.

Fast forward to November2022: the Swedish finance ministry published a budget that eliminated the discount and introduced a punitive energy tax. The rate jumped from SEK0.006 ($0.0006) per kWh to SEK0.36 ($0.035) per kWh - a 6,000% hike. The tax took effect in July2023, giving operators barely any time to adjust.

Why Sweden Reversed Course

The government framed the shift as a response to two core concerns: environmental impact and economic contribution. Officials argued that crypto mining offered “minimal contribution to economic activity, job creation, and energy infrastructure,” especially after the 2018 market crash saw many operators default on electricity bills and strain the grid.

Sweden’s energy mix is heavily weighted toward hydroelectric power, which is both renewable and low‑cost. That made the country an outlier in Europe where electricity prices were soaring because of the Ukraine conflict. By raising the tax, policymakers aimed to protect cheap, clean energy for industries they deemed more socially valuable.

How the Numbers Stack Up

| Metric | Before July2023 | After July2023 |

|---|---|---|

| Corporate tax on electricity | 2% of market rate (98% reduction) | 100% of market rate (no reduction) |

| Energy tax per kWh | SEK0.006 ($0.0006) | SEK0.36 ($0.035) |

| Effective cost increase | ~0% (incentive) | ~5600% (tax hike) |

| Mining capacity retained | ~150MW | ~5MW (estimated) |

The math is stark: a typical ASIC miner consumes about 3kW. At the old rate, electricity cost would be roughly $0.012 per hour. After the hike, it jumps to $0.105 per hour, erasing most of the profit margin even when Bitcoin trades at $30,000.

Industry Reaction - From Shock to Exit

Operators on Reddit and crypto‑mining forums described the policy as “devastating.” One miner, who chose to stay anonymous, wrote, “We’re packing up 40ASIC rigs and shipping them to Kazakhstan. The tax alone would bleed us dry.”

Even large‑scale outfits that had built purpose‑built facilities faced a dilemma: either liquidate equipment in a market flooded with used hardware, or incur massive relocation costs. The sudden supply glut drove second‑hand ASIC prices down by 30% in Q42023.

Energy grid operators in northern Sweden also felt the shock. The abrupt loss of a 150MW load required rapid rebalancing, prompting temporary price spikes for residential consumers as the grid sought stability.

Where the Displaced Miners Are Going

Data from mining‑hardware exporters shows a clear migration pattern. By early 2024, shipments of ASICs from Sweden to Kazakhstan rose 120%, while U.S. states such as Texas and Wyoming saw a 45% increase in hardware arrivals. Canadian provinces like Alberta, which offers low‑cost natural‑gas power, also reported a modest uptick.

This redistribution is reshaping the global mining map. Countries that previously struggled to attract miners are now competing on electricity tariffs, climate‑friendly cooling, and regulatory certainty.

Comparing Sweden’s Approach to Other Jurisdictions

Sweden’s punitive tax stands in sharp contrast to places like ElSalvador, where the government subsidizes solar‑powered mining as part of its Bitcoin strategy. In the United States, several states actively market themselves as mining‑friendly, offering tax credits and low‑cost power. Even neighboring Norway, while cautious about energy consumption, has not imposed a dedicated mining tax.

Across the EU, most countries prefer a lighter‑touch approach: Germany imposes a modest electricity surcharge, while France focuses on environmental reporting. None have matched Sweden’s 6,000% tax increase, making Stockholm a cautionary tale for any jurisdiction considering a similarly aggressive stance.

Practical Steps for Miners Facing the New Regime

- Run a profitability calculator. Input your ASIC’s hash rate, power draw, current electricity cost (SEK0.36/kWh), and Bitcoin price. If the breakeven point exceeds realistic market forecasts, it’s time to consider relocation.

- Identify alternative jurisdictions. Look for regions with electricity costs below $0.05/kWh and clear regulatory guidance.

- Plan hardware logistics early. Shipping ASICs can take 4‑6 weeks; factor customs duties and insurance.

- Negotiate with your current energy provider for a phased shutdown to avoid abrupt contract penalties.

- Consider repurposing equipment for other high‑performance computing workloads (e.g., AI inference) if relocation proves too costly.

These steps can help mitigate financial loss and preserve the lifespan of expensive mining rigs.

Long‑Term Implications for European Crypto Policy

Sweden’s experiment is already influencing EU debates. Lawmakers cite the Swedish model when discussing a continent‑wide “energy‑intensive activity tax.” While no other member state has introduced comparable measures, the Swedish case provides a data point for both advocates of stricter regulation and those warning about stifling innovation.

For the broader crypto ecosystem, the lesson is clear: tax policy can be a decisive factor in where mining power concentrates. As the industry matures, we may see more jurisdictions using fiscal levers-either to attract or to deter-rather than outright bans.

Frequently Asked Questions

What exactly did Sweden change about its crypto‑mining taxes?

Sweden eliminated the 98% corporate tax reduction on data‑center electricity and introduced an energy tax of SEK0.36 per kilowatt‑hour, a 6,000% increase from the previous rate. The changes took effect in July2023.

How does the new tax affect ASIC profitability?

At the new electricity cost, an average ASIC consuming 3kW would pay about $0.105 per hour for power alone. Unless Bitcoin’s price jumps by several hundred percent, the operating cost outstrips the revenue from mining, rendering most rigs unprofitable.

Which countries are attracting former Swedish miners?

Kazakhstan, several U.S. states (notably Texas, Wyoming, and New York), and Canadian provinces such as Alberta and Saskatchewan have seen a noticeable influx of relocated mining equipment.

Is Sweden likely to re‑introduce incentives in the future?

Current political statements suggest the government views crypto mining as a low‑value, high‑energy activity. Reversing the tax would require a major shift in fiscal policy and public opinion, which seems unlikely in the near term.

What other EU nations are watching Sweden’s policy?

France, Germany, and the Netherlands have referenced Sweden in recent regulatory consultations, but none have proposed tax rates anywhere near the Swedish level.

Stefano Benny

May 15, 2025 AT 13:37Yo, the Swedish tax surge is a classic case of regulatory over‑engineering 📈-they just turned PoW into a cost‑center nightmare. The 6,000% hike in SEK‑per‑kWh skews the break‑even hash‑rate curve, making the marginal profitability metric negative for any ASIC under 110 TH/s. In plain terms, you’re paying more for electricity than you ever earn in block rewards, unless you’re moon‑shotting on BTC price. It’s a perfect storm of policy‑induced energy arbitrage collapse.

Jenae Lawler

May 15, 2025 AT 19:26While the aforementioned assessment captures the economic ramifications, it neglects the broader strategic implications for European energy policy. The Scandinavian precedent underscores a decisive shift toward safeguarding low‑cost renewable capacity for critical industries, rather than speculative crypto ventures. Such a stance may, in the long term, fortify grid stability and promote sustainable development, albeit at the expense of nascent mining enterprises.

Prince Chaudhary

May 16, 2025 AT 02:23We should acknowledge the resilience of miners facing this abrupt policy change. It is commendable that many are proactively evaluating relocation options, conducting thorough profitability analyses, and seeking jurisdictions with favorable electricity tariffs. By doing so, they not only preserve capital investment but also contribute to a more balanced global distribution of mining resources.

Jayne McCann

May 16, 2025 AT 09:20Honestly, the hype around Sweden’s tax move is overblown. Energy costs are just one piece of the puzzle, and miners have always adapted. If Bitcoin climbs, profit margins bounce back regardless of tax rates.

emmanuel omari

May 16, 2025 AT 14:53The simplistic view ignores the undeniable fact that Sweden’s decision is a triumph of fiscal sovereignty protecting national interests. By imposing a steep energy levy, the government safeguards its citizens from unnecessary power strain and redirects resources toward homegrown industries. This bold action sets a benchmark for other nations to follow.

Somesh Nikam

May 16, 2025 AT 21:50It's great to see miners taking data‑driven steps – run that profitability calculator, compare electricity rates, and then map out the logistics. 📊 The sooner you plan the hardware shipment, the smoother the transition, and you’ll avoid costly downtime. Keep the momentum going!

Jan B.

May 17, 2025 AT 04:46Sweden's move is a clear signal that crypto mining is no longer a free‑ride on cheap power.

MARLIN RIVERA

May 17, 2025 AT 11:43This is what happens when governments start whining about their budgets – they choke off innovation and punish anyone willing to take risk. Sweden just proved it can't handle disruptive tech, so expect more of the same in other progressive economies.

Debby Haime

May 17, 2025 AT 18:40Don't let this setback crush your enthusiasm! Use this as fuel to explore alternative energy solutions, maybe even on‑site solar or wind to offset the tax. Turning challenges into opportunities is the hallmark of true entrepreneurs.

Andy Cox

May 18, 2025 AT 01:36Interesting shift. It’ll be worth watching how the migration patterns affect local power markets elsewhere.

Courtney Winq-Microblading

May 18, 2025 AT 08:33The essence of this regulatory upheaval lies in the tension between individual enterprise and collective resource stewardship. When a state decides to prioritize communal energy stability over private profit, it forces a reexamination of value creation within the digital economy, prompting both reflection and adaptation among stakeholders.

katie littlewood

May 18, 2025 AT 15:30Reading about Sweden’s abrupt policy reversal feels like watching a high‑stakes drama unfold on the global mining stage, where each act reveals a new layer of complexity that challenges our assumptions about profitability, sustainability, and geopolitical maneuvering.

First, the sheer magnitude of the tax increase-6,000%-shatters any lingering optimism that miners could simply absorb the cost and keep humming along. The arithmetic is unforgiving: a 3 kW rig that once paid pennies per hour now faces a dime‑plus outlay, eroding margins to the point where even a bullish Bitcoin rally would struggle to offset the overhead.

Second, this move sends a clear message to the wider EU: regulatory environments can pivot overnight, rendering previously lucrative jurisdictions hostile. That unpredictability introduces a premium on risk‑adjusted returns, prompting investors to price in country‑specific policy risk much earlier in the decision‑making process.

Third, the migration pattern is reshaping the global mining map. Countries like Kazakhstan, Texas, and Alberta are suddenly on the radar, each offering distinct advantages-whether it’s cheap coal‑derived power, abundant wind, or favorable tax regimes. The resulting hardware redistribution could drive down second‑hand ASIC prices, catalyze local economies, and even stimulate ancillary tech sectors such as cooling solutions and AI‑focused compute.

Fourth, the environmental narrative cannot be ignored. Sweden’s stance, framed around preserving clean hydro resources, aligns with a growing global sentiment that high‑energy, low‑value activities should yield to greener uses. This may inspire other nations to embed environmental considerations into their fiscal policies, potentially nudging the industry toward renewable‑powered mining or alternative consensus mechanisms.

Finally, for miners on the ground, the practical advice is crystal clear: run the numbers, scout for jurisdictions with sub‑$0.05/kWh electricity, and consider diversifying workloads beyond Bitcoin to hedge against policy shocks. Adaptability, rather than stubborn persistence, will define who thrives in this evolving landscape.

In sum, Sweden’s tax hike is more than a fiscal footnote; it’s a catalyst for systemic realignment, urging the entire ecosystem to rethink where and how digital gold is forged.

Bobby Ferew

May 18, 2025 AT 22:26Well, if the Swedish authorities think they can simply tax away competition, they'll soon discover that markets have a way of finding loopholes.

John Kinh

May 19, 2025 AT 05:23Nice move 🙄

Mark Camden

May 19, 2025 AT 12:20It is incumbent upon each of us to scrutinize the ethical dimensions of incentivizing energy‑intensive activities that yield negligible societal benefit. The Swedish government's corrective action serves as a reminder that policy should align with the greater public good, rather than subsidizing speculative ventures that exacerbate carbon footprints and strain essential infrastructure.

Evie View

May 19, 2025 AT 19:16Honestly, this whole tax drama is just another example of elites protecting their own interests while the average miner fumes in the background, forced to scramble for survival. It's infuriating how quickly support evaporates once profit margins shrink.

Sidharth Praveen

May 20, 2025 AT 02:13Even with these hurdles, there's still a path forward for miners willing to innovate. Exploring renewable partnerships or integrating mining with data‑center services can turn the cost pressure into a collaborative advantage.

Sophie Sturdevant

May 20, 2025 AT 09:10Leverage the power‑usage effectiveness (PUE) metric to fine‑tune your setups, and don't shy away from negotiating bulk electricity contracts. By optimizing the kilowatt‑hour cost curve, you can reclaim a portion of that tax burden and keep the hash‑rate profitable.

Nathan Blades

May 20, 2025 AT 16:06In the grand tapestry of technological progress, each regulatory gust either propels the sail of innovation or clips its wings. Sweden's decisive gust may momentarily dampen the mining fleet, yet the winds of decentralization continue to blow, urging pioneers to seek new horizons where freedom and energy converge.

Chad Fraser

May 20, 2025 AT 23:03Hey folks, if you're feeling stuck after the tax changes, remember you've got a community here. Share your relocation plans, swap tips on cheaper power, and let's help each other stay afloat.