Sweden Crypto Mining Tax: What You Need to Know

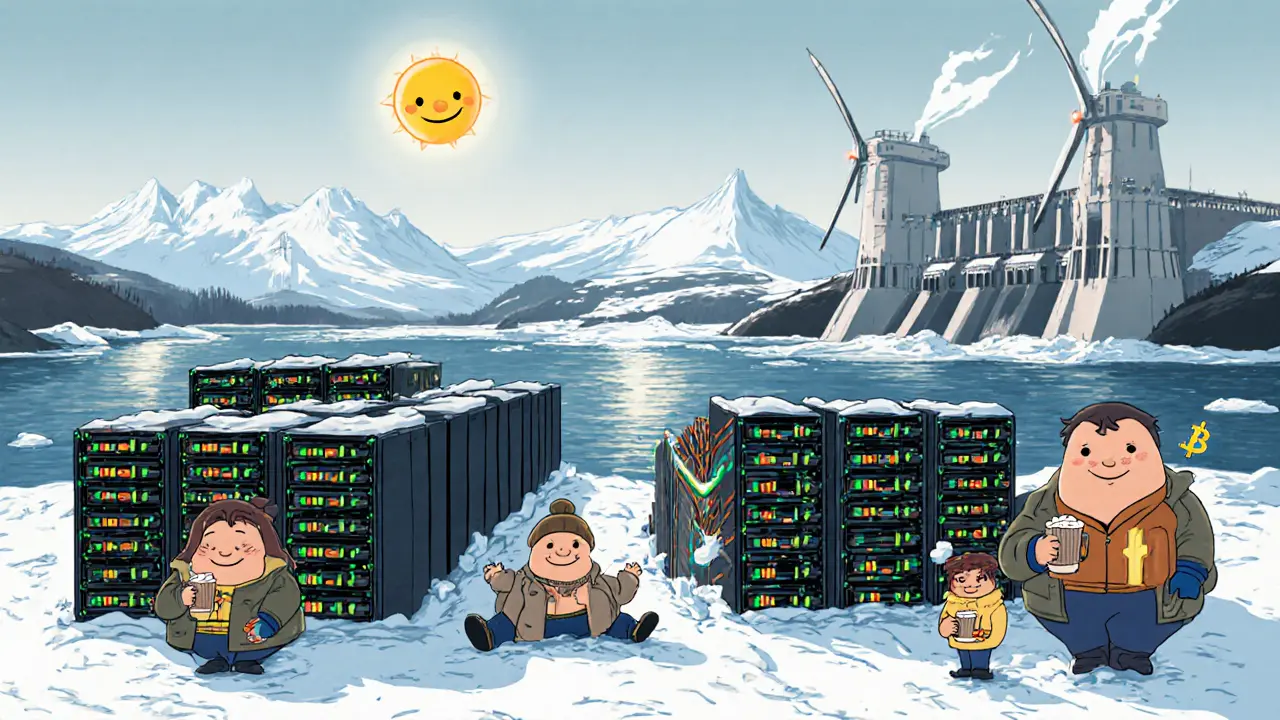

When dealing with Sweden crypto mining tax, the set of rules Sweden applies to income from proof‑of‑work mining activities. Also called Swedish mining tax, it is enforced by Swedish Tax Agency, the government body that collects taxes and issues guidelines for crypto earnings. The broader concept of cryptocurrency mining tax, tax treatment of mined coins in most jurisdictions shares many similarities, but Sweden adds specific rules about electricity deductions and depreciation of mining hardware. Understanding proof‑of‑work mining, the process that creates new coins by solving computational puzzles is essential because the tax liability hinges on whether the activity is classified as a hobby or a business.

How Sweden Classifies Mining Income

Swedish tax law draws a clear line between hobby mining and a taxable business. If you mine a handful of coins on a personal laptop and the earnings are low, the tax office may treat that as a hobby and only tax any profit as capital gains. Once you own dedicated rigs, rent space, or generate a steady stream of coins, the activity is seen as a business. That classification triggers two main obligations: you must register as a sole trader or company, and you must report mining income in the regular income tax return (INK1). The Sweden crypto mining tax therefore requires accurate bookkeeping of mined coins, their fair market value at the time of receipt, and any expenses directly tied to the operation. Missing a filing deadline can lead to penalties, so many miners set up a simple spreadsheet or use accounting software that supports crypto. The key takeaway is that the same activity can be taxed differently based on scale, intent, and how you document it.

One of the most valuable ways to lower the tax bill is to claim the electricity deduction, a tax‑allowable expense for the power consumed by mining hardware. Sweden lets you deduct the exact kilowatt‑hours your rigs use, multiplied by the local electricity price you actually pay. The deduction is reported on the same form you use for business expenses, and you can also write off a portion of your internet costs if they are used solely for mining. In addition to electricity, the tax code permits depreciation of mining equipment over a standard three‑year schedule, meaning you can spread the cost of GPUs, ASICs, or cooling systems across multiple tax years. If your operation runs at a loss because electricity prices are high, you can carry the loss forward and offset it against future profits. All these rules create a direct link: Sweden crypto mining tax ↔ electricity deduction ↔ hardware depreciation. By keeping receipts, invoices, and energy meter readings, you give the Swedish Tax Agency the proof it needs and protect yourself from audits.

Below you’ll find a curated list of articles that dig deeper into each of these points. Whether you’re just starting to mine in Stockholm, expanding a farm in Gothenburg, or looking for the best way to report your earnings, the posts cover practical steps, common pitfalls, and the latest updates from the Swedish Tax Agency. Dive in to get the details you need to stay compliant and keep more of your mined crypto.