Stablecoin Regulations: What You Need to Know in 2025

When you hold a stablecoin, a cryptocurrency designed to maintain a stable value, usually tied to a fiat currency like the US dollar. Also known as pegged tokens, they’re the backbone of crypto trading, lending, and DeFi—but they’re also under more scrutiny than ever. Unlike Bitcoin or Ethereum, stablecoins like USDT, Tether, the most widely used stablecoin, often claimed to be backed 1:1 by reserves aren’t just digital assets—they’re financial instruments. And that means governments are stepping in. In 2024 and 2025, the U.S., EU, and other major economies are rolling out new rules that could block access, freeze wallets, or shut down platforms that don’t comply.

These rules don’t just affect big exchanges—they hit everyday users too. If you’re using a platform like dYdX, a decentralized derivatives exchange that still enforces geographic restrictions to meet legal requirements, you might find yourself locked out based on where you live. That’s not a glitch—it’s compliance. Stablecoin regulations are forcing even "decentralized" platforms to act like centralized ones. Meanwhile, airdrops tied to stablecoin ecosystems, like those on BNB Chain or Polygon, now come with extra steps: KYC checks, residency confirmations, or even tax reporting requirements you didn’t sign up for.

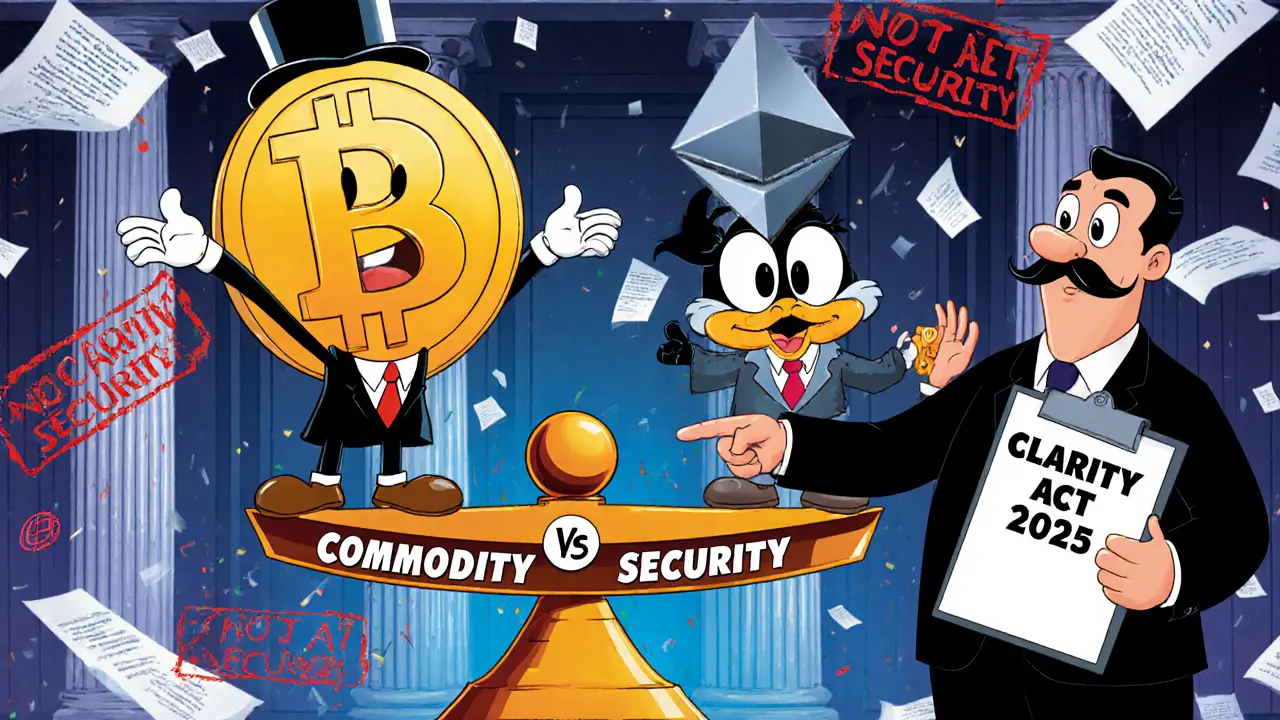

And it’s not just about where you live. Regulators care about who backs these coins. If a stablecoin issuer can’t prove it holds enough cash or short-term bonds to cover every token in circulation, it’s at risk of being labeled a security—or worse, a fraud. That’s why platforms like Karatbit or Garantex got flagged: their ties to unverified reserves raised red flags. Even meme coins that accept USDT as payment now face indirect fallout. If your wallet gets flagged for interacting with a non-compliant stablecoin, you could lose access to other tokens—even ones with real utility.

What does this mean for you? If you’re holding stablecoins, you need to know not just how to buy them, but who’s allowed to issue them, where they’re legal, and which exchanges still accept them without asking too many questions. You’ll find posts here that break down exactly that: how airdrops like APENFT or Corite are adapting to new rules, why some crypto exchanges vanished overnight, and how to trade safely without crossing legal lines. These aren’t theoretical debates—they’re real, urgent decisions that impact your portfolio right now. Below, you’ll see how others are navigating this maze—without hype, without fluff, just what works.