When you buy or trade crypto, you might think it’s just you and the blockchain. But behind every transaction, there’s a web of laws - and those laws are changing fast. In 2025, international securities laws for crypto aren’t just a footnote in legal textbooks anymore. They’re the gatekeepers of whether your favorite token can be traded legally, whether your exchange can operate, and whether banks will even touch your crypto holdings.

What Makes a Crypto Asset a Security?

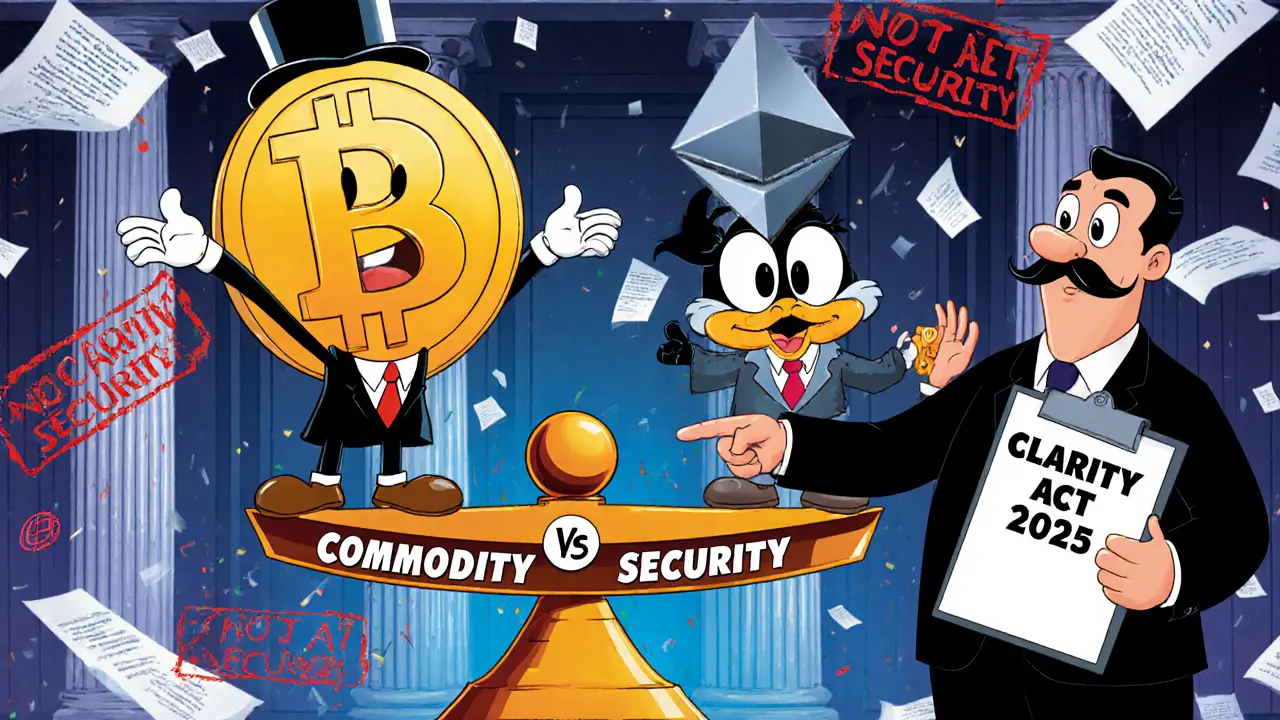

The biggest question in crypto regulation isn’t about technology. It’s about legal classification. Is your token a security? Or is it a commodity? That one distinction determines everything: who regulates it, what rules apply, and whether you can sell it to the public without a license. In the U.S., the answer used to be a guessing game. The SEC would sue companies after the fact, claiming their tokens were unregistered securities. That approach scared off innovation. But in July 2025, SEC Chair Paul Atkins flipped the script. In a landmark speech launching Project Crypto, he said: “Most crypto assets are not securities.” That wasn’t just a comment - it was a policy shift. The SEC is now required to build clear guidelines so companies can know upfront whether their token falls under securities law. The old test, called the Howey Test, looked at whether money was invested in a common enterprise with an expectation of profit from others’ efforts. That worked for old-school stocks, but it’s messy for crypto. If you buy Bitcoin because you believe its network will grow - not because someone promised you returns - is that a security? Under the new guidance, probably not. The CLARITY Act, expected to pass in late 2025, will codify this. It gives the CFTC authority over decentralized digital commodities like Bitcoin and Ethereum. The SEC keeps control only over tokens that clearly function like investment contracts - like those sold in ICOs where the issuer promises future profits or development.Stablecoins Are Now a Federal Issue - And They’re Tied to the Dollar

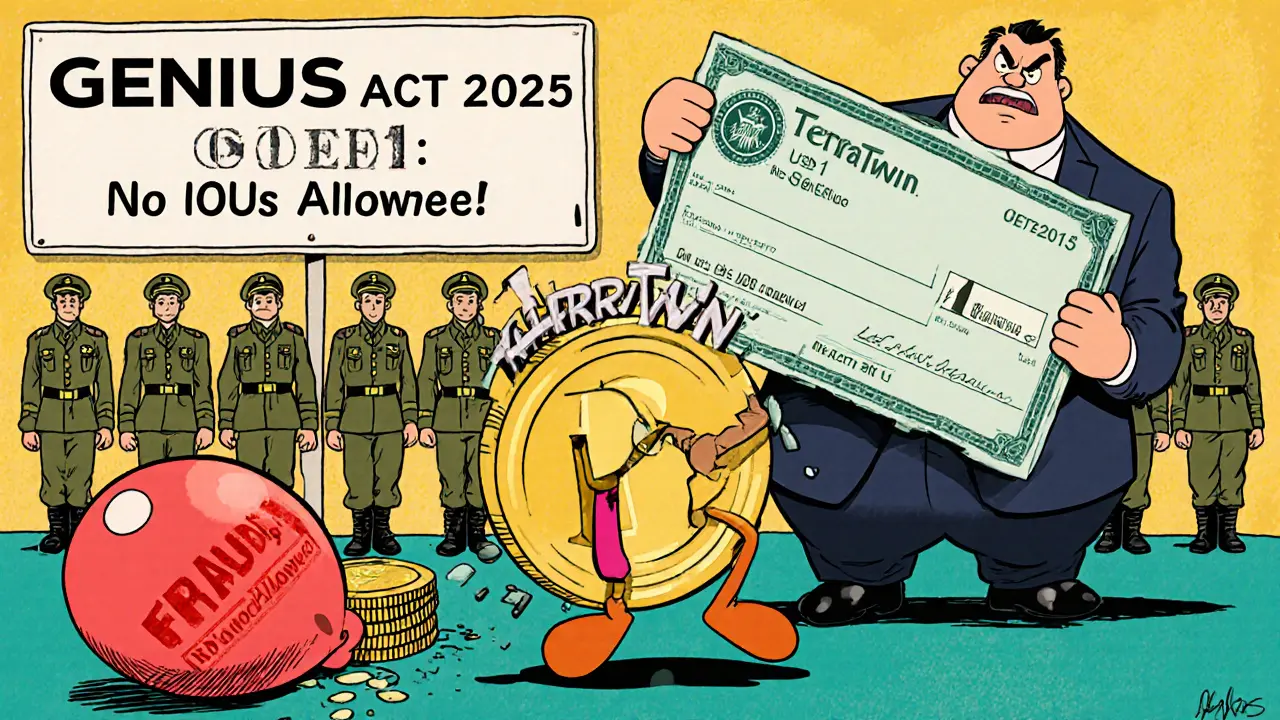

Stablecoins aren’t just another crypto. They’re the bridge between traditional finance and digital assets. And in 2025, they’re under strict federal rules. The GENIUS Act, signed into law in March 2025, says: if you issue a stablecoin pegged to the U.S. dollar, you must back every coin with cash or ultra-liquid assets like Treasury bills. No IOUs. No risky collateral. No fractional reserves. And you must be licensed by the U.S. Treasury or registered as a foreign issuer operating in the U.S. Monthly audits are mandatory. Anti-money laundering checks are required. Consumer protection disclosures must be clear and upfront. This isn’t about stifling innovation - it’s about preventing another TerraUSD collapse. The law also bans unbacked algorithmic stablecoins outright. If your stablecoin isn’t 1:1 backed, it’s illegal to issue or trade in the U.S. Outside the U.S., places like Singapore and Hong Kong are following similar models. The EU’s MiCAR also requires full reserve backing, but with a twist: it applies to all stablecoins, not just dollar-pegged ones. That means EUR-pegged or JPY-pegged stablecoins must also be fully backed - and issuers must get licensed across the entire bloc.Europe’s MiCAR: A Complex, Patchwork System

The European Union’s Markets in Crypto-Assets Regulation (MiCAR) was supposed to bring harmony. But in practice, it’s created a compliance maze. Starting January 2026, every crypto transaction over €1,000 going to or from a self-hosted wallet (like MetaMask) must include verified owner information. That’s a huge shift. Previously, privacy-focused wallets could move crypto anonymously. Now, exchanges and custodians must collect and store KYC data even for transfers to personal wallets. Service providers - exchanges, custodians, issuers - must get licensed by national regulators in each EU country. But the rules aren’t uniform. Germany’s rules are stricter than Malta’s. France requires additional reporting. This isn’t a single market - it’s 27 different interpretations of the same law. Many startups are relocating. Some are moving to Switzerland, which isn’t in the EU but has its own clear crypto licensing system. Others are setting up legal entities in Singapore or Dubai, where rules are simpler and faster to navigate.

Asia: Innovation With Teeth

Asia isn’t waiting for global consensus. It’s building its own rules - and attracting crypto businesses by doing it well. Hong Kong launched its licensing regime in early 2025. To operate, exchanges must meet strict custody standards, have insurance for customer assets, and pass regular audits. They can’t offer leveraged trading to retail users without passing a knowledge test. The government is also drafting rules for crypto derivatives - a move that signals it wants to be a global hub, not just a safe haven. Singapore took it further. Its Monetary Authority of Singapore (MAS) now requires all crypto firms to apply for a license before they can even start marketing. No more “launch first, ask questions later.” The MAS also enforces strict AML rules and limits advertising to avoid misleading retail investors. The result? Over 80% of crypto firms in Southeast Asia now have their legal HQ in Singapore. Japan, South Korea, and Australia have similar licensing systems. But none are as comprehensive as Hong Kong or Singapore. That’s why fintech investors are pouring capital into those two jurisdictions.China: The Complete Ban

Then there’s China. While the rest of the world is writing laws, China is erasing crypto from its financial system. In 2021, China banned all crypto trading and mining. In 2025, it doubled down. Banks are prohibited from processing any crypto-related payments. Domestic exchanges are shut down. Even using overseas platforms to trade crypto can lead to fines or account freezes. The government’s stance hasn’t changed: crypto threatens financial control. But here’s the irony - China’s central bank digital currency (CBDC), the digital yuan, is thriving. It’s not crypto. It’s state-controlled money. So while private digital assets are outlawed, government digital money is expanding.

Latin America and Africa: Regulation by Necessity

In Brazil, the Cryptoassets Act of 2023 made the central bank the main regulator. Crypto businesses must register, report transactions, and prevent fraud. The law also defines criminal acts - like using crypto to launder money - and sets jail time for violations. South Africa took a different path. In 2024, it passed rules requiring crypto exchanges to register as financial service providers. They must now comply with FATF guidelines and report suspicious activity. Tax authorities treat crypto like property - so every trade triggers capital gains tax. In Nigeria and Kenya, where banking access is limited, crypto adoption exploded. But governments didn’t ban it. Instead, they regulated it. Now, crypto firms must get licenses, verify users, and pay taxes. The result? Crypto is now part of the formal economy - not a shadow system.Why This Matters for You

If you’re a trader, investor, or developer, these laws affect you directly. - If you’re holding Bitcoin or Ethereum, you’re likely fine. They’re treated as commodities under the new U.S. framework. No registration needed. - If you’re holding a token from a startup that promised “high returns,” you might be holding an unregistered security. That’s a red flag. - If you’re using a stablecoin, make sure it’s backed 1:1. Avoid any that claim to be “algorithmic” or “crypto-backed.” They’re now illegal in most major markets. - If you’re running a business, you need to know where your users are. A U.S.-based user triggers SEC rules. An EU-based user triggers MiCAR. A Singapore user means you need a local license. The days of “crypto is lawless” are over. The new reality is: crypto is regulated - just differently everywhere.What’s Next?

The next big move will be international alignment. Right now, the U.S., EU, and Asia are on different paths. But pressure is building. The Financial Stability Board (FSB) is pushing for global standards. The G20 is discussing crypto tax reporting. The IMF is studying how to integrate crypto into financial stability monitoring. For now, the winners are the jurisdictions that offer clarity, not control. Singapore, Hong Kong, and the U.S. (post-2025 reforms) are leading. Places with vague or hostile rules are losing talent, capital, and innovation. The message is simple: if you’re serious about crypto, you need to understand the laws - not just the technology. Because in 2025, the blockchain doesn’t run on code alone. It runs on regulation.Are all cryptocurrencies considered securities under international law?

No. Only crypto assets that meet specific legal criteria - like being sold with an expectation of profit based on others’ efforts - are classified as securities. In the U.S., Bitcoin and Ethereum are now treated as commodities under the CLARITY Act. Most decentralized tokens fall outside securities laws. But tokens issued by companies promising future returns, especially in ICOs, are often classified as securities and require registration.

Can I trade crypto across borders without worrying about laws?

No. Every jurisdiction has its own rules. If you’re trading from the U.S., you must comply with SEC and CFTC rules. If you’re trading with someone in the EU, MiCAR applies. Even if your exchange is based in a crypto-friendly country like Switzerland, your users’ home countries still regulate how they can use crypto. Cross-border trading doesn’t bypass local laws - it multiplies them.

What happens if I use an unbacked stablecoin after 2025?

In the U.S., EU, Singapore, and Hong Kong, unbacked stablecoins are illegal to issue or trade. If you hold one, you risk losing your funds if the issuer collapses. If you’re a business using them, you could face fines, asset freezes, or criminal charges. The GENIUS Act and MiCAR require 1:1 backing with cash or liquid assets. Anything else is considered a fraud risk.

Do I need a license to hold crypto personally?

No. Individuals holding crypto for personal use don’t need a license anywhere in the world. Licenses apply to businesses: exchanges, custodians, issuers, and service providers. But even personal holders must comply with tax rules. Selling crypto for profit triggers capital gains tax in most countries, including the U.S., EU, and Australia.

Why are banks suddenly okay with crypto now?

In March 2025, the U.S. Office of the Comptroller of the Currency (OCC) issued Interpretive Letter 1183, which removed previous restrictions on banks handling crypto. Banks can now custody crypto, issue stablecoins, and participate in blockchain networks - as long as they meet safety standards. This change came after years of regulatory clarity, especially around stablecoins and commodity classification. Banks no longer fear being penalized for crypto activity - so they’re entering the market.

Is crypto mining still legal anywhere?

Yes - but only in places with clear rules. China banned mining in 2021 and still enforces it. The U.S., Canada, Germany, and Kazakhstan allow it, but with environmental and energy regulations. Some U.S. states like Texas and Wyoming have actively courted miners with tax breaks. In the EU, mining is legal but subject to energy efficiency rules under MiCAR. Always check local energy and environmental laws before setting up a mining operation.