SEC Crypto Rules: What You Need to Know About Crypto Regulation in 2025

When it comes to SEC crypto rules, the legal framework the U.S. Securities and Exchange Commission uses to classify, monitor, and restrict digital assets. Also known as crypto securities regulation, it’s the single biggest force shaping whether a token lives or dies in the U.S. market. If you’re trading, investing, or even just holding crypto, these rules aren’t just paperwork—they directly impact what exchanges you can use, which tokens you can buy, and whether your airdrop even makes it to your wallet.

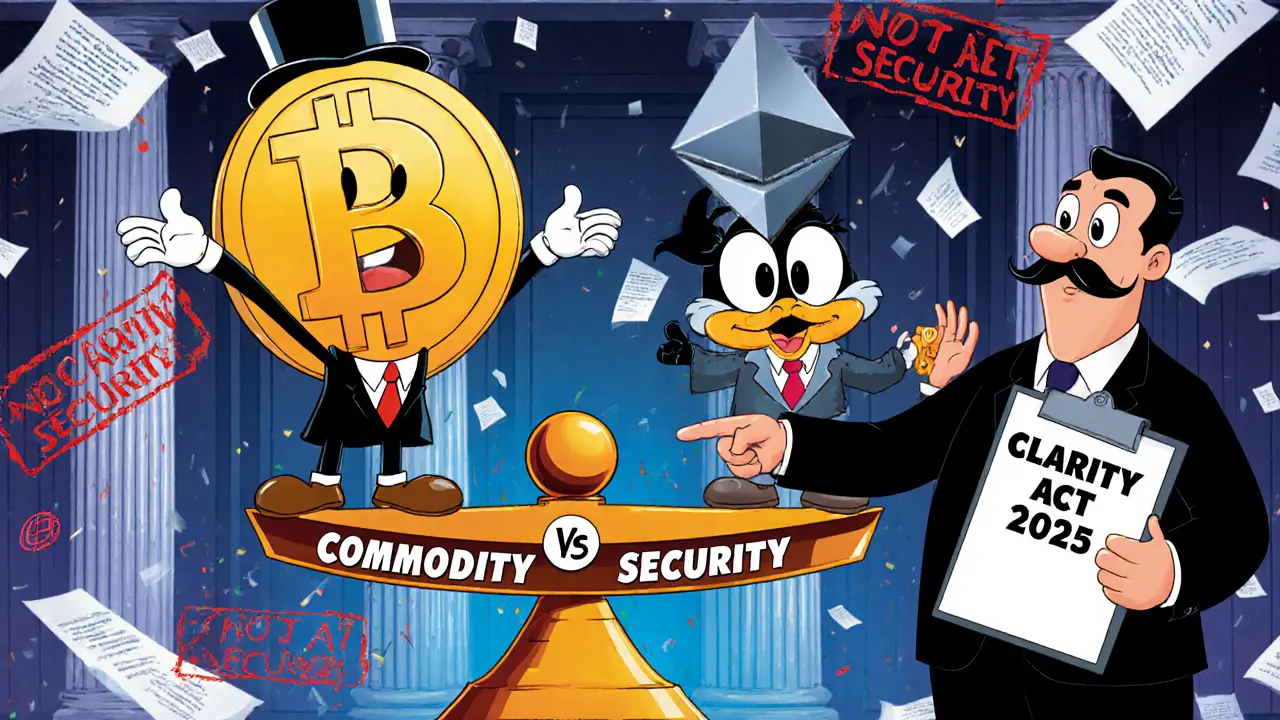

The SEC enforcement, the active legal actions taken by the SEC against crypto projects and platforms that violate securities laws. Also known as crypto crackdowns, it’s not theoretical. The SEC has sued major players like Binance, Coinbase, and Kraken. They’ve also shut down platforms like EOSex and Karatbit because they offered token sales that looked like unregistered securities. Even decentralized exchanges like dYdX now block U.S. users—not because they want to, but because they have to. The DeFi regulations, how decentralized finance projects are treated under existing securities and financial laws. Also known as regulatory gray zones, it’s a mess. The SEC says if a token is sold with the promise of profit from others’ work, it’s a security. That rule applies whether the project is centralized or not.

That’s why you see so many airdrops on this site tied to CoinMarketCap or BNB Chain. They’re designed to avoid triggering SEC flags—no promises of returns, no centralized distribution, no token sales. Projects like Chimpzee, AstraAI, or SWAPP Protocol walk a tightrope: they need to attract users without sounding like an investment contract. Meanwhile, tokens like BORG or ASTRA survive because they offer clear utility—governance, cashback, AI tools—not just speculative hype. The SEC doesn’t go after every meme coin, but it does go after anything that looks like a stock in disguise.

If you’re in a restricted country or using a platform that vanished overnight, it’s not random. It’s compliance—or the lack of it. The crypto regulation, the evolving legal landscape that determines which crypto activities are legal, illegal, or ignored by authorities. Also known as digital asset oversight, is changing fast. Some states are trying to create their own rules, but the SEC still holds the final say. That’s why you’ll find guides here on how to trade legally in restricted zones, how to spot a scam disguised as a regulatory warning, and why some exchanges just disappear without warning.

What you’ll find below isn’t just a list of articles. It’s a map of the battlefield. From the failed profit-sharing exchange EOSex to the banned countries on dYdX, from the NFT airdrops that skirt securities laws to the sanctions hitting Garantex—every post shows how SEC crypto rules play out in real life. No fluff. No theory. Just what’s happening, who’s affected, and how to protect yourself before the next crackdown hits.