PoS Security: How Proof of Stake Keeps Blockchains Safe

When you stake your crypto instead of mining it, you're not just earning rewards—you're helping secure the whole network. This is Proof of Stake, a consensus mechanism where validators are chosen based on how much crypto they lock up, not how much computing power they have. Also known as staking consensus, it’s what keeps networks like Ethereum, Cardano, and Solana running without massive energy bills. But PoS isn’t magic. It has weaknesses—and attackers are always looking for them.

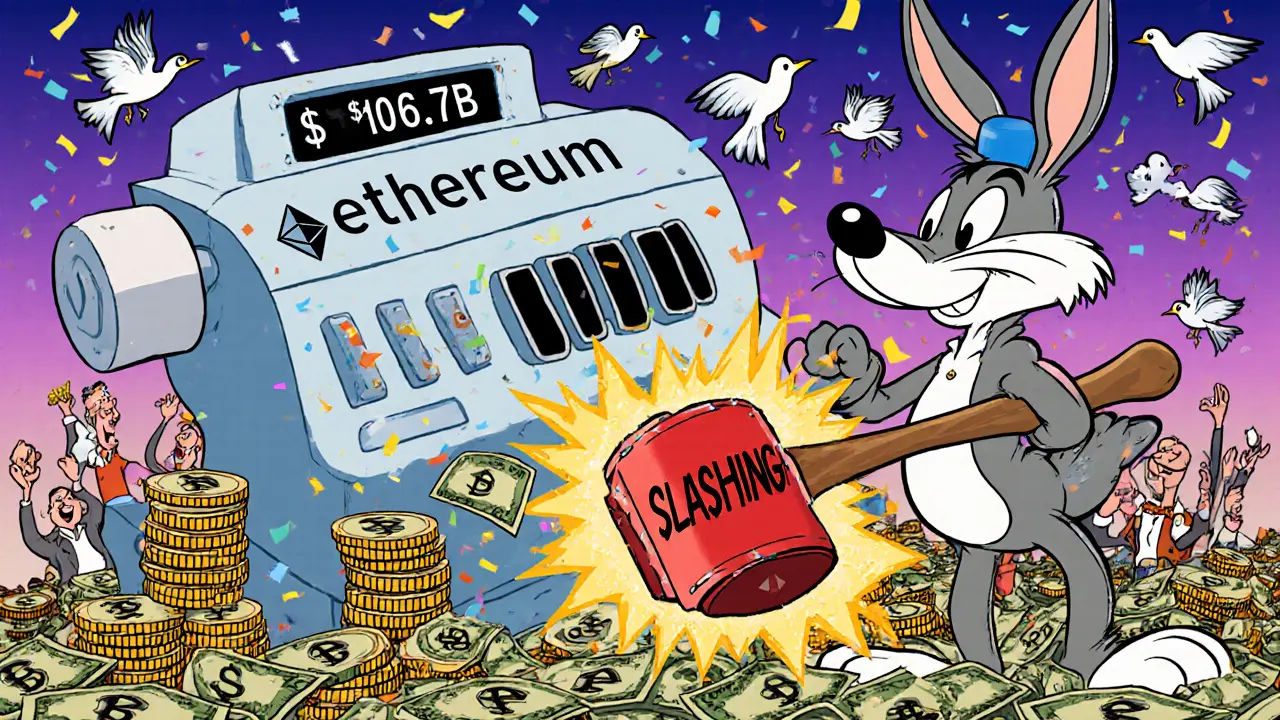

One big threat is the Sybil attack, where one person creates hundreds of fake identities to gain control over a network. In Bitcoin’s Proof of Work system, this is nearly impossible because each identity needs expensive hardware. But in some PoS chains, if you own enough tokens, you can flood the network with fake validators. That’s why the best PoS systems don’t just look at how much you stake—they check your history, your reputation, and even how long you’ve held your coins. Networks like Polkadot and Cosmos use social trust graphs and slashing rules to punish bad actors. If you try to cheat, you lose your stake. No second chances. Another issue? Centralization. If 10 big wallets hold 70% of the total stake, the network isn’t really decentralized—it’s just controlled by a few players. That’s why some projects add random validator selection, minimum stake limits, or even governance votes to keep power spread out.

Staking profitability might look easy, but PoS security depends on how well the system discourages bad behavior and rewards honest participation. A chain with high rewards but weak rules? That’s a target. A chain with low rewards but strong penalties for cheating? That’s the kind that lasts. You’ll see both in the posts below—some projects claiming to be secure while hiding dangerous flaws, others quietly building real resilience. Whether it’s a fake airdrop pretending to be part of a PoS ecosystem, or an exchange that claims to support staking but doesn’t follow best practices, the red flags are always there. You just need to know what to look for.

Below, you’ll find real breakdowns of what works, what doesn’t, and why some blockchains stay safe while others collapse under pressure. No hype. Just facts from the front lines of crypto security.