Economic Finality Calculator

Calculate how much staked ETH would be required to make reversing a transaction economically unfeasible. Based on Ethereum's current staking model (as of October 2025).

Transaction Details

How It Works

Economic finality means reversing a transaction would require more capital than the transaction value. Based on Ethereum's design:

- • Requires 33% of total staked ETH to reverse

- • Current staked ETH value: $320 billion

- • Minimum reversal cost: $106.7 billion

- • Finality time: 12.8 minutes (2 epochs)

Finality Analysis

Economic Finality Analysis

Transaction value: $

Minimum stake required to reverse:

Cost comparison:

When you send ETH to a friend or swap tokens on Uniswap, how do you know the transaction can’t be undone? In Bitcoin, you wait for six confirmations-about an hour-because each new block makes it harder to reverse the past. But in Proof of Stake blockchains like Ethereum, there’s something different: economic finality. It doesn’t rely on brute-force computing power. Instead, it uses money-your own-to make reversing a transaction too expensive to ever make sense.

What Is Economic Finality?

Economic finality means a transaction becomes irreversible not because it’s mathematically impossible to undo, but because doing so would cost more than it’s worth. Think of it like this: if you tried to steal your neighbor’s car, but the only way to do it was to burn $100 million in cash, you’d probably just walk away. That’s economic finality in action. In Proof of Stake systems, validators lock up their own cryptocurrency-called staking-to help secure the network. If they try to cheat-like approving two conflicting blocks-they lose a big chunk of their stake. The protocol is designed so that the cost of cheating is far higher than any possible gain. On Ethereum, reversing a finalized block would require destroying at least $106.7 billion in staked ETH as of October 2025. No one has that kind of capital, and even if they did, the market would crash before they could pull it off. This system replaced the old Proof of Work model where miners competed to solve math puzzles. PoW gives you probabilistic finality: the more blocks that come after yours, the safer it feels. But it’s never 100% guaranteed. Economic finality, by contrast, gives you a hard stop. Once a block is finalized, it’s done. No more waiting.How Ethereum Achieves Economic Finality

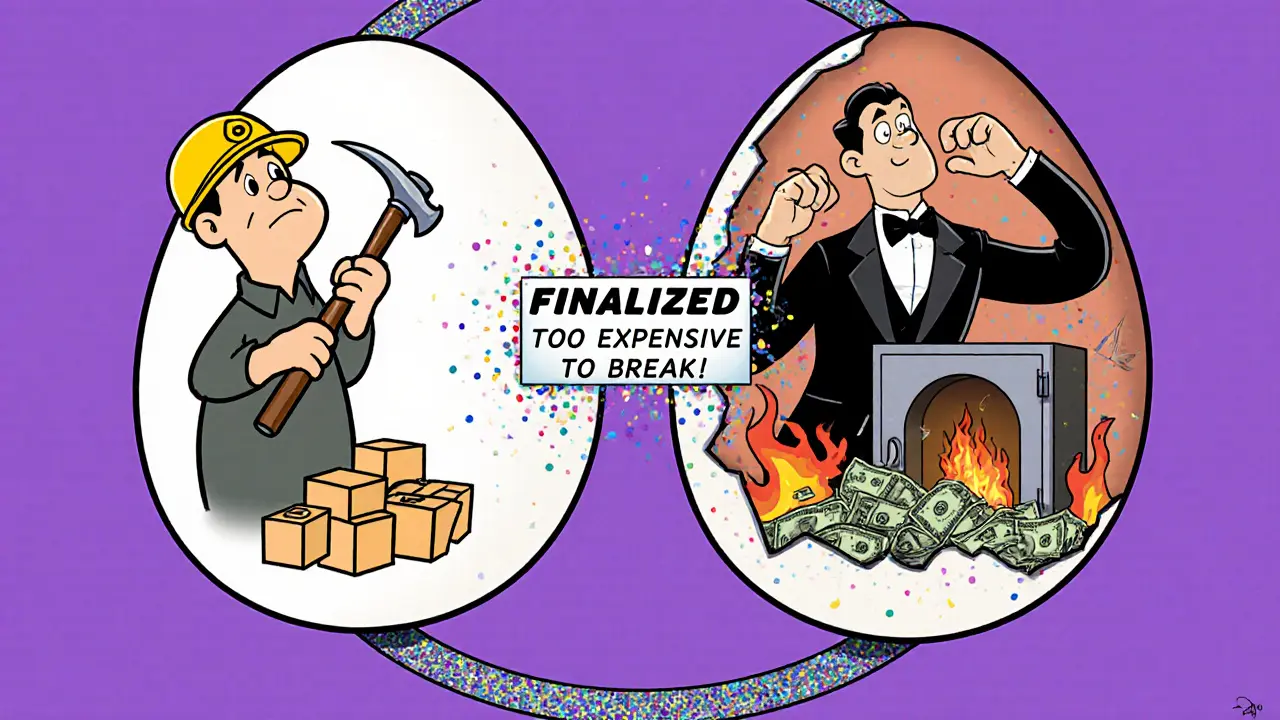

Ethereum’s version of economic finality runs on a mechanism called the Casper Friendly Finality Gadget (FFG). Here’s how it works in plain terms:- Validators vote on blocks in groups called epochs. Each epoch lasts 6.4 minutes.

- After one epoch, if two-thirds of validators agree a block is valid, it becomes “justified.”

- After the next epoch, if those same validators confirm the justified block again, it becomes “finalized.”

- That’s it. Two epochs = 12.8 minutes = permanent record.

How It Compares to Proof of Work

Bitcoin doesn’t have economic finality. It has probabilistic finality. That means each new block adds more confidence, but it’s always a probability. After six blocks (60 minutes), you’re at 99.99% confidence. But technically, a miner with 51% of the hash power could still reverse it-just at a huge cost. Ethereum’s economic finality gives you that same level of confidence in 12.8 minutes. And it’s faster for everyday use. DEXs like Uniswap rely on this speed. If you’re swapping tokens, you don’t want to wait an hour for your trade to settle. With economic finality, you get near-instant confirmation, and within 15 minutes, it’s locked in. But here’s the trade-off: Bitcoin’s security comes from physical hardware-mining rigs, electricity, cooling. It’s tangible. Economic finality is based on market value. If ETH’s price dropped 90%, the cost to reverse a block might become feasible. That’s why Bitcoin maximalists argue it’s not “real” security. They say only physical work can guarantee finality. Ethereum’s team counters: the cost isn’t just the value of ETH-it’s the loss of trust. If someone could reverse a finalized block, the entire network’s value would evaporate. So the incentive to protect the system is stronger than the incentive to attack it.

Other Blockchains Using Economic Finality

Ethereum isn’t alone. Most major PoS chains use similar models:- Cardano (ADA): Uses Ouroboros Praos. Finality takes about 5 hours (2,160 slots). Slower, but designed for extreme security.

- Solana (SOL): Achieves sub-second finality using Tower BFT. It’s fast, but relies on tight network sync. If nodes get out of sync, reorgs can happen.

- Polkadot (DOT): Uses NPoS with a finality gadget called GRANDPA. Finality is reached every 6 seconds on average.

Real-World Risks and Mistakes

Economic finality isn’t foolproof. Developers sometimes misunderstand it. In August 2025, a DeFi protocol lost $2.3 million because it treated a block as final after just 3 minutes. But on Ethereum, full finality takes 12.8 minutes. Between 3 and 12 minutes, there’s a window where reorganizations can still happen-especially during network congestion. That’s what happened. The protocol assumed safety too early. Etherscan’s user report from February 2025 showed that during a spike in NFT mints, 12% of users had transactions reversed despite seeing 10+ confirmations. Why? Because the network was overloaded, and validators temporarily disagreed on the chain’s state. The system eventually resolved itself, but the damage was done. That’s why smart protocols use two thresholds:- Safe Head (5 minutes): Good enough for low-value actions like tipping or small trades.

- Finalized Head (12.8 minutes): Required for large transfers, smart contract executions, or asset custody.

What’s Changing in 2026?

Ethereum’s next major upgrade, Prague, is scheduled for early 2026. One of its biggest changes? Cutting finality time from 12.8 minutes to just 4.2 minutes. How? By improving how leaders are chosen for each block. Instead of a random selection that can cause delays, the new Single Secret Leader Election (SSLE) system makes leader assignment faster and more predictable. This won’t weaken security-it’ll make it faster. The result? More transactions per second, quicker settlements, and better user experience-all without sacrificing the economic guarantee that keeps the network safe.Why Institutions Are Choosing PoS

Banks and enterprises aren’t using Bitcoin for settlement. They’re using Ethereum, Solana, and other PoS chains. JP Morgan’s Onyx platform processes billions in daily transactions using PoS because 15-minute finality beats 60+ minutes. The Bank for International Settlements reported that 82% of blockchain banking pilots in 2025 used PoS for settlement layers. Why? Speed. Predictability. Cost-efficiency. Even regulators are catching up. In July 2025, the SEC officially recognized economic finality as a valid security model-but only if networks maintain at least 33% staking participation. That’s a clear signal: the system works, but only if enough people are playing by the rules.Final Thoughts: Is Economic Finality Real Security?

It’s not magic. It’s math, economics, and game theory working together. The system doesn’t promise impossibility. It promises irrationality. Why would you spend $100 billion to reverse a $10 million transaction? You wouldn’t. And that’s the point. Critics say it’s a social contract. They’re right-but so is money. So is law. So is trust. Economic finality doesn’t replace trust. It codifies it. For everyday users, developers, and institutions, it’s the fastest, most reliable way to know your transaction is final. And as more applications-from DeFi to real-world asset tokenization-rely on blockchain, that speed and certainty won’t just be nice. It’ll be necessary.If you’re building on a PoS chain, don’t guess at finality. Know the numbers. Wait for two epochs. Trust the economics. And remember: the most secure networks aren’t the ones that can’t be broken. They’re the ones where breaking them makes no sense.

sky 168

November 22, 2025 AT 03:25Frank Verhelst

November 23, 2025 AT 22:31andrew casey

November 24, 2025 AT 07:50sammy su

November 24, 2025 AT 09:22Roshan Varghese

November 25, 2025 AT 20:51Jennifer Corley

November 26, 2025 AT 06:19jack leon

November 27, 2025 AT 15:20Lynn S

November 28, 2025 AT 02:59Natalie Reichstein

November 28, 2025 AT 05:28Lani Manalansan

November 29, 2025 AT 19:06Devon Bishop

December 1, 2025 AT 12:38Kris Young

December 3, 2025 AT 08:55Khalil Nooh

December 4, 2025 AT 02:01Jack Richter

December 4, 2025 AT 17:01Dexter Guarujá

December 6, 2025 AT 01:25