FIU-IND Registration: What It Is and Why It Matters in Crypto

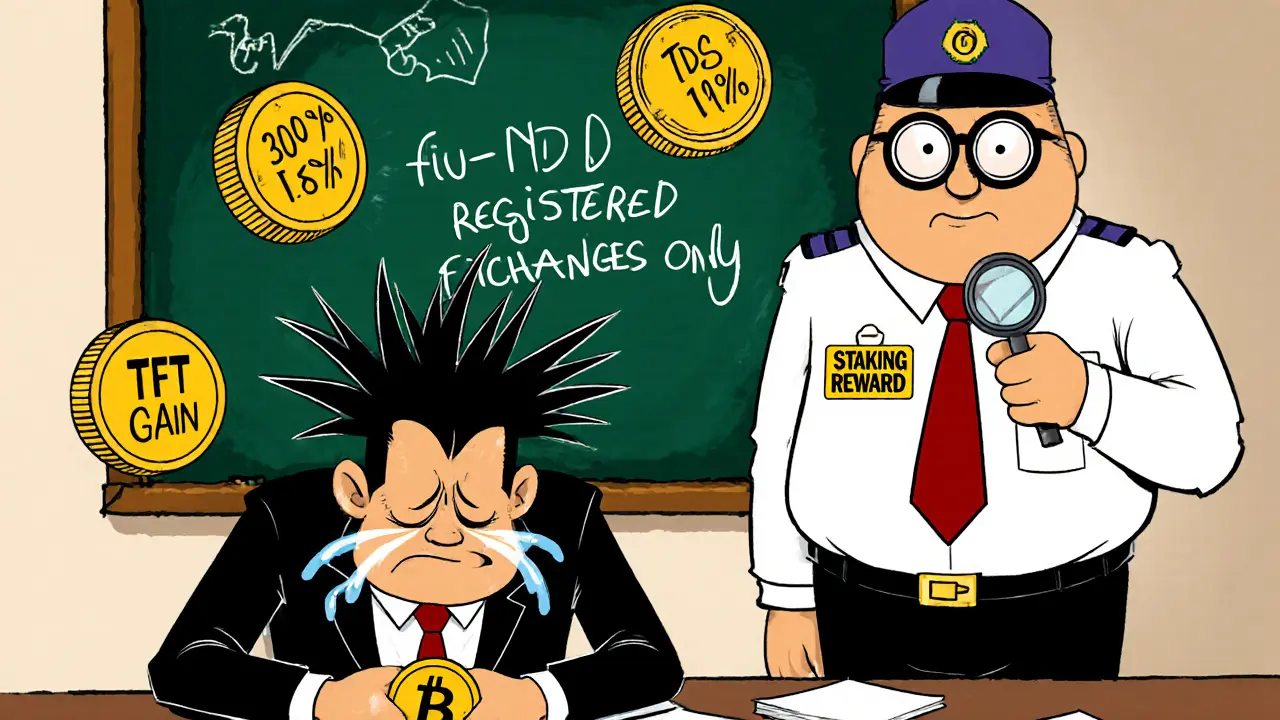

When a crypto project claims it’s FIU-IND registration, the mandatory compliance process for virtual asset service providers in India under the Financial Intelligence Unit-India. Also known as FIU-IND compliance, it’s not just paperwork—it’s the difference between operating legally and being shut down overnight. This isn’t some bureaucratic formality. It’s how India tracks crypto transactions to stop money laundering, fraud, and scams. If you’re using an exchange, running a token, or even running an airdrop in India, ignoring FIU-IND registration means you’re flying blind—and possibly breaking the law.

Think about the posts below. You’ll see reviews of exchanges like Bit4you, a Belgian platform with no regulation or user activity, or GIBXChange, an unregulated broker offering MT5 trading. These platforms don’t have FIU-IND registration because they’re not even trying to play by the rules. Meanwhile, projects like DeFiChain (DFI), a blockchain with real airdrops tied to CoinMarketCap tasks or APENFT, a token tied to NFTs and CMC campaigns that are active in India need to be registered—or risk losing access to Indian users. FIU-IND registration forces transparency. It means you can trace who’s behind a token, where funds are flowing, and whether the project has a legal footprint.

And that’s why scams like the fake SUNI airdrop, a token with no website, team, or value, or the non-existent POLYS airdrop, a rumor pushed by phishing sites keep popping up. They don’t register. They don’t report. They disappear. FIU-IND registration doesn’t guarantee a project is good—but it does mean someone checked their ID. That’s the first filter. The posts here cover everything from fake exchanges to real airdrops, from staking profits to crypto bans. But behind every one of them is a question: Is this legal? Is this tracked? Is this registered? You’ll find the answers in the details below—no fluff, no hype, just what matters for your safety and your portfolio.