Crypto Tax Calculator for India

Calculate Your Tax Liability

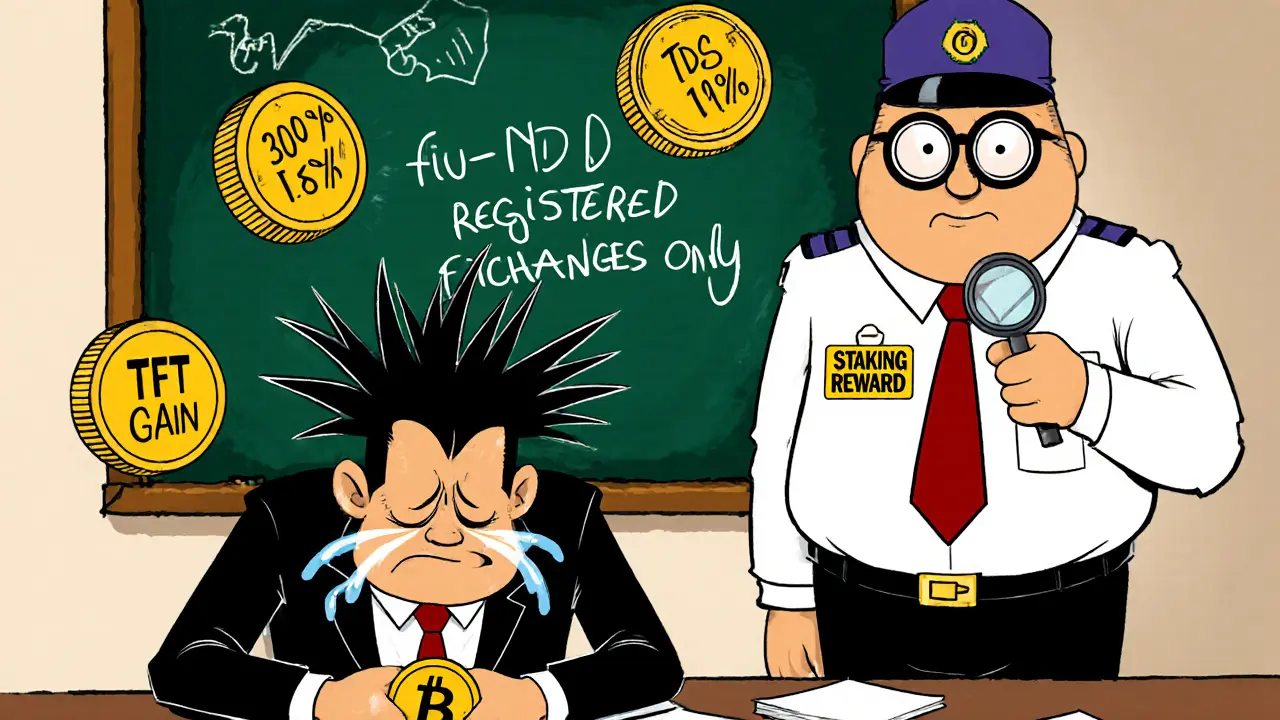

Determine how much tax you owe on your crypto transactions under Indian regulations (30% tax + 1% TDS).

India doesn’t ban cryptocurrency. But if you think you can dodge taxes or use unregistered platforms to avoid oversight, you’re setting yourself up for trouble. The rules aren’t about stopping crypto-they’re about making sure everyone plays fair. If you’re trading Bitcoin, Ethereum, or NFTs in India, the goal isn’t to avoid restrictions. It’s to follow them so you don’t get fined, frozen, or flagged.

What’s Actually Allowed in India?

Cryptocurrencies are legal in India. You can buy, sell, hold, and trade them. The Supreme Court overturned the RBI’s 2018 banking ban back in 2020, and since then, the government has built a system around taxation and tracking-not prohibition. The key change came in August 2025 with the new Income Tax (No. 2) Bill, which replaced the old 1961 Act and officially recognized Virtual Digital Assets (VDAs) as taxable property.That means: if you made a profit from selling Bitcoin for INR, or trading ETH for SOL, you owe taxes. No exceptions. No loopholes. The government isn’t trying to scare people away-it’s trying to make sure everyone reports their gains.

The Two Big Rules: 30% Tax and 1% TDS

There are only two tax rules you need to remember:- You pay 30% tax on every profit from crypto sales or trades.

- Every time you transfer crypto (even between wallets), the exchange must deduct 1% as Tax Deducted at Source (TDS).

There are no deductions. No offsetting losses. If you bought Bitcoin at ₹500,000 and sold it at ₹700,000, you owe 30% on ₹200,000-that’s ₹60,000. And if you bought it on WazirX or CoinDCX, they already took ₹7,000 (1%) when you sold. That ₹7,000 counts toward your 30% tax bill.

Many traders get confused thinking they can avoid TDS by using peer-to-peer (P2P) platforms or offshore exchanges. But here’s the truth: if you’re an Indian resident, the Income Tax Department can track your bank deposits. If you deposit ₹500,000 from an unregistered exchange into your savings account and don’t declare it, you’ll get a notice. And if you can’t prove where the money came from? You could face penalties up to 200% of the tax due.

Only Use FIU-IND Registered Exchanges

The Financial Intelligence Unit India (FIU-IND) is the agency that keeps tabs on money laundering. All crypto exchanges operating legally in India must register with them. As of October 2025, over 50 platforms have cleared this hurdle, including Binance, Coinbase, WazirX, CoinDCX, and Zebpay.Why does this matter? Because registered exchanges do three things for you:

- They collect your KYC documents (ID, address, PAN card).

- They automatically deduct 1% TDS on every trade.

- They issue annual tax reports (Form 26AS) showing all your transactions.

That last point is critical. If you use an unregistered platform like BingX or LBank (both banned in 2024 for non-compliance), you won’t get any tax paperwork. That means you’re on your own to track every single trade, every swap, every withdrawal. And if you mess up? The tax department won’t care that you didn’t know how. You’re still liable.

Real traders in India say the same thing: use only registered exchanges. It’s not about convenience-it’s about proof. If you’re audited, you need records. Only registered platforms give you those.

Keep Every Single Transaction Record

You don’t need fancy software. You don’t need a blockchain explorer. You need a spreadsheet. And you need to update it after every trade.Here’s what to log for every transaction:

- Date and time

- Exchange used

- Asset bought/sold (e.g., BTC, ETH, USDT)

- Amount

- Price in INR at time of trade

- Transaction ID (from exchange)

- Purpose (e.g., “bought for investment,” “traded for SOL”)

Why? Because crypto-to-crypto trades are taxable events. If you swap 0.5 BTC for 15 ETH, that’s a sale of BTC and a purchase of ETH. You owe tax on the gain from BTC. Many people forget this. They think “I didn’t cash out to INR, so I’m fine.” Not true. The tax department treats every trade as a realization of gain.

Keep these records for at least six years. Indian tax law requires it. And if you’re using a registered exchange, you can download your trade history as a CSV. Save it. Back it up. Don’t rely on the exchange forever-they might change their systems, shut down, or get acquired.

Don’t Try to Hide It

Some people think they can use offshore wallets, VPNs, or anonymous P2P trades to stay under the radar. Here’s what happens when they do:- They deposit crypto into a non-KYC wallet, then convert it to INR via a P2P platform.

- The money hits their bank account.

- The bank flags it as an unusual transaction.

- The Income Tax Department gets a report.

- They get a notice: “Explain source of ₹12 lakhs.”

- They can’t prove it came from crypto because they didn’t keep records.

- They pay 200% in penalties plus interest.

There’s no evidence that the government is actively hunting small-time traders. But they’re watching the money flow. And if your bank account suddenly shows a ₹5 lakh deposit with no explanation, you’re on their radar.

The smarter move? Be transparent. Use a registered exchange. Report your gains. Pay your tax. You’ll sleep better. And if the rules change next year? You’ll already be set up.

What About NFTs and DeFi?

NFTs? Taxed. DeFi staking rewards? Taxed. Airdrops? Taxed. Any income from a virtual digital asset falls under the same 30% rule. If you earn ETH from staking on a DeFi protocol and sell it for INR, that’s taxable. If you get an NFT as a reward and later sell it, that’s taxable too.There’s no special exemption for “decentralized” or “non-custodial” systems. The tax law doesn’t care if you used MetaMask or a centralized exchange. If you made money, you owe tax.

Who Can Help You Stay Compliant?

Most accountants don’t understand crypto. But there are specialists in India who do. Look for tax advisors who work with crypto traders. They can help you:- Calculate gains across multiple exchanges

- Handle crypto-to-crypto trades correctly

- File your ITR with the right forms

- Respond to tax notices

Platforms like CoinTracker, Koinly, and ZenLedger work with Indian users and can auto-import data from registered exchanges. They generate reports in the format the tax department expects. A good advisor will use these tools to save you time and avoid mistakes.

The Bottom Line: Compliance Isn’t Avoidance

There’s no magic trick to “avoiding” crypto restrictions in India. The restrictions aren’t about blocking access-they’re about making sure you pay your share. The government isn’t trying to kill crypto. It’s trying to bring it into the formal economy.Thousands of Indian traders are doing this right. They use WazirX or CoinDCX. They keep spreadsheets. They pay 30%. They file returns. And they sleep soundly.

If you’re thinking of hiding your crypto activity, ask yourself: is saving a few thousand rupees in taxes worth risking a legal notice, a frozen bank account, or a 200% penalty? The answer should be obvious.

The real strategy isn’t evasion. It’s execution. Know the rules. Follow them. Keep your records. And move forward without looking over your shoulder.

Is it illegal to use Binance or Coinbase in India?

No, it’s not illegal. Both Binance and Coinbase are registered with FIU-IND and operate legally in India. They comply with KYC, TDS, and reporting rules. As long as you use their Indian platforms and complete your KYC, your activity is fully legal.

Can I avoid 1% TDS by using P2P trading?

You might avoid TDS on the P2P side, but you can’t avoid the tax. If you deposit INR from a P2P sale into your bank account and don’t declare it as crypto income, the tax department will flag it. The 1% TDS is just a withholding-it’s not extra tax. You still need to report the full gain and pay 30%. Avoiding TDS doesn’t mean avoiding tax-it just makes it harder to prove you paid it.

What happens if I don’t file crypto taxes?

You’ll get a notice from the Income Tax Department. If you ignore it, they can freeze your bank accounts, seize assets, or initiate legal proceedings. Penalties can reach 200% of the unpaid tax, plus interest. In 2024, over 3,000 crypto-related notices were issued in India. Most were resolved when people came forward with records.

Are crypto losses tax-deductible in India?

No. Unlike stocks, you cannot offset crypto losses against other income or future gains. Every profit is taxed at 30%, regardless of whether you lost money elsewhere in crypto. This is one of the strictest crypto tax rules in the world.

Do I need to report crypto if I only hold it and don’t sell?

No. You only owe tax when you sell, trade, or convert crypto into INR or another asset. Holding Bitcoin or Ethereum without selling doesn’t trigger any tax. But you still need to keep records in case you sell later.

Can the government track my crypto wallet?

They can’t track your wallet directly-but they can track your bank account. If you cash out crypto to INR, the money enters the banking system. Banks report large or unusual deposits to FIU-IND. If you can’t explain the source, you’ll be asked to prove it came from crypto. That’s why keeping transaction records is essential.

Is staking crypto taxable in India?

Yes. Any reward you receive from staking-whether it’s ETH, SOL, or INR-is considered income. You pay 30% tax on the INR value of the reward at the time you receive it. Even if you don’t sell the staked asset, the reward itself is taxable.

Will India ban crypto in the future?

Unlikely. The government has moved from skepticism to regulation. They’re working with global bodies like the FSB and G20 to align with international standards. The focus is on compliance, not prohibition. Banning crypto would mean shutting down a $6.6 billion market and losing tax revenue. That’s not a smart move.

Ankit Varshney

November 30, 2025 AT 00:57Used WazirX for 2 years. Paid 30% on every profit. Never got a notice. Keep your CSVs. Simple.

Christy Whitaker

December 1, 2025 AT 03:58Why do we even bother? The government doesn’t care about small traders-they just want to squeeze everyone dry. This isn’t regulation, it’s extortion dressed up as compliance.

Heather Hartman

December 1, 2025 AT 10:16Actually, this is really helpful. I was terrified of crypto taxes but now I feel like I can actually do this. Thank you for breaking it down without the fear-mongering.

Mohamed Haybe

December 3, 2025 AT 00:37India is becoming a tax dictatorship and you people are clapping. Crypto was supposed to be freedom. Now you’re begging the state for permission to hold your own money. Pathetic

Nancy Sunshine

December 3, 2025 AT 09:21Thank you for this comprehensive breakdown. As someone who has spent years navigating international tax systems, I can confirm that India’s approach-while strict-is remarkably transparent compared to many jurisdictions. The clarity around TDS and reporting obligations is actually a model for other emerging markets.

The 30% rate is high, yes-but the absence of loss offsetting is not unique. Countries like South Korea and Germany also treat crypto gains as non-deductible income. What’s remarkable is the institutional infrastructure: FIU-IND registration, automated reporting, and integration with Form 26AS. This isn’t punitive-it’s integration.

Many critics miss the point: the goal isn’t to stifle innovation. It’s to prevent money laundering, protect retail investors from offshore scams, and bring unregulated capital into the formal economy. The fact that over 50 platforms are now compliant speaks to the industry’s adaptability.

For new traders: don’t overcomplicate it. Use one registered exchange. Export your CSV monthly. Log every trade-even ETH for SOL. Use Koinly. File ITR-2 with Schedule CG. Done.

The real risk isn’t the tax. It’s the ignorance. And that’s what this post correctly identifies.

Ziv Kruger

December 4, 2025 AT 21:01What if the state becomes the blockchain?

Who watches the watchers?

We traded decentralization for a spreadsheet.

Marsha Enright

December 6, 2025 AT 07:31Just started trading last month and this saved me so much stress. I was about to use P2P to avoid TDS-thank god I read this first. Now I’m using CoinDCX and keeping a simple Google Sheet. 1% TDS is not the enemy. Being audited is.

Sharmishtha Sohoni

December 7, 2025 AT 11:06What about staking rewards in USDT? Do I pay tax when I get them or only when I sell to INR?

Ankit Varshney

December 8, 2025 AT 01:12Pay tax when you receive it. Value in INR at time of receipt. Even if you hold USDT. That’s the rule. Not when you sell.

Ann Ellsworth

December 8, 2025 AT 10:02Let’s be honest: the 30% rate is predatory. This isn’t taxation-it’s wealth extraction disguised as fiscal responsibility. The government has no moral authority to claim 30% of speculative gains when the entire system is built on rent-seeking intermediaries like CoinDCX and WazirX who profit from every trade.

And don’t get me started on the TDS mechanism. It’s a Kafkaesque loop: you pay 1% upfront, then pay 30% later, and the 1% is ‘credited’-but only if you file correctly. Which means you need an accountant who understands crypto. Which means you need to pay more.

This isn’t compliance. It’s a tax trap for the technically literate.

And for those who say ‘just use Koinly’-have you seen their pricing? $199/month for Indian users. That’s not a tool. It’s a toll.

Meanwhile, the state collects billions in unreported crypto income from the untracked P2P market-but they’re not cracking down on the big players. They’re cracking down on the 23-year-old who bought 0.1 BTC in 2022.

Who benefits? The exchanges. The tax auditors. Not the user.

Paul McNair

December 8, 2025 AT 23:15I appreciate the nuance here. I’m American, but I’ve got family in India who trade crypto. This post actually made me rethink how I’ve been framing crypto regulation to them. It’s not about control-it’s about inclusion. They’re not banning crypto. They’re bringing it into the system.

And honestly? The TDS system is smarter than most Western approaches. In the U.S., you’re on your own to track every trade. Here, the exchange does it for you. That’s infrastructure, not oppression.

Yes, 30% is steep. But at least you know where you stand.

Catherine Williams

December 9, 2025 AT 16:19For anyone scared of the 30% tax: think of it like a membership fee to play in the legal game. You want to trade without fear? Pay the fee. Keep your records. Use the right platforms. It’s not perfect-but it’s the least painful path.

I’ve seen friends get notices because they used BingX and didn’t keep records. They paid 200% penalties. That’s not the tax. That’s the cost of being lazy.

Don’t be that person.

Andrew Brady

December 9, 2025 AT 16:38Everything you’re being told is a lie. The government doesn’t want to regulate crypto-they want to control it. FIU-IND? That’s surveillance under another name. TDS? That’s financial fingerprinting. The moment you link your PAN to an exchange, you’re no longer free.

And they’re using your compliance to justify future bans. First they tax you, then they restrict you, then they ban you. This is how totalitarian states work.

Use a VPN. Use a non-KYC wallet. Keep your coins off-exchange. The real victory isn’t paying taxes-it’s staying off their radar.

Althea Gwen

December 11, 2025 AT 11:20so like... if i hold btc and it goes up... but i dont sell... am i just... vibing with potential? 🤔✨

Durgesh Mehta

December 12, 2025 AT 08:53Good post. I use Zebpay. Export CSV every month. Save in Google Drive. Pay tax. Done. No drama

Sarah Roberge

December 13, 2025 AT 13:37Wait so if I buy ETH with BTC and then sell ETH for INR... I pay 30% on the BTC gain AND the ETH gain? But I didn’t even have INR at the start? This is like paying tax on a dream. This isn’t capitalism. This is metaphysical accounting.

Alan Brandon Rivera León

December 15, 2025 AT 10:15As someone who’s lived in both the U.S. and India, I’ve seen how crypto regulation evolves. The U.S. is a mess-IRS guidance is outdated, exchanges fight them, and most people just guess. India? They built a system. It’s not perfect, but it’s clear. That’s rare.

Yes, 30% hurts. But if you’re trading, you’re making money. And if you’re making money, you owe something back. That’s not oppression. That’s citizenship.

And if you’re using P2P to avoid TDS? You’re not being clever. You’re being risky. The bank doesn’t care if you used a VPN. It just sees a ₹5 lakh deposit with no source. And then you’re in trouble.

Use the system. It’s there for a reason.

Ziv Kruger

December 16, 2025 AT 14:49So we traded sovereignty for spreadsheets.

And called it progress.