Fake Crypto Exchange: How to Spot Scams and Avoid Losing Your Money

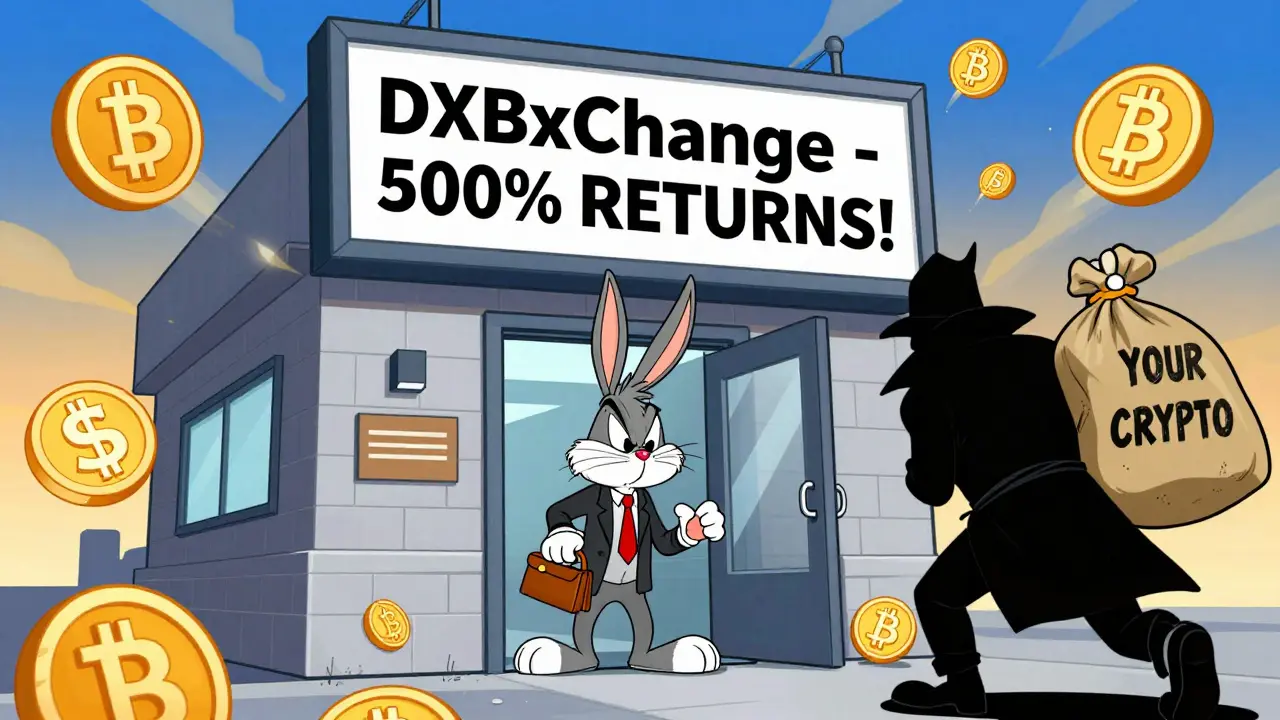

When you hear about a new fake crypto exchange, a platform that pretends to let you trade cryptocurrency but has no real infrastructure, no regulation, and often vanishes with users’ funds. Also known as a ghost exchange, it’s one of the most common ways people lose money in crypto. These aren’t just bad websites—they’re designed to look real. They copy logos from Binance or MEXC, use fake testimonials, and even show fake trading volumes. The goal? Get you to deposit funds, then disappear.

Behind every fake crypto exchange, a platform that mimics legitimate services but operates without oversight, transparency, or security. Also known as a scam exchange, it often pushes fake airdrops to lure you in. You’ll see offers for free tokens from projects like POLYS, VLX GRAND, or SUNI—none of which exist. These are traps. Once you connect your wallet to claim the tokens, scammers drain it. And if you try to withdraw your deposit? No customer support. No response. Just silence.

Real exchanges like Binance, MEXC, or Aster have public team members, audit reports, and regulatory licenses. Fake ones? Nothing. No proof of reserves. No user reviews. No history. Platforms like EvmoSwap, Bit4you, and EOSex were all presented as legitimate—until they vanished. Even GIBXChange and EOSex promised profit-sharing or advanced tools, but never delivered. These aren’t mistakes—they’re calculated frauds.

And it’s not just exchanges. Fake airdrops, cloned websites, and impersonated Telegram groups all feed into the same ecosystem. If a site asks for your private key, your seed phrase, or a wallet signature to "claim" free tokens, it’s a scam. No legitimate project will ever ask for that. The crypto airdrop scam, a fraudulent scheme where fake tokens are offered to steal wallet access or personal data. Also known as a token claim scam, it thrives because people want something for nothing. But in crypto, if it sounds too good to be true, it’s designed to take your money.

What’s worse? Many of these scams target beginners who don’t know how to check if an exchange is real. They look at flashy designs, fake social media followers, or a YouTube ad and assume legitimacy. But real platforms don’t need to shout. They don’t promise 100x returns. They don’t disappear after a few months. They build trust slowly, with transparency, security, and time.

Below, you’ll find real reviews of platforms that turned out to be fake—or barely real. You’ll see exactly what to look for: missing licenses, zero trading volume, anonymous teams, and hidden terms. You’ll also learn how to spot fake airdrops, avoid phishing links, and protect your wallet before it’s too late. This isn’t theory. These are cases that happened. And they can happen to you—if you don’t know the signs.