Cryptocurrency Mining Tax Incentives: How They Shape Profitability

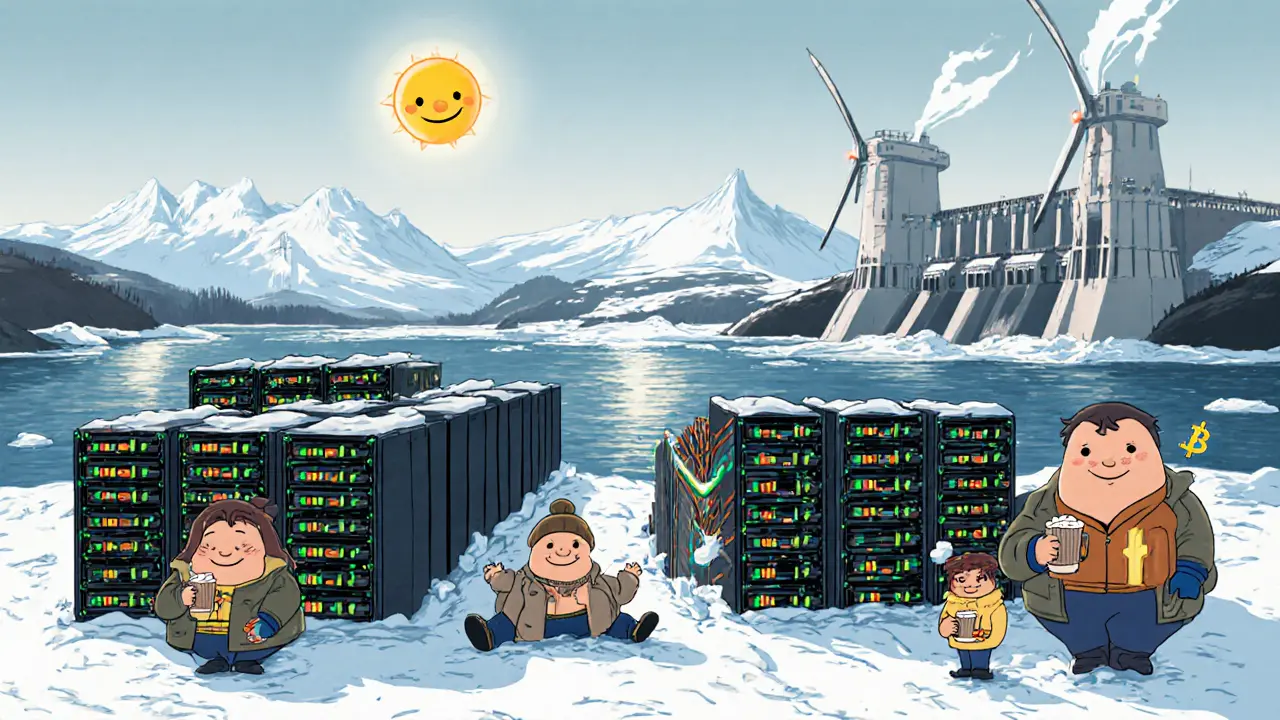

When exploring cryptocurrency mining tax incentives, the financial breaks governments give to crypto miners to lower tax bills. Also known as mining tax breaks, they aim to make mining projects more viable in high‑cost regions.

One of the main tools is tax credits, deductions that directly reduce the amount of tax owed on mining income. These credits can be tied to renewable‑energy usage, equipment investment, or job creation. When a jurisdiction pairs tax credits with energy subsidies, financial support that lowers the price of electricity for miners, the combined effect can slash operating costs dramatically, turning a marginal operation into a profitable one.

That’s why government policy, the set of regulations and incentives a country adopts for crypto mining becomes a decisive factor. A clear policy can attract large mining farms, while vague rules can deter investment. Policy stability also impacts the long‑term planning of miners who need to amortize expensive hardware over several years.

Understanding cryptocurrency mining tax incentives can be the difference between a thriving operation and a marginal loss. The incentive landscape is built on a few core relationships: tax incentives encompass tax credits, tax credits reduce operating costs, energy subsidies boost mining profitability, and government policy influences mining profitability. These semantic links help you see why a change in one area—like a new renewable‑energy subsidy—can ripple through your ROI calculations.

Take Texas, for example. The state offers a sales‑tax exemption on mining equipment and a reduced franchise tax for companies that generate at least 50% of electricity from renewables. Combine that with federal tax credits for energy‑efficient hardware, and a miner can shave up to 30% off total expenses. In contrast, countries with high corporate tax rates and no clear subsidy framework often see miners relocate to friendlier zones such as Kazakhstan or the United Arab Emirates, where government policy explicitly supports crypto‑friendly tax regimes.

Compliance is another piece of the puzzle. Even the most generous incentive package requires accurate reporting of mining revenue, proper documentation of energy costs, and adherence to local tax filing deadlines. Failure to comply can turn a tax credit into a hefty penalty, eroding any advantage the incentive provided. Many jurisdictions now demand real‑time monitoring of energy consumption, meaning miners must integrate smart‑meter data into their accounting stacks.

Below you’ll find a curated set of articles that break down specific incentive programs, compare regional tax regimes, and show how you can apply these benefits to your mining strategy. Dive in to see which policies match your operation’s scale, what documentation you’ll need, and how to maximize profitability through smart tax planning.