Crypto Securities Laws: What You Need to Know About Regulation and Compliance

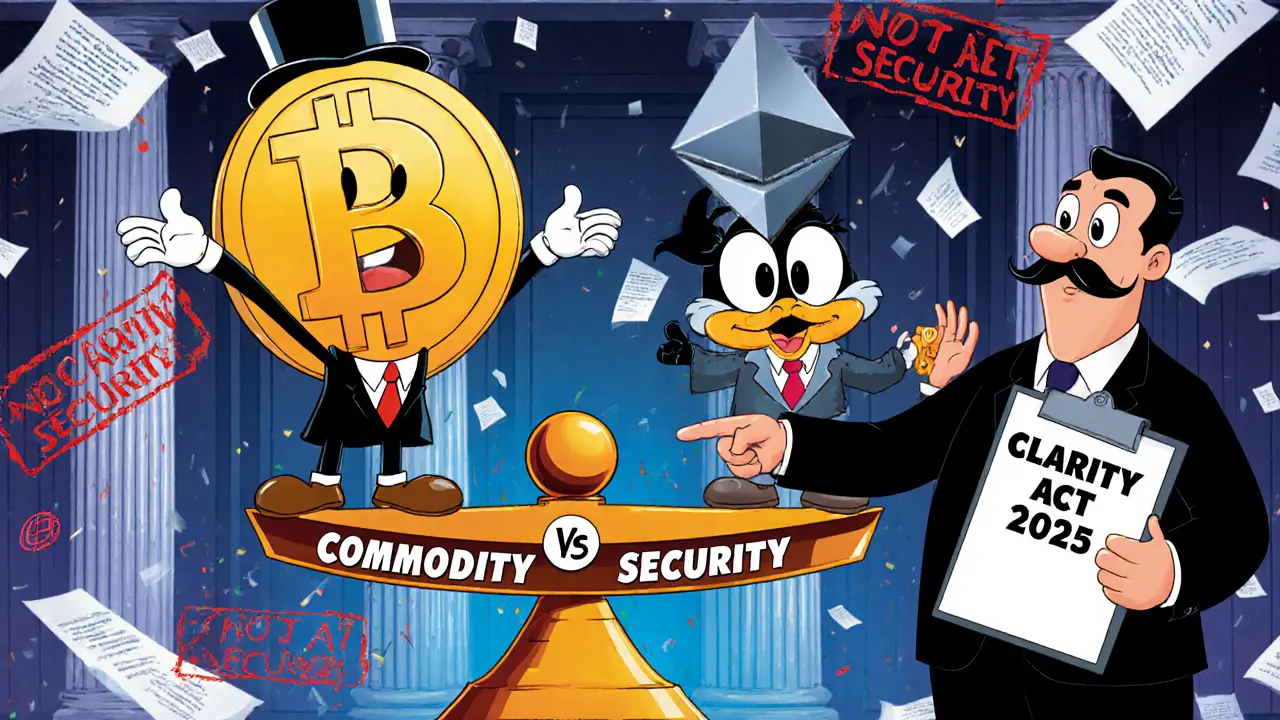

When you buy a crypto token, you might think you’re just investing in a digital asset—but under crypto securities laws, rules that determine whether a digital asset is treated as a financial security by government agencies. Also known as digital asset regulation, it’s what separates legal projects from ones that get shut down overnight. The SEC, the U.S. agency that enforces federal securities laws and has taken action against major crypto platforms like Coinbase and Binance doesn’t care if your token runs on Ethereum or Solana. If it’s sold as an investment expecting profit from others’ work, it’s likely a security. That’s why projects like dYdX block users in certain countries—because they’re trying to avoid violating these same laws.

It’s not just about big exchanges. Even small airdrops and DeFi tokens can cross the line. If a project promises you returns based on its team’s efforts—like staking rewards tied to platform growth, profit-sharing from trading fees, or governance rights that influence revenue—you’re probably holding a security. That’s why token classification, the process of deciding whether a crypto asset is a security, utility token, or commodity matters more than hype. The compliance crypto, the set of legal practices projects use to operate within financial regulations isn’t about being boring—it’s about staying open. Look at SwissBorg or Corite: they offer governance and rewards, but they do it with legal structures in place. Meanwhile, platforms like EOSex and Karatbit vanished because they ignored these rules entirely.

What does this mean for you? If you’re trading, staking, or claiming tokens, you need to know who’s behind the project and how they’re structured. Airdrops from CoinMarketCap or Phala Network are usually safe because they’re promotional, not investment contracts. But if a token’s whitepaper talks about "revenue sharing," "price support," or "investor returns," tread carefully. Countries like the U.S., UK, and EU are tightening enforcement. Even self-custody wallets won’t protect you if the platform you bought from gets flagged. The goal isn’t to avoid crypto—it’s to avoid the ones that break the rules. Below, you’ll find real cases, exchange reviews, and airdrop guides that show exactly where the lines are drawn—and how to stay on the right side of them.