Crypto Restrictions in India: What You Can and Can't Do in 2025

When it comes to crypto restrictions in India, the rules that limit how people buy, trade, or hold digital assets under Indian law. Also known as Indian crypto regulations, these rules don’t ban cryptocurrency outright—they just make it harder to use without jumping through hoops. Unlike China, where crypto is fully blocked, India lets you own Bitcoin and Ethereum, but the government watches every move. You can buy crypto with UPI, but you’ll pay taxes on every profit. You can trade on local exchanges, but they’re not allowed to offer leverage or derivatives. And if you try to hide your gains? The Income Tax Department already has your transaction data.

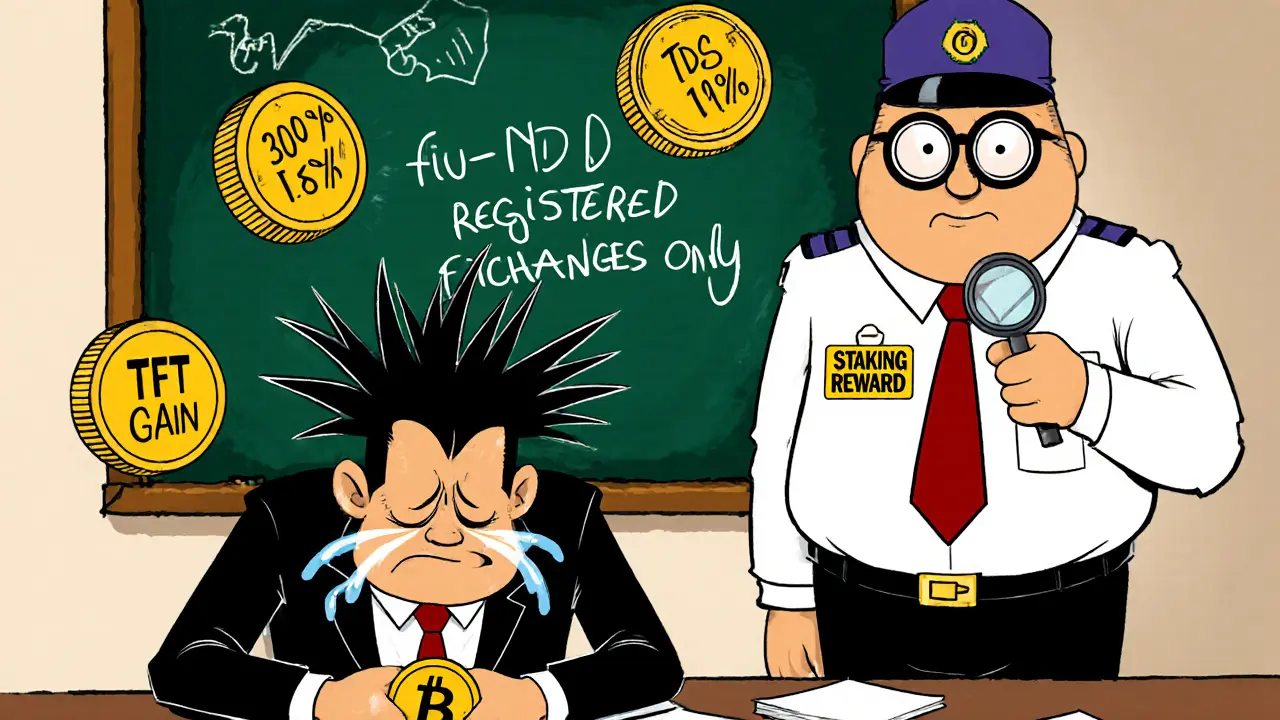

The real challenge isn’t legality—it’s clarity. UPI crypto purchases, using India’s instant payment system to buy tokens. Also known as digital rupee transactions, they’re the most common way retail investors enter the market. But banks sometimes freeze accounts linked to crypto wallets, even if you’re just buying Bitcoin. Then there’s crypto tax India, a 30% flat tax on gains, with no deductions for losses. This isn’t like stock market taxes—it’s harsher. Even if you lose money trading, you still owe tax on every win. And if you receive tokens from an airdrop or staking reward? That’s taxable income too. Meanwhile, exchanges like Binance and CoinDCX operate under heavy scrutiny, while local platforms like WazirX and ZebPay have built compliance into their systems—because they have to.

What’s missing? Clear licensing for crypto businesses. No exchange in India has a full regulatory license yet. That’s why you see so many fake platforms popping up—scammers know people are desperate for safe options. That’s also why posts here focus on real exchanges, how to spot scams, and what to do when your bank blocks a transaction. You won’t find advice on bypassing taxes or hiding wallet addresses. You’ll find what works: how to legally buy crypto, how to report it, and which platforms actually protect your funds.

India’s crypto scene is a balancing act—between innovation and control, between opportunity and risk. The rules change fast, but the core truth stays the same: if you’re trading, you’re being watched. The smart move isn’t to fight the system—it’s to understand it, work within it, and protect your assets. Below, you’ll find real guides on buying crypto with UPI, avoiding fake exchanges, and navigating the tax mess. No fluff. No hype. Just what you need to stay safe and legal in 2025.