Crypto Regulation: What It Means, Who Controls It, and How It Affects Your Wallet

When you hear crypto regulation, the set of laws and rules governments use to control how cryptocurrencies are traded, taxed, and used. Also known as cryptocurrency laws, it's not just about stopping scams—it's about deciding who gets to play, how, and under what conditions. This isn't theoretical. In 2025, your ability to trade, stake, or even hold crypto depends entirely on where you live and what rules are enforced.

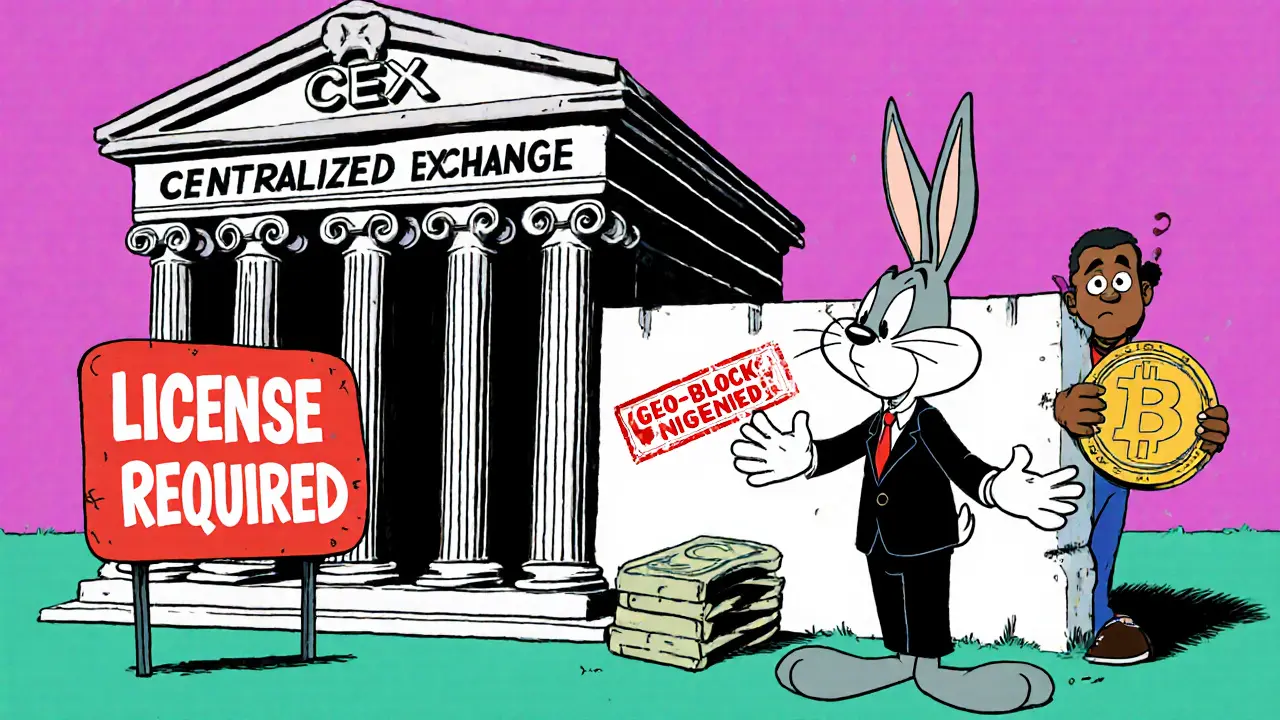

Crypto taxes, the mandatory payments governments demand on crypto gains or income are one of the most common ways regulation hits your wallet. India doesn’t ban crypto—it taxes every trade at 30%. China bans it outright, while Nigeria went from blocking banks to licensing exchanges. The U.S. under Trump’s 2025 policy shift created a Strategic Bitcoin Reserve and banned CBDCs, making it the clearest market in the world. These aren’t abstract policies—they determine whether you can use UPI to buy Bitcoin, whether your exchange is legal, or if your staking rewards get seized.

Crypto exchanges, platforms where you buy, sell, or trade digital assets are ground zero for regulation. Some, like Aster and Echobit, offer advanced tools but lack licenses—making them risky. Others, like Bit4you or GIBXChange, pretend to be real but have no oversight, no reserves, and no accountability. Meanwhile, MiCA in Europe and FIU-IND in India force exchanges to prove they’re legitimate. If an exchange isn’t regulated, your funds aren’t protected. And if you’re using a fake platform like IMOEX or EvmoSwap, you’re not trading—you’re giving money to scammers.

Regulation also defines what’s real and what’s fake. Airdrops like APENFT X CMC or PHA from Phala Network are legal because they’re tied to active projects with transparent rules. But SUNI, VLX GRAND, or POLYS airdrops? They’re traps—no team, no website, no utility. Regulation doesn’t just protect you from fraud—it helps you spot it. The same rules that ban unlicensed exchanges also expose fake airdrops and phantom tokens.

And it’s not just about money. Blockchain compliance, the steps projects and users must take to follow legal requirements affects how networks stay secure. Sybil attacks, where fake identities overload a network, are harder to pull off when social trust and identity verification are built into the system. Economic finality in Proof of Stake? That’s regulation-friendly tech—it makes transactions irreversible without relying on slow, energy-heavy mining. Countries that embrace this tech, like those using Ethereum’s model, are building faster, cleaner systems. Others, like Iran mining Bitcoin to bypass sanctions, are playing a high-stakes game with global regulators.

What you’ll find below isn’t a list of random posts. It’s a map of how crypto regulation actually plays out—across borders, exchanges, taxes, and scams. You’ll see how Nigeria flipped its policy, how India makes you pay but lets you trade, and how China’s total ban leaves holders with zero protection. You’ll learn which airdrops are real, which exchanges are safe, and how to avoid losing everything to a fake platform. This isn’t about guessing what’s legal. It’s about knowing exactly what’s allowed—and what will cost you.