Crypto Access Checker

Which crypto services work in your country?

Check your access to centralized and decentralized exchanges based on regional regulations

Centralized Exchanges (CEX)

Decentralized Exchanges (DEX)

Recommended Approach

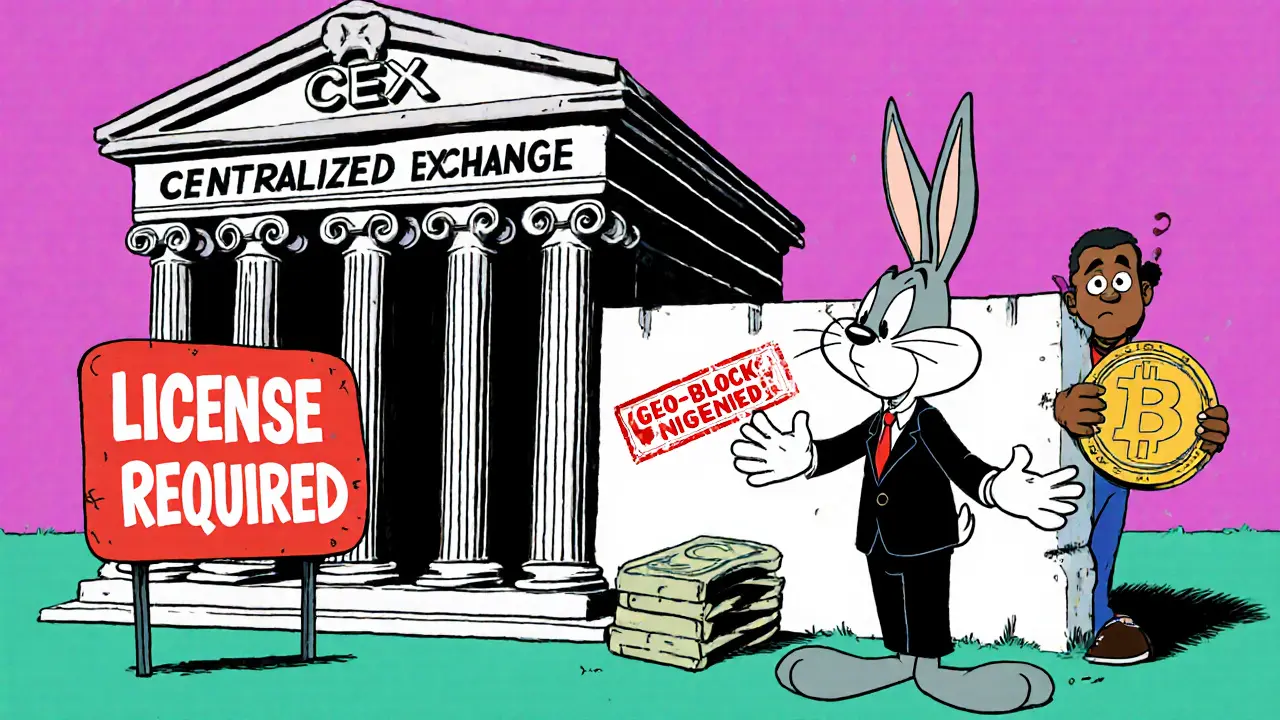

If you’ve ever tried to trade crypto and got blocked by a message like "This service isn’t available in your country", you’ve felt the real-world impact of geographic restrictions. It’s not just annoying-it’s a fundamental divide between how centralized exchanges and decentralized exchanges handle the world’s patchwork of crypto laws.

Why CEXs Block You by Country

Centralized exchanges (CEXs) like Binance, Coinbase, and Kraken act like banks with crypto. They need licenses. They need to follow AML rules. They need to report to governments. That’s why they block users based on IP address, KYC documents, and even the billing address linked to your credit card.Take the U.S. For example. Coinbase operates there because it holds money transmitter licenses in every state where it’s allowed. But it can’t offer derivatives or staking to everyone. In New York, only a handful of tokens are approved under the BitLicense. In Texas, you can trade more-but not everything. Meanwhile, in countries like Nigeria or Vietnam, Binance restricts fiat deposits because local banks refuse to work with them. The result? Two people with identical crypto knowledge, sitting in different cities, have completely different access to markets.

CEXs don’t just block countries-they block features. Derivatives? Locked in the EU. Margin trading? Disabled in Canada. Stablecoin swaps? Not available in Singapore unless you’re an accredited investor. These aren’t technical limits. They’re legal ones. And every time a new regulation drops, CEXs scramble to update their geo-filters. If they don’t, they risk fines, shutdowns, or worse-losing their banking partners entirely.

How DEXs Bypass Geographic Blocks (For Now)

Decentralized exchanges (DEXs) like Uniswap, PancakeSwap, and dYdX don’t have headquarters. They don’t have customer support teams. They don’t collect your ID. You connect your wallet-MetaMask, Phantom, or Ledger-and trade directly with a smart contract. No middleman. No approval process.This is why someone in Iran, Venezuela, or Russia can still trade ETH for USDC on Uniswap, even if Binance has blocked them. As long as they can get crypto into their wallet-through a peer-to-peer marketplace, a friend, or a crypto ATM-they can use a DEX. No passport needed. No government clearance. No IP check.

That’s not magic. It’s architecture. DEXs run on public blockchains. Their code is open. Transactions are permissionless. You can’t shut down a smart contract by sending a cease-and-desist letter. There’s no server to take offline. No CEO to jail. That’s why regulators hate them-and why they’re so hard to stop.

The Myth of Complete Freedom

But here’s the catch: DEXs aren’t truly free from geography. They’re just harder to control.Some DEXs are starting to build in geo-blocks-not because they want to, but because they’re being forced to. In 2024, the EU’s MiCA regulation began pressuring DEX aggregators and wallet providers to implement location checks. A few DEXs now use IP-based filtering on their frontends. Not because the smart contract can’t be accessed, but because the website that connects you to it now blocks your browser.

Then there’s the issue of stablecoins. USDT and USDC are issued by centralized companies. If you’re in a sanctioned country, your bank might freeze your account if you send money to Tether’s wallet. Even if you trade on a DEX, you still need to get your fiat in and out. That’s the choke point. No DEX can solve that.

And let’s not forget: using a DEX doesn’t make you immune to local laws. In China, trading crypto on any platform is illegal. In India, you must report all crypto gains. In the U.S., the IRS treats crypto as property. Just because a DEX doesn’t ask for your ID doesn’t mean you’re not still liable under your country’s tax and financial laws.

Fiat On-Ramps: The Real Geographic Gatekeeper

One of the biggest differences between CEXs and DEXs isn’t the exchange itself-it’s how you get money in.CEXs let you deposit USD, EUR, or AUD directly. That’s convenient. But it’s also their Achilles’ heel. To do that, they need banking relationships. And banks are terrified of crypto. If a bank thinks a CEX is serving users in a high-risk jurisdiction, they’ll cut them off. That’s why Binance lost its banking partners in the UK and Australia in 2023. They had to shut down fiat deposits there overnight.

DEXs don’t handle fiat. You need to buy crypto elsewhere first-through a P2P platform like LocalBitcoins, a crypto ATM, or even a friend. That’s a barrier, yes. But it’s also a loophole. If you can get crypto into your wallet without a bank, you can trade on a DEX no matter where you live.

That’s why in places like Nigeria or Argentina, where local banks restrict crypto, people use P2P to buy BTC with mobile money, then swap it for stablecoins on a DEX. It’s messy. It’s slower. But it works.

Security, Control, and Responsibility

CEXs promise safety. They store your crypto in cold wallets. They offer two-factor authentication. They have customer support to recover your account if you forget your password.DEXs don’t. You are your own bank. Lose your seed phrase? Your coins are gone forever. Send ETH to the wrong address? No one can reverse it. No one will help you.

That’s the trade-off. CEXs give you convenience and protection-but they also give regulators the keys to your account. DEXs give you control-but you’re on your own if things go wrong.

And here’s something few people talk about: if you live in a country where crypto is illegal or heavily restricted, using a CEX puts you at risk. If the government seizes your account, they can see your entire trading history, your ID, your bank details. On a DEX? No one knows it was you unless you voluntarily link your identity.

What’s Next? The Regulatory Push

Regulators aren’t giving up. In 2025, the FATF (Financial Action Task Force) pushed new guidelines requiring DEX platforms to implement “reasonable measures” to prevent illicit use-including location checks. Some DEXs are responding by partnering with identity verification providers like Onfido or Jumio. Others are building blockchain-based geolocation tools using IP and wallet history.It’s not the end of DEXs. But it’s the end of the idea that they’re completely unregulated. The future isn’t CEX vs DEX. It’s regulated DEXs vs unregulated DEXs. And users will have to choose: convenience and compliance, or privacy and risk.

Which One Should You Use?

If you live in the U.S., Canada, EU, Japan, or Australia-use a CEX. It’s legal, safe, and easy. You’ll get access to fiat, customer support, and more trading pairs.If you’re in a country with heavy restrictions-Russia, Iran, Nigeria, Venezuela, or parts of Southeast Asia-use a DEX. But only after you’ve bought crypto through a P2P method. Don’t try to deposit fiat directly. Use a hardware wallet. Never store large amounts on a DEX interface. And always assume your activity is visible to your government.

And if you’re anywhere in between? Use both. Keep your main holdings on a CEX for easy access. Use a DEX for trading tokens that aren’t listed locally. It’s not ideal. But in 2025, crypto isn’t about one-size-fits-all. It’s about layered access.

Can I use a DEX if my country bans crypto?

Technically, yes. DEXs don’t require registration or KYC, so you can access them from anywhere with an internet connection. But if your country bans crypto entirely, using a DEX could still break local laws-even if the platform itself doesn’t know who you are. You’re responsible for knowing your country’s rules.

Why can’t DEXs just block users like CEXs do?

The smart contracts powering DEXs run on public blockchains and can’t be changed or shut down by any single entity. However, the websites or apps you use to connect to them (like Uniswap’s interface) can be blocked by IP address. So while the underlying protocol remains open, access points can be restricted.

Are DEXs safer than CEXs?

It depends. CEXs protect your assets with insurance and cold storage, but they can be hacked or frozen by regulators. DEXs give you full control over your funds, but if you lose your private key or fall for a scam, there’s no recovery. Your security depends on your habits, not the platform.

Can I deposit fiat on a DEX?

No. DEXs don’t handle fiat currency. You need to buy crypto first using a CEX, P2P platform, or crypto ATM, then transfer it to your wallet to trade on a DEX. This is why DEXs aren’t a full replacement for CEXs-they’re a complementary tool.

Which countries have the strictest crypto restrictions?

Countries like China, Egypt, Algeria, and Morocco have outright bans on crypto trading. Others like India, Nigeria, and Russia impose heavy reporting rules, banking restrictions, or taxes that make crypto use difficult. CEXs often withdraw from these markets entirely. DEXs remain accessible, but users face legal and financial risks.

Maggie Harrison

December 1, 2025 AT 12:18Just used Uniswap from my couch in Ohio to swap ETH for USDC after my bank froze my CEX account 😅 Turns out you don't need a passport when you've got a seed phrase and a VPN. The real freedom isn't in the exchange-it's in owning your keys. 🚀

Steve Savage

December 2, 2025 AT 17:58CEXs are like Starbucks-convenient, regulated, and you know exactly what you're getting. DEXs are like that weird taco truck behind the gas station-no menu, no health inspector, but sometimes the best damn thing you've ever eaten. Both have their place. Just don't blame the truck when you get food poisoning from a scam token.

Joe B.

December 3, 2025 AT 11:04Let’s be real-regulators aren’t trying to stop DEXs, they’re trying to stop anonymity. The entire architecture of DeFi is built on pseudonymity, which is why MiCA and FATF are coming for wallet providers and frontends. If you think blockchain is decentralized, you’re ignoring the fact that 87% of DEX traffic flows through Cloudflare and Infura. The infrastructure is centralized. The code is not. That’s the tension. And no, IP filtering on Uniswap’s UI doesn’t mean the contract is blocked-it means your browser got a 403. Big difference.

Rod Filoteo

December 3, 2025 AT 23:22They're watching us. Always. Even if you're on a DEX, your wallet address is logged by every node, every explorer, every analytics firm. The government doesn't need your ID-they just need your transaction history and a subpoena. And don't even get me started on how Tether is basically a CIA front. USDC? Same thing. They're all controlled. You think you're free? You're just in a bigger cage with fewer bars.

Reggie Herbert

December 4, 2025 AT 09:36Incorrect. DEXs are not ‘harder to control’-they are unenforceable. Enforcement requires jurisdiction over actors. No actor exists on a DEX. The smart contract is code. Code is not a legal entity. Therefore, regulation targeting DEXs is fundamentally incoherent. The only enforceable targets are on-ramps, off-ramps, and UIs. The rest is performative policy-making. Stop conflating accessibility with legality.

Darlene Johnson

December 5, 2025 AT 11:12Of course you can use a DEX in a banned country. But do you really think you're some underground crypto rebel? You're just a data point in a blockchain analytics firm's heatmap. Every swap you make is tagged, traced, and sold to compliance bots. You're not anonymous-you're just poorly informed. And now your neighbor's cousin in Lagos is getting flagged because you swapped 0.03 ETH last Tuesday. Thanks for the collateral damage.

Ivanna Faith

December 7, 2025 AT 01:14CEXs are for people who want to sleep at night DEXs are for people who want to own their money and dont care if the government comes knocking 🤷♀️ I use both but my 95% is on DEXs. No one can freeze my wallet. No one can tell me what to trade. Thats worth more than customer service

Akash Kumar Yadav

December 8, 2025 AT 15:58India banned crypto trading but we still use DEXs. How? We buy USDT from Telegram groups with UPI. Then swap on PancakeSwap. No bank involved. No KYC. No problem. The government can ban apps but they can't ban blockchain. You think your CEX is safe? It's just a middleman who reports to the RBI. We don't need them. We are the system.

samuel goodge

December 9, 2025 AT 22:29It’s worth noting that the real geopolitical divide isn’t between CEX and DEX-it’s between jurisdictions that treat crypto as property versus those that treat it as currency. In the U.S., the IRS taxes every trade; in the EU, MiCA imposes licensing on service providers; in Nigeria, the central bank forbids banks from facilitating crypto-but the blockchain itself? It’s indifferent. The infrastructure is global. The laws are local. And until regulators stop trying to apply 20th-century banking rules to 21st-century consensus mechanisms, we’ll keep seeing this absurd patchwork.

Vidyut Arcot

December 11, 2025 AT 09:50For folks in India or Nigeria-don’t stress. DEXs are your lifeline. Just use a hardware wallet, never keep large amounts on hot wallets, and always double-check contract addresses. It’s not perfect, but it’s better than being locked out of the global economy. You’re not breaking the system-you’re building a parallel one. Keep going.

Jay Weldy

December 11, 2025 AT 17:58I get why people hate CEXs. They feel corporate. But I also get why people rely on them. Not everyone wants to be their own bank. Not everyone can afford to lose $5k because they copied a bad contract address. Maybe the answer isn’t choosing one over the other-it’s understanding when to use each. CEX for stability. DEX for freedom. Both have value.

Melinda Kiss

December 13, 2025 AT 01:14Just wanted to say thank you for writing this. As a woman in tech who’s watched friends get scammed on DEXs because they thought ‘no KYC = no risk’-this is exactly the nuance we need. Safety isn’t about the platform. It’s about education. And we need way more of it.

Christy Whitaker

December 14, 2025 AT 06:29So you’re telling me I should use a DEX in the U.S. because it’s ‘more private’? That’s cute. You think the IRS doesn’t track wallet addresses? They’ve been buying blockchain data from Chainalysis since 2019. Your ‘anonymity’ is a myth. You’re not a revolutionary-you’re a fool who thinks encryption makes you invisible. Wake up.

Nancy Sunshine

December 15, 2025 AT 15:41Regulatory frameworks are evolving toward a hybrid model: regulated on-ramps, permissionless execution layers. The future of crypto is not CEX versus DEX-it is compliant infrastructure interfacing with decentralized protocols. This is not a regression. It is maturation. The goal is not to eliminate decentralization, but to integrate it into a globally coherent financial architecture. The transition will be messy, but inevitable.