Crypto Geographic Restrictions: Where You Can and Can't Trade Crypto in 2025

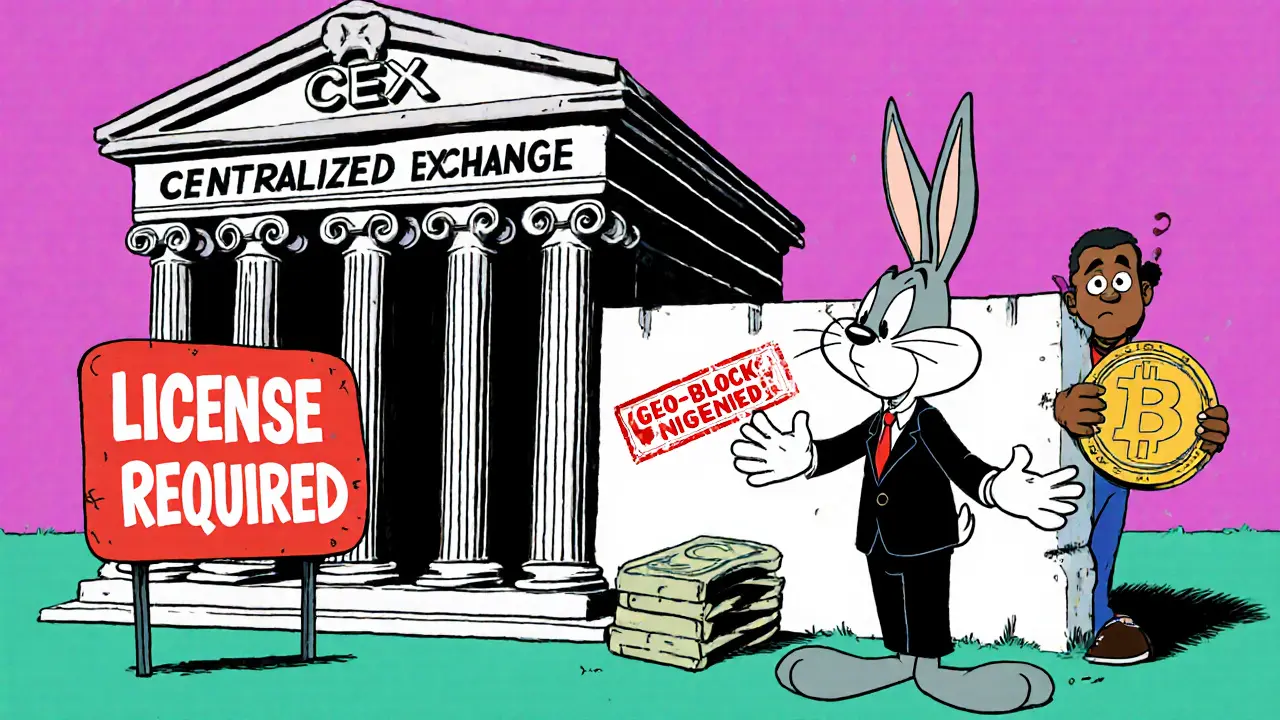

When you think about crypto geographic restrictions, rules that determine where you can legally buy, sell, or hold cryptocurrency based on your location. Also known as crypto regulations by country, these rules aren’t just paperwork—they decide if your wallet works, if you can cash out, or if you’re risking fines or jail. One person in Nigeria can legally trade crypto through licensed platforms, while someone in China could lose everything—and face penalties—for even holding Bitcoin.

These restrictions aren’t random. They’re shaped by national financial policy, how governments control money flow, protect citizens, and maintain economic stability, tax law, how income from crypto is treated, reported, and collected, and sanctions evasion, when countries use crypto to bypass Western financial controls. In Iran, mining isn’t just a hobby—it’s a sanctioned workaround for global banking blockades. In India, you’re not banned from owning crypto, but you pay a 30% tax on every profit, and the government tracks every transaction through FIU-IND. In Nigeria, the Central Bank went from shutting down bank accounts for crypto users to officially licensing exchanges. That’s not a policy tweak—it’s a full U-turn.

Some places pretend to ban crypto but quietly allow it. Others make it impossible to even open a wallet without jumping through legal hoops. The U.S. doesn’t ban crypto, but its rules change with every election cycle—2025 saw a major shift with the GENIUS Act and a Strategic Bitcoin Reserve. Meanwhile, China enforces a total ban: no trading, no mining, no holding. If you’re caught, your assets are seized, and you’re on a watchlist. There’s no gray area. And in Europe, MiCA is slowly bringing order—but only for exchanges that register. Unregulated platforms like Bit4you or GIBXChange? They’re legal ghosts.

What does this mean for you? If you’re traveling, moving, or just using a VPN, you’re not hiding from the law—you’re risking it. Airdrops that work in the U.S. might be illegal in South Korea. Staking rewards in Canada? Fine. Same rewards in Russia? Risky. Even claiming a token on CoinMarketCap could land you in trouble if your country doesn’t recognize it as property. This isn’t about tech—it’s about where you live, what your government allows, and whether you’ve checked the rules this month.

Below, you’ll find real-world breakdowns of how countries handle crypto—from outright bans to tax-heavy compliance. You’ll see which exchanges are safe where, how scams target people in restricted zones, and why some airdrops are legal traps. No theory. No fluff. Just what’s actually happening in 2025—and what you need to do to stay out of trouble.