Crypto Compliance in India: What You Need to Know in 2025

When it comes to crypto compliance in India, the set of legal and financial rules that govern how individuals and businesses use, trade, and report cryptocurrency. Also known as Indian crypto regulations, it’s no longer about whether crypto is allowed—it’s about how you follow the rules. The government doesn’t ban crypto like China does. Instead, it’s watching closely, taxing heavily, and demanding transparency.

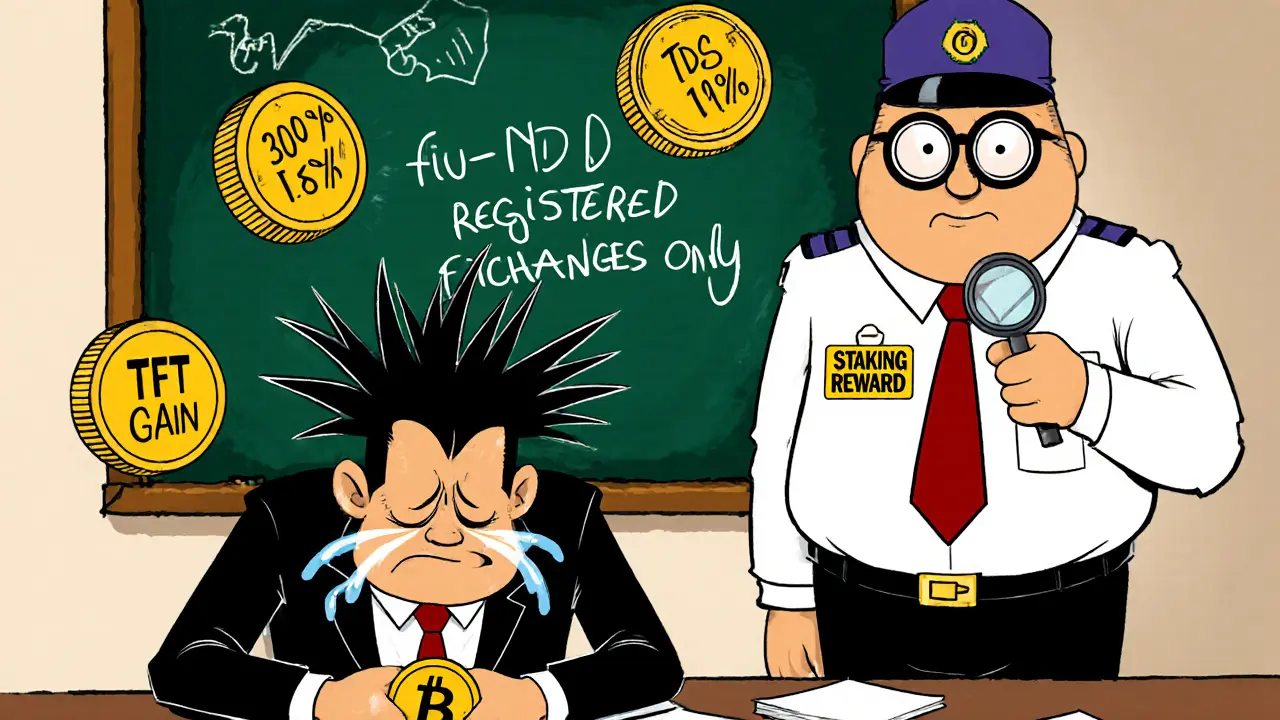

Every time you buy, sell, or trade crypto in India, you’re triggering a tax event. The crypto tax India rate is 30% on gains, plus a 1% TDS on every transaction. That’s not a suggestion—it’s enforced. Exchanges like WazirX, CoinDCX, and ZebPay now report user activity to the tax department. If you didn’t report your trades last year, you’re already at risk. Even if you hold crypto without trading, you still need to declare it in your income tax return under ‘assets.’ There’s no gray area anymore.

What about exchanges? Not all platforms are created equal. Some, like Bit4you or GIBXChange, operate without Indian oversight. Others, like those registered with the Financial Intelligence Unit (FIU), follow KYC and AML rules. Choosing a regulated exchange isn’t just safer—it’s legally required if you want to avoid penalties. The Indian crypto exchange, a platform licensed to facilitate crypto trading under India’s financial laws. Also known as regulated crypto platform, must now verify your identity, track your transactions, and share data with authorities. If you use an unregulated one, you’re not just risking your money—you’re risking legal trouble.

And don’t get fooled by airdrops or meme coins promising free tokens. The cryptocurrency legality India, the current legal framework determining which crypto activities are permitted, restricted, or penalized. Also known as crypto law India, doesn’t protect you if you fall for a scam. The SEC and Indian authorities treat fake airdrops like SUNI or Velas GRAND as fraud. Claiming tokens from a site with no team, no website, or no whitepaper? That’s not a windfall—it’s a trap. Compliance isn’t about limiting freedom. It’s about protecting you from bad actors and ensuring your investments aren’t wiped out by unregulated chaos.

So what’s next? If you’re trading, staking, or holding crypto in India, you need three things: a compliant exchange, accurate records of every transaction, and proof you’ve paid your taxes. No guesswork. No shortcuts. The rules are clear. The penalties are real. And the data is already being shared.

Below, you’ll find real reviews, scam alerts, and step-by-step guides that cut through the noise. No fluff. Just what works—and what gets you in trouble—in India’s crypto landscape in 2025.