CEX vs DEX: What’s the Real Difference and Which One Fits Your Crypto Strategy?

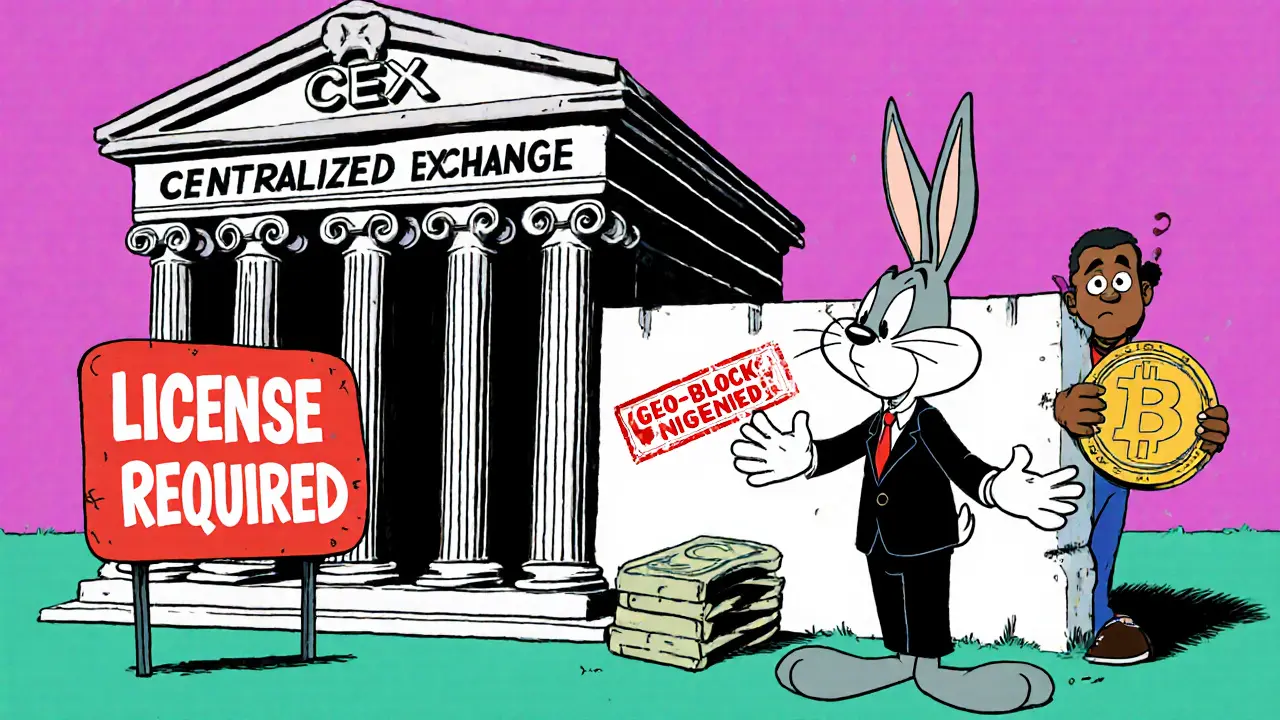

When you trade crypto, you’re choosing between two very different systems: a centralized exchange, a platform run by a company that holds your funds and manages trades, like Binance or Coinbase. Also known as CEX, it’s fast, familiar, and handles customer support for you. On the other side is a decentralized exchange, a peer-to-peer trading platform that runs on blockchain code, letting you trade directly from your wallet without a middleman. Also known as DEX, it gives you full control but puts all the responsibility on you. This isn’t just a technical detail—it changes how safe your money is, how fast you can trade, and who’s really in charge.

Most people start with a CEX because it feels like using a bank: you deposit fiat, buy crypto with a click, and get help if something goes wrong. But here’s the catch—you don’t own your keys. If the exchange gets hacked, freezes your account, or shuts down, your funds could vanish. That’s why so many posts here warn about fake exchanges like IMOEX or EvmoSwap—they look real, but they’re just websites with no real backing. Meanwhile, DEXs like Aster or Polkadex let you trade without handing over control. But they come with their own risks: low liquidity, complex interfaces, and smart contract bugs that can drain your wallet. You can’t call customer service if a DEX glitch wipes out your trade. And if you send crypto to the wrong address? Too bad. No refunds.

The real question isn’t which is better—it’s which fits your goals. If you’re trading daily, need fast withdrawals, or use leverage, a CEX gives you speed and tools. If you’re holding long-term, care about privacy, or want to avoid third-party risks, a DEX keeps your assets yours. But neither is perfect. Even top DEXs struggle with slippage on small tokens, and CEXs like GIBXChange operate without regulation, leaving you exposed. That’s why understanding CEX vs DEX isn’t about picking a side—it’s about knowing when to use each. The posts below show you real examples: how Polkadex tries to fix DEX liquidity problems, why Aster offers hidden orders for advanced traders, and how scams like CtcSwap trick users into thinking they’re on a real exchange. You’ll also see how TVL and economic finality help measure whether a DEX is actually trustworthy. Whether you’re avoiding airdrop scams or learning how market orders work on order books, this collection gives you the facts—not the hype—to make smarter moves.