Centralized Exchange: What It Is, How It Works, and Where to Trade Safely

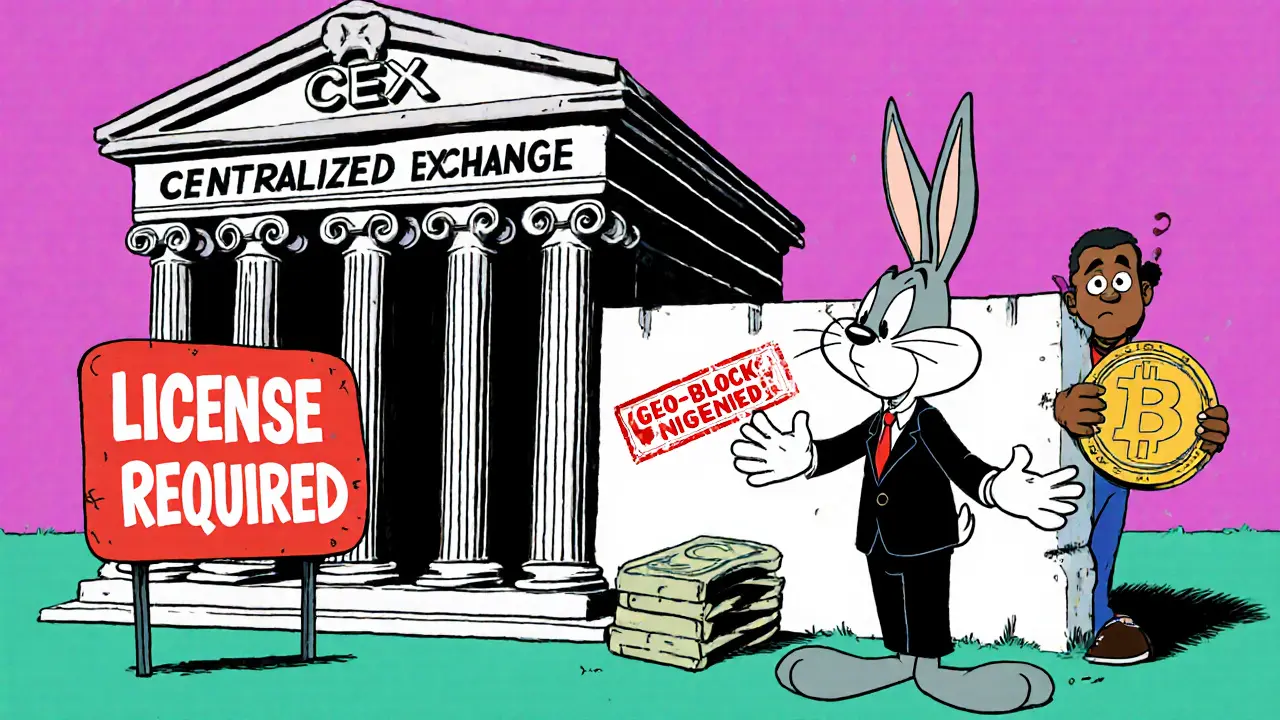

When you buy crypto with a credit card or trade Bitcoin for Ethereum, you’re probably using a centralized exchange, a company-run platform that holds your crypto and handles trades between users. Also known as CEX, it’s the reason most people can trade crypto without learning how to manage their own wallet. Unlike decentralized platforms, centralized exchanges act like banks—they store your coins, match your orders, and control access. That makes them fast and easy, but also a target for hacks and shutdowns.

Most big names you’ve heard of—Binance, the world’s largest crypto exchange by volume, offering hundreds of tokens and low fees, MEXC, a global platform popular for new token listings and futures trading, or even smaller ones like Echobit—are centralized. They handle everything: deposits, withdrawals, order books, customer support. But they also hold your keys. If they get hacked, go offline, or get shut down by regulators, you could lose access. That’s why users who care about control avoid them. But for most people, the trade-off is worth it: instant trades, fiat on-ramps, and simple interfaces.

Not every exchange claiming to be a CEX is real. Posts here reveal fake platforms like IMOEX and EvmoSwap—ghost sites with no history, no users, and no licenses. Others, like Bit4you and GIBXChange, look legit but lack regulation or transparency. The difference between a safe exchange and a scam often comes down to one thing: proof. Do they show reserves? Are they registered anywhere? Do real people leave reviews? If not, walk away. Even big names like Binance and MEXC aren’t perfect—they’ve had outages and regulatory fights—but they’ve survived because they’ve built trust over time.

Understanding centralized exchanges helps you avoid traps. You’ll see posts that explain why some tokens never list on major platforms, why order books matter for trading, and how airdrops tied to these exchanges can be risky. You’ll also find guides on how to trade safely, spot scams, and pick exchanges that actually protect your funds. Whether you’re new or experienced, knowing how centralized exchanges operate isn’t just useful—it’s necessary to keep your crypto secure.