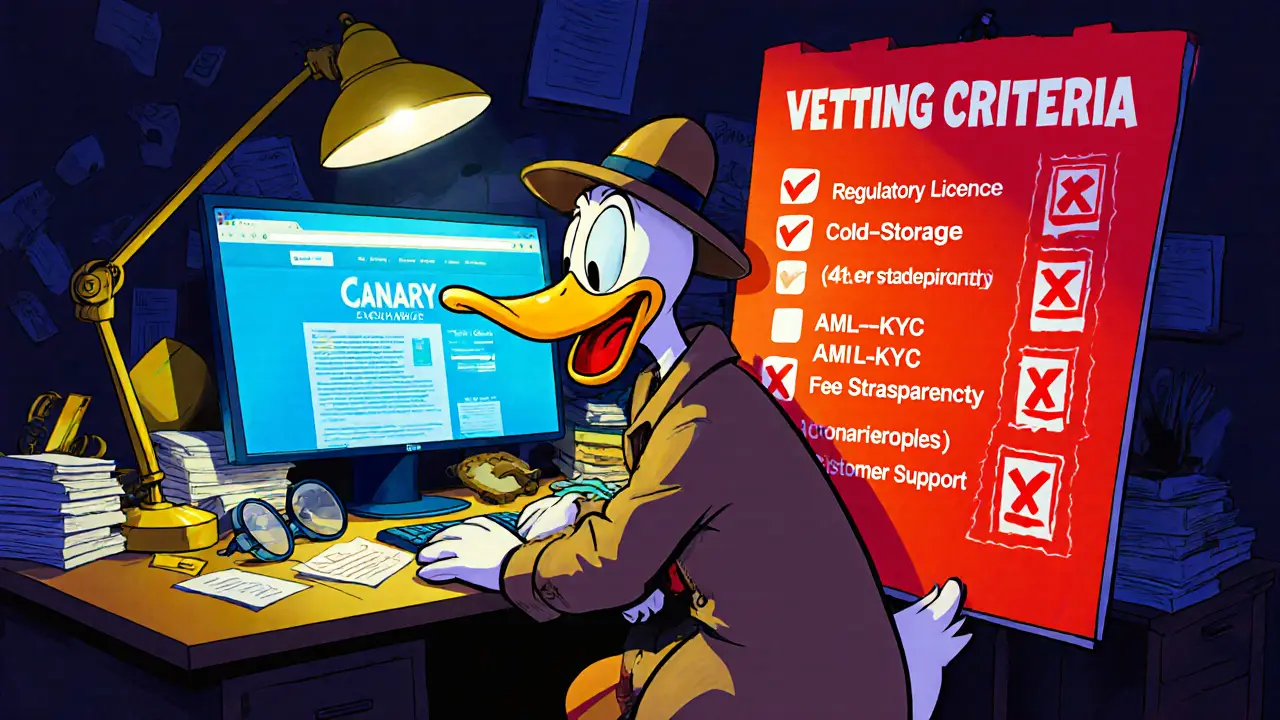

Canary Exchange Review: Fees, Security, and Features Explained

When working with Canary Exchange, a crypto exchange that launched in 2023 offering spot, futures and a native token. Also known as Canary, it aims to combine fast execution with a user‑friendly interface. Crypto exchange fees, the cost structure for deposits, withdrawals and trades play a big role in trader profitability, while Security protocols, the mix of two‑factor authentication, encryption and cold‑storage practices determine how safe your assets are. Finally, the range of Token listings, available coins, tokens and DeFi projects on the platform shapes liquidity and the ability to capture new market trends. In short, Canary Exchange encompasses spot trading, requires robust security, and its fee model influences ROI for both beginners and pros.

What Sets Canary Apart?

First, the fee schedule is tiered: makers enjoy a 0.08% rebate at high volume, takers pay 0.12% on the first 1 M USD, and the rates drop as you trade more. This structure mirrors larger players but stays competitive thanks to lower maker fees for early adopters. Second, security is built around hardware‑security‑module (HSM) signed transactions, mandatory SMS and app‑based 2FA, and a 95% cold‑wallet reserve. Those security protocols reduce the risk of hacks, a concern that still haunts many exchanges. Third, the exchange lists over 300 tokens, including emerging DeFi projects that integrate with Canary’s native staking pool. By offering both popular assets and niche tokens, the platform boosts liquidity and gives traders a chance to diversify without hopping between multiple services. Together, these elements create a synergy: lower fees attract volume, strong security retains users, and a broad token list fuels market depth.

Beyond the basics, Canary’s UI includes real‑time charting, API access for bots, and a built‑in portfolio tracker that syncs with external wallets. The platform also supports fiat on‑ramps in USD, EUR and GBP, making it easier for newcomers to deposit without converting to crypto first. For advanced users, the futures market offers up to 10x leverage, with settlement in the native Canary token, which can be staked for additional yield. This blend of features means the exchange appeals to a wide audience—from casual investors who just want to buy Bitcoin to algorithmic traders seeking low‑latency order books. The integration of DeFi services, like yield farming pools and cross‑chain bridges, further expands its utility, tying the exchange’s core trading engine to the broader ecosystem.

All these pieces—fee tiers, security layers, token variety, and DeFi extensions—form a cohesive picture of what you can expect from Canary. Whether you’re measuring cost efficiency, evaluating how your assets are protected, or scouting new tokens to add to your basket, the review below breaks each aspect down with practical takeaways. Dive into the articles to see real‑world performance data, compare Canary against other platforms, and discover actionable tips that can help you decide if this exchange fits your trading style.