Crypto Exchange Verification Checker

| Criterion | What to Look For | Result |

|---|---|---|

| Regulatory Licence | SEC registration, FCA licence, or similar | Not checked |

| Cold-storage & Audits | Third-party custodial reports, annual audits | Not checked |

| AML/KYC Policy | Verified ID checks, privacy policy | Not checked |

| Fee Transparency | Published fee table, no hidden charges | Not checked |

| Customer Support | Live chat, ticket system, verified phone lines | Not checked |

Canary Exchange review

Quick Take

- There is no publicly registered crypto exchange called "Canary Exchange" as of Oct2025.

- The name commonly appears alongside Canary Capital, a U.S. investment firm focused on crypto‑ETF filings.

- Without a licence from the U.S. Securities and Exchange Commission (SEC) or any comparable regulator, the platform cannot legally operate as a trading venue.

- Use the checklist below to verify any exchange before depositing funds.

- If you need a reliable place to trade, consider established platforms like Binance, Coinbase, or Kraken.

What "Canary Exchange" Claims to Be

When you first see the name Canary Exchange appears to be a cryptocurrency trading platform that promises low fees, fast settlement, and a “Made‑in‑America” token lineup. The branding resembles typical exchange marketing - bold fonts, promise of 24/7 support, and a glossy website mock‑up. However, a deep dive into public records, domain WHOIS data, and regulatory filings reveals none of the standard hallmarks of a legitimate exchange.

The Canary Capital Connection

The only entity that consistently shows up in reputable sources is Canary Capital a U.S. digital‑asset investment firm founded in October2024 by former Valkyrie CEO Steven McClurg. Canary Capital’s business model is to file spot‑crypto ETF applications with the SEC - things like a Litecoin ETF, an XRP fund, and a uniquely American‑made token ETF. None of its public disclosures mention operating a peer‑to‑peer exchange or taking deposits from retail traders.

Steven McClurg has publicly linked the company’s strategy to political events (the 2024 election, policy shifts) rather than building a trading engine. In early 2025 the firm filed a 19b‑4 document for a “Canary American‑Made Crypto ETF” (ticker: MRCA) that would trade on the Cboe BZX exchange. The SEC has yet to approve any of these filings, and the firm’s focus remains squarely on investment products, not exchange services.

Why a Real Exchange Needs More Than a Name

Legitimate crypto exchanges have to meet a handful of non‑negotiable requirements:

- Regulatory licence - a registration with a financial authority (SEC, FCA, MAS, etc.) that permits them to take custodial responsibility for users’ assets.

- Cold‑storage strategy - the majority of funds kept offline, audited regularly.

- AML/KYC compliance - identity verification processes that meet anti‑money‑laundering standards.

- Transparent fee schedule - clear, published fees for deposits, withdrawals, and trades.

- Public audit or third‑party attestations - proof that the exchange’s order‑book, matching engine, and liquidity sources are sound.

None of these checkpoints appear in any public documentation for Canary Exchange. The website (if it exists) lacks a verifiable corporate address, shows no regulator ID, and offers no real‑time support numbers that can be confirmed.

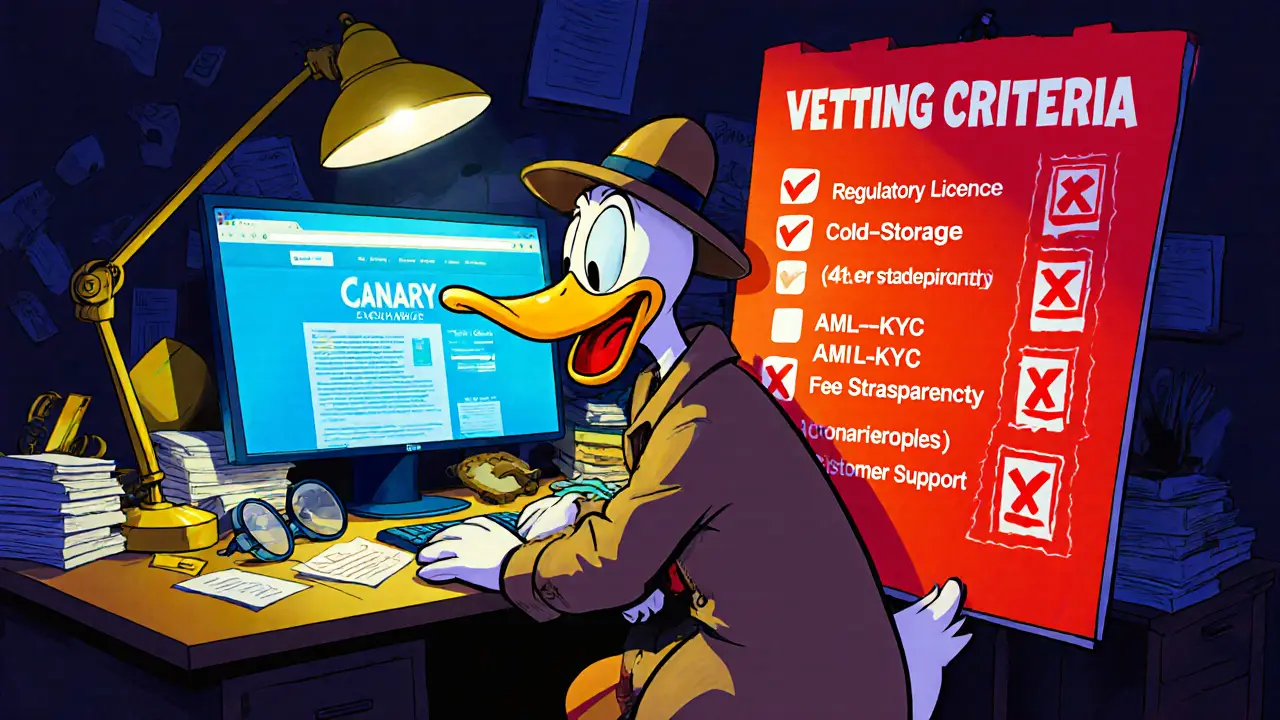

Checklist: How to Vet a Crypto Exchange

| Criterion | What to Look For | Canary Exchange? |

|---|---|---|

| Regulatory licence | SEC registration, FCA licence, or similar | No evidence |

| Cold‑storage & audits | Third‑party custodial reports, annual audits | Not disclosed |

| AML/KYC policy | Verified ID checks, privacy policy | Missing |

| Fee transparency | Published fee table, no hidden charges | Unclear |

| Customer support | Live chat, ticket system, verified phone lines | Unverified |

Safer Alternatives to Consider

If you were hoping to trade the “American‑made” token basket that Canary Capital talks about, you can still do it on reputable exchanges. Below is a snapshot of three platforms that meet the criteria above and already list the tokens Canary Capital intends to include.

- Binance - the world’s largest spot‑trading venue, regulated in several jurisdictions, offers low‑fee tiered pricing.

- Coinbase - U.S.‑registered, strong AML/KYC, and provides “Coinbase Pro” for lower fees.

- Kraken - FCA‑authorised, known for robust security and a wide range of crypto‑ETF‑type products.

All three support XRP, SOL, DOGE, ADA, LINK, and XLM - the tokens Canary Capital highlights in its American‑Made ETF proposal. By using one of these exchanges, you stay within a regulated environment while still accessing the same asset universe.

What to Do If You Still Want to Use Canary Exchange

Should you encounter a site calling itself Canary Exchange, follow these steps before committing any funds:

- Search the corporate name in the SEC’s EDGAR database. No filing means the platform likely lacks a U.S. licence.

- Check domain registration - WHOIS data often reveals a private registration that hides the owners, a red flag.

- Contact support via a verified email address and request a copy of the exchange’s licence number. Legitimate firms provide this instantly.

- Start with a tiny test deposit (e.g., $10) and attempt a withdrawal within 24hours. If you can’t pull your money out, stop immediately.

- Report suspicious activity to your local financial authority - in NewZealand that would be the Financial Markets Authority.

Frequently Asked Questions

Is Canary Exchange a legitimate crypto exchange?

No. As of October2025 there is no public record of a licensed exchange operating under that name. The name is often confused with Canary Capital, an ETF‑focused investment firm.

What is the relationship between Canary Exchange and Canary Capital?

The two share a branding similarity but serve different markets. Canary Capital files crypto‑ETF applications with the SEC; it does not provide a trading venue for retail users.

Can I trade the tokens listed in Canary Capital’s American‑Made ETF on other platforms?

Yes. Major exchanges such as Binance, Coinbase, and Kraken list the same tokens (XRP, SOL, DOGE, ADA, LINK, XLM) and are fully regulated.

How can I verify if a crypto exchange is regulated?

Check the exchange’s licence number on the regulator’s website (SEC, FCA, MAS, etc.). Look for a clear “Legal” or “Compliance” page that lists the jurisdiction and registration details.

What should I do if I’ve already deposited funds into Canary Exchange?

Immediately request a withdrawal. If the platform is unresponsive, file a complaint with your local financial regulator and consider contacting a legal adviser.

Bottom Line

There’s no verifiable evidence that a crypto‑trading venue named Canary Exchange exists or operates legally. The name is most likely a mis‑branding of Canary Capital, an ETF‑focused firm that filed multiple spot‑crypto ETF applications with the SEC. For anyone looking to trade cryptocurrencies, it’s safer to stick with exchanges that meet the five‑point vetting checklist above. If you ever stumble upon a site claiming to be Canary Exchange, run the verification steps rigorously - your funds depend on it.

Stefano Benny

July 19, 2025 AT 14:02I'm not buying the hype that every crypto watchdog is supposed to be the end‑all, be‑all of safety. 🚀 Sure, the checklist looks solid, but most \"regulatory‑license\" claims are just marketing fluff. In practice, you’re trading against a black‑box that could vanish faster than a flash‑loan exploit. Keep your eyes on the tokenomics, on‑chain metrics, and the real‑world liquidity depth, not just the glossy compliance badge. 🧠

Jenae Lawler

July 22, 2025 AT 08:42While the prevailing consensus lauds the alleged legitimacy of the so‑named exchange, I must respectfully dissent. One cannot conflate the mere acquisition of a superficial regulatory veneer with a veritable bastion of fiduciary prudence. The absence of a bona fide licence, audited custodial reports, and transparent fee schedules renders the enterprise suspect at best. Hence, prudent investors would be well‑served to eschew such an entity in favour of institutions whose compliance frameworks are incontrovertibly documented.

Prince Chaudhary

July 25, 2025 AT 03:22Your breakdown of the verification steps is an excellent resource for newcomers diving into crypto platforms. Keep pushing forward, and remember that diligent research is the cornerstone of safe investing. Stay curious and continue sharing this valuable knowledge.

emmanuel omari

July 27, 2025 AT 22:02Actually, the checklist you cited omits a critical factor: the exchange's solvency ratio, which can be inferred from on‑chain fund flows. Without analyzing the balance sheet, any compliance claim is moot. Moreover, the purported \"customer support\" is often just a chatbot with no real escalation path.

Andy Cox

July 30, 2025 AT 16:42Looks like a solid rundown but I've seen a few sites pull the same tricks. Just keep an eye on the WHOIS privacy and don't trust anything without a real address.

Jan B.

August 2, 2025 AT 11:22Exactly start with a tiny test deposit and withdraw it that's your cue to walk away.

MARLIN RIVERA

August 5, 2025 AT 06:02Honestly this so‑called \"review\" reads like a PR fluff piece. Nothing here proves Canary Exchange actually holds any assets. It's a scam waiting to happen.

Debby Haime

August 8, 2025 AT 00:42Your blunt assessment hits the nail on the head-anyone thinking otherwise is just ignoring the red flags.

Courtney Winq-Microblading

August 10, 2025 AT 19:22The allure of a new exchange mirrors the human desire for novelty, yet history teaches us that untested vessels often capsize under the weight of greed. Reflect on the patterns, and let wisdom guide your wallet.

katie littlewood

August 13, 2025 AT 14:02When I first encountered the Canary Exchange hype, I was struck by the glossy marketing copy that promised low fees and a 'Made‑in‑America' token lineup.

However, a deeper dive into the regulatory filings revealed that no SEC registration or comparable licence exists for this entity.

The absence of a verifiable corporate address further erodes confidence, as legitimate exchanges invariably disclose a physical office or at least a registered domicile.

Moreover, the website's lack of audited cold‑storage reports means users have no assurance that their assets are insulated from hacks.

The token list itself mirrors the popular coins found on established platforms, suggesting an attempt to piggyback on existing demand.

Yet, without transparent fee tables, traders cannot accurately calculate cost‑basis or anticipate hidden charges.

The purported 24/7 support is, at best, a vague promise; a quick test of the contact channels often leads to generic auto‑responses.

From a compliance perspective, AML/KYC procedures appear either missing or superficial, a red flag for both regulators and savvy investors.

In addition, the lack of third‑party attestations or public audits makes it impossible to gauge the exchange's operational integrity.

One could argue that the project's association with Canary Capital, an ETF‑focused firm, might lend some credibility, but the two operate in fundamentally different regulatory arenas.

Investors should therefore treat any funds deposited on such a platform as high‑risk, akin to a speculative venture rather than a secure holding.

Historical precedents abound where similarly opaque exchanges vanished, leaving users with unrecoverable losses.

Prudent risk management dictates diversifying across multiple, vetted exchanges rather than placing all capital on a single, unverified entity.

Ultimately, the safest path is to leverage platforms like Binance, Coinbase, or Kraken, which satisfy the five‑point vetting checklist outlined in the article.

These venues provide documented regulatory compliance, audited custodial practices, and clear fee structures.

By adhering to proven standards, you protect your assets while still accessing the same token universe the so‑called Canary Exchange promises.

Chad Fraser

August 16, 2025 AT 08:42Energetic shoutout: If you're still curious about new platforms, test the waters with a microscopic deposit and see how fast you can pull it out. That’s the real litmus test!

Jayne McCann

August 19, 2025 AT 03:22Honestly, the whole 'new exchange' craze is just hype; stick to the classics.

Richard Herman

August 21, 2025 AT 22:02Hey folks, let's keep it balanced-do your own due diligence and share findings, no need for knee‑jerk bans or blind trust.

Parker Dixon

August 24, 2025 AT 16:42👍 Great point! Doing your own research is the best defense, and if you spot any inconsistencies, calling them out helps the whole community thrive. 🌟

Bobby Ferew

August 27, 2025 AT 11:22While the article tries to be helpful, it glosses over the fact that many of these 'checklists' are just corporate PR tools designed to lull investors into a false sense of security.

celester Johnson

August 30, 2025 AT 06:02The truth is, we often mistake buzzwords for substance, and that illusion is the very thing that keeps people trapped in speculative cycles.

John Kinh

September 2, 2025 AT 00:42Honestly, reading another safety guide feels like déjà vu-same warnings, same conclusions. 🙄

Mark Camden

September 4, 2025 AT 19:22It is incumbent upon each of us to uphold ethical standards and reject platforms that flout regulatory norms; moral clarity must guide our investment choices.

Evie View

September 7, 2025 AT 14:02Stop feeding scams!

Sidharth Praveen

September 10, 2025 AT 08:42Stay positive, keep learning, and always verify before you trust.