Canary Capital: Crypto Venture Insights

When exploring Canary Capital a crypto‑focused venture capital firm that backs early‑stage blockchain startups CC, you’re looking at a player that mixes deep‑tech expertise with aggressive market timing. Canary Capital Canary Capital encompasses venture funding, requires rigorous due diligence, and influences the growth of the DeFi ecosystem. Its core strategy is to identify projects that solve real‑world problems on chain, then provide the capital and mentorship needed to scale.

How Canary Capital Connects to the Wider Crypto Landscape

In the DeFi decentralized finance ecosystem arena, Canary Capital often serves as a bridge between innovative protocols and institutional money. By investing in liquidity‑mining platforms, decentralized exchanges, and token‑omics experiments, it helps shape market dynamics and sets benchmarks for token utility. The firm’s involvement also drives token‑based governance, allowing investors to vote on protocol upgrades—a clear example of token‑based governance influencing venture outcomes.

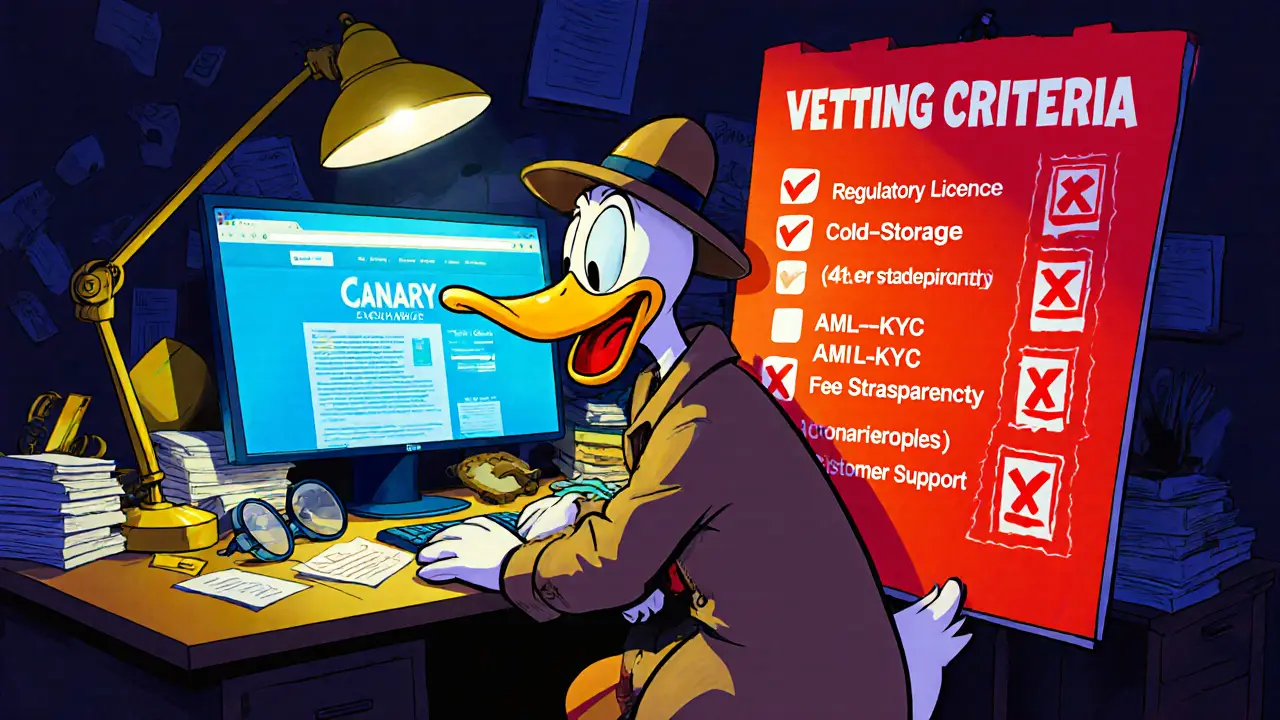

Another pillar of its activity is supporting blockchain startups early‑stage companies building infrastructure, applications, or services on distributed ledgers. These startups benefit from Canary Capital’s network, which includes legal advisors, marketing teams, and technical mentors. The firm’s due‑diligence process looks at security audits, code quality, and community traction, ensuring that each investment can survive high TPS demands and fast finality trade‑offs. This focus on security and scalability mirrors the insights shared in our fast‑finality trade‑off analysis.

Finally, the broader venture capital a funding model that provides capital to early‑stage, high‑growth companies ecosystem feeds into Canary Capital’s sourcing pipeline. The firm keeps tabs on global VC trends, especially those intersecting with crypto regulation, multi‑factor authentication, and cross‑chain token standards. By staying aware of regulatory shifts in regions like Abu Dhabi’s ADGM or Turkey’s crypto restrictions, Canary Capital can anticipate where new opportunities will arise and adjust its portfolio accordingly.

Below you’ll find a curated collection of articles that dive deeper into these themes—ranging from Mango Network’s multi‑VM architecture to fast finality trade‑offs, security best practices, and market analyses. Each piece adds a layer to understanding how Canary Capital operates within the fast‑moving world of blockchain investment.