ASIC hardware profitability – your roadmap to mining ROI

When you start looking at ASIC hardware profitability, the net gain you can expect from running an application‑specific integrated circuit for crypto mining after accounting for all expenses. Also known as ASIC mining ROI, it helps you decide whether a miner is worth the upfront spend. Mining profitability is the broader outcome you chase, while electricity cost and hashrate are the two levers that move the needle. In short, ASIC hardware profitability encompasses mining profitability, requires electricity cost analysis, and is driven by hash rate performance.

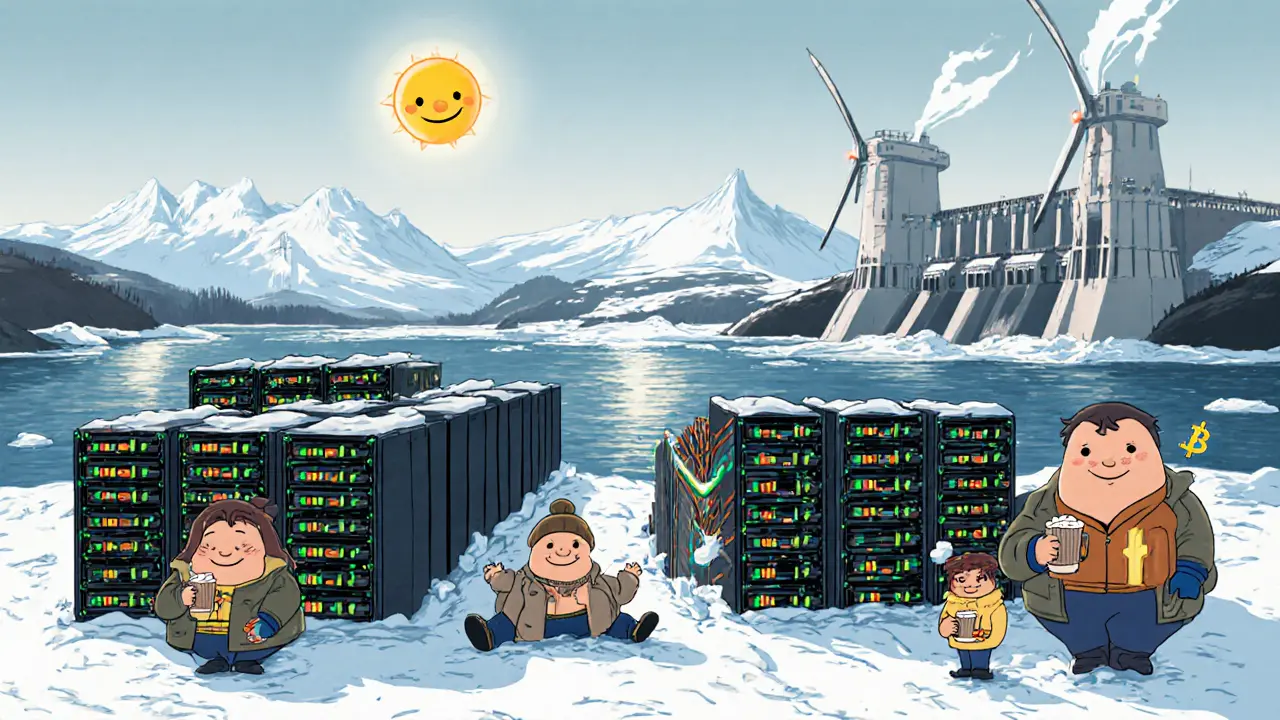

Think of it like a simple equation: revenue from block rewards plus transaction fees minus power bills and maintenance equals profit. The revenue side hinges on the current crypto market price and the miner’s hashrate, which measures how many hashes the device can compute per second. A higher hash rate speeds up block discovery, but it also usually means higher power draw. That’s where electricity cost enters the picture—if you’re paying $0.08 per kWh in a cheap region, the same miner will look far more attractive than in a $0.20/kWh market. The next semantic link is clear: hashrate influences ASIC hardware profitability, and electricity cost determines whether that influence translates into positive net earnings. Beyond the raw numbers, you also need to factor in device lifespan, cooling requirements, and depreciation. An ASIC that delivers 100 TH/s today might drop to 80 TH/s in a year as newer, more efficient chips hit the market. If you ignore that depreciation, your profitability calculation will be overly optimistic. Likewise, cooling fans and ambient temperature affect power efficiency; an overheated miner wastes energy and shortens hardware life. All these variables feed back into the core metric—ASIC hardware profitability—making it a dynamic figure that changes with market conditions, energy rates, and technology upgrades. If you’re still unsure where to start, look at the most popular calculators that plug in your hashrate, power consumption, and local electricity rate. They instantly show you the break‑even point and expected daily, weekly, or monthly profit. Most of these tools also let you compare different ASIC models, so you can see how a Bitmain Antminer S19 Pro stacks up against a MicroBT Whatsminer M30S in your specific region. That comparison is the practical side of our earlier semantic triple: mining profitability requires a clear view of both hardware performance and energy cost. Below you’ll find a curated list of articles that dive deeper into each piece of this puzzle. From detailed ASIC reviews and electricity‑rate optimization tips to real‑world case studies on how hash‑rate fluctuations affect earnings, the collection gives you actionable insights you can apply right away. Ready to see how the numbers play out for your setup? Keep reading to explore the specifics.