ASD, or AscendEX Token, isn't just another crypto coin. It’s a utility token built to make trading on the AscendEX exchange cheaper and more rewarding-if you actually use the platform. Unlike Bitcoin or Ethereum, ASD doesn’t exist to be a store of value or a global payment system. It’s a tool. And like any tool, its worth depends entirely on how you use it.

What ASD Actually Does

ASD is the fuel for AscendEX, a cryptocurrency exchange founded in 2018 by former Wall Street quant traders. Originally called BitMax, it rebranded to AscendEX in 2020 to reflect its broader range of services: spot trading, margin, and futures across 200+ crypto pairs. ASD’s only job? Reduce your trading fees.

If you hold ASD on AscendEX, you get tiered discounts on trading fees. The more ASD you hold, the lower your fees. Holding 100,000 ASD can cut your spot trading fee from 0.1% down to 0.02%. For active traders, that adds up fast. One user on Reddit said holding that amount paid for itself in just three months of regular trading.

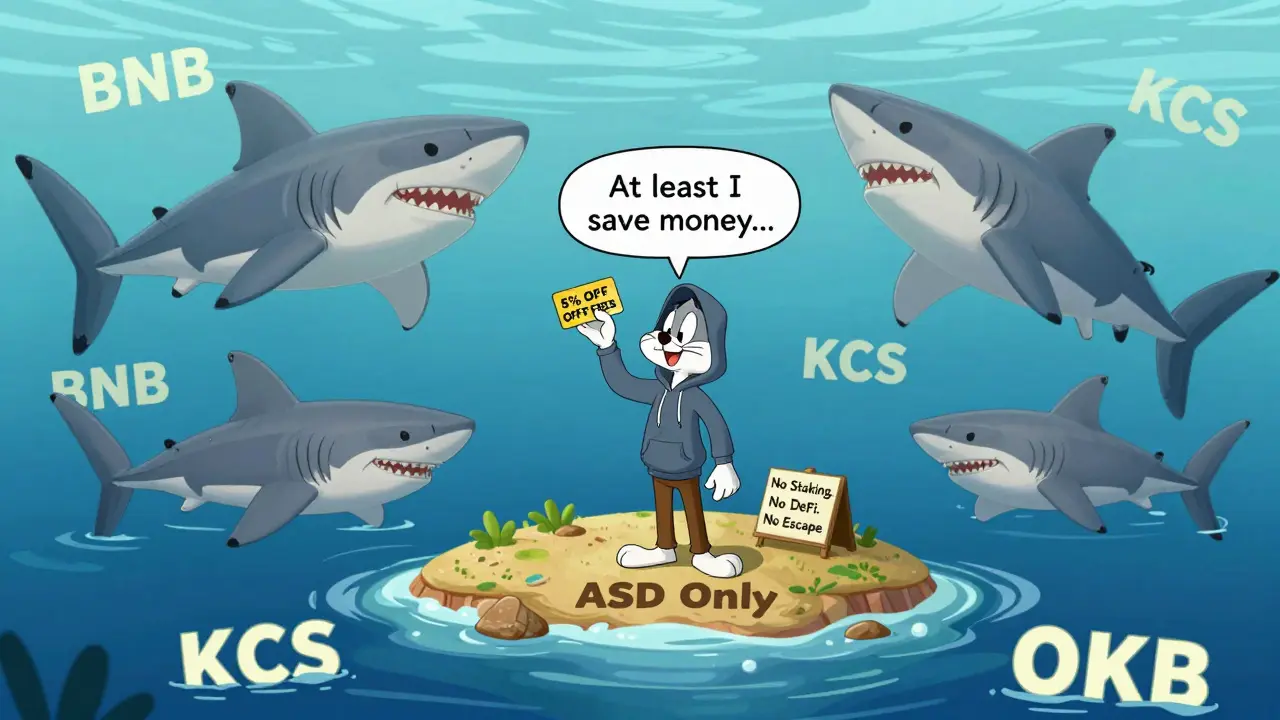

But here’s the catch: ASD only works on AscendEX. If you trade on Binance, Coinbase, or Kraken, ASD is useless. There’s no staking for passive income outside the platform, no DeFi integration, no NFT marketplace. It’s a closed-loop system.

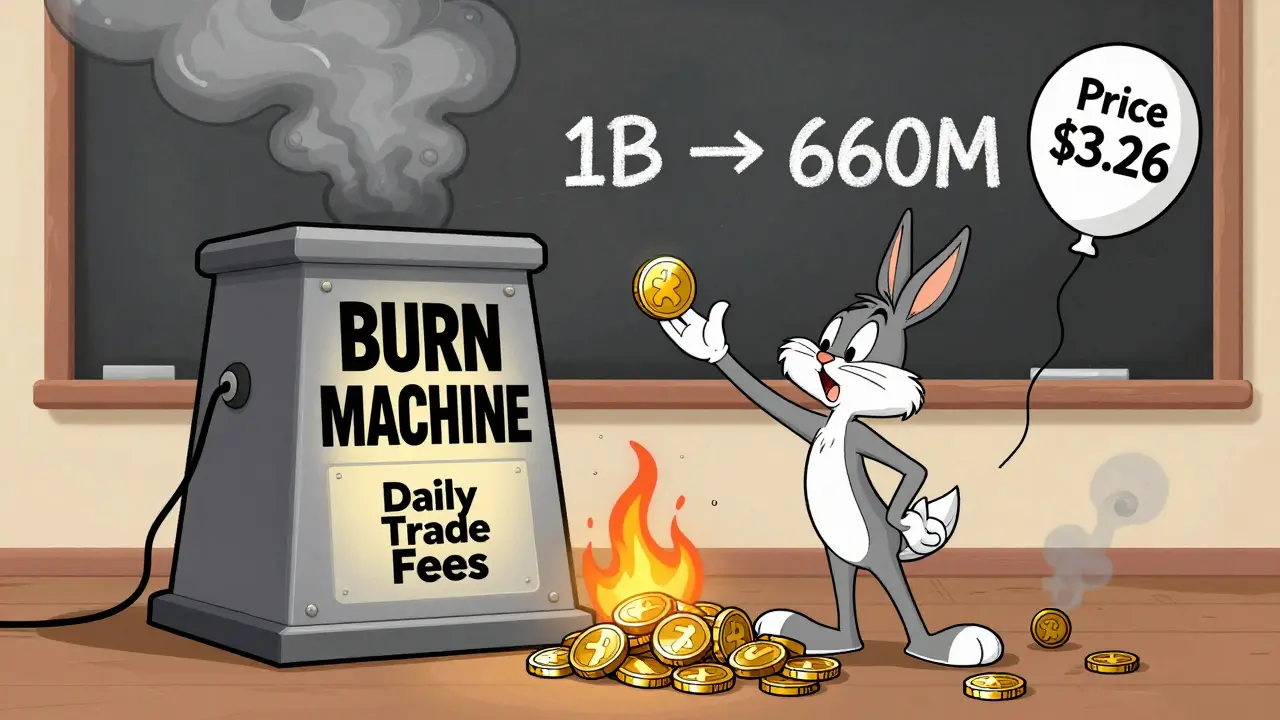

How ASD’s Supply Works (The Burn Mechanism)

ASD’s biggest technical quirk is its deflationary design. When you pay trading fees with ASD, 50% of that amount is permanently destroyed-burned. That means every time you trade using ASD, the total supply shrinks.

Originally, there were 1 billion ASD tokens. As of early 2026, only about 660 million are in circulation. The rest? Burned. This isn’t a quarterly event like Binance’s BNB burns. It’s daily. Every trade you make on AscendEX with ASD chips away at the total supply.

Why does this matter? Less supply, if demand stays steady, can push prices up. But here’s the problem: demand hasn’t kept up. The token’s all-time high was $3.26 in March 2021. Today, it trades around $0.02364-a 99.2% drop. The burn mechanism hasn’t saved it from massive sell pressure.

ASD’s Price and Market Reality

As of January 2026, ASD’s market cap hovers between $15 million and $20 million. That puts it around #850-1300 on CoinGecko’s list of cryptocurrencies. Compare that to BNB, which sits at over $50 billion. ASD is a speck in the crypto universe.

Its 24-hour trading volume is only about $1.2 million. That’s low. Low volume means wide spreads and slippage. If you try to sell a large amount of ASD, you’ll likely get a worse price than you expect. There are only about 958 known wallet holders, according to CoinSwitch. That’s not a community-it’s a niche.

The 52-week price range is $0.021 to $0.079. That’s extreme volatility for a token with so little liquidity. It’s not a stable investment. It’s a speculative bet on AscendEX growing its user base.

ASD vs. BNB, KCS, and Other Exchange Tokens

ASD isn’t alone. Binance’s BNB, KuCoin’s KCS, and OKX’s OKB all serve similar roles. But they’re built differently.

- BNB powers Binance’s entire ecosystem: Binance Chain, BNB Chain, DeFi apps, NFTs, and even payments. It’s a multi-use token with massive adoption.

- KCS used to pay dividends to holders. ASD doesn’t. It only gives fee discounts.

- ASD has no governance. You can’t vote on platform changes. Upgrades are decided by AscendEX’s team alone.

ASD’s advantage? Simplicity. It doesn’t try to do everything. It just lowers your trading fees. But that’s also its weakness. If you’re not actively trading on AscendEX, ASD has zero value. BNB, even if you don’t trade on Binance, can still be used in hundreds of DeFi protocols. ASD can’t.

Who Should Hold ASD?

ASD makes sense for one type of person: active traders who use AscendEX regularly and want to cut costs.

If you:

- Trade spot, margin, or futures on AscendEX at least 5-10 times a week

- Can afford to lock up $2,000-$5,000 worth of ASD to hit the top fee discount tier

- Don’t mind the risk of a token with no outside utility

Then ASD might save you money over time.

If you:

- Trade on multiple exchanges

- Want passive income from staking

- Believe in crypto as a long-term store of value

Then ASD isn’t for you. It’s not an investment. It’s a cost-saving tool.

Is ASD a Good Investment?

Most analysts say no. CoinMarketCap, MarketBeat, and CryptoCompare all give ASD cautious or negative ratings. MarketBeat labels it a "Strong Sell." The technical charts show a steady decline across all timeframes. The YTD drop in 2026 alone is nearly 48%.

AscendEX’s internal team claims ASD could 3-5x in value if daily trading volume hits $1 billion. Right now, it’s at $200-300 million. That’s a 3-4x increase in volume needed just to match the token’s old valuation.

That’s a huge "if." AscendEX isn’t growing fast. It’s stuck in the shadow of giants like Binance and Coinbase. And with regulatory limits in the U.S. and EU, its growth potential is capped.

How to Get ASD

You can’t buy ASD on Coinbase or Kraken. You need to trade on AscendEX itself. The token is listed only on AscendEX and one other minor exchange, according to data aggregators.

Steps to get ASD:

- Create an account on AscendEX.com

- Verify your identity (KYC required)

- Deposit Bitcoin, Ethereum, or another major crypto

- Go to the ASD/USDT or ASD/BTC trading pair

- Buy ASD using your deposited funds

Once you have it, you can hold it in your AscendEX wallet or withdraw it to any Ethereum-compatible wallet (like MetaMask) since it’s an ERC-20 token. But remember: withdrawing it doesn’t give you any extra benefits. The only perks happen on the AscendEX platform.

The Bottom Line

ASD isn’t a cryptocurrency you buy because you believe in its future. It’s a discount card for a specific exchange. If you trade on AscendEX often, it’s worth holding. If you don’t, it’s just another crypto asset sitting in your wallet, slowly losing value.

Its deflationary burn is clever. Its lack of outside utility is deadly. Its price crash isn’t a bug-it’s a feature of a token that never escaped its niche.

Think of ASD like a loyalty card for a local coffee shop. If you drink coffee there every day, it’s worth it. If you only go once a month, it’s a waste of space in your wallet.

Nishakar Rath

January 16, 2026 AT 09:57Pat G

January 17, 2026 AT 04:31CHISOM UCHE

January 17, 2026 AT 19:13Stephanie BASILIEN

January 19, 2026 AT 04:49Pramod Sharma

January 19, 2026 AT 09:23Tony Loneman

January 19, 2026 AT 13:39Shaun Beckford

January 21, 2026 AT 05:56Lauren Bontje

January 23, 2026 AT 03:18Ashlea Zirk

January 24, 2026 AT 12:15Dustin Secrest

January 25, 2026 AT 08:23nathan yeung

January 27, 2026 AT 06:52Liza Tait-Bailey

January 28, 2026 AT 15:06Chidimma Okafor

January 29, 2026 AT 12:18Chris Evans

January 31, 2026 AT 00:27Jason Zhang

January 31, 2026 AT 08:38Haley Hebert

February 1, 2026 AT 12:03Rod Petrik

February 3, 2026 AT 06:16Josh V

February 4, 2026 AT 05:00Deb Svanefelt

February 4, 2026 AT 18:27