Strategic Bitcoin Reserve Value Calculator

Calculate Reserve Value

The U.S. Strategic Bitcoin Reserve holds 214,000 BTC (as of January 2025)

Reserve Value Results

On January 23, 2025, everything changed for crypto in the United States. Within hours of taking office, President Donald J. Trump signed an executive order that didn’t just tweak regulations-it ripped up the rulebook. The Biden administration’s aggressive enforcement tactics, led by the SEC under Gary Gensler, were officially buried. In their place came a bold, unapologetic push to turn the U.S. into the crypto capital of the world. This wasn’t a slow pivot. It was a full-speed U-turn, and the market felt it instantly.

The Three Pillars of the 2025 Crypto Overhaul

The Trump administration didn’t make vague promises. They delivered three concrete, legally binding actions that redefined the U.S. stance on digital assets.First, the Executive Order on Strengthening American Leadership in Digital Financial Technology created the President’s Working Group on Digital Asset Markets. Chaired by venture capitalist David Sacks-dubbed the administration’s ‘Crypto and AI Czar’-this group included the heads of the SEC, CFTC, Treasury, Commerce, and the Attorney General. Their mandate? Deliver a full regulatory roadmap in 180 days. They did it on July 30, 2025, exactly on time, with a 160+ page report that laid out rules for stablecoins, derivatives, and market structure.

Second, the Strategic Bitcoin Reserve was announced on March 6, 2025. This wasn’t a symbolic gesture. The U.S. Treasury now holds 214,000 BTC-worth $14.2 billion at the time-acquired solely from criminal forfeitures. No taxpayer money was used. And here’s the kicker: the reserve is legally prohibited from ever selling Bitcoin. It’s held as a strategic national asset, like gold in Fort Knox. The goal? Signal long-term confidence in Bitcoin as a store of value.

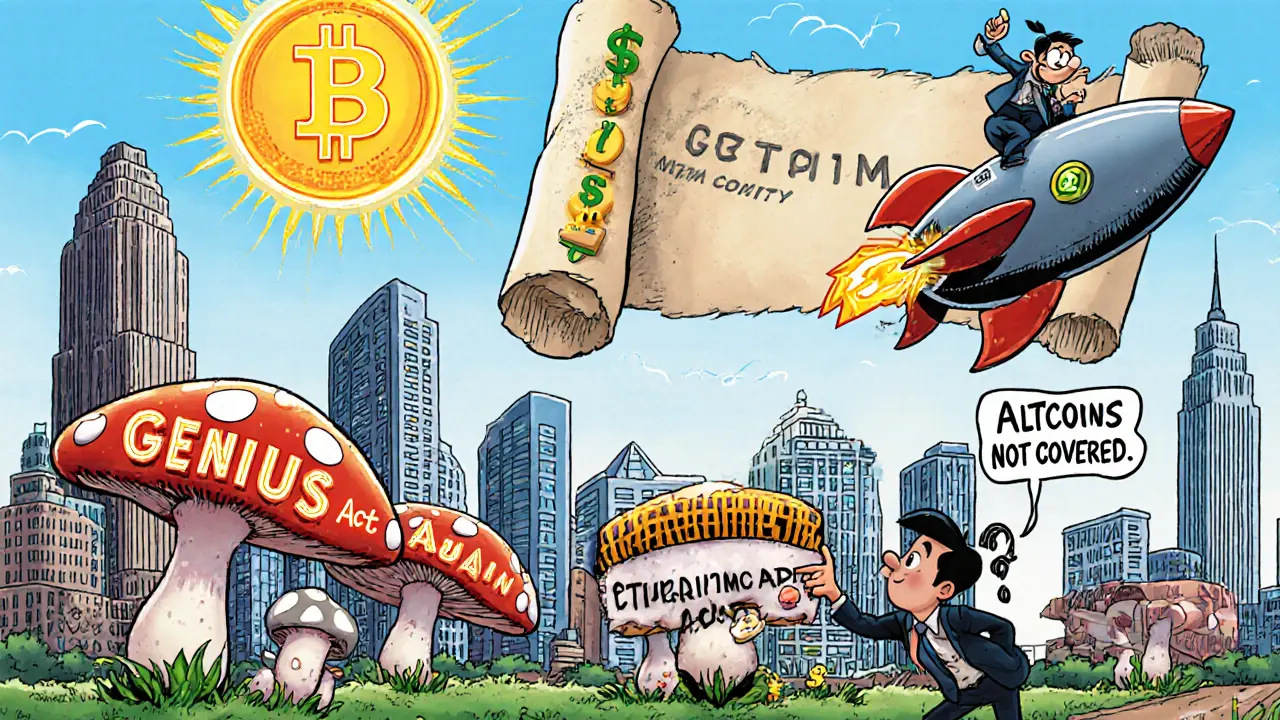

Third, the GENIUS Act, signed into law in July 2025, became the most significant crypto legislation since Wyoming’s pioneering blockchain bills in 2014. It includes 27 specific provisions: clear tax treatment for crypto transactions, standardized rules for stablecoin issuers, and explicit authority for the CFTC to oversee crypto derivatives. Trump called it ‘pure GENIUS’-and for the first time, crypto businesses knew exactly where they stood under federal law.

What Was Reversed? The Biden Era’s Shadow

Before January 2025, the U.S. crypto scene operated under constant uncertainty. The SEC sued more than 40 crypto firms between 2022 and 2024, often without clear rules. The Treasury Department was actively exploring a U.S. Central Bank Digital Currency (CBDC), a move that terrified privacy advocates and decentralized communities.The Trump administration killed both paths. Executive Order 14067 was revoked. The CBDC exploration framework was erased. And the White House issued a firm directive: no CBDC will ever be created under this administration. That single move alone reversed years of regulatory pressure and gave crypto projects breathing room.

Where Biden’s team saw risk, Trump’s team saw opportunity. Where the SEC focused on enforcement, the new working group focused on clarity. The shift wasn’t just political-it was structural. The goal wasn’t to control crypto. It was to own it.

Market Impact: Volume, Jobs, and Capital Flood In

The numbers don’t lie. Between January and June 2025, U.S. crypto trading volume jumped 214%. Institutional investors poured $84 billion into the market-tripling the previous record. Crypto job postings rose 189% year-over-year. Startups that spent years avoiding the U.S. because of regulatory fear suddenly opened offices in Austin, Miami, and Salt Lake City.Reddit threads exploded. One top comment from March 2025 said: ‘The Strategic Bitcoin Reserve announcement literally sent BTC +18% in 24 hours.’ CoinDesk surveyed 500 crypto executives in April 2025. 87% called the policy changes ‘favorable.’ 72% said they were expanding operations in the U.S.

Even Ethereum developers noticed the shift. While Bitcoin and stablecoins got the spotlight, Ethereum and other non-BTC chains faced regulatory ambiguity. Ethereum Foundation researcher Vlad Zamfir pointed out in February 2025 that the GENIUS Act barely mentioned altcoins. That gap hasn’t been fixed yet-but it’s being debated in Congress.

The Strategic Bitcoin Reserve: Why It Matters

Most governments treat Bitcoin as a threat. The U.S. now treats it like a sovereign asset.The reserve isn’t just about holding BTC. It’s about sending a message: Bitcoin is durable, decentralized, and valuable enough to be part of America’s financial backbone. The Treasury Department is required to maintain it indefinitely. No sales. No liquidation. Only growth through forfeitures.

By September 2025, the reserve had grown by another 12,500 BTC through ‘seizure optimization protocols’-a fancy term for better coordination between federal agencies to track and claim forfeited crypto. No new spending. Just smarter enforcement.

Analysts at Grant Thornton predict the reserve could be worth $50-75 billion by 2030. If Bitcoin hits $350,000, it could hit $75 billion. That’s more than the entire gold reserves of many small nations.

Industry Reactions: Cheers, Caution, and Concerns

The crypto industry celebrated. Coinbase, Kraken, and BlockFi all announced U.S. hiring surges. Fidelity launched a new crypto custody service tailored to institutional clients under the new rules.But not everyone was thrilled. Former CFTC Chair Gary Gensler, writing in the Harvard Business Review, called the 180-day timeline ‘dangerously rushed.’ He warned that complex financial systems can’t be rebuilt in six months without leaving dangerous loopholes.

Smaller firms struggled too. According to BHFS legal analysis in September 2025, 32% of crypto startups had to hire external compliance consultants just to understand the new rules. The speed of change was overwhelming.

And then there’s the elephant in the room: the Strategic Bitcoin Reserve could eventually hold more than 500,000 BTC-2.4% of the total supply. The Congressional Budget Office warned this could distort markets if the government ever needed to sell. But the administration says that won’t happen. Ever.

What’s Next? The Roadmap Through 2026

The White House released a 12-month implementation plan after the July 2025 report. Key deadlines:- January 15, 2026: SEC finalizes stablecoin rules

- March 30, 2026: CFTC issues guidance on crypto derivatives

- June 30, 2026: Treasury publishes reporting standards for non-BTC digital assets in the Digital Asset Stockpile

These aren’t suggestions. They’re legal deadlines. Failure to meet them could trigger congressional hearings.

Meanwhile, the Treasury Department is already exploring ways to use the Digital Asset Stockpile (which holds non-Bitcoin assets like Ethereum, Solana, and stablecoins) more effectively. They can’t sell BTC, but they can sell other assets-potentially funding public projects without raising taxes.

Global Rivalry: Can the U.S. Stay Ahead?

The U.S. wasn’t the first to embrace crypto. Singapore and Switzerland led in venture funding in 2024. The EU passed MiCA in 2023. China banned crypto but built its own digital currency.Now, the U.S. has the biggest reserve, the clearest laws, and the most aggressive timeline. But global competition isn’t slowing down. The European Central Bank is preparing a digital euro pilot. Japan is relaxing its exchange rules. India is moving toward a regulated crypto exchange ecosystem.

The Trump administration knows this. In a September 20, 2025 speech at the Blockchain Summit, Trump said: ‘We are just getting started-this is American Brilliance at its best, and we are going to show the World how to WIN with Digital Assets like never before!’

Whether that’s hype or reality will depend on whether the next administration keeps the course-or reverses it again.

What This Means for You

If you’re a crypto investor: The U.S. is now the safest major market for holding Bitcoin. The Strategic Bitcoin Reserve is a long-term bull signal.If you’re a business owner: The GENIUS Act gives you legal clarity. Stablecoins are now regulated. Tax rules are defined. You can build without fear of sudden enforcement.

If you’re a developer: The U.S. is hiring. The talent gap is real. Skills in compliance, smart contract auditing, and blockchain infrastructure are in high demand.

If you’re skeptical: Yes, this is political. Yes, it’s fast. And yes, it could change again in 2029. But for now, the rules are clear. The market is responding. And the U.S. is no longer playing defense.

This isn’t just policy. It’s a new financial era. And it started on January 23, 2025.

Arthur Crone

November 12, 2025 AT 13:29And don't even get me started on 'Strategic Reserve'-that's just state-sponsored hoarding with a PR team.

Michael Heitzer

November 13, 2025 AT 21:25Anyone who says it’s rushed hasn’t lived through the last five years of SEC witch hunts. We needed this. Now we have it.

Rebecca Saffle

November 15, 2025 AT 10:07They didn’t just reverse policy. They reversed fear.

Adrian Bailey

November 17, 2025 AT 09:16like i thought the bitcoin reserve thing was a meme but nooo it’s real? 214k btc from forfeitures?? that’s wild

and the fact they can’t sell it?? that’s actually genius honestly

i work in fintech and we’ve been stuck in regulatory limbo for years but now?? we’re actually thinking about opening an office in miami

also i think i just cried a little bit

also i think i typoed like 3 times but you get the point lol

Rachel Everson

November 17, 2025 AT 19:45This? This is the first time I feel safe. Not just legally-but emotionally. The reserve isn’t just holding BTC. It’s holding hope. And for the first time, I believe this isn’t temporary.

You’re not just building a market. You’re building trust. Thank you.

Johanna Lesmayoux lamare

November 18, 2025 AT 05:14ty ty

November 19, 2025 AT 15:03Wow. The circle of life is complete. Next they’ll say the moon landing was faked by aliens and we should mine it for crypto.

What a joke.

BRYAN CHAGUA

November 19, 2025 AT 15:52The Strategic Bitcoin Reserve, while unprecedented, aligns with historical precedents of sovereign asset accumulation-comparable to the U.S. gold reserves at Fort Knox. The prohibition on liquidation ensures long-term price discovery mechanisms remain market-driven rather than politically manipulated.

While implementation speed presents operational challenges for small firms, the net gain in investor confidence and institutional capital inflow far outweighs transitional friction. This is not merely policy-it is institutional evolution.

Debraj Dutta

November 20, 2025 AT 11:28tom west

November 22, 2025 AT 10:42The reserve? 214k BTC? That’s 2.4% of the total supply. You think that won’t distort liquidity? You think miners and exchanges won’t game the system knowing the government won’t sell?

This isn’t leadership. It’s arrogance with a press release.

dhirendra pratap singh

November 23, 2025 AT 11:10THE RESERVE IS REAL?? I WAS CRYING WHEN I READ IT

AND NOW THE WORLD IS GOING TO SEE WHAT AMERICA CAN DO 💪🇺🇸

TO ALL THE HATERS: YOU’RE JUST MAD BECAUSE YOU’RE NOT IN THE ROOM WHERE IT HAPPENED 😤

WE ARE THE FUTURE AND WE DON’T ASK FOR PERMISSION 🚀💎

Ashley Mona

November 23, 2025 AT 13:48Small devs like me finally have a shot. No more begging for legal clarity. No more running from regulators.

And hey-if you’re still stuck in ‘crypto is dead’ mode? Come on in, the water’s fine. We’ve got coffee and code waiting.

Suhail Kashmiri

November 23, 2025 AT 22:15