Portugal still lets you keep all your crypto profits if you hold for just one year. No taxes. No surprises. Just pure, clean gains when you sell after 365 days. This isn’t a loophole. It’s the law. And as of 2026, it’s more solid than ever.

How Portugal’s Crypto Tax Rules Actually Work

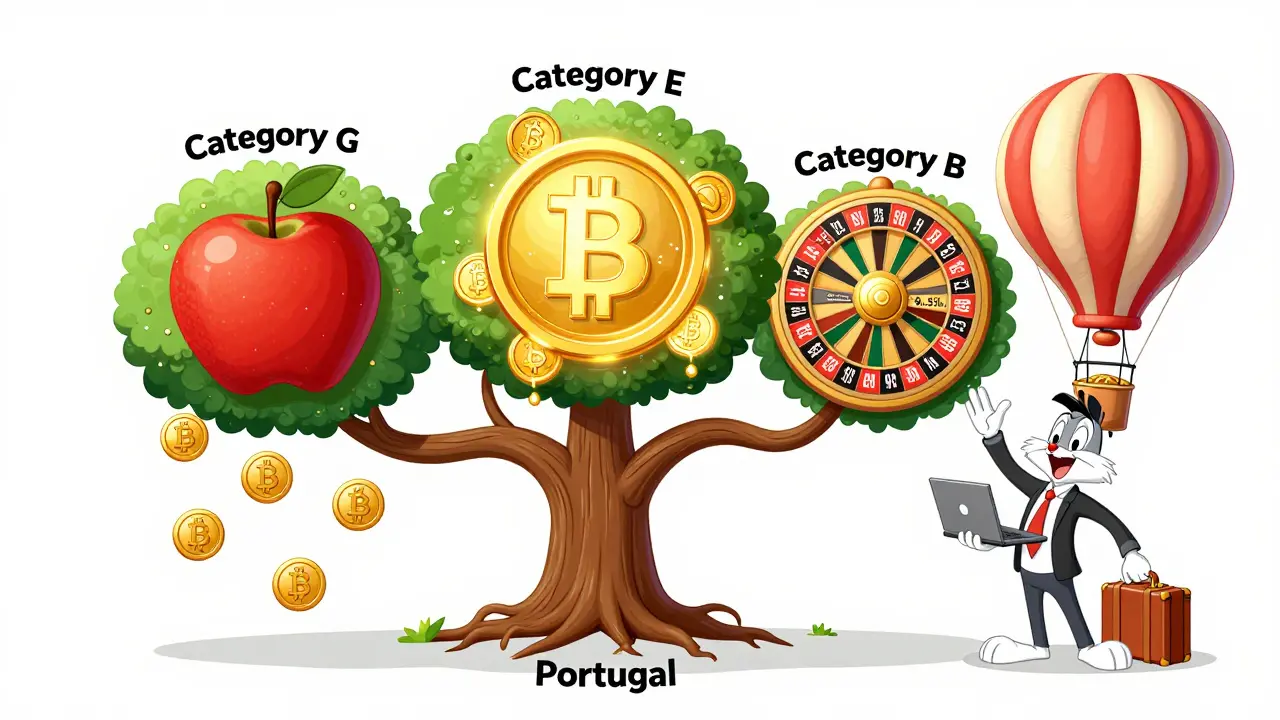

Portugal doesn’t tax crypto gains if you hold your coins for more than 365 days. That’s it. No hidden conditions. No complex formulas. Just buy, hold for a year, sell to euros - and keep every cent. The tax authority doesn’t care how much you made. If you waited long enough, you pay zero. But here’s the catch: this only applies to personal investors. If you’re trading crypto like a job - buying and selling daily, running a mining rig, or earning rewards from staking - those profits are taxed. That’s where the 28% flat rate kicks in. It’s not a penalty. It’s a clear line between investing and operating a business. The Portuguese tax code splits crypto income into three buckets:- Category G (Capital Gains): Selling crypto you held under a year? 28% tax. Over a year? $0.

- Category E (Capital Income): Staking, lending, or earning interest on crypto? That’s 28% flat, no matter how long you held.

- Category B (Self-Employment): If crypto is your main income source - say, you’re a professional trader or miner - your profits are taxed like regular income, from 14.5% up to 53%.

Why Portugal Still Beats Every Other EU Country

Most of Europe taxes crypto like stocks - every gain, every time. France? 30% on everything. Italy? 26%. Spain? Up to 47% if you’re high-income. Even Germany, often seen as crypto-friendly, has strict rules around what counts as a “private sale” and requires detailed record-keeping. Portugal doesn’t. No minimum holding period beyond one year. No caps on profit size. No reporting for crypto-to-crypto trades. You can swap Bitcoin for Ethereum, then Ethereum for Solana, and never trigger a taxable event. Only when you cash out to euros does the clock start ticking. And unlike Belgium, where exemptions depend on income thresholds and transaction volume, Portugal’s rule is blunt and universal. If you’re not trading professionally, and you held for a year - you owe nothing. This isn’t accidental. Portugal built this system to attract digital nomads, remote workers, and global crypto investors. In 2025, over 12,000 crypto-related businesses registered in Lisbon and Porto. Thousands more relocated just to lock in the tax-free long-term gain rule.What You Must Track (And What You Don’t)

You don’t need to report every trade. But you absolutely must track two things:- When you bought each coin - date and purchase price in euros.

- When you sold - date and sale price in euros.

What’s Still Taxed? The Hidden Traps

Don’t assume everything is free. Here’s where people get tripped up:- Staking rewards - Every time you earn ETH, DOT, or SOL from staking, it’s taxed as income at 28% when you receive it. Even if you don’t sell it.

- DeFi earnings - Liquidity pool rewards, yield farming tokens, or airdrops? Taxed at 28% on the euro value when you receive them.

- Using crypto to buy stuff - Buying a car with Bitcoin? That’s a disposal. If you held under a year, you owe 28% on the gain. If over a year? No tax.

- Crypto held outside the EEA - If your wallet is on a non-EEA exchange (like Binance US or KuCoin), Portugal may treat it as a taxable event even if you held over a year. Keep assets on EEA-regulated platforms.

How to Prove You Held for a Year

Portugal doesn’t require you to submit proof upfront. But if they audit you - and they will if you’re a high-net-worth investor - you need records. Use a tool like CoinTracking, Koinly, or CryptoTaxCalculator. Import your wallet addresses or exchange CSV files. These tools auto-calculate holding periods and flag which sales are tax-free. You can also manually track with a spreadsheet:| Date Bought | Coin | Amount | Cost (EUR) | Date Sold | Sale Value (EUR) | Holding Period | Taxable? |

|---|---|---|---|---|---|---|---|

| 2024-02-10 | ETH | 2.5 | 5,200 | 2025-02-15 | 8,700 | 370 days | No |

| 2024-11-05 | ADA | 10,000 | 3,800 | 2025-01-20 | 5,100 | 76 days | Yes (28%) |

Who Should Move to Portugal for Crypto?

This isn’t just for retirees or millionaires. It’s for anyone who:- Owns crypto and plans to hold it long-term

- Wants to avoid progressive income tax rates (like Spain’s 47%)

- Works remotely and needs a legal, stable base

- Uses crypto for payments or DeFi and wants to avoid tax traps

What’s Next? Will Portugal Change This Again?

The 2023 rules were meant to be the final version. After years of uncertainty, the government wanted clarity. They didn’t want to chase away investors - they wanted to tax the traders, not the holders. Since then, there’s been no push to change the one-year rule. Even with the EU’s MiCA regulation rolling out in 2025, Portugal kept its tax autonomy. MiCA enforces AML and consumer rules - not tax policy. Experts agree: the long-term exemption is now baked into Portugal’s identity as a crypto hub. Changing it would risk losing thousands of residents, millions in local spending, and dozens of blockchain startups. The only risk? If you treat crypto like a job. If you’re trading 10 times a week, earning staking rewards daily, and running a mining farm - you’re already in Category B. You’re paying taxes anyway. So the exemption doesn’t help you. But if you’re holding, waiting, building wealth? Portugal still gives you the best deal in Europe.Final Tip: Don’t Rush the Clock

The biggest mistake? Selling too early. People see a 50% gain in six months and panic-sell. They pay 28% - and lose half their profit to tax. Wait. Just six more months. Hold through the next market cycle. Ride out the volatility. Then cash out. You’ll keep every euro. No tax. No fees. No regrets. Portugal didn’t make this rule to be nice. They made it because it works. And right now, no other country in Europe offers the same simplicity, certainty, and freedom.Is crypto still tax-free in Portugal if I hold it for more than a year?

Yes. If you hold cryptocurrency for more than 365 days and then sell it for euros, your capital gains are completely tax-free in Portugal. This applies to Bitcoin, Ethereum, Solana, and most other tokens - as long as you’re a private investor and not trading professionally.

Are crypto-to-crypto trades taxed in Portugal?

No. Swapping one cryptocurrency for another - like trading BTC for ETH or USDT for ADA - is not a taxable event in Portugal. Taxes are only triggered when you convert crypto into fiat currency (euros) or use it to buy goods or services.

Do I pay tax on staking rewards in Portugal?

Yes. Staking rewards, yield farming income, and airdrops are taxed as capital income at a flat 28% rate when you receive them - regardless of how long you hold the tokens afterward. This is separate from capital gains on sales.

What if I hold crypto on a non-EEA exchange like Binance US?

Portugal may treat crypto held on non-EEA exchanges differently. While the one-year exemption still applies in theory, tax authorities may question whether the asset is truly under Portuguese jurisdiction. To avoid risk, keep your crypto on EEA-regulated platforms like Kraken EU, Bitpanda, or Binance EU.

Do I need to file a tax return for crypto in Portugal?

You only need to file if you had taxable events - like selling crypto under a year, earning staking rewards, or running a crypto business. If you only made tax-free long-term gains, you’re not required to report them. But keeping records is still strongly advised in case of an audit.

Can I become a tax resident in Portugal just for the crypto tax benefit?

Yes. To qualify as a tax resident, you need to spend more than 183 days per year in Portugal. You don’t need to buy property or become a citizen. Many digital nomads and crypto investors relocate temporarily to take advantage of the tax exemption while maintaining global income sources.

Is Portugal’s crypto tax rule safe from EU changes?

Yes. The EU’s MiCA regulation covers anti-money laundering and consumer protection - not taxation. Each EU country still sets its own crypto tax rules. Portugal’s one-year exemption is protected under national sovereignty. There’s no current EU proposal to override it.

What happens if I sell crypto after 366 days but didn’t keep records?

You’re still tax-free. Portugal doesn’t require you to prove your holding period unless audited. But if audited and you can’t show you held for over a year, the tax office may assume the gain is taxable. Always keep purchase and sale dates - even if you don’t file.

josh gander

January 30, 2026 AT 19:15Portugal’s crypto rule is the ultimate flex 🤑 I mean, who wouldn’t want to hold for a year and just *vanish* 28% of their tax burden? I bought my first ETH in March 2024, and I’m literally counting days like it’s a countdown to freedom. No more watching my gains get nibbled by Uncle Sam. This is why I’m packing my bags and moving to Lisbon next year. 365 days? That’s not a wait-it’s a gift.

And don’t even get me started on crypto-to-crypto swaps. I’ve swapped like 17 different tokens this year-no taxes, no paperwork, just pure crypto yoga. Mind blown. 🙏

Tom Sheppard

January 30, 2026 AT 19:37bro i just sold my sol after 368 days and i didnt even file anything and now i have 12k in my bank account with no tax man knockin on my door 😭 i thought portugal was a myth but its real. i’m gonna move there and open a coffee shop that only accepts crypto. name it ‘tax free java’ ☕💸

Devyn Ranere-Carleton

February 1, 2026 AT 00:42Wait, so if I buy BTC on Kraken EU, hold it for a year, then swap it for ETH and hold that for another year before cashing out to euros-do I get tax-free on both legs? Or does the clock reset on the ETH? I’m trying to game this like a puzzle. Someone smarter than me please explain. I’ve got spreadsheets open and I’m sweating.

Jerry Ogah

February 2, 2026 AT 06:25THIS IS WHY AMERICA IS FALLING BEHIND. People are fleeing to Europe because we tax *thought*. We tax *hope*. We tax *waiting*. Portugal doesn’t punish patience-they reward it. Meanwhile, the IRS is still asking for receipts from 2017. I’m not mad, I’m just disappointed. We built a country that taxes your dreams. Portugal built one that lets you keep them. 🇺🇸 vs 🇵🇹-it’s not even close.

Andrea Demontis

February 2, 2026 AT 17:41There’s something deeply philosophical about this. The one-year rule isn’t just tax policy-it’s a cultural statement about time, value, and human patience. In a world that rewards instant gratification, Portugal says: ‘Wait. See what happens.’ It’s a quiet rebellion against the algorithmic frenzy of DeFi and day trading. Holding isn’t passive-it’s a radical act of trust. Trust in the market. Trust in yourself. Trust that your vision outlasts the noise.

And yet… it’s so simple. No complex deductions. No loopholes. Just time. Maybe that’s the real tax break: peace of mind.

Raju Bhagat

February 3, 2026 AT 17:38bro i been staking ada since 2022 and i keep getting taxed on rewards like its a monthly salary 😭 but when i cash out after a year? free money! so i just stack and stack and cash out once a year like its my birthday. portugal is the only country that gets me. i love them. i want to live there and drink port wine and watch my btc grow while the europeans sip espresso and laugh at us americans paying 40% tax. 🤪