Crypto Tax India: What You Need to Know

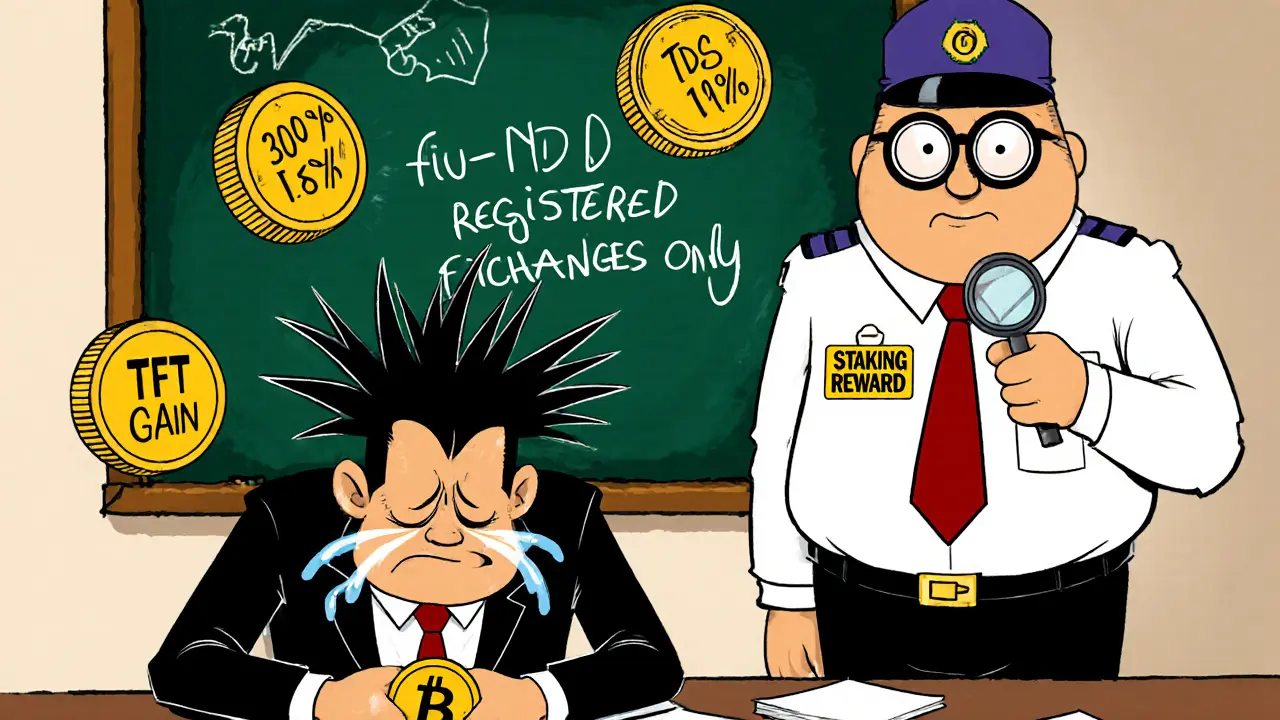

When navigating Crypto Tax India, the set of tax rules that apply to cryptocurrency transactions for Indian residents. Also known as India crypto taxation, it governs how gains, losses, and income from digital assets are reported to the tax authorities.

One major piece of the puzzle is Capital Gains Tax, which taxes the profit you make when you sell crypto at a higher price than you bought it. Meanwhile, the Income Tax Department of India receives your annual return and verifies that crypto earnings are included. Crypto tax India also brings GST, a goods‑and‑services tax that can apply to certain crypto‑related services like exchange fees. Finally, Crypto Exchange Reporting obliges Indian platforms to share user transaction data with the tax authorities, ensuring transparency.

Why This Matters for Every Trader

Understanding these connections helps you stay compliant and avoid surprise penalties. Crypto Tax India encompasses capital gains tax, requires filing with the Income Tax Department, and is influenced by GST rules. Knowing how exchange reporting fits in lets you prepare accurate records before the fiscal year ends. Below, you’ll find articles that break down each component, share filing tips, and explain recent regulatory updates so you can manage your crypto portfolio with confidence.