Blockchain Consensus: How Networks Agree on Truth Without Central Control

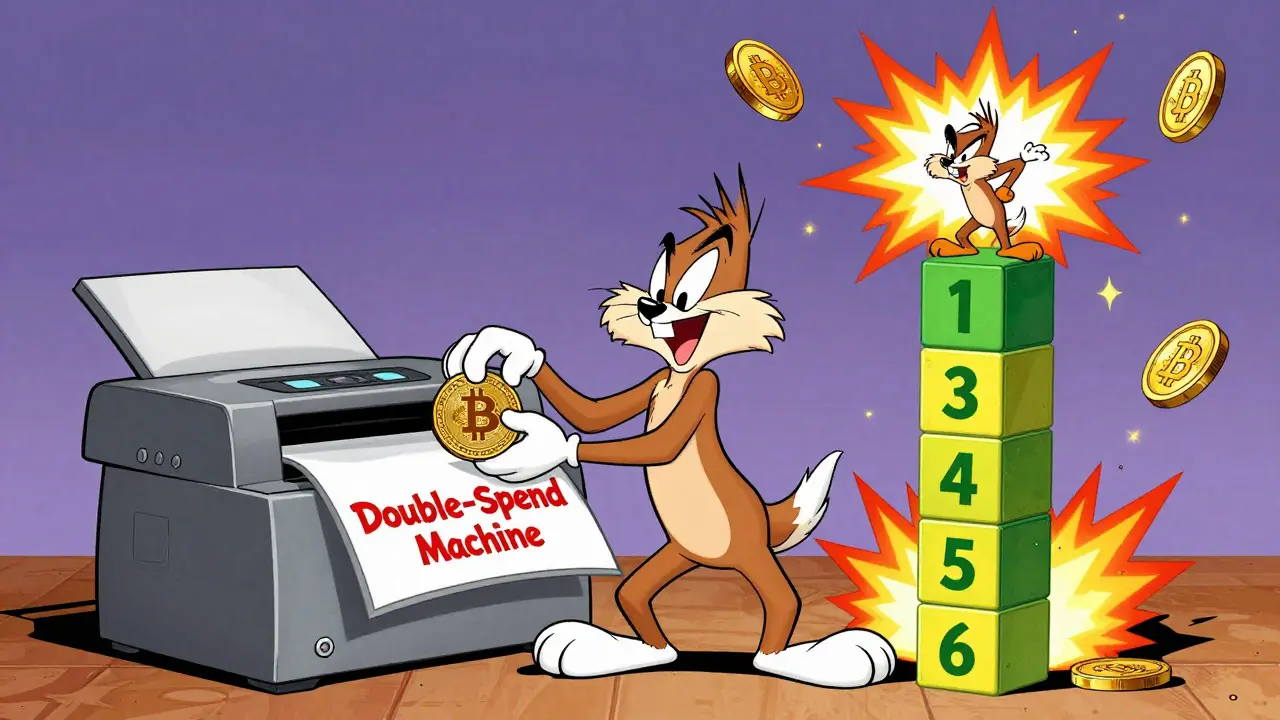

When you send Bitcoin or swap tokens on a decentralized exchange, no bank approves it. No company verifies it. Instead, a blockchain consensus, the system that lets distributed computers agree on one version of truth. Also known as consensus mechanism, it’s what stops someone from spending the same coin twice — and why crypto networks stay secure even when no one’s in charge. Without this, blockchain would just be a fancy database with no trust.

There are a few main ways networks reach consensus. Proof of Work, the original method used by Bitcoin where miners solve hard math puzzles to add blocks. Also known as PoW, it’s energy-heavy but proven over more than a decade. Then there’s Proof of Stake, where validators are chosen based on how much crypto they lock up. Also known as PoS, it’s faster, cheaper, and used by Ethereum, Solana, and many newer chains. These aren’t just tech buzzwords — they shape how fast transactions go, how much fees cost, and even how secure a network is against attacks. Some chains mix both, or use other methods like Delegated Proof of Stake or Practical Byzantine Fault Tolerance, each with trade-offs in speed, decentralization, and energy use.

Why does this matter to you? Because every exchange you use, every airdrop you claim, and every DeFi pool you join runs on one of these systems. If a platform says it’s "decentralized" but doesn’t explain its consensus, it’s probably lying. Look at posts about Aster DEX or Echobit — they rely on specific consensus rules to enable fast trades and high leverage. The same goes for tokenomics: if a coin’s value depends on staking, it’s built on Proof of Stake. If mining is involved, it’s likely Proof of Work. Understanding this helps you spot real innovation from hype, and avoid platforms that are just rebranded centralized servers pretending to be blockchain.

What you’ll find below isn’t just random crypto articles. It’s a collection of real-world examples showing how blockchain consensus shapes everything — from why Iran mines Bitcoin to why fake airdrops can’t touch a secure network. You’ll see how consensus rules affect exchange security, how token incentives tie into validation, and why some platforms vanish while others keep running. No theory. No fluff. Just how the system actually works — and what to look for when your money’s on the line.