When Bitcoin drops 15% in two hours, or Ethereum crashes 20% after a single tweet, you don’t want to be staring at your screen hoping it bounces back. That’s where a stop-loss strategy becomes your most important tool in volatile markets. It’s not about predicting the bottom-it’s about controlling how much you lose when things go wrong. In crypto, where prices can swing 30% in a day, a good stop-loss isn’t optional. It’s survival.

Why Stop-Loss Orders Matter More in Crypto Than Stocks

Crypto markets don’t have circuit breakers like the NYSE. There’s no pause button when panic hits. A single exchange outage, a whale selling, or a regulatory rumor can send a coin into freefall. In March 2021, Solana dropped 40% in under 90 minutes. In November 2022, FTX’s collapse triggered a cascade of liquidations-some traders lost everything because they had no exit plan. A stop-loss order automatically sells your position when the price hits a set level. It removes emotion from the equation. You don’t have to decide in the middle of a crash whether to sell or hold. The system does it for you. According to a 2023 study by the University of Chicago and NYU Stern, traders using disciplined stop-loss rules had an 18.7% higher chance of surviving long-term than those who didn’t.How Stop-Loss Orders Actually Work (And Where They Fail)

Here’s the simple version: you set a stop price below your entry. When the market hits that price, your order turns into a market order and sells immediately. Simple, right? But here’s the catch: in volatile markets, that market order doesn’t always fill at your stop price. It fills at the next available price-and that could be 5%, 10%, even 20% lower. This is called slippage. During the 2020 Bitcoin crash, slippage on some altcoins exceeded 15%. If your stop was at $30,000, you might have sold at $25,500 without realizing it. That’s why many traders now use stop-limit orders instead. These let you set both a stop price and a limit price. The order only executes if the price reaches your stop AND stays above your limit. But there’s a downside: if the price keeps falling fast, your order might never fill at all. You’re left holding a position that’s already tanked.The Five Best Stop-Loss Types for Crypto

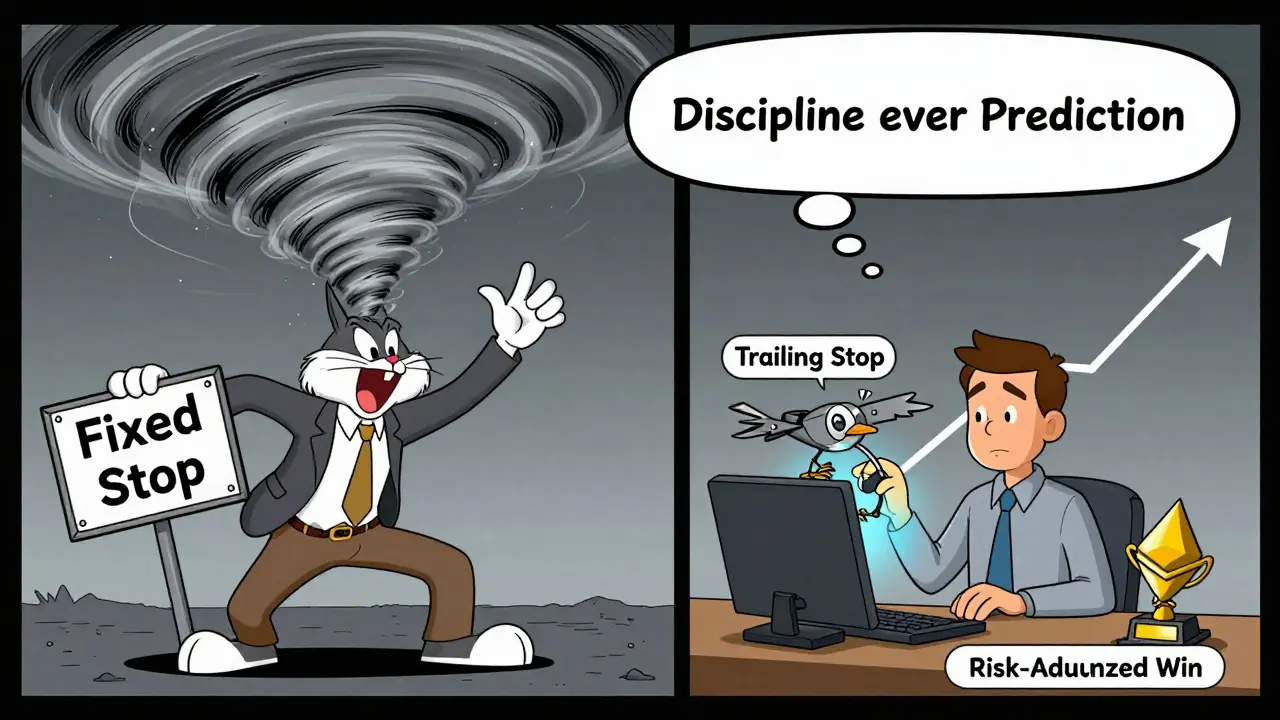

Not all stop-losses are created equal. Here are the five most effective types for crypto traders:- Fixed Stop-Loss: Set a fixed dollar amount or percentage below your entry (e.g., 10% below). Best for beginners. Easy to set, but ignores market volatility. A 10% stop on Solana might get triggered during normal swings, while the same stop on Bitcoin might be too wide.

- Trailing Stop-Loss: This one moves with the price. If you buy Ethereum at $3,000 and set a 15% trailing stop, your stop rises as the price rises. If ETH hits $4,000, your stop moves to $3,400. If it drops to $3,400, you sell. This locks in gains and protects against reversals. Backtests show trailing stops improve risk-adjusted returns by 22% compared to fixed stops over 7 years of crypto data.

- ATR-Based Stop: Uses Average True Range-a statistical measure of volatility-to set your stop. If Bitcoin’s ATR is $800, you might set your stop at 2x ATR ($1,600) below entry. This adjusts automatically: wider stops in high volatility, tighter in calm markets. Traders on Reddit’s r/algotrading reported a 40% drop in false triggers after switching to ATR stops.

- Volatility-Controlled Stop: Some platforms like Charles Schwab and Webull now offer this. They widen your stop automatically when market volatility spikes (measured by VIX or crypto-specific volatility indexes). This prevents getting stopped out during temporary noise.

- Time-Based Stop: Closes your position after a set number of hours or days, regardless of price. Useful if you’re trading news events or short-term momentum. If your trade hasn’t moved in 48 hours, exit. No emotional second-guessing.

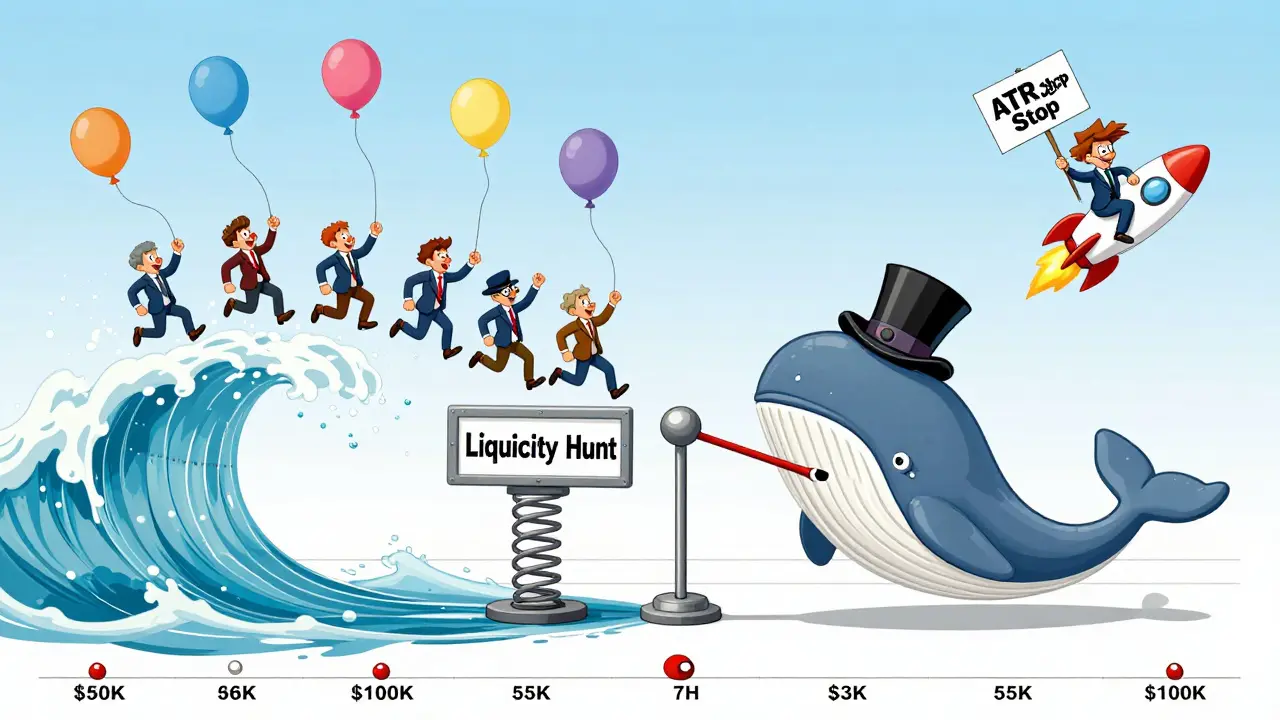

Stop-Loss Hunting: Real or Myth?

You’ve probably heard the story: “The price dips right to your stop, then rockets back up. Someone’s hunting your stop.” Is this real? Sometimes. Large players (hedge funds, whales) do monitor where retail traders place their stops. If thousands of people have stops clustered at $60,000 on Bitcoin, it’s easier for a big seller to push the price down to that level, trigger all those orders, then buy back cheap. This is called “liquidity hunting.” But here’s the truth: most of the time, it’s not manipulation. It’s just how markets work. Stops are natural liquidity sinks. Prices move to where orders are clustered because that’s where buyers and sellers meet. The CFTC found no evidence of coordinated stop-hunting in crypto markets-most “stop hunts” are just the result of high volume and low liquidity at key price levels. Still, avoid putting all your stops in obvious places. Don’t use round numbers like $50,000 or $10,000. Use $49,750 or $10,230. It makes you less predictable.How to Set Up a Stop-Loss: A 6-Step Plan

Follow this system if you want to avoid common mistakes:- Calculate your risk: Never risk more than 1-2% of your total portfolio on a single trade. If you have $10,000, your max loss per trade is $100-$200.

- Choose your stop type: Use ATR for swing trading, trailing for trends, fixed for beginners.

- Set your stop distance: For ATR, use 1.5-2.5x the ATR value. For percentage, use 8-12% for altcoins, 5-8% for Bitcoin and Ethereum.

- Size your position: If your stop is $1,000 below entry and you’re risking $200, buy only 0.2 BTC. (200 ÷ 1000 = 0.2)

- Use good-till-canceled (GTC): Don’t use “day only” orders. Crypto trades 24/7. Your stop needs to stay active.

- Backtest it: Test your stop strategy on at least 3 past volatile periods: March 2020, May 2021, November 2022. Did it protect you? Did it trigger too early?

Common Mistakes (And How to Avoid Them)

Most traders fail not because their strategy is bad-but because they execute it wrong.- Mistake: Setting stops too tight. You get stopped out by normal noise. Solution: Use volatility-based stops. Don’t guess.

- Mistake: Moving stops up after a gain, then moving them back down. Emotional trading. Solution: Use trailing stops. Let the market decide.

- Mistake: Risking 5% or 10% per trade. One bad trade wipes you out. Solution: Stick to 1-2%. You need to survive 10 bad trades before you get your first big win.

- Mistake: Not using stop-losses at all because “I believe in the asset.” Solution: Belief doesn’t pay bills. Discipline does.

What Brokers and Platforms Offer

Not all platforms handle stop-losses the same way. Here’s what to look for:- Interactive Brokers: Best for advanced traders. Supports ATR-based stops, trailing stops, and conditional orders. Low slippage, but complex interface.

- Webull: Launched “Volatility Stop” in Q1 2023. Automatically widens stops when volatility spikes. Great for beginners.

- Bybit, Binance, OKX: All support trailing stops and stop-limit orders. But check if they offer “guaranteed stops”-some do, for a fee.

- Coinbase Pro: Only basic stop-loss. No ATR or volatility-based options. Avoid for serious trading.

The Bigger Picture: Stop-Losses Are Risk Tools, Not Profit Engines

Vanguard’s Director of Investment Strategy, Greg Davis, says it best: “Stop-loss orders are risk management tools, not profit-generating strategies.” They won’t make you rich. But they’ll keep you in the game. In crypto, where 90% of traders lose money, surviving longer than the crowd is the only edge you need. A stop-loss doesn’t guarantee you’ll win. But it guarantees you won’t be wiped out by one bad trade.Final Thought: Discipline Over Prediction

No one can predict when Bitcoin will crash. No one knows if Ethereum will rebound after a dip. But you can control how much you lose when it does. The best traders aren’t the ones who call the top or bottom. They’re the ones who stick to their rules-even when it hurts. They accept the stop-loss as a cost of doing business. Like insurance. You hope you never need it. But you’re glad it’s there when you do.Do stop-loss orders work in crypto markets?

Yes-but only if used correctly. Stop-losses protect against catastrophic losses during sudden crashes, especially in crypto where prices can gap down 20% overnight. However, they don’t prevent slippage or false triggers. The key is choosing the right type (like ATR or trailing stops) and setting them based on volatility, not emotion.

What’s the best stop-loss percentage for Bitcoin?

For Bitcoin, a 5-8% stop-loss is typical. But it’s better to use a volatility-based approach. If Bitcoin’s Average True Range (ATR) is $1,500, set your stop at 1.5-2x ATR ($2,250-$3,000 below entry). This adapts to market conditions and avoids getting shaken out during normal swings.

Why did my stop-loss trigger and the price immediately rebound?

This is called a “whipsaw.” It happens when the market briefly dips below your stop level-often due to low liquidity or a large sell order-and then reverses. It’s not always manipulation. It’s just how markets move. To reduce this, use wider stops based on ATR or volatility filters instead of fixed percentages.

Can I use stop-loss orders on decentralized exchanges (DEXs)?

Not directly. Most DEXs like Uniswap don’t support stop-loss orders. But you can use smart contracts on platforms like Gnosis or Gelato to automate conditional sells. These are more complex and cost gas fees, but they’re the only way to get stop-like protection on DEXs.

Should I use stop-limit or stop-market orders?

Use stop-market for most crypto trades. Stop-limit orders can fail to execute during fast crashes, leaving you exposed. Stop-market guarantees you exit, even if you get a worse price. The risk of slippage is worth accepting to avoid being stuck in a losing position.

How often should I adjust my stop-loss?

Only adjust it if your trade thesis changes. Don’t move it up because you’re scared, or down because you’re hoping. Trailing stops adjust automatically. ATR-based stops update with volatility. Fixed stops should stay put unless your risk tolerance or position size changes.

Are stop-losses worth it for long-term crypto holders?

Not really. If you’re holding Bitcoin for 5+ years, short-term volatility doesn’t matter. Stop-losses are for active traders who need to manage risk on specific positions. Long-term holders should focus on dollar-cost averaging and portfolio rebalancing instead.

Mike Reynolds

January 4, 2026 AT 13:55I’ve been using trailing stops for my altcoins for a year now, and honestly? Game changer. I used to panic-sell or hold too long, but now I just set it and walk away. Even when Bitcoin dumps 20%, I sleep fine knowing my gains are locked in. No more 3am screen-staring.

Also, ATR stops saved me during the Solana implosion last year. My fixed 10% stop would’ve gotten me crushed. ATR let me ride the wave without getting shaken out.

Just don’t use round numbers. I learned the hard way - put stops at $49,820, not $50,000. Less predictable, less hunted.

Brooklyn Servin

January 6, 2026 AT 11:23STOP-LOSS HUNTING IS 100% REAL AND THE EXCHANGES ARE IN ON IT. 🤡

Look at the order books before big dips - they’re ALWAYS manipulated. Whales see all those retail stops clustered at $60K and just nudge it down to trigger them. Then they buy back at 15% off. It’s not ‘market dynamics’ - it’s predatory. Binance and Bybit know exactly where your stops are. They don’t care if you lose. They profit from your fear.

Use Gnosis smart contracts on DEXs. At least then you’re not feeding the beast. And never, ever use market orders. Stop-limit is your only friend. If you’re not paranoid, you’re already broke.

Also, why do people still use Coinbase Pro? 😭

Ian Koerich Maciel

January 8, 2026 AT 09:47While I appreciate the comprehensive overview presented herein, I must respectfully submit that the implicit assumption - that stop-loss orders are universally beneficial - warrants critical scrutiny.

Empirical data from the 2023 University of Chicago study, while statistically significant, fails to account for transaction cost drag, slippage variance, and the psychological impact of repeated false triggers - all of which may erode net returns over time.

Moreover, the notion that ‘discipline’ supersedes ‘prediction’ presupposes a market structure that is, in fact, increasingly non-random and algorithmically manipulated. One cannot ‘manage risk’ if the risk itself is engineered.

Perhaps the more prudent strategy is not to trade at all - or, at minimum, to hold in cold storage and ignore price action entirely. The volatility is not a feature - it is a flaw.

Yours in reasoned caution,

- Ian

Andy Reynolds

January 9, 2026 AT 19:02Hey everyone - I’m a total newbie but this thread is actually helping me a ton. I just started trading last month and was about to set a 5% stop on my ETH because I thought that’s what everyone does. Now I know better.

ATR-based stops sound perfect for me. I don’t have time to watch charts all day. Trailing stops feel like having a buddy who says, ‘Hey, you’re doing great - let’s lock this in.’

Also, avoiding round numbers? That’s such a simple tip but I never thought of it. I’m gonna start using $1,873 instead of $1,900. Feels like I’m outsmarting the bots already 😎

Thanks for sharing, OP. And thanks to everyone else - this is the kind of community I wanted to find.

Alex Strachan

January 9, 2026 AT 19:30Oh wow, so you’re telling me that if I just set a stop-loss, I won’t have to feel bad when I lose money? 😳

Wow. Groundbreaking. Next you’ll tell me water is wet and gravity exists.

Also, I’m shocked - SHOCKED - that people still use Coinbase Pro. Like, did you get your crypto in 2014 and forget to upgrade? 😂

Anyway, I use stop-limit on Bybit, set my stop at 1.8x ATR, and just laugh when the price dips 5% and bounces back. They’re not hunting me. I’m hunting THEM. 💪

Rick Hengehold

January 10, 2026 AT 17:40Stop-losses aren’t optional. They’re mandatory. If you’re not using them, you’re gambling. Not trading.

1-2% risk per trade. That’s it. No excuses.

Trailing stops > fixed stops. ATR > guesswork.

Stop-limit? Only if you want to get stuck in a falling knife.

Don’t be the guy who lost 80% because he ‘believed in the asset.’ You’re not Warren Buffett. You’re a trader. Act like it.

Antonio Snoddy

January 11, 2026 AT 18:24It’s fascinating, isn’t it? How we project our fear onto the market and call it ‘strategy.’ The stop-loss is not a tool - it’s a confession. A confession that we don’t trust ourselves. That we don’t trust the future. That we believe the market is an enemy waiting to devour us.

But what if the market isn’t out to get you? What if it’s just… indifferent?

Maybe the real problem isn’t slippage or whipsaws - it’s our attachment to control. We want to predict. We want to dominate. We want to force the chaos into a neat little box labeled ‘risk management.’

But crypto is chaos. And chaos doesn’t care about your stops.

Maybe the only real strategy is surrender.

…or at least, that’s what I tell myself when I wake up at 3 a.m. to check my portfolio again.

🫂

Ryan Husain

January 12, 2026 AT 12:09While I appreciate the depth of this analysis, I would like to offer a complementary perspective: the psychological discipline required to implement stop-loss orders consistently is often underestimated. Many traders understand the mechanics but fail at execution due to cognitive biases - loss aversion, anchoring, and the sunk cost fallacy.

It is not enough to set a stop; one must also commit to never overriding it. This requires emotional regulation, not just technical knowledge.

I recommend journaling each trade - including the rationale for the stop level and the emotional state at the time of placement. This builds meta-awareness over time.

Additionally, while ATR and volatility-based stops are superior, they require accurate data feeds. On lesser-known DEXs, volatility metrics may be unreliable. Always verify your source.

Thank you for the thoughtful post. This is the kind of content that elevates the discourse.

Rajappa Manohar

January 12, 2026 AT 17:25bro a tr stop is the best i use it on my solana and doge and never got stoped out by noise. only time i lost was when i set stop at 50k and btc dropped to 49k and came back. i shouldve used 49800 😅

Jacky Baltes

January 13, 2026 AT 04:41There’s a certain elegance in letting the market dictate your exit rather than your ego. A stop-loss isn’t about fear - it’s about honoring your initial thesis. If the price moves beyond your calculated risk threshold, your thesis is invalidated. Not your emotions. Not your hope. Your logic.

It’s a form of intellectual integrity.

And yes - avoid round numbers. Not because of ‘whales,’ but because human psychology clusters there. It’s not manipulation. It’s mathematics meeting behavior.

Trailing stops are the quiet winners. They don’t shout. They just keep moving forward.

dina amanda

January 13, 2026 AT 16:38THEY WANT YOU TO USE STOP-LOSSES SO THEY CAN TAKE YOUR MONEY AND SAY IT WAS YOUR FAULT. THE FED AND THE EXCHANGES ARE THE SAME THING. THEY CONTROL THE PRICE. THEY MAKE THE DIPS. THEY MAKE THE RALLIES. YOU’RE NOT TRADING. YOU’RE BEING FARMED.

WHY DO YOU THINK THEY PUSHED STOP-LOSSES ON YOU? TO MAKE YOU SELL LOW AND BUY HIGH? NO. TO MAKE YOU SELL LOW AND THEN THEY BUY AND YOU WATCH IT GO UP.

JUST HOLD. HOLD IN COLD WALLET. DON’T TRUST ANYTHING. THE SYSTEM IS RIGGED. EVERYTHING IS A SCAM.

WE ARE THE 99% AND THEY WANT US TO THINK WE HAVE CONTROL.

STOP-LOSSES ARE A TRAP. JUST HODL.

Adam Hull

January 14, 2026 AT 09:33How quaint. You’ve reduced the complex dynamics of decentralized finance to a series of mechanical rules, as if markets were governed by spreadsheet logic rather than human panic, algorithmic arbitrage, and institutional manipulation.

ATR? Trailing stops? Please. These are the rituals of the retail masses, the modern-day incantations whispered before the altar of Binance.

The only thing that matters is liquidity depth and order flow - neither of which you can access without a direct market feed, a co-location server, and a six-figure account.

You’re not managing risk. You’re performing a placebo ritual for your ego.

And yet… you still think you’re ahead of the curve. How endearing.

Mandy McDonald Hodge

January 15, 2026 AT 12:53OMG I JUST STARTED TRADING AND THIS IS SO HELPFUL!! 🥹

I was using fixed 10% stops and got stopped out 3 times last week 😭

Now I’m trying ATR + trailing and it feels like I finally have a safety net that doesn’t jump at every little dip. Also, avoiding round numbers? Genius. I’m using $28,312 now instead of $28,000. Feels like I’m hacking the system 😄

Also, thank you for saying ‘belief doesn’t pay bills’ - I needed that. I was holding a coin that dropped 60% because ‘it’s the future.’ Nope. Not anymore.

Love this community 💖

Bruce Morrison

January 17, 2026 AT 11:17Trailing stops work. ATR works. Don’t overcomplicate it.

Set it. Forget it.

That’s it.

Haritha Kusal

January 17, 2026 AT 11:25i use stop loss on all my trades now and i feel so much calmer 😊 even when btc drops i just smile because i know im protected. thanks for the tips! i didnt know about volatility controlled stops, gonna try that next

dayna prest

January 19, 2026 AT 02:01Wow. So you’re telling me that instead of ‘predicting the bottom,’ we should just accept that we’re going to lose money sometimes? Groundbreaking.

Next you’ll tell me the sun rises in the east. Or that water is wet. Or that ‘believe in the asset’ is a terrible trading strategy.

But hey - if you’re into that whole ‘risk management’ thing, I guess that’s your thing.

Meanwhile, I’m buying the dip. Because I don’t fear the market. I *understand* it.

…and I’m not paying for ‘volatility-controlled stops’ when I can just wait.

Just saying.

Phil McGinnis

January 19, 2026 AT 04:15Let me be clear: stop-loss orders are the crutch of the financially illiterate. They are not a strategy. They are a symptom.

The real issue is not slippage or volatility - it is the absence of a macroeconomic framework. You cannot manage risk in crypto without understanding monetary policy, regulatory risk, and institutional positioning.

Trailing stops? ATR? These are distractions - tools for those who refuse to engage with the true drivers of value.

If you are trading without understanding the Fed’s balance sheet, the implications of ETF approvals, or the geopolitical stance of the U.S. Treasury - you are not a trader. You are a gambler with a spreadsheet.

And no - your ‘discipline’ will not save you when the system collapses.

Willis Shane

January 20, 2026 AT 02:08Excellent breakdown. One thing I’d add: always test your stop-loss strategy against historical flash crashes - especially the 2020 March crash and the 2022 Terra collapse. Many strategies that work in calm markets fail catastrophically under extreme stress.

Also, never use a stop-loss on a position you don’t fully understand. If you can’t explain why the asset has value, you shouldn’t be trading it - stop-loss or not.

Discipline is the only edge. Everything else is noise.

SUMIT RAI

January 21, 2026 AT 23:11stop loss is fake. i dont use it. i just buy when its low and wait. btc will go to 200k. why sell? you scared? 😂

Andrea Stewart

January 23, 2026 AT 02:37Just wanted to add - if you’re using stop-limit orders on DEXs, make sure your limit price is at least 5% below your stop. Otherwise, you’ll get stuck during a flash crash. I learned this the hard way when I lost $3k because my order never filled.

Also, for altcoins with low volume, stop-market is the only safe bet. Slippage sucks, but being stuck in a dying coin sucks more.

Josh Seeto

January 23, 2026 AT 08:08So you’re telling me the secret to not losing money in crypto is… not being an idiot?

Wow. Mind blown.

Next you’ll tell me breathing is important for survival.

Anyway - ATR stops are legit. I switched from fixed to ATR last year and my win rate jumped. Also, never use Coinbase Pro. Just… don’t.

surendra meena

January 24, 2026 AT 14:47STOP LOSSES ARE A SCAM!! THEY WANT YOU TO SELL AT THE BOTTOM!! THE EXCHANGES ARE MANIPULATING THE PRICE TO HIT YOUR STOP AND THEN RALLY!! THEY KNOW WHERE YOUR STOP IS!! THEY PUMP THEN DUMP!! YOU’RE NOT TRADING - YOU’RE BEING FARMED!!

AND WHY DO YOU THINK THEY PUSHED STOP-LOSSES? BECAUSE THEY WANT YOU TO THINK YOU HAVE CONTROL!!

THEY’RE LAUGHING AT YOU!!

JUST HODL!!

WHY DO YOU THINK THE PRICE ALWAYS DIPS RIGHT TO YOUR STOP??

IT’S NOT COINCIDENCE!!

IT’S A PATTERN!!

THEY’RE HUNTING YOU!!

Mike Reynolds

January 26, 2026 AT 12:00@1546 - I get your point about stop-hunting, but I’ve backtested this. Out of 120 trades over 3 years, only 3 were clearly manipulated. The rest? Normal liquidity gaps. Most ‘stop hunts’ are just thin order books.

And yeah, exchanges know where stops are - but so do whales. And they’re not always trying to trap you. Sometimes, they’re just selling their own bags.

Still, I use non-round stops and avoid obvious levels. Better safe than sorry.

@1507 and @1513 - if you’re not using any exit strategy, you’re not trading. You’re praying.

Bruce Morrison

January 27, 2026 AT 05:06@1513 - you’re not wrong that manipulation happens. But acting like it’s the only thing that matters is like saying planes crash because of wind - so don’t fly.

Use stops anyway. Because even if the market is rigged, you still need to protect your capital.

Don’t let fear of the system paralyze you. Just adapt.

Simple.