By 2026, if you still hold Monero, Zcash, or Dash, you're not just holding a cryptocurrency-you're holding a legal gray area. The world of privacy coins has changed dramatically. What once felt like a niche tech experiment is now a high-stakes battleground between personal financial freedom and global financial control. And the outcome? It’s not what most people expected.

Why Privacy Coins Are Under Siege

Privacy coins were built to hide what regular blockchains expose. Bitcoin shows every transaction ever made. If you sent 0.5 BTC to a friend last year, anyone can trace it. Privacy coins like Monero is a cryptocurrency that uses ring signatures and stealth addresses to obscure sender, receiver, and transaction amount do the opposite. They mix your transaction with dozens of others, hide the real address, and make it mathematically impossible to link inputs to outputs. That’s powerful. And that’s exactly why regulators hate it. The Financial Action Task Force (FATF) is an intergovernmental body that sets global standards for anti-money laundering and counter-terrorism financing doesn’t see privacy as a right-it sees it as a loophole. Their Travel Rule, updated in 2025, says any crypto transfer over $1,000 must carry KYC data: name, ID, address. Monero can’t do that. Zcash can, if you use transparent mode-but most users don’t. So exchanges are being forced to choose: comply or get shut down.Who’s Delisting Privacy Coins-and Why

You won’t find Monero on Binance, Coinbase, or Kraken anymore. Not because they’re bad coins. Not because they’re hacked. But because regulators made it too risky. In South Korea, listing any privacy coin is now a criminal offense. Japan followed suit in early 2025. The European Union’s MiCA (Markets in Crypto-Assets) is a comprehensive regulatory framework for digital assets in the EU, set to fully take effect in 2027 regulation is even more aggressive. By 2027, it will ban privacy coins outright. The U.S. hasn’t passed a federal ban yet-but the Financial Crimes Enforcement Network (FinCEN) is the U.S. Treasury agency responsible for enforcing anti-money laundering laws in the financial system has issued dozens of cease-and-desist orders to exchanges still listing Zcash or Dash. Many U.S.-based platforms quietly removed them months ago. The math is simple: if your exchange handles $10 billion in volume and one of your listed coins is used in a money laundering case, you could lose your license. Or worse-face criminal charges. So they pull the plug. No warning. No explanation. Just a tweet saying “Trading suspended.”What Happens When a Privacy Coin Gets Delisted

Liquidity evaporates. Price crashes. Suddenly, the coin you bought for $50 drops to $12. Why? Because the only buyers left are people on decentralized platforms-and they’re not buying in bulk. Take Monero. In 2023, it traded on over 120 major exchanges. By late 2025, that number dropped to 14. Most of those were offshore or unregulated. Trading volume fell by 78%. The same thing happened to Zcash. Even though Zcash lets you choose between shielded (private) and transparent (public) transactions, regulators didn’t care. They saw the option and said, “We can’t monitor it. Remove it.” This isn’t just about price. It’s about access. If you’re not a crypto expert, you can’t just hop onto a decentralized exchange. You need a wallet, private keys, a bridge, and the patience to deal with slippage and gas fees. For most people, that’s too much. So they sell. And the cycle continues: delisting → lower demand → lower price → more delistings.

The Rise of Decentralized Trading

So where are people trading privacy coins now? On platforms that don’t ask for ID. Flashift is a decentralized non-custodial crypto exchange that allows peer-to-peer trading without KYC, SideShift is a non-KYC automated cryptocurrency exchange platform supporting privacy coins, and ThorChain is a decentralized liquidity network that enables cross-chain swaps without intermediaries have seen user growth of over 300% since 2024. These platforms don’t hold your money. They don’t know who you are. You send your Monero, they send you Bitcoin in return. No paperwork. No trace. But here’s the catch: regulators are watching these too. The U.S. SEC is the U.S. government agency responsible for regulating securities markets and protecting investors and CFTC is the U.S. federal agency regulating derivatives markets including futures and swaps have started issuing subpoenas to developers behind these platforms. One developer in Singapore was arrested in late 2025 for “facilitating unregistered financial services.” So now we’re in a new phase: the underground market. Privacy coins aren’t dead. They’re just harder to reach. And riskier to use.Legitimate Uses vs. Criminal Misuse

Let’s be honest: privacy coins are used for bad things. Drug markets, ransomware, sanctions evasion-yes, it happens. But they’re also used for good. Think about journalists in authoritarian regimes. Or whistleblowers. Or small businesses negotiating mergers where competitors can’t see their cash flow. Or someone in Venezuela avoiding hyperinflation by moving value across borders without government tracking. In New Zealand, where I live, privacy coins aren’t illegal. But if you use them to pay rent, your bank might freeze your account. If you file taxes and don’t report Monero holdings, the IRD (Inland Revenue Department) could audit you. There’s no clear guidance. No safe harbor. Regulators treat all privacy as suspect. But privacy isn’t the problem. Lack of clear rules is.

The Future: Integration or Extinction?

The smartest move isn’t to fight regulation. It’s to work around it. Ethereum is already experimenting with privacy layers. Projects like Tornado Cash (though now heavily restricted) showed that privacy can be added to public blockchains. Future versions of Ethereum might let you choose: public for tax compliance, private for personal use. That’s the future. Monero and Zcash won’t survive if they stay isolated. Their best chance is becoming modules-not currencies. Think of them like encrypted email protocols: built into bigger systems, not standalone. Some experts predict that by 2030, standalone privacy coins will be rare. Instead, you’ll use a wallet that lets you toggle privacy on/off per transaction. Regulators get their traceability. Users get their confidentiality. The middle ground.What Should You Do in 2026?

If you hold privacy coins:- Know your local laws. In some countries, owning them is a crime. In others, it’s just frowned upon.

- Don’t trade them on centralized exchanges. You’re asking for trouble.

- Use non-custodial wallets. Never leave them on an exchange you don’t control.

- Keep records. Even if you’re not required to report, you might need proof later.

- Understand the risks. If your coins are used in a crime, even unknowingly, you could be investigated.

- Forget payroll platforms. Too risky.

- Avoid U.S. and EU markets unless you have legal counsel.

- Look at regions with clearer rules: Singapore, Switzerland, or parts of Southeast Asia.

- Build with transparency options. A privacy coin with an optional audit trail has a better chance of surviving.

Final Thought

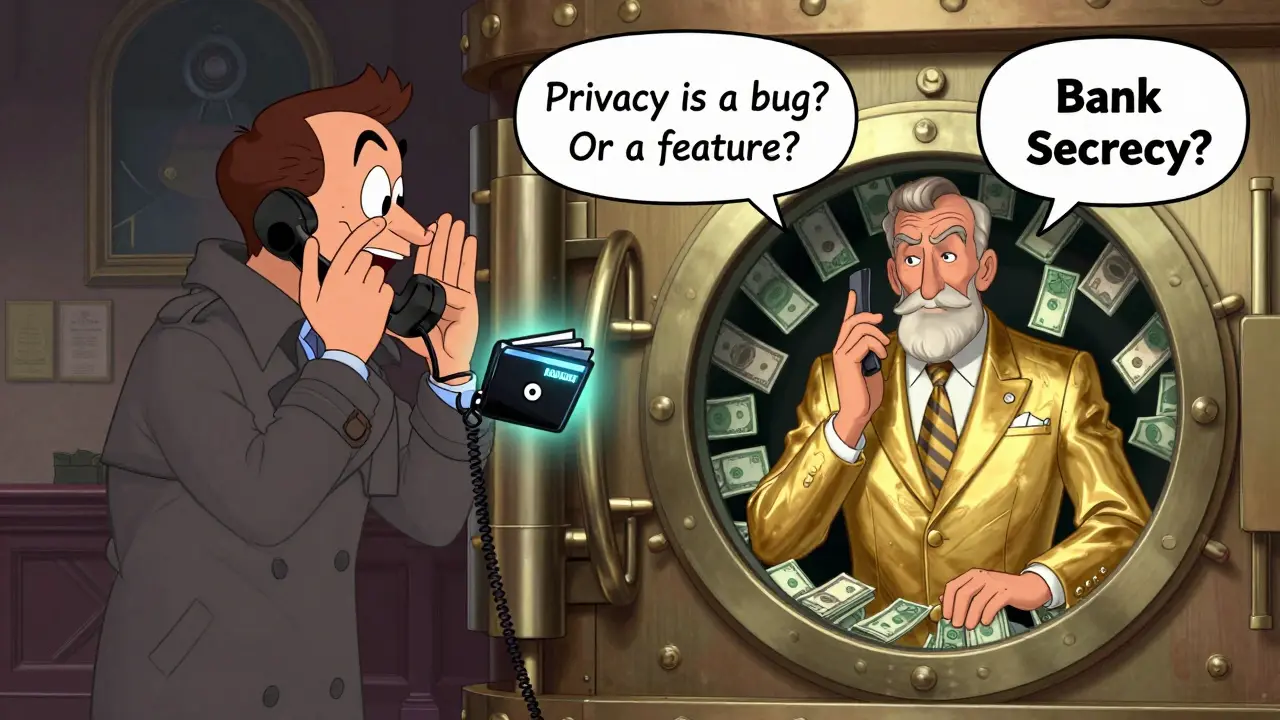

Privacy coins didn’t fail because they were too private. They failed because the world wasn’t ready to accept that privacy isn’t a bug-it’s a feature. The same regulators who demand bank secrecy for wealthy clients are terrified of ordinary people using crypto to protect their money. That’s not logic. It’s hypocrisy. The future of money isn’t about total transparency. It’s about choice. And right now, privacy coins are the last standing symbol of that choice.Are privacy coins illegal?

No, privacy coins are not illegal in most countries as of 2026. However, many governments restrict or ban their trading on regulated exchanges. In South Korea and Japan, listing them is prohibited. The EU plans to ban them entirely by 2027. In the U.S., they remain legal but are delisted by nearly all major exchanges due to regulatory pressure. Holding them privately is generally not a crime-but using them for unreported transactions may trigger tax or AML investigations.

Why did exchanges like Binance and Coinbase delist Monero and Zcash?

Exchanges delisted privacy coins because they can’t comply with global anti-money laundering rules like the FATF Travel Rule. These rules require exchanges to track the origin and destination of every transaction above $1,000. Monero’s ring signatures and stealth addresses make this impossible. Zcash’s shielded transactions offer the same challenge. To avoid fines, license revocation, or criminal liability, exchanges removed them.

Can I still trade privacy coins in 2026?

Yes, but not on major exchanges. You can still trade them on decentralized platforms like Flashift, SideShift, and ThorChain, which don’t require KYC. Peer-to-peer marketplaces like LocalMonero also still operate. However, these methods come with higher risks: no customer support, price volatility, and potential future regulation targeting non-KYC services. You’re on your own.

What’s the difference between Monero and Zcash?

Monero hides all transaction details by default-sender, receiver, and amount. It uses ring signatures and stealth addresses to mix transactions. Zcash offers optional privacy: you can choose between transparent (public) and shielded (private) transactions. This flexibility made Zcash a target too, because regulators couldn’t trust users to always pick transparency. Both are now largely delisted, but Monero remains the most private.

Will privacy coins disappear completely?

Not completely. They’re likely to become niche assets traded only on decentralized, non-KYC platforms. Their long-term survival depends on whether they can integrate into larger blockchains like Ethereum as optional privacy layers. Standalone privacy coins will fade unless they adapt. The future belongs to hybrid systems that offer both transparency for regulators and privacy for users.

Is it safe to use privacy coins for everyday purchases?

Not really. Most businesses don’t accept them. Banks monitor incoming crypto deposits. If you use Monero to pay rent or buy groceries, your bank might flag the transaction, freeze your account, or report you to authorities. Even if the purchase is legal, the method raises red flags. For now, privacy coins are better suited for long-term holding or cross-border transfers-not daily spending.