When the U.S. government targets a cryptocurrency wallet with sanctions, it doesn’t just freeze a bank account-it freezes a digital address on a public ledger that can’t be undone. That’s the reality for any crypto business operating under U.S. jurisdiction. OFAC cryptocurrency sanctions aren’t optional guidelines. They’re enforceable legal requirements with real penalties, and ignoring them can cost millions-or worse, shut your business down.

What OFAC Actually Controls in Crypto

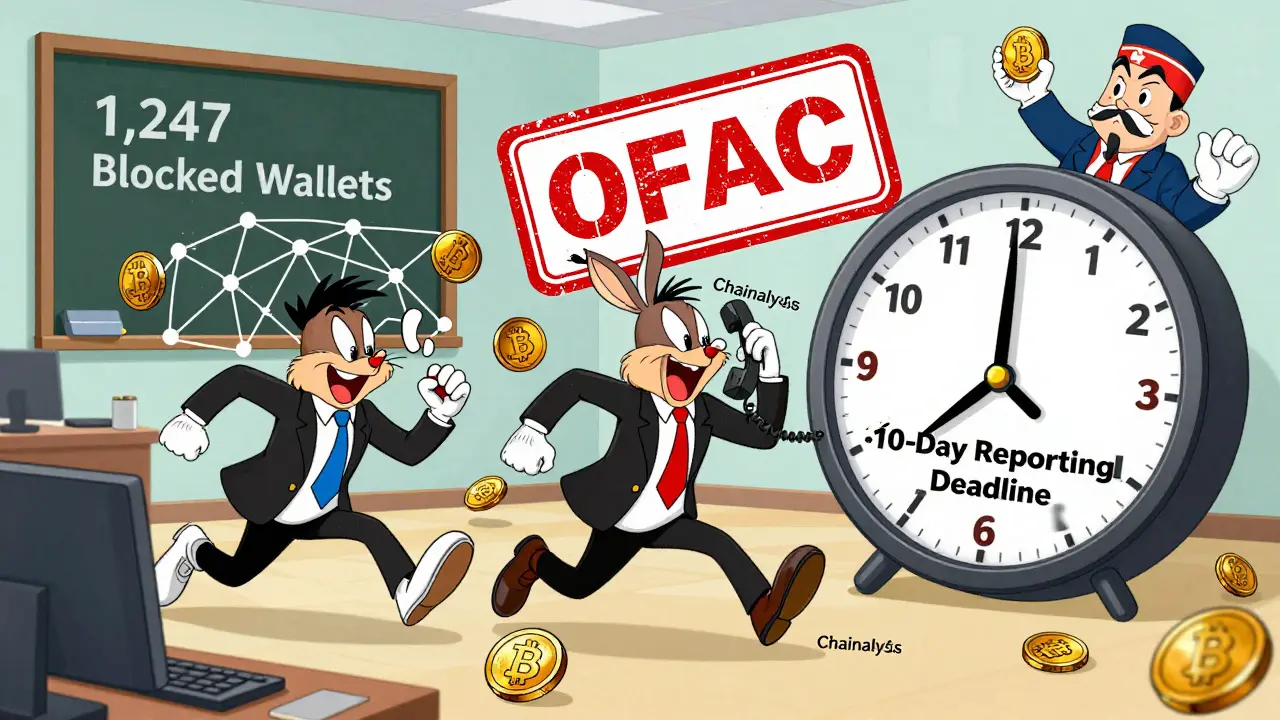

The Office of Foreign Assets Control (OFAC) doesn’t regulate crypto prices or trading volumes. It controls who you can transact with. Since 2018, OFAC has been adding digital currency addresses to its Specially Designated Nationals (SDN) List. As of October 2025, that list includes 1,247 cryptocurrency addresses linked to sanctioned individuals, groups, or governments. These aren’t random addresses. They’re tied to entities involved in terrorism, cybercrime, drug trafficking, or supporting regimes like Iran, North Korea, Russia, Cuba, Syria, and Sudan. If you’re a U.S. person, a company incorporated in the U.S., or even a foreign entity that touches the U.S. financial system, OFAC rules apply to you. That means every transaction you process-no matter how small-must be screened against the SDN List. There’s no minimum threshold. A $5 transfer to a blocked wallet is just as illegal as a $5 million one. OFAC doesn’t care if you didn’t know the address was blocked. Under strict liability rules, ignorance is not a defense. That’s why ShapeShift paid $750,000 in September 2025 for processing $12.5 million in transactions from users in sanctioned countries. They didn’t intentionally break the law. They just didn’t block geolocations or screen wallet addresses properly.How to Screen Crypto Addresses Correctly

You can’t manually check 1,247 addresses every time someone sends Bitcoin. That’s where blockchain analytics tools come in. Services like Chainalysis, Elliptic, and TRM Labs maintain live feeds of OFAC’s SDN List and scan every transaction for matches. These tools don’t just flag known addresses-they trace transaction paths, identify mixing services, and detect patterns linked to sanctioned entities. Here’s how it works in practice:- When a user deposits crypto, your system checks the sender’s wallet against the SDN List.

- If the wallet is flagged, the transaction is automatically blocked.

- Blocked funds must be held in a separate, isolated wallet labeled “Blocked SDN Digital Currency.”

- You must report these blocked assets to OFAC within 10 business days.

The Cost of Getting It Wrong

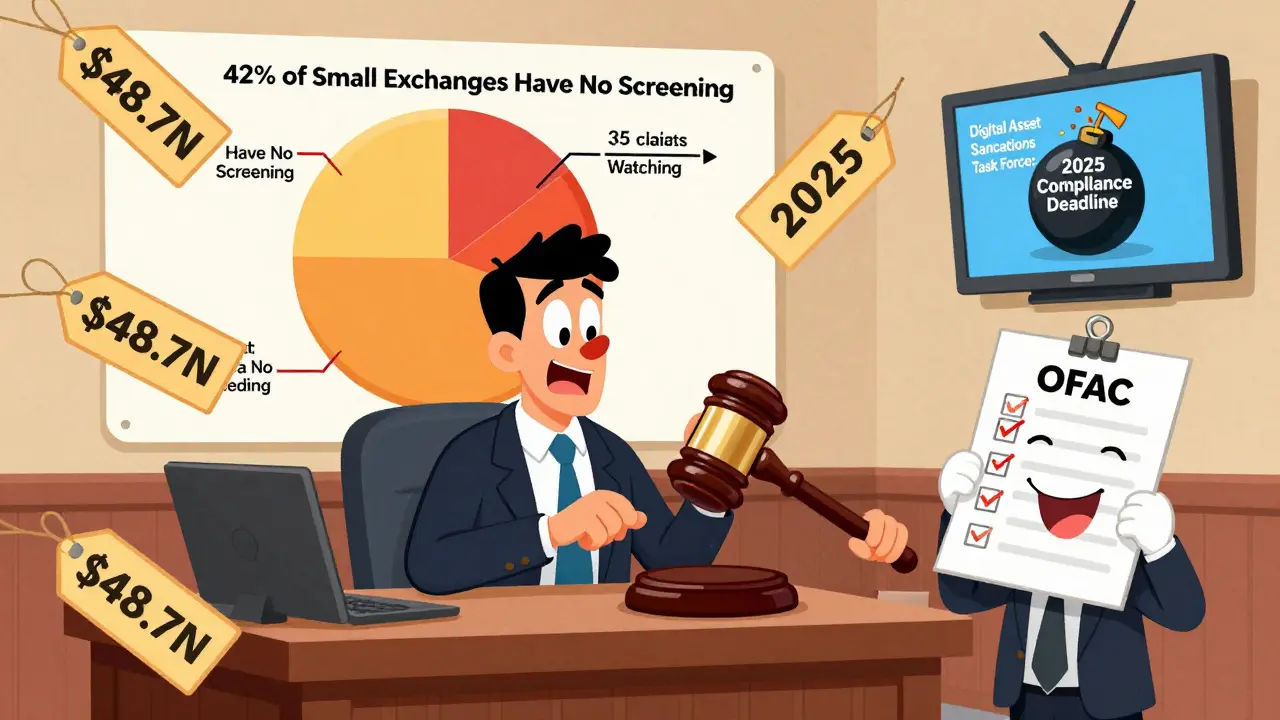

The ShapeShift case wasn’t an outlier. In August 2025, OFAC re-designated Garantex Europe OU for processing over $100 million in illicit crypto transactions since 2019. But they didn’t stop there. They also sanctioned Garantex’s successor, Grinex, and six other companies linked to the same network. This is a new pattern: OFAC is going after entire ecosystems, not just individual exchanges. Penalties aren’t just financial. In 2025, OFAC issued 17 cryptocurrency-related enforcement actions, totaling $48.7 million in fines since 2018. The UK’s OFSI, by comparison, has issued only three. Singapore has five. The U.S. isn’t just enforcing-it’s leading. Smaller exchanges aren’t safe. In 2025, a survey found that only 42% of crypto businesses processing under $100 million monthly had any sanction screening in place. That’s a ticking time bomb. OFAC doesn’t care about your size. They care about your risk.

Building a Real Compliance Program

You can’t just buy a tool and call it a day. OFAC requires a formal Sanctions Compliance Program (SCP) with five core parts:- Management Commitment - Board-level oversight. Someone at the top must be accountable.

- Risk Assessment - Update it quarterly. Identify which services (exchanges, wallets, DeFi) pose the highest risk.

- Internal Controls - Automated screening tools, geolocation blocking, wallet address filtering.

- Testing and Auditing - Hire an independent third party to audit your system at least once a year.

- Training - All staff who touch transactions must be trained. ACAMS found compliance officers need 147 hours of specialized training to do it right.

The Big Challenges: Privacy Coins and DeFi

Not all crypto is equal when it comes to compliance. Privacy coins like Monero and Zcash are designed to hide transaction details. That makes them nearly impossible to screen with current tools. In October 2025, OFAC updated its guidance to require “reasonable measures” to prevent transactions involving blocked persons-even with privacy coins. But what’s “reasonable”? There’s no clear answer yet. Decentralized finance (DeFi) is even trickier. In a liquidity pool, you don’t know who you’re transacting with. There’s no KYC. No user account. Just smart contracts. A 2025 Global Legal Insights report found 73% of firms struggle to apply traditional sanctions rules to DeFi protocols. Some are trying to solve this. Ethereum’s proposed EIP-7594 would add on-chain sanction checks directly into the protocol. But the community pushed back hard-1,247 comments on the AllCoreDevs call called it a threat to decentralization. The tension between regulation and open blockchain is only growing.

What You Should Do Right Now

If you’re running a crypto business in 2025, here’s your checklist:- Confirm your business falls under OFAC jurisdiction (U.S. entity, U.S. users, or U.S. financial system access).

- Implement automated blockchain analytics tools that update in real time.

- Block all transactions to and from SDN-listed addresses.

- Set up a segregated “Blocked SDN Digital Currency” wallet.

- Train all staff on sanctions compliance and document training completion.

- Conduct a risk assessment and update it every quarter.

- Prepare for an independent audit.

- Monitor OFAC’s weekly SDN updates-new crypto addresses are added regularly.

Khaitlynn Ashworth

December 31, 2025 AT 18:45Oh wow, OFAC’s got a new toy and it’s called ‘blockchain surveillance’ 🙃 So now we’re policing digital ghost money like it’s 2008 and we’re chasing petty cash thieves? I mean, I get it-money laundering’s bad-but freezing a wallet like it’s a bank account on a public ledger? That’s not compliance, that’s digital McCarthyism. And don’t get me started on DeFi. You can’t sanction a smart contract that doesn’t know who’s holding the keys. This isn’t regulation. It’s performance art for bureaucrats who miss the 90s.

NIKHIL CHHOKAR

January 1, 2026 AT 22:17Actually, this is exactly the kind of responsible framework the crypto space needs. Many of us in India have seen how unregulated platforms become havens for fraud and terror financing. It’s not about control-it’s about accountability. Tools like Chainalysis aren’t invasive; they’re necessary. If you’re running a business, you owe it to honest users to screen transactions. Ignorance isn’t bliss-it’s negligence. And yes, it’s expensive, but so is losing your license-or your freedom.

Mike Pontillo

January 3, 2026 AT 18:40So let me get this straight. You’re telling me I can’t send 5 bucks to my cousin in Iran because some address got added to a list I didn’t even know existed? And if I do, I’m a criminal? No warning? No grace period? This isn’t compliance. It’s digital witch hunt with a fine print. And don’t even get me started on the ‘blocked wallet’ nonsense. You mean I can’t even move my own crypto? What’s next-OFAC deciding which memes I can send?

rachael deal

January 3, 2026 AT 23:53Love this breakdown. Seriously. So many people think crypto is lawless, but this is the exact kind of structure that’ll make it sustainable. Automation isn’t evil-it’s efficient. And training? YES. My team just finished our 147-hour ACAMS refresher and honestly? It changed everything. We cut false positives by 70%. It’s not about fear. It’s about doing it right. If we want crypto to go mainstream, we need to be the adults in the room. No more ‘move fast and break things.’ Time to move smart and build right.

Elisabeth Rigo Andrews

January 5, 2026 AT 19:43Let’s be real-this is the bare minimum. We’re talking about blockchain analytics tools that cost six figures, quarterly risk assessments, third-party audits, and mandatory training. And yet, 58% of small exchanges still don’t even have a compliance officer. That’s not incompetence-that’s malpractice. If your ‘compliance’ is a spreadsheet you update once a year, you’re not a business. You’re a liability waiting for a subpoena. OFAC isn’t being harsh. You’re just unprepared.

Bruce Morrison

January 6, 2026 AT 21:30Good post. Solid checklist. The part about segregated wallets is critical. I’ve seen too many firms try to ‘just move it to another address’ and think that fixes it. Nope. That’s a violation. And the training part? Don’t just do it once. Do it every quarter. People forget. Systems change. Threats evolve. Compliance isn’t a project. It’s a culture. And culture starts at the top. If your CEO doesn’t care, your compliance is theater.

nayan keshari

January 6, 2026 AT 22:52OFAC is just trying to kill innovation under the guise of safety. Privacy coins aren’t evil-they’re privacy. DeFi isn’t a loophole-it’s evolution. You can’t regulate code. You can’t police anonymity. If you want control, go back to banks. Crypto was built to escape this exact control. This isn’t compliance. It’s colonization of the open internet.

alvin mislang

January 8, 2026 AT 00:05Wow. Just wow. 😤 So now I need to pay $2 million so I can’t send $5 to my friend in Russia? And if I don’t? I get fined? This isn’t justice. It’s extortion. OFAC thinks they’re the police of the internet. They’re not. They’re just scared of tech they don’t understand. And now they’re making everyone else pay for their panic. I’m done. I’m moving my business offshore. Good luck with your digital police state.

Alexandra Wright

January 9, 2026 AT 09:37Let’s cut through the noise. The ShapeShift fine? That was a slap on the wrist. They made $12.5M from users in sanctioned countries and only got $750K? That’s a tax write-off. If you’re a crypto business and you’re not spending at least $500K a year on compliance, you’re not trying. You’re gambling. And guess what? The regulators aren’t bluffing. They’re hiring ex-FBI agents. They’re using AI to trace mixers. They’re watching. And they’re not going away. This isn’t about fear. It’s about survival. Get the tools. Train your team. Document everything. Or get out.

Jack and Christine Smith

January 10, 2026 AT 17:13ok so i read this whole thing and like… i think i get it? kinda? but also… why does it feel like we’re being asked to police the whole internet? like if someone sends me crypto from a wallet that’s on some list… but i didn’t even know who they were… how am i supposed to know? also i think someone misspelled ‘compliance’ in the article? or was that on purpose? 😅 anyway, i’m gonna go buy Chainalysis now. my accountant says i have to. or else i’ll ‘go to crypto jail’.

Raja Oleholeh

January 12, 2026 AT 02:32Michelle Slayden

January 13, 2026 AT 12:18It is, in fact, a profound epistemological dilemma: to enforce legal compliance upon a decentralized, pseudonymous, and permissionless system is to impose a centralized authority upon an architecture designed explicitly to resist such imposition. The ontological tension between regulatory sovereignty and cryptographic autonomy is not merely a policy challenge-it is a civilizational inflection point. The U.S. Treasury, in its zeal for control, risks fracturing the very integrity of the open ledger paradigm upon which blockchain’s legitimacy is founded. One may ask: if the ledger is no longer trustless, is it still a ledger?

christopher charles

January 14, 2026 AT 22:10Okay, real talk: if you’re a small shop and you’re spending $200K a year on compliance, you’re doing it wrong. You don’t need the fancy $2M system Binance uses. You need a solid API from Elliptic, a simple blocklist, and a person who checks it weekly. I’ve seen shops with 10K monthly transactions run lean and clean for under $50K. Training? Yeah, do it. But don’t hire a consultant to write a 50-page PDF. Just sit everyone down for 45 minutes. Show them a real blocked transaction. Make it real. Not theoretical. And for god’s sake, stop calling it ‘the system.’ It’s just software. You’re not running NASA.

Vernon Hughes

January 15, 2026 AT 12:13Alison Hall

January 16, 2026 AT 06:31Amy Garrett

January 17, 2026 AT 12:04