China Crypto Legal Status Checker

Check whether your cryptocurrency-related activity is legal in China as of June 1, 2025. The Chinese government has implemented a complete ban on all crypto-related activities.

Select an activity to check its legal status

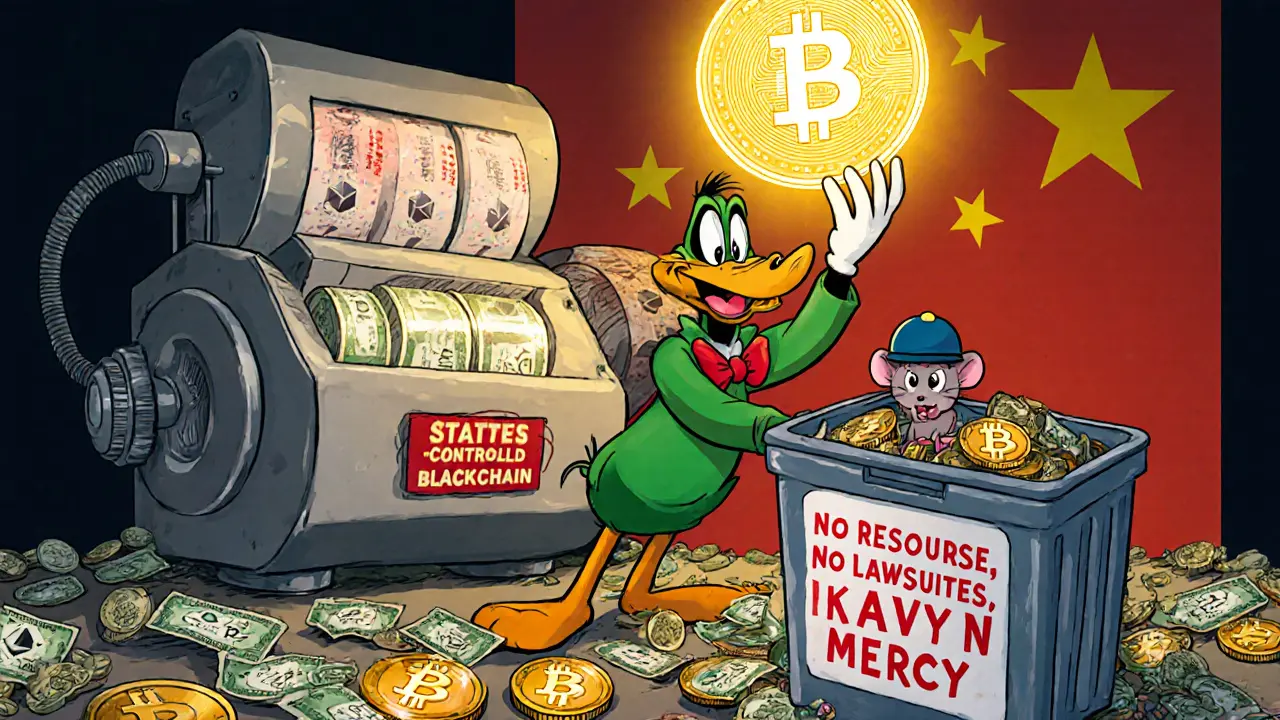

As of June 1, 2025, cryptocurrencies are completely illegal in China. Not just trading or mining - owning them carries no legal protection, and any transaction involving them is considered a violation of financial law. This isn’t a gray area. It’s a hard stop. If you’re in China, holding Bitcoin, Ethereum, or any other crypto coin, you’re doing so at your own risk - with no recourse if it’s seized, hacked, or lost. The government doesn’t just discourage it. It actively erases it.

How China Went From Crypto Hub to Crypto Zero

Just a decade ago, China was the epicenter of the global cryptocurrency scene. Over 70% of Bitcoin mining happened in Chinese data centers. Exchanges like Huobi and OKX handled billions in daily trades. Chinese investors were among the most active in the world. But that changed fast. In 2017, the People’s Bank of China banned initial coin offerings (ICOs), calling them illegal fundraising. Then in 2021, all crypto transactions were declared void under Chinese law. But it wasn’t until June 2025, with the release of Circular No.237, that the final nail was driven in. The new rules didn’t just restrict exchanges or mining - they outlawed every single link in the chain: buying, selling, exchanging, even providing pricing data for crypto. The shift wasn’t about technology. It was about control. China saw decentralized money as a threat to its financial sovereignty. If people could move value outside state supervision, it undermined the government’s ability to monitor capital flows, enforce taxes, or prevent money laundering. The solution? Erase it entirely.What Exactly Is Illegal Now?

The 2025 ban is comprehensive. Here’s what you can’t do in China without breaking the law:- Buy or sell any cryptocurrency - even peer-to-peer

- Mine Bitcoin or any other coin - all mining farms have been shut down

- Hold crypto in any wallet, whether hot or cold

- Offer crypto trading services, even as a freelance intermediary

- Accept crypto as payment for goods or services

- Market or promote crypto platforms to Chinese residents

- Use offshore exchanges to trade while physically in China

Penalties Are Real - And Harsh

The government doesn’t just issue warnings. It enforces. Fines are common, but criminal charges are not rare. If you’re caught running a crypto exchange from your apartment, or mining with a cluster of GPUs, you could face charges for illegal fundraising, financial fraud, or operating an unlicensed financial service. Authorities don’t just target businesses. They go after individuals. In 2024, a Shanghai resident was fined 120,000 RMB ($16,500) for holding over $50,000 in crypto and transferring it to an offshore exchange. The money was confiscated. The case was publicized as a warning. Foreigners aren’t exempt. Whether you’re a tourist, expat, or business traveler, Chinese law applies to you while you’re in the country. If you’re caught using a crypto app on your phone while in Beijing, you can be detained, fined, or deported - especially if authorities suspect you’re facilitating transactions for others.

Blockchain Is Fine. Crypto Is Not.

Here’s the twist: China still loves blockchain. But only if it’s state-controlled. The government actively funds blockchain research, patents, and pilot programs. State banks use blockchain for supply chain tracking. Local governments use it for land registry and tax records. But every blockchain project in China is centralized. No decentralization. No anonymity. No tokens. The message is clear: technology is good when the state controls it. Private digital money is dangerous because it can’t be monitored. That’s why China is pushing its own digital currency - the e-CNY, or digital yuan - with over 500 million users in pilot cities like Shenzhen and Hangzhou. The e-CNY isn’t just a digital version of cash. It’s a surveillance tool. Every transaction is logged. The government can freeze payments, set expiration dates, and track spending patterns. It’s the opposite of Bitcoin. And it’s the future China wants.Hong Kong Is the Exception - But Only for Now

Hong Kong operates under a different legal system. While mainland China bans crypto, Hong Kong passed the Stablecoin Bill in May 2025, creating a licensing regime for stablecoin issuers. Major exchanges like Binance and Kraken have opened offices there. But don’t mistake this as a loophole. Hong Kong’s rules don’t apply to mainland China. If you’re a Hong Kong resident and you send crypto to someone in Guangzhou, you’re still breaking Chinese law. The border isn’t just geographic - it’s legal. Even Hong Kong’s approach is cautious. Only USD-pegged stablecoins are allowed. No altcoins. No DeFi. No NFTs. The goal isn’t to enable crypto freedom - it’s to keep Hong Kong relevant as a financial hub while staying aligned with Beijing’s broader strategy.What About Offshore Companies?

If you run a crypto exchange based in Singapore or the Cayman Islands, you might think you’re safe. You’re not. Chinese law now explicitly bans any offshore entity from marketing crypto services to Chinese citizens - even if the transaction happens outside China. If your website is in Chinese, accepts Chinese payment methods, or targets Chinese users, you’re violating the law. Authorities have shut down dozens of offshore platforms this year for “illegally soliciting clients in China.” There’s no licensing path. No gray zone. No legal way for an offshore company to legally serve the Chinese market with crypto services. Any attempt to do so risks being blocked, fined, or blacklisted by Chinese regulators.

What’s Next? No Reversal in Sight

Some people hoped China would soften its stance after the 2021 crackdown. Others thought the digital yuan would be a stepping stone to broader crypto acceptance. Neither happened. The 2025 ban was the endpoint of a seven-year strategy: eliminate private crypto, centralize digital finance, and replace it with state-controlled money. The government has no incentive to reverse course. Crypto is seen as a threat to financial stability, monetary policy, and social control. The digital yuan is now embedded in daily life - used for public transport, utility bills, and even school lunches. The infrastructure is built. The habits are forming. Why would China go back to a system it spent years destroying? The future of crypto in China isn’t about regulation. It’s about absence. The door is locked. The key was thrown away.What Should You Do If You’re in China?

If you’re living in or visiting China:- Don’t hold crypto. Even if you bought it before 2025, it’s not protected.

- Don’t use crypto apps. They’re blocked on Chinese networks.

- Don’t mine. Even small setups are detected through power usage patterns.

- Don’t try to trade through VPNs. Authorities monitor traffic patterns and can trace activity.

- Use the digital yuan if you need digital payments. It’s legal, safe, and widely accepted.

Why This Matters Beyond China

China’s move isn’t just about its own citizens. It’s a global signal. The world’s second-largest economy has chosen state control over decentralization. It’s showing other nations that you can ban crypto - and actually enforce it. Countries watching China’s success with the digital yuan are taking notes. The U.S., EU, and India are all exploring CBDCs - but none have gone as far as China in eliminating private alternatives. China proves you don’t need to negotiate with crypto. You can just remove it. This isn’t a temporary crackdown. It’s a new model. And it’s working - for the state.Is it illegal to own cryptocurrency in China?

Yes, owning cryptocurrency in China carries no legal protection. While the law doesn’t explicitly criminalize private possession, any transaction, transfer, or use of crypto is illegal. Financial institutions cannot handle crypto, courts won’t enforce crypto-related contracts, and authorities can seize holdings without compensation. Holding crypto is tolerated in practice only if you don’t trade or promote it - but you’re still at risk.

Can I mine Bitcoin in China?

No. All cryptocurrency mining operations are illegal in China as of 2025. The government shut down over 95% of mining facilities after the 2021 crackdown, and the 2025 ban made it a criminal offense to operate or support any mining activity. Power companies monitor usage spikes, and local authorities conduct raids. Even small-scale mining with a few GPUs can lead to fines or equipment seizure.

Can I use Binance or Coinbase in China?

No. All major international crypto exchanges, including Binance and Coinbase, have been blocked by China’s internet censorship system. Accessing them via VPN is technically possible but risky. Authorities track traffic patterns and have fined users for using crypto platforms. Even if you access an exchange from outside China, promoting or facilitating access to Chinese users violates the law.

Is the digital yuan the same as cryptocurrency?

No. The digital yuan (e-CNY) is a central bank digital currency (CBDC) issued and controlled by the People’s Bank of China. Unlike Bitcoin or Ethereum, it’s not decentralized, has no anonymity, and all transactions are tracked by the government. The digital yuan is designed to replace cash, not compete with crypto. China promotes it as the only legal digital money - everything else is banned.

What happens if I get caught trading crypto in China?

If you’re caught trading or holding crypto, you may face administrative penalties like fines or confiscation of assets. In cases involving large sums, repeated activity, or promotion of crypto services, you could be charged with illegal fundraising or financial fraud. Criminal charges are rare for individuals but possible. Foreigners can be detained or deported. Courts consistently rule against crypto claimants - because the activity itself is illegal under Chinese law.

Can I transfer crypto to someone in China?

No. Sending crypto to someone in China is considered facilitating an illegal financial transaction. Even if you’re outside China, if the recipient is in China and the transaction involves Chinese currency, payment methods, or communication channels, you’re violating the law. Authorities monitor cross-border digital payments and have prosecuted individuals for sending crypto to Chinese residents.

Are NFTs legal in China?

NFTs are not explicitly banned, but they’re heavily restricted. Chinese companies can issue NFTs only if they’re tied to physical goods or intellectual property - and they cannot be traded on open markets or linked to cryptocurrency. Platforms like Alibaba’s AliNFT and Tencent’s Tencent Arts allow NFTs for digital art or collectibles, but only as non-transferable digital certificates. Any NFT that functions like a crypto asset is blocked.

Will China ever legalize cryptocurrency again?

It’s extremely unlikely. The 2025 ban was the final step in a deliberate, multi-year strategy to eliminate private digital currencies and replace them with the state-controlled digital yuan. The government views crypto as a threat to financial control, monetary policy, and social stability. With over 500 million digital yuan users and deep infrastructure investment, reversing course would undermine everything China has built. There are no signs of policy change - only deeper enforcement.

Mike Stadelmayer

November 20, 2025 AT 15:06Norm Waldon

November 21, 2025 AT 20:06Khalil Nooh

November 22, 2025 AT 10:29jack leon

November 23, 2025 AT 17:27Chris G

November 24, 2025 AT 04:16Phil Taylor

November 25, 2025 AT 21:26diljit singh

November 26, 2025 AT 06:48Abhishek Anand

November 27, 2025 AT 14:49vinay kumar

November 27, 2025 AT 21:15Lara Ross

November 28, 2025 AT 20:42Leisa Mason

November 28, 2025 AT 22:09Tim Lynch

November 29, 2025 AT 05:42Melina Lane

November 30, 2025 AT 01:39andrew casey

December 1, 2025 AT 03:57Lani Manalansan

December 1, 2025 AT 09:09Frank Verhelst

December 2, 2025 AT 13:47Roshan Varghese

December 2, 2025 AT 18:18Dexter Guarujá

December 3, 2025 AT 18:22Jennifer Corley

December 5, 2025 AT 01:04Natalie Reichstein

December 5, 2025 AT 06:07Kaitlyn Boone

December 6, 2025 AT 06:19James Edwin

December 7, 2025 AT 07:20Kris Young

December 8, 2025 AT 14:40LaTanya Orr

December 9, 2025 AT 12:02