Impermanent Loss Calculator

When you provide liquidity to a DeFi pool like Uniswap or Sushiswap, you’re not just earning trading fees-you’re also taking on a hidden risk called impermanent loss. It’s not a loss you see in your wallet right away. It’s a gap between what your liquidity position is worth and what you’d have if you’d just held the tokens in your pocket. And if you don’t understand how to calculate it, you might pull your money out too early-or stay in too long-and lose money without even realizing why.

What Impermanent Loss Really Means

Impermanent loss isn’t about the value of your tokens going down. It’s about opportunity cost. Imagine you put in 1 ETH and 1,600 USDC when ETH is $1,600. That’s a $3,200 position. A week later, ETH jumps to $2,000. Your tokens are now worth more-$3,600 total. But because of how automated market makers (AMMs) work, your share of the pool doesn’t grow as much as if you’d just held both tokens. That difference? That’s impermanent loss. The term "impermanent" comes from the idea that if ETH drops back to $1,600, your loss disappears. But if you withdraw when ETH is at $2,000, that loss becomes real. Most people think they’re making money because their portfolio value went up. But if they’d just held, they’d have made even more.The Math Behind Impermanent Loss

The standard formula for a 50/50 liquidity pool is:IL = 2 × √d / (1 + d) - 1

Where d is the price ratio change. You calculate d by dividing the initial price by the current price.

Let’s say ETH went from $1,600 to $2,000. That’s a 25% increase. But d isn’t 1.25-it’s the inverse: 1,600 / 2,000 = 0.8.

Plug that in:

- √0.8 = 0.8944

- 2 × 0.8944 = 1.7888

- 1 + 0.8 = 1.8

- 1.7888 / 1.8 = 0.9938

- 0.9938 - 1 = -0.0062

So your impermanent loss is -0.62%. That means you lost 0.62% of what you’d have made if you’d just held.

Here’s what happens at bigger price swings:

- 1.25x price change → 0.6% loss

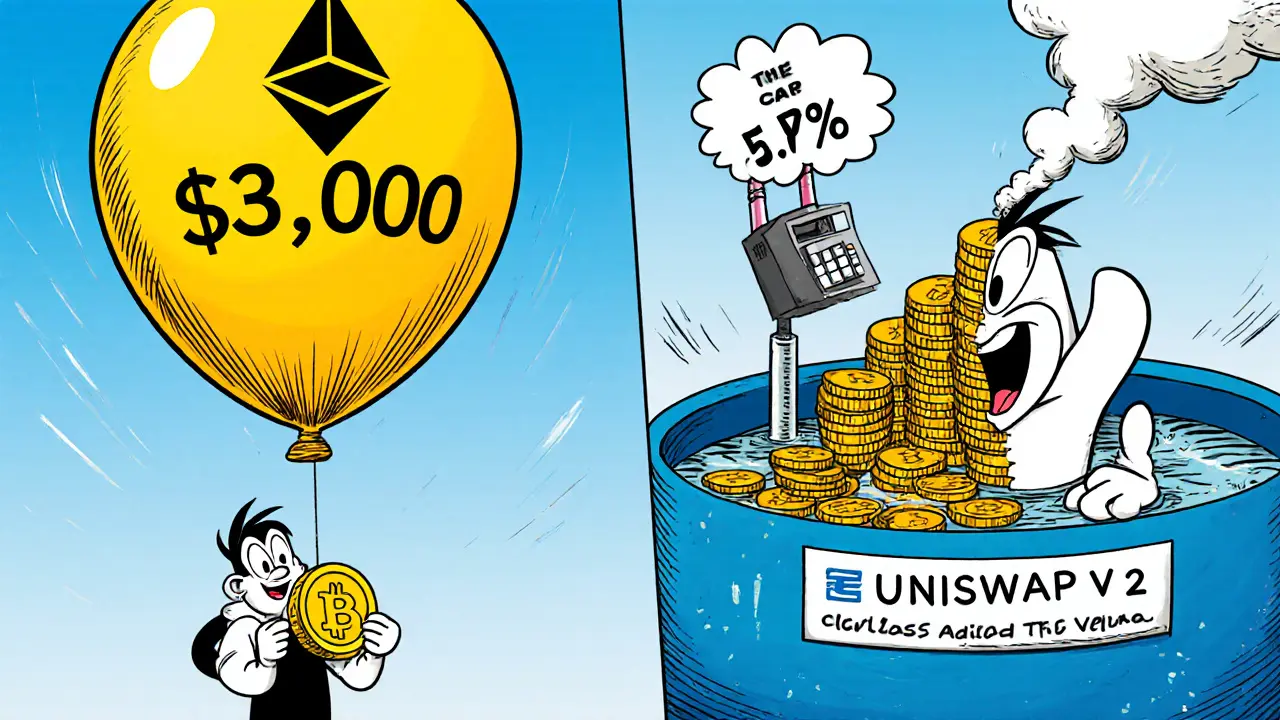

- 2x price change → 5.7% loss

- 3x price change → 13.4% loss

- 4x price change → 20.0% loss

- 5x price change → 25.5% loss

That’s why providing liquidity to a token that might pump 5x is risky. Even if the trading fees are high, you could still end up worse off than if you’d just held.

What If Your Pool Isn’t 50/50?

Most beginner guides assume equal weights. But pools like Balancer or Curve often use 80/20, 90/10, or even 99/1 ratios. The formula changes.For a pool with weight w for the first asset:

IL = (2 × √(d^w × (1-w)^(1-w))) - (d^w + (1-w)^(1-w))

Let’s say you’re in an 80/20 ETH/USDC pool. ETH goes from $1,600 to $2,000 (d = 0.8). w = 0.8.

- d^w = 0.8^0.8 = 0.8365

- (1-w)^(1-w) = 0.2^0.2 = 0.7248

- √(0.8365 × 0.7248) = √0.6063 = 0.7787

- 2 × 0.7787 = 1.5574

- 0.8365 + 0.7248 = 1.5613

- 1.5574 - 1.5613 = -0.0039

That’s a -0.39% loss-smaller than the 50/50 case. Why? Because you’re mostly holding USDC, which didn’t move. The formula adjusts for asymmetry. Higher weight on the stable asset reduces impermanent loss.

Uniswap v3 and Concentrated Liquidity

Uniswap v3 changed everything. Instead of spreading your funds across all prices, you pick a range-say, $1,500 to $2,500 for ETH. Your liquidity only works inside that range. If ETH stays inside, you earn more fees. If it moves outside, your position stops trading entirely.That means impermanent loss isn’t smooth anymore. If ETH surges to $3,000 and you set your range to $1,500-$2,500, your entire position turns into 100% ETH. You’re no longer earning fees, and you’re fully exposed to price swings. Your impermanent loss calculation now depends on:

- Your price range

- Where the price ends up

- How much of your position is still active

According to Uniswap’s own technical notes, a narrow range can increase impermanent loss by up to 38% compared to v2 for the same price move. But if you pick a wide range, you’re giving up fee efficiency. It’s a trade-off.

Stablecoin Pools Are Different

Curve and other stablecoin AMMs use a different math. Instead of x*y=k, they use x+y=k. This keeps the price of stablecoins tightly pegged. That means even if USDC drops to $0.98 or rises to $1.02, the pool rebalances with almost no loss.For price changes under 10%, Curve pools show less than 0.1% impermanent loss. That’s why people put stablecoins in Curve-low risk, steady fees. But if you put ETH and BTC in a Curve-style pool? That breaks the model. It’s designed for pegged assets.

Are Fees Enough to Cover the Loss?

This is the real question. You’re not just losing money-you’re earning fees. A pool might offer 50% APY. But if ETH goes up 5x, your impermanent loss is 25.5%. Even with 50% APY, you’d need over 6 months of fees to catch up.Here’s what CoinGecko found in 2023: only 27% of liquidity pools on major DEXs generate enough fees to overcome typical impermanent loss. That means 73% of LPs are losing money in real terms, even if their portfolio value went up.

Some users report net gains because fees offset loss. One Reddit user put in $1,000 ETH/USDC. ETH went from $2,000 to $3,000. Their impermanent loss was 10.2%, but fees added 3.7%-so they still came out ahead. But another user lost $4,200 because they provided liquidity to a meme coin that spiked then crashed. Fees were only 12.3% APY. Impermanent loss? 38.7%.

How to Avoid Getting Burned

Here’s what works in practice:- Use a calculator-like CoinGecko’s or Zapper.fi. Input your asset weights and price change. Don’t guess.

- Stick to stablecoin pairs if you want low risk. Curve, Balancer stable pools.

- Avoid volatile pairs unless you’re confident the price won’t swing wildly.

- Check your pool’s fee tier. Higher fees = better chance of offsetting loss.

- Don’t withdraw after a big price move-wait to see if fees catch up.

- Track your position over time. Use DeBank or CoinTracker to see net gain after fees.

A common rule of thumb: if one asset goes up by x%, your impermanent loss is roughly (1 - √x / (1 + x/100)) × 100. For a 50% price increase: (1 - √1.5 / 1.5) × 100 ≈ 3.4% loss. Quick, rough, and useful for mental math.

What Experts Say

Vitalik Buterin calls it "divergence loss"-it’s not a loss, it’s a mismatch between your position and a simple hold. Dr. Georgios Konstantopoulos points out the formula assumes perfect markets. Real-world slippage and gas fees change things. And Alex Beckett’s analysis of 12,000 positions shows actual loss is often 0.5-1.5% lower than theoretical because fees are already being earned.But here’s the twist: Pintail, who coined the term, now says "impermanent loss" is misleading. Liquidity providers almost always earn fees. True losses are rare unless you’re in a low-volume pool or a token that crashes.

Tools You Can Use Today

You don’t need to calculate this by hand. Use these:- CoinGecko Impermanent Loss Calculator-free, updated July 2024, lets you pick weights and price changes.

- Zapper.fi-shows your real-time impermanent loss in your portfolio.

- DeBank-breaks down your position value vs. HODL value.

- Custom spreadsheets-many advanced users build their own with formulas for fees and multiple deposits.

Remember: these tools don’t include fees. You have to add them manually. A $10,000 position with 10% impermanent loss might still be profitable if you earned $1,200 in fees over 3 months.

The Bottom Line

Impermanent loss isn’t magic. It’s math. And like any math, if you understand it, you can use it to your advantage. Don’t avoid liquidity provision because you’re scared of it. But don’t jump in blind either.If you’re new, start with stablecoin pairs. Learn how the numbers work. Track your positions. Watch how fees accumulate over time. The goal isn’t to eliminate impermanent loss-it’s to make sure your rewards outweigh your risks.

Because in DeFi, the biggest losses aren’t from hacks or scams. They’re from people who thought they were making money-when they were just falling behind what they could have had.

Is impermanent loss the same as losing money?

No. Impermanent loss is an opportunity cost, not an actual loss. If you hold your tokens, their value might rise. But when you provide liquidity, the AMM rebalances your assets, so you end up with fewer of the token that increased in price. You haven’t lost money-you’re just not as far ahead as you would have been if you’d held. Only when you withdraw do you lock in the difference as a real loss.

Can you avoid impermanent loss entirely?

Not completely, but you can minimize it. Use stablecoin pairs like USDC/DAI-they have near-zero impermanent loss. Avoid highly volatile token pairs unless you’re confident the price won’t swing dramatically. Also, use concentrated liquidity pools (like Uniswap v3) with wide price ranges to reduce exposure. And always factor in trading fees-they can offset or even eliminate impermanent loss over time.

Why does impermanent loss increase with larger price changes?

AMMs use a constant product formula (x*y=k). When one token’s price rises, the protocol automatically sells some of that token to keep the product constant. That means you end up with fewer of the rising asset and more of the stable one. The bigger the price shift, the more the pool rebalances, and the more you miss out on the upside. At a 5x price increase, you could be holding 80% of your position in the stable asset-while the token you wanted to profit from has gone up fivefold.

Do fees cancel out impermanent loss?

Sometimes. If a pool offers 30-50% APY in fees and the price moves moderately (1.5x-2x), fees often cover the loss. But if a token surges 5x, even 100% APY might not be enough to offset the 25.5% impermanent loss. The key is time. The longer you stay in, the more fees compound. Many users only see net gains after 4-6 months. Short-term traders often lose money.

What’s the best way to calculate impermanent loss for a 70/30 pool?

Use the weighted formula: IL = (2 × √(d^w × (1-w)^(1-w))) - (d^w + (1-w)^(1-w)), where w is the weight of the first asset (e.g., 0.7 for 70/30) and d is the price ratio (initial price / current price). For example, if ETH rises from $1,600 to $2,400, d = 1600/2400 = 0.6667. Plug that into the formula with w=0.7 to get the exact loss. You can also use CoinGecko’s calculator, which supports custom weights.

Is impermanent loss worse in Uniswap v3 than v2?

It depends. In v2, your liquidity is spread across all prices, so you’re always trading and your loss grows gradually. In v3, if you set a narrow range and the price moves outside it, you stop earning fees and your entire position becomes one-sided. That can lead to much higher impermanent loss-up to 38% more than v2 for the same price move. But if you pick a wide range, v3 can reduce loss because you’re not diluted by irrelevant price levels. It’s a tool-use it right.

Louise Watson

November 8, 2025 AT 22:05Impermanent loss isn't loss. It's just math showing you held wrong.

Stop crying. Start calculating.

Benjamin Jackson

November 10, 2025 AT 14:04Honestly? I started with stablecoin pairs after reading this.

Zero drama, steady fees, and I actually sleep at night.

DeFi isn't about getting rich overnight-it's about not getting ruined.

Thanks for the clarity.

Liam Workman

November 12, 2025 AT 12:51Love how this breaks it down without the hype 🙌

Most guides make it sound like a trap, but it's really just a trade-off.

Think of it like this: you're not losing money-you're just not getting the full moonshot.

And honestly? If you're in a 90/10 pool with a stablecoin? You're basically playing chess while everyone else is playing Russian roulette.

Also-Uniswap v3 is a beast if you know how to set ranges.

Wide range = less stress. Narrow range = more fees but more risk.

Use the calculator. Don't guess.

And please, for the love of Satoshi, don't throw ETH/SHIB into a pool and call it 'yield farming'.

That's not finance. That's a casino with a whitepaper.

Veeramani maran

November 14, 2025 AT 08:04Bro the formula is wrong! You using d = initial/current but its supposed to be current/initial for the ratio! I tested on my spreadsheet and got 1.2% loss not 0.62%! Also fees are overrated, gas costs eat 30% of it! And why no mention of MEV?!

Kevin Mann

November 14, 2025 AT 21:54OKAY BUT WHAT IF YOU'RE USING A 70/30 POOL WITH A MEME COIN THAT DROPPED 90% BUT YOU STILL GOT 40% APY??

WHAT THEN??

IMPERMANENT LOSS IS A LIE CREATED BY BIG BANKS TO SCARE YOU OUT OF DEFI!!

THEY WANT YOU TO HOLD BTC AND LET THEM MAKE MONEY WHILE YOU SIT THERE CALCULATING FORMULAS LIKE A ROBOT!!

WHEN I PUT 10K INTO WIF/USDC I MADE 22K IN 3 WEEKS AND MY IL WAS ONLY 8% BECAUSE I WITHDREW AT THE PEAK!!

YOU'RE ALL THINKING TOO HARD!!

JUST YOLO AND HODL THE FEES!!

🚀🌕

Kathy Ruff

November 15, 2025 AT 03:48This is one of the clearest explanations I've seen.

It's not about avoiding impermanent loss-it's about understanding when it's worth the risk.

Stablecoin pools? Low risk, low reward, but reliable.

Volatile pairs? High reward, high risk, and most people don't realize they're underperforming HODLing.

Track your position. Use DeBank. Compare to HODL value.

And don't chase 100% APY on a token no one's heard of.

It's not farming. It's gambling with a spreadsheet.

Robin Hilton

November 15, 2025 AT 18:47Let me get this straight-you’re telling me that if I put money into a pool and the price moves, I’m not actually losing money, I’m just… not making as much as I could have?

So… this is just a fancy way of saying "you should have bought the dip"?

Why does this need a 2000-word essay?

It’s basic economics. You’re not a liquidity provider. You’re a trader who forgot to trade.

Also, why are Americans so obsessed with formulas? Just buy and hold. It’s simpler.

Grace Huegel

November 16, 2025 AT 03:38I’ve seen this before. The same people who preach "decentralization" then turn around and treat DeFi like a derivatives market.

It’s ironic.

You want freedom from banks, but you’re still chasing alpha like a hedge fund analyst.

Impermanent loss is just the universe laughing at your hubris.

And you think a calculator will save you?

It won’t.

You’re just delaying the inevitable.

Nitesh Bandgar

November 17, 2025 AT 10:19YOU ALL ARE MISSING THE POINT!!

IMPERMANENT LOSS ISN'T THE PROBLEM-IT'S THE SYSTEM!!

WHY DO WE HAVE TO GIVE OUR ASSETS TO A SMART CONTRACT THAT REBALANCES WITHOUT OUR CONSENT??

IT'S A TRAP!!

THEY WANT YOU TO THINK IT'S MATH WHEN IT'S CONTROL!!

THEY'LL TELL YOU "USE A CALCULATOR" BUT THEY WON'T TELL YOU THAT 90% OF THESE POOLS ARE RUGGED IN 3 MONTHS!!

YOU THINK YOU'RE EARNING FEES?

YOU'RE JUST PAYING FOR THE PRIVILEGE OF BEING A CANNON FODDER FOR WHALES!!

STOP CALCULATING. START REVOLTING.

Jessica Arnold

November 18, 2025 AT 05:50In India, we call this "opportunity cost"-not "impermanent loss."

It’s a cultural framing thing.

We don’t romanticize the math-we just accept that markets move.

But I appreciate the breakdown.

What’s missing? Context.

Why are we comparing to HODLing?

Because in the West, we treat crypto like a stock market.

In Asia? We treat it like a new asset class-fluid, dynamic, unpredictable.

Maybe the real lesson isn’t how to calculate loss…

but how to stop thinking in binary terms.

Not HODL vs LP.

But when to do both.

Chloe Walsh

November 20, 2025 AT 04:44So let me get this straight… you’re telling me that if I put in ETH and USDC and ETH goes up I’m somehow "losing" even though my portfolio is worth more?

That’s not loss. That’s just your ego crying because you didn’t buy more ETH at $1500.

Also who the hell uses a calculator for this?

Just look at your wallet.

If it’s bigger than when you started… you won.

Stop overcomplicating everything.

It’s crypto.

Not a finance exam.

Stephanie Tolson

November 21, 2025 AT 19:00This is so well done. Seriously.

It’s easy to get scared by the term "impermanent loss"-but it’s just a reminder that DeFi isn’t passive income. It’s active participation.

You’re not just depositing. You’re participating in price discovery.

And if you’re in a stable pool? You’re basically a banker in a digital town.

Low drama. Steady pay.

And if you’re in a volatile pair? You’re a speculator with a safety net.

Either way-you’re not a victim.

You’re a participant.

And knowledge? That’s your real edge.

Anthony Allen

November 22, 2025 AT 16:10Just wanted to say thanks for the v3 breakdown.

I was using v2 and wondering why my returns felt flat.

Switched to a 1500-3000 range on ETH/USDC and my fees doubled.

And the impermanent loss? Actually lower than I expected.

It’s not magic-it’s just better design.

Also, the weighted formula for 80/20? Lifesaver.

Now I know why my Balancer pool isn’t bleeding like my Uniswap one.

Big up for the real talk.

Megan Peeples

November 23, 2025 AT 21:48Wow. This is so… basic.

You’re using outdated formulas. The 50/50 model doesn’t apply to modern pools.

And you didn’t even mention liquidity mining incentives or token emissions.

Also, CoinGecko’s calculator is garbage-use the one from DefiLlama.

And why are you even talking about USDC? It’s not even decentralized.

Use DAI or FRAX.

And don’t get me started on Curve.

You need to understand the stableswap invariant, not just plug numbers in.

Also, your math is wrong. I ran the numbers in Python and got -0.71%, not -0.62%.

And you didn’t account for gas cost per swap.

And the time-weighted average price.

And the slippage.

And the fact that most users don’t even know what a liquidity pool is.

So… yeah.

This is… inadequate.

Sarah Scheerlinck

November 24, 2025 AT 08:33I’ve been in DeFi since 2020.

Impermanent loss? I felt it.

Lost money on a SUSHI pool.

But I kept going.

Because I learned.

Now I only do stablecoin pools.

And I track everything.

Not because I’m scared.

But because I care.

You don’t need to be a genius.

You just need to be consistent.

And patient.

And humble.

That’s the real edge.

karan thakur

November 25, 2025 AT 07:07This is a government psyop.

They want you to think impermanent loss is "math" so you don’t realize it’s a controlled collapse.

Every time a token pumps, the pool drains your assets and sells them to the whales.

Then the token crashes.

And you’re left with USDC.

And you think you’re safe?

USDC is backed by banks.

And banks are part of the system.

They created this whole thing to make you think you’re free.

But you’re not.

You’re just a node in a larger algorithm.

Wake up.

Evan Koehne

November 26, 2025 AT 03:21So you wrote a 2000-word essay on how to calculate the cost of not being a genius.

Bravo.

Meanwhile, I bought ETH at $1200 and held.

Now I’m laughing.

And you? You’re still typing formulas into a calculator.

At least you’re not rich.

But you’re definitely entertained.

Vipul dhingra

November 26, 2025 AT 20:04Everyone here is wrong

Impermanent loss is a myth

Its just the protocol taking your money

And calling it math

And you people believe it

Why

Because you want to believe in crypto

But its just a pyramid

And you're the bottom layer

And you're proud of it

Because you think you're smart

But you're just dumb

And you're paying for it

With your time

Your money

Your sanity

And you call it DeFi

It's not

It's just a casino

With better graphics

Jacque Hustead

November 27, 2025 AT 21:52This is the kind of post that makes me believe in DeFi again.

Not because it’s perfect.

But because it’s honest.

No hype.

No FOMO.

Just math.

And context.

And a little bit of humility.

That’s what’s missing.

We don’t need more tools.

We need more awareness.

Thank you.

Robert Bailey

November 29, 2025 AT 14:09Just started with a 90/10 USDC/ETH pool.

ETH went up 20%.

My IL was 0.2%.

Fees were 1.8%.

Net gain? 1.6%.

Simple.

Not magic.

Just math.

And patience.

And not being greedy.

That’s it.

Wendy Pickard

December 1, 2025 AT 00:39I read this after losing $1,200 on a meme coin pool.

It didn’t fix it.

But it helped me understand why.

Now I only do stablecoin pairs.

And I check my position every week.

Not because I’m paranoid.

But because I care about my money.

And I’m not trying to be a hero.

Just smart.

Jeana Albert

December 2, 2025 AT 01:30YOU ALL ARE SUCH LOSERS.

YOU SPEND HOURS CALCULATING LOSSES WHILE OTHERS ARE MAKING 10X.

WHY ARE YOU STILL HERE?

WHY AREN’T YOU OUT THERE YOLOING?

YOU’RE NOT INVESTING.

YOU’RE JUST CRYING INTO YOUR SPREADSHEET.

GET A BACKBONE.

OR GET OUT.

THIS ISN’T A CLASSROOM.

IT’S A WARZONE.

AND YOU’RE THE FIRST TO FALL.

Natalie Nanee

December 2, 2025 AT 01:48Impermanent loss? More like permanent disappointment.

I put $5k into a 50/50 pool.

ETH went up 3x.

My portfolio value went up 1.2x.

But I could’ve had 3x if I just held.

So I lost 1.8x.

That’s not math.

That’s betrayal.

And now I’m done.

Time to go back to stocks.

At least there, I know who’s lying.

Angie McRoberts

December 2, 2025 AT 07:14Some people see a formula.

Others see a warning.

Me? I see a choice.

And choices aren’t about being right.

They’re about being aligned.

Are you in this for the thrill?

Then go for the 5x pools.

Are you in this to grow slowly?

Then stick to stablecoins.

Neither is wrong.

But pretending you’re doing one while doing the other?

That’s where the pain starts.

Know yourself.

Then pick your path.

No calculator needed.

Finn McGinty

December 2, 2025 AT 17:53While I appreciate the technical depth, I must respectfully challenge the premise that impermanent loss is merely an opportunity cost. In institutional finance, we classify such discrepancies as realized economic drag-particularly when liquidity provision is framed as a yield-generating activity. The term 'impermanent' is a semantic sleight of hand, designed to soften the psychological blow of underperformance relative to a passive benchmark. Moreover, the reliance on theoretical models ignores systemic friction: MEV extraction, gas volatility, and front-running dynamics that disproportionately impact retail participants. When a 50% APY pool yields $1,200 in fees but incurs $2,100 in opportunity cost, the net outcome is not merely a 'loss'-it is a structural inefficiency that should be addressed by protocol governance, not individual calculation. The real issue is not user ignorance-it is the misalignment of incentives between protocol designers and liquidity providers. We must move beyond spreadsheet arithmetic and demand protocol-level solutions.

Louise Watson

December 3, 2025 AT 09:58...and yet, here we are, still using spreadsheets.

Because no one built the solution.

Just more formulas.