Iran Bitcoin Mining Calculator

How Iran's Mining Works

Iran uses surplus electricity to mine Bitcoin, converting it to stablecoins to bypass sanctions. This calculator shows how much Bitcoin is generated from electricity consumption.

Iran controls 5% of global Bitcoin mining (2025 estimate). 175 MW mining farms run on state-subsidized power. $4.18B in crypto left Iran in 2024.

Calculate Your Bitcoin Mining Output

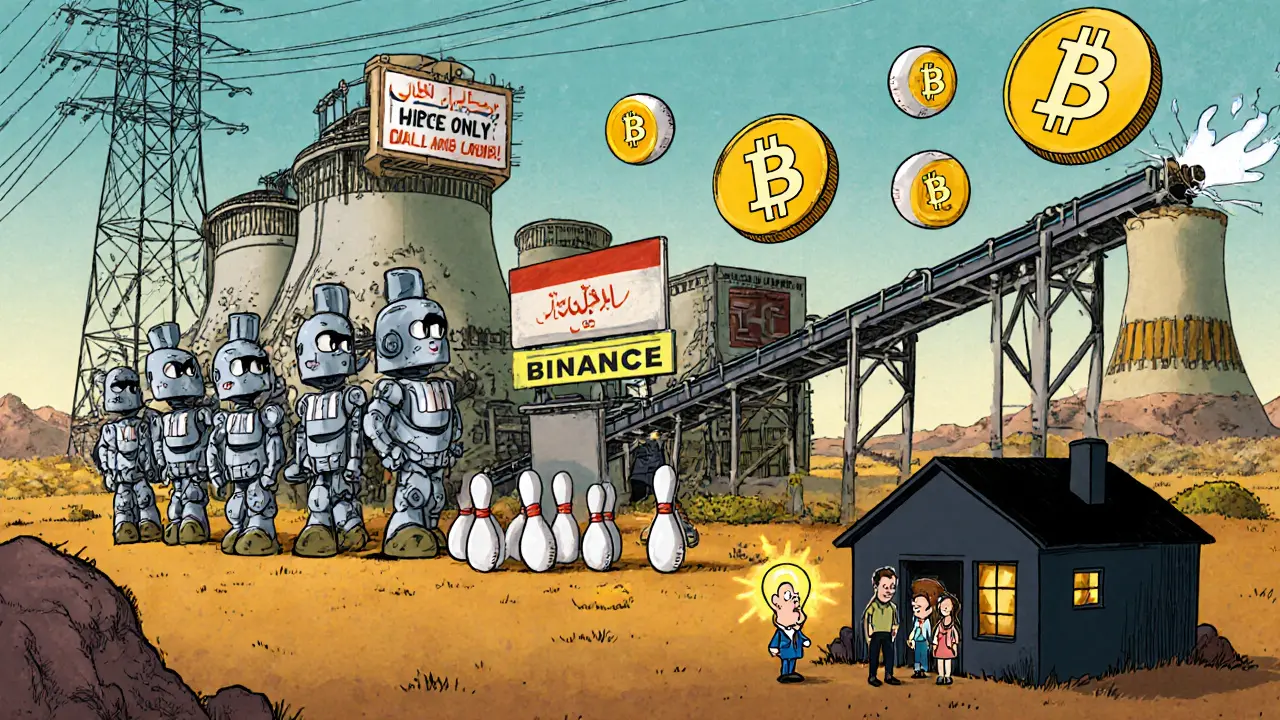

By 2025, Iran is mining nearly 5% of all Bitcoin on the planet-not because it’s the cheapest place to do it, but because it has to. When Western banks cut Iran off from the global financial system after the U.S. pulled out of the nuclear deal in 2018, the country didn’t just scramble for cash. It built a digital underground economy powered by electricity, hardware, and Bitcoin.

How Bitcoin Mining Became Iran’s Financial Workaround

Iran doesn’t have easy access to dollars, euros, or SWIFT payments. Its banks can’t process international transfers. Its oil can’t be sold through normal channels. So it turned to something the sanctions couldn’t touch: Bitcoin mining. The math is simple. Iran has cheap power-some of the cheapest in the world-thanks to massive natural gas reserves and state-subsidized electricity. It has the technical know-how. And it has a government willing to ignore energy shortages to keep the machines running. Miners plug in their ASIC rigs, burn through electricity, and generate Bitcoin. That Bitcoin gets sold on exchanges, converted to stablecoins, and used to buy everything from medicine to machinery. By 2024, over $4.18 billion in cryptocurrency had left Iran. That’s a 70% jump from the year before. And it’s not just small-time operators. The Islamic Revolutionary Guard Corps (IRGC) runs massive mining farms-some as big as 175 megawatts-on military land, with direct power lines and no bills to pay. These aren’t hobbyists. They’re state-backed industrial operations designed to move value across borders without banks.How It Works: From Power Plant to Wallet

Here’s how it actually works on the ground:- Iranian power plants-mostly gas-fired-produce more electricity than the country needs for homes and factories.

- Instead of wasting it, the government redirects surplus power to licensed mining zones in Kerman, Bushehr, and Khuzestan.

- Chinese-made ASIC miners, smuggled in through Turkey and the UAE, run 24/7, hashing Bitcoin nonstop.

- Bitcoin rewards are sent to wallets controlled by state-linked entities or IRGC-affiliated firms.

- Those Bitcoin are then moved through exchanges like Binance, converted to USDT or TRX, and used to pay for imports.

Why Iran’s Model Is Different From Venezuela or North Korea

Other sanctioned countries tried crypto. Venezuela launched the Petro, a government token no one trusted. North Korea stole crypto through hacks. Iran did neither. It didn’t invent a new coin. It didn’t steal from others. It mined Bitcoin the same way anyone else does-just with state support and zero electricity costs. That’s the key difference. Iran’s approach is scalable, sustainable, and technically compliant with Bitcoin’s rules. It doesn’t break the blockchain-it exploits the system’s design. Bitcoin doesn’t care where the power comes from. It doesn’t ask who owns the miner. As long as the hardware runs and the network validates the blocks, the Bitcoin gets created. This made Iran the world’s most effective sanctions-circumvention model. Russia started doing something similar after 2022, but Iran had a seven-year head start. It built licensing systems, trained technicians, created domestic exchanges, and embedded crypto into its economic infrastructure. It didn’t just adapt-it institutionalized it.The Hidden Costs: Blackouts, Inequality, and Global Risk

But this strategy isn’t free. It’s paid for by Iranian citizens. The electricity used by Bitcoin miners in Iran equals the output of 10 million barrels of oil per year. That’s roughly 4% of Iran’s total oil exports. And it’s not just lost revenue-it’s lost power. Cities like Tehran and Isfahan suffer rolling blackouts while mining farms in Rafsanjan run at full capacity. Hospitals struggle. Factories shut down. Families pay higher prices for basic goods because the grid can’t keep up. The benefits don’t trickle down. The miners making millions aren’t ordinary Iranians. They’re connected to the IRGC, religious foundations like Astan Quds Razavi, or government elites. Regular citizens can’t get licenses. They can’t access subsidized power. They can’t even buy mining rigs without paying black-market prices. And globally, the ripple effects are growing. Blockchain analysts from Elliptic and Chainalysis confirm that 4.5% of Bitcoin’s total hash rate comes from Iran. That means every Bitcoin transaction-whether it’s a coffee purchase in Berlin or a stock trade in New York-has a 1 in 22 chance of being validated by Iranian hardware. Financial institutions are now forced to track where Bitcoin comes from, not just who sends it. Some exchanges have started blocking Iranian IPs. Others ignore it, fearing they’ll break Bitcoin’s core principle: neutrality.

Can Sanctions Stop It?

The U.S. Treasury and EU regulators have tried. They’ve sanctioned Iranian mining firms. They’ve pressured exchanges to cut off Iranian wallets. They’ve issued advisories warning banks about crypto flows tied to Tehran. But it’s like trying to shut off a river with a sieve. Bitcoin mining doesn’t need a bank. It doesn’t need a passport. It doesn’t need a physical shipment. It just needs electricity and internet. And Iran has both-especially in remote areas where monitoring is weak. Even when a mining farm gets shut down, another one pops up. The hardware is modular. The software is open-source. The miners are decentralized. The only way to truly stop it would be to cut Iran’s entire power grid-which would cause a humanitarian crisis, not just a financial one. So instead, the West is left with a hard choice: tolerate crypto mining as a side effect of sanctions, or risk alienating the global Bitcoin community by trying to censor the network.What Comes Next?

Iran isn’t slowing down. In 2025, it’s expanding mining into new provinces and building its own domestic crypto exchanges to reduce reliance on foreign platforms. It’s also exploring stablecoin systems and blockchain-based trade agreements with Russia, China, and Turkey. Meanwhile, Bitcoin’s mining difficulty keeps rising. Energy-efficient hardware is getting cheaper everywhere. Iran’s advantage-cheap power-isn’t as unique as it once was. But its willpower is. As long as sanctions stay, Iran will keep mining. The bigger question isn’t whether Iran can keep doing it. It’s whether the rest of the world can afford to let it.Bitcoin was meant to be decentralized. But when a state uses it to bypass sanctions, it becomes something else: a tool of geopolitical power. And that changes everything.

dhirendra pratap singh

November 12, 2025 AT 14:20Ashley Mona

November 13, 2025 AT 18:55Edward Phuakwatana

November 15, 2025 AT 00:18Suhail Kashmiri

November 16, 2025 AT 06:44Kristin LeGard

November 17, 2025 AT 22:14Arthur Coddington

November 19, 2025 AT 04:55Stephanie Platis

November 20, 2025 AT 08:34Michelle Elizabeth

November 21, 2025 AT 23:37Joy Whitenburg

November 23, 2025 AT 16:49Raymond Day

November 25, 2025 AT 04:27Noriko Yashiro

November 25, 2025 AT 14:23Atheeth Akash

November 27, 2025 AT 12:10James Ragin

November 27, 2025 AT 13:23David Billesbach

November 29, 2025 AT 01:49Andy Purvis

November 29, 2025 AT 02:06Ruby Gilmartin

November 30, 2025 AT 22:52Douglas Tofoli

December 1, 2025 AT 08:59William Moylan

December 1, 2025 AT 15:31Michael Faggard

December 3, 2025 AT 08:29Elizabeth Stavitzke

December 4, 2025 AT 14:02Ainsley Ross

December 5, 2025 AT 22:31Brian Gillespie

December 6, 2025 AT 01:06Wayne Dave Arceo

December 6, 2025 AT 08:36Edward Phuakwatana

December 8, 2025 AT 00:35