Glide Finance Fee Calculator

Fee Breakdown

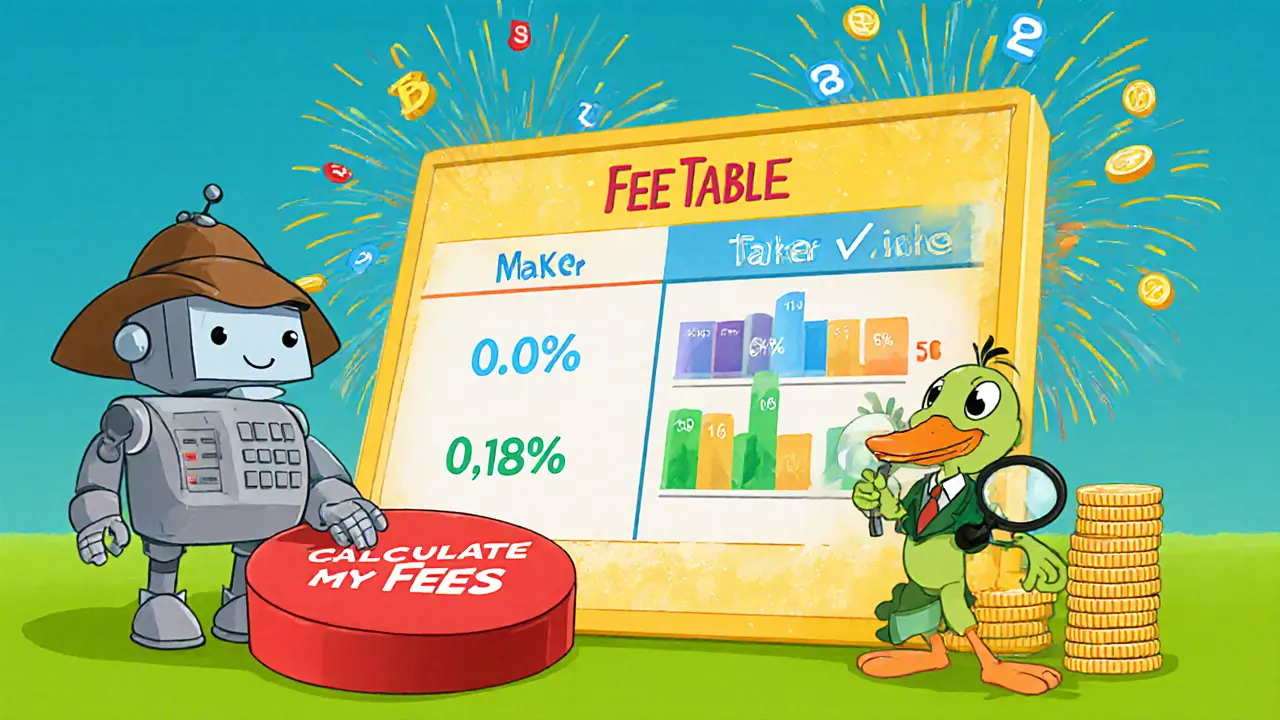

Glide Finance Fee Structure

Glide Finance uses a tiered maker-taker fee model. Your actual fee depends on your monthly trading volume:

| Role | Volume Range | Fee Rate |

|---|---|---|

| Maker | < $50k | 0.08% |

| Maker | $50k-$500k | 0.06% |

| Maker | > $500k | 0.04% |

| Taker | < $50k | 0.12% |

| Taker | $50k-$500k | 0.10% |

| Taker | > $500k | 0.08% |

* Fees are subject to change. This calculator provides estimates based on current rates.

When you hear the name Glide Finance is a relatively new crypto exchange that launched in early 2024, targeting both retail traders and institutional users with a blend of low‑fee spot trading and integrated DeFi services. While it hasn’t yet hit the headlines like the big players, its promise of sub‑0.1% fees, instant fiat on‑ramps, and a mobile‑first design makes it worth a closer look. This Glide Finance crypto exchange review breaks down what the platform actually offers, where it shines, and where it still has work to do.

Key Takeaways

- Supports 150+ cryptocurrencies, including major coins like Bitcoin and Ethereum.

- Tiered maker‑taker fee model starts at 0.08% for makers and 0.12% for takers.

- Security stack includes cold‑storage for 98% of assets, two‑factor authentication, and SOC‑2 compliance.

- Onboarding is streamlined: email verification, KYC via ID scan, and optional facial recognition.

- Compared to peers like OKEx and Best Wallet, Glide offers lower fees but fewer advanced order types.

What Is Glide Finance?

Glide Finance positions itself as a “one‑stop shop” for crypto trading and decentralized finance (DeFi) participation. The platform runs on a proprietary matching engine built in Rust, promising sub‑millisecond latency for spot orders. Its product suite includes:

- Spot trading for a wide range of tokens.

- Liquidity‑mining pools that let users earn yields on stablecoins.

- Integrated staking for select Proof‑of‑Stake assets.

- A mobile app (iOS/Android) with push‑notifications for price alerts.

All services are accessed through a unified account, so you don’t need separate wallets for DeFi participation.

Supported Assets and Trading Tools

Glide lists over 150 trading pairs, covering the top 20 market‑cap coins and a selection of emerging tokens. Notable features include:

- Limit, market, and stop‑limit orders.

- Real‑time order‑book depth charts.

- Basic charting with indicators like EMA, RSI, and Bollinger Bands.

- API access for algorithmic traders (REST+WebSocket).

The exchange also offers a “Quick Swap” button that executes trades at the best available price across its internal liquidity and partnered DEX aggregators, cutting down slippage for smaller orders.

Fee Structure and Limits

Glide Finance adopts a maker‑taker model that rewards liquidity providers. The current schedule (as of Oct2025) looks like this:

| Role | Monthly Volume (USD) | Fee (%) |

|---|---|---|

| Maker | < $50k | 0.08 |

| Maker | $50k‑$500k | 0.06 |

| Maker | > $500k | 0.04 |

| Taker | < $50k | 0.12 |

| Taker | $50k‑$500k | 0.10 |

| Taker | > $500k | 0.08 |

Deposits are free for most fiat gateways (USD, EUR, CAD). Withdrawal fees vary by blockchain; for example, Bitcoin withdrawals cost 0.0005BTC, while Ethereum withdrawals are $5‑plus gas.

Security, Compliance, and Insurance

Security is a top priority for Glide Finance. Here’s the breakdown:

- Cold storage: 98% of user funds are stored offline in geographically distributed vaults.

- Two‑factor authentication (2FA): Google Authenticator or hardware keys (YubiKey) are mandatory for withdrawals above $1,000.

- Regulatory compliance: The platform follows AML/KYC standards aligned with FATF guidance and holds a Money Service Business (MSB) license in Estonia.

- Insurance: A third‑party insurer covers up to $20million against custodial breaches.

- Bug bounty: Active program paying up to $50,000 for critical vulnerabilities.

Independent audits were performed in Q22025 by CertiK, confirming the integrity of the smart‑contract staking modules.

User Experience - What It Feels Like to Trade

The web UI follows a clean, dark‑mode default with a side navigation pane. New users are guided through a three‑step onboarding wizard: email verification → identity upload → facial scan (optional). The mobile app mirrors the desktop experience, offering fingerprint or Face ID login. Customer support operates 24/7 via live chat and a ticket system; response times average 4minutes for live chat.

One common complaint in community forums is the lack of advanced order types (e.g., trailing stops, iceberg orders) that power traders expect from platforms like OKEx. However, Glide’s “Quick Swap” feature compensates for casual traders who just want instant execution.

Glide Finance vs. Competitors

| Feature | Glide Finance | OKEx | Best Wallet |

|---|---|---|---|

| Supported Coins | 150+ | 180+ | 1,000+ |

| Lowest Spot Fee | 0.04% (maker) | 0.08% (maker) | 0.10% (flat) |

| Leverage | Up to 5× | Up to 100× | None |

| Mobile App | iOS/Android | iOS/Android | iOS/Android |

| DeFi Integration | Staking & liquidity pools | Limited (only token swaps) | None |

| Insurance | $20M coverage | $10M coverage | None |

| Regulatory License | Estonia MSB | Malta & UK licences | None (unregulated) |

In a nutshell, Glide excels at low fees and built‑in DeFi, while OKEx offers deep liquidity and high leverage. Best Wallet shines for sheer token variety but lacks advanced trading tools.

Pros and Cons

- Pros:

- Very competitive fee structure.

- Strong security with insurance.

- Integrated staking and liquidity pools.

- User‑friendly mobile experience.

- Cons:

- Limited advanced order types.

- Leverage caps at 5×, not suitable for high‑risk traders.

- Relatively new, so community size is smaller.

How to Get Started on Glide Finance

- Visit the official website and click “Sign Up”.

- Enter your email, create a strong password, and confirm the verification link.

- Complete KYC: upload a government‑issued ID and a selfie. The verification usually finishes within 15minutes.

- Enable 2FA in the security settings.

- Deposit fiat (USD, EUR, or CAD) via bank transfer or credit card. Instant credit‑card deposits have a 1.5% surcharge.

- Navigate to the “Spot Market” tab, select your trading pair (e.g., BTC/USDT), and place a limit or market order.

- If you want to earn passive income, go to the “DeFi” section, choose a liquidity pool, and stake your assets.

All actions are logged in your account activity feed, making it easy to audit your trades and withdrawals.

Frequently Asked Questions

Is Glide Finance regulated?

Yes. Glide holds an MSB license in Estonia and complies with FATF‑recommended AML/KYC procedures.

What are the withdrawal limits?

Daily fiat withdrawals are capped at $25,000 for verified accounts. Crypto withdrawals follow blockchain‑specific minimums, e.g., 0.001BTC per transaction.

Can I trade on margin?

Glide offers margin trading up to 5× for select major pairs. Higher leverage is not available.

Is there a loyalty program?

Yes. Users who hold the native GLD token receive fee discounts of up to 20% and early access to new DeFi pools.

How does Glide's insurance work?

A third‑party insurer covers loss of custodial assets up to $20million. The coverage applies only to hot‑wallet breaches; cold‑storage is considered secure by design.

katie littlewood

August 18, 2025 AT 10:57Glide Finance feels like the fresh breeze that sweeps through a market often clogged with legacy fees, and I must say the tiered maker‑taker model is a delightful surprise for anyone who has ever winced at a 0.2% charge.

First, the 0.08% maker fee for sub‑$50k volume already undercuts many older exchanges, which still cling to a 0.15% baseline.

Second, once you cross the $500k threshold, the fee gracefully slides down to a mere 0.04% for makers, making high‑volume traders giddy with the prospect of saving thousands over a year.

Third, the taker side, while a tad higher at 0.12% for newcomers, still feels generous compared to the 0.25%‑plus structures seen elsewhere.

Moreover, the platform’s commitment to cold‑storage, with 98% of assets offline, paints a reassuring picture of security that many newer platforms neglect.

Adding to the allure, the $20 million insurance policy offers a safety net that speaks directly to risk‑averse users yearning for peace of mind.

The integrated staking and liquidity pool options transform Glide from a mere exchange into a modest one‑stop‑shop for passive income, a feature that resonates with the growing DeFi crowd.

Even the mobile app shines with its intuitive dark‑mode UI, making quick swaps feel as effortless as ordering a coffee.

That said, the lack of advanced order types like trailing stops or iceberg orders does leave power‑traders slightly desiring more depth, a gap that could be filled in future updates.

Additionally, the 5× leverage cap, while prudent, might deter those chasing high‑risk, high‑reward strategies.

Community size is still modest, but the engaged Telegram groups often buzz with helpful tips and friendly banter, fostering a welcoming environment for newcomers.

On the compliance front, the Estonian MSB license signals a serious regulatory stance, aligning Glide with FATF AML/KYC standards and adding a layer of legitimacy.

The fee calculator embedded on the site provides an immediate sense of transparency, letting users preview their monthly costs before committing capital.

In comparison charts, Glide’s sub‑0.1% fees consistently outshine OKEx and Best Wallet, especially when you factor in the added DeFi utilities.

Overall, Glide Finance portrays itself as a well‑rounded, fee‑friendly contender that balances security, usability, and emerging DeFi features, albeit with room to grow in advanced trading tools.

Parker Dixon

August 30, 2025 AT 18:16Totally agree with the vibe here! 🎉 Glide’s low‑fee structure really helps keep more of the gains in our pockets, and the mobile experience is slick.

Security-wise, the cold‑storage and insurance give a solid hug of confidence, especially for those of us a bit jittery about hacks.

Hope they add those advanced order types soon – it would make the platform even more versatile.

Bobby Ferew

September 12, 2025 AT 01:35The liquidity‑mining modules are built on a composable smart‑contract framework employing ERC‑20 token wrappers, which effectively reduces gas overhead during yield accrual cycles.

From a risk‑adjusted perspective, the native GLD token utility aligns stakeholder incentives via fee rebates, thereby enhancing the protocol’s tokenomics equilibrium.

Oreoluwa Towoju

September 24, 2025 AT 08:53Glide’s insurance is a nice safety net, but the community could still use more educational resources.

Jason Brittin

October 6, 2025 AT 16:12True that, the insurance does feel comforting – like a cozy blanket on a cold night. 😎

Still, a few tutorials on staking would go a long way for newbies.

Amie Wilensky

October 18, 2025 AT 23:30Well-here’s the thing-Glide’s UI, while clean, occasionally suffers from latency spikes during peak volume periods; moreover, the order‑book depth charts could benefit from enhanced granularity, particularly for low‑liquidity pairs; additionally, the onboarding wizard, though helpful, might overwhelm users with too many verification steps at once.

MD Razu

October 31, 2025 AT 05:49Addressing the UI latency you mentioned, it appears the underlying Rust‑based matching engine, despite its design for sub‑millisecond execution, may be throttled by the current AWS instance scaling policy, which could be rectified by adopting a more aggressive auto‑scaling group and incorporating a Redis‑based order cache to mitigate read‑write contention during flash‑crash events.

Furthermore, the depth chart granularity you desire could be achieved by integrating a WebSocket‑driven depth aggregation layer, allowing real‑time tick updates without overwhelming the client’s rendering pipeline.

Finally, streamlining the KYC flow with a progressive disclosure pattern would reduce cognitive load, presenting only essential fields initially and expanding as needed, thereby improving user conversion rates.

Charles Banks Jr.

November 12, 2025 AT 13:07Sure, Glide’s got the basics down, but let’s be real – without trailing stops, it feels stuck in the early‑2020s.

Lindsay Miller

November 24, 2025 AT 20:26When we think about the trade‑off between simplicity and sophistication, Glide reminds us that a platform can be both welcoming to beginners and still hold depth for those willing to explore.

Katrinka Scribner

December 7, 2025 AT 03:45i think thats really nice :) i woud love to try the staking thing bc it sounds fun nd easy

VICKIE MALBRUE

December 19, 2025 AT 11:03Glide is a solid choice for new traders.

Naomi Snelling

December 31, 2025 AT 18:22Everyone talks about Glide’s insurance like it’s a blanket, but have you considered that the insurer might be backed by offshore entities with murky ties? 😑

Regulatory oversight varies wildly, and the MSB license in Estonia, while technically legit, could be a soft spot if European authorities tighten crypto rules.

Just saying, keep an eye on the fine print before you stash millions.

Billy Krzemien

January 13, 2026 AT 01:40Great insights overall! For anyone starting out, remember to enable 2FA and keep your recovery phrases offline – those little habits can save a lot of headaches later.

april harper

January 25, 2026 AT 08:59Another platform promising the moon, yet delivering a modest staircase. The fees are low, but the excitement fizzles when you hit the leverage ceiling – truly a tepid performance.

Somesh Nikam

February 6, 2026 AT 16:17Hey folks! 😊 If you’re curious about the staking rewards, start small and watch the APY roll in – it’s a gentle way to get comfortable with the DeFi side of Glide.