GIBXChange Risk Assessment Tool

Risk Assessment

Key Risk Factors

- Regulatory Status Unregulated

- Withdrawal Processing Time 7+ days

- Insurance Coverage None

- Account Verification Issues reported

When you're looking for a crypto exchange that also lets you trade forex, indices, and commodities all in one place, GIBXChange sounds like a dream. It promises access to over 290 cryptocurrencies, integrates MetaTrader 5, offers AI-powered trading tools, and even has staking rewards. But here’s the catch: no one knows who’s actually watching over your money.

What GIBXChange Claims to Be

GIBXChange positions itself as a global trading hub built for serious traders. It says it was launched in August 2021 by financial professionals with experience in forex and digital assets. The platform combines traditional forex trading with crypto markets using the MT5 system - something very few exchanges do. You can trade BTC, ETH, LTC, and dozens of other coins across multiple quote pairs: QC, USDT, BTC, and ETH. That’s more than 300 trading pairs, which puts it in the same league as bigger names like Binance or Kraken.

It also touts features most retail traders don’t see elsewhere: grid trading bots, AI-driven arbitrage systems, and DeFi integration built into the backend. For someone who already uses MT5 for forex, switching to GIBXChange feels familiar. The interface, order types, and charting tools mirror what you’d find on a professional forex broker. That’s a big plus if you’re experienced.

The Big Red Flag: No Real Regulation

Here’s where things fall apart. GIBXChange claims to be compliant with the FCA, ASIC, and NFA. But if you dig deeper - and independent watchdogs like WikiFX and Forex Wikibit have - there’s zero public proof. No license numbers. No regulatory filings. No official pages on any of those agencies’ websites.

That’s not a minor oversight. It’s a dealbreaker. When you deposit $100 or $10,000 into an exchange, you’re trusting them with your life savings. Regulated platforms like eToro or Coinbase are required to keep client funds separate, undergo audits, and follow strict security rules. GIBXChange doesn’t have to do any of that. It’s operating in a legal gray zone, likely based in the U.S. but serving users worldwide without any official oversight.

Forex Wikibit put it bluntly: “Approach with caution! The platform offers a variety of trading instruments and uses MT5, which is great. But don’t forget that this broker is unregulated. Take care!” That’s not just a warning - it’s a red flare.

Trading Features and Performance

On the technical side, GIBXChange delivers. The platform uses what it calls a “seventh-generation transaction engine” with reported order success rates of up to 96%. That’s solid - better than many regulated brokers. Spreads are tight: 0.3 pips on major forex pairs, 1.0 pip on minors, and 2.0 on exotics. Crypto trading has no fixed fees, just spreads, which is good for high-frequency traders.

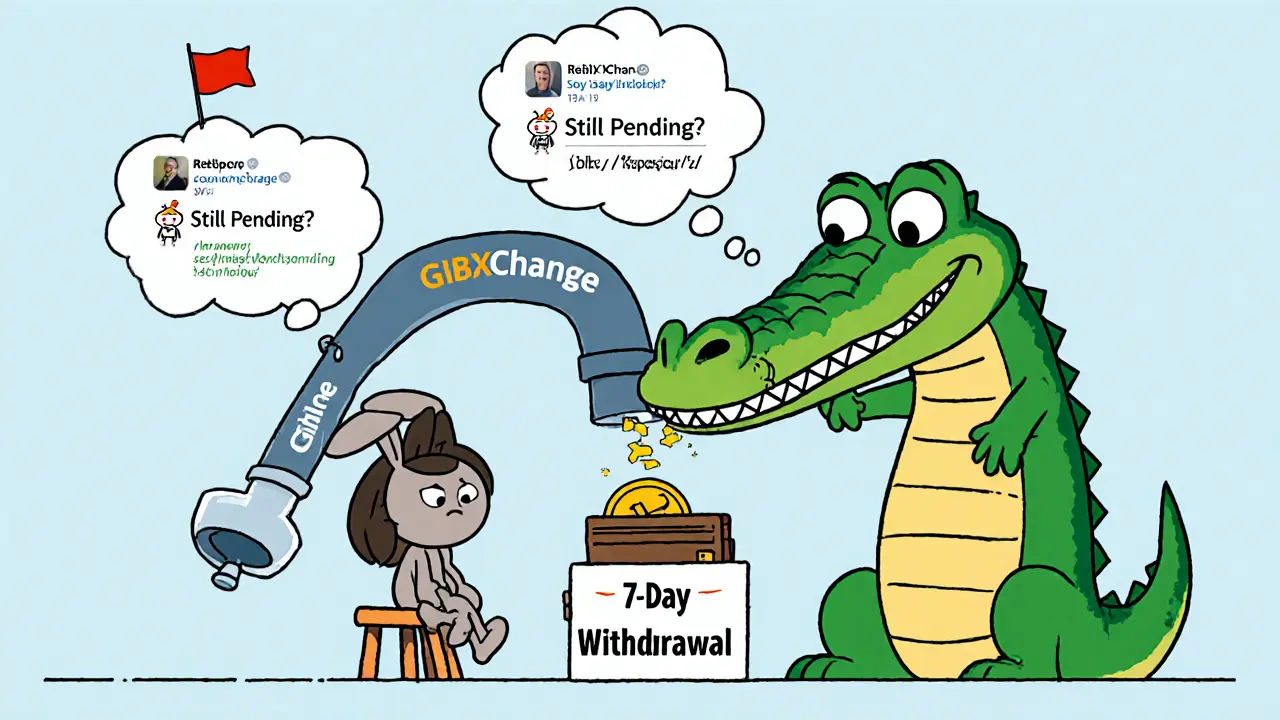

The mobile apps (Android and iOS) work well. The web platform is responsive. Deposits and withdrawals are processed quickly - if they go through. Users report deposits hitting their accounts within minutes. But withdrawals? That’s where the stories turn sour. Multiple Reddit users from r/Forex in early 2025 described delays of 7+ business days. Some said they had to chase support for weeks. One user wrote: “I sent a withdrawal request on Monday. It’s Friday. Still pending. No explanation.”

Customer support is available 24/7 via live chat and email. Live chat responses average 14 minutes. Email? Around 2 hours and 17 minutes. That’s not terrible for an unregulated platform, but it’s not the kind of service you want when your funds are stuck.

Security: What’s Actually in Place?

GIBXChange says it uses cold storage for most funds, multi-factor authentication (SMS and Google Authenticator), and remote login alerts. That’s standard stuff. But without third-party audits or proof of wallet ownership, you’re taking their word for it. There’s no public proof of reserve ratios. No transparency reports. No insurance fund disclosures.

Compare that to Coinbase, which publicly publishes its proof-of-reserves every quarter. Or Kraken, which has been audited by independent firms for years. GIBXChange doesn’t even pretend to offer that level of accountability. If something goes wrong - a hack, a server crash, a sudden shutdown - you have no legal recourse.

Who Is This Platform Actually For?

GIBXChange isn’t for beginners. The platform is packed with advanced tools: AI trading bots, grid systems, leverage up to 1:100. If you don’t know what a stop-loss is, or how to read a candlestick chart, you’ll get crushed.

It’s also not for users in Europe, Canada, Australia, or the U.S. - at least not safely. Regulators in those regions actively warn against using unlicensed platforms. Even if you can sign up, you’re putting yourself at risk of losing funds with no way to recover them.

So who might consider it? Traders in countries with weak or non-existent crypto regulations. People who prioritize trading tools over safety. Those who’ve already lost money on regulated platforms and are chasing higher leverage or lower fees. But even then, the risks outweigh the rewards.

How It Stacks Up Against the Competition

Let’s be clear: GIBXChange is not in the same league as Binance, Coinbase, or Kraken. Those platforms have billions in assets under management, public audits, insurance policies, and regulatory licenses. GIBXChange has none of that.

It’s more like a shadow broker - flashy tech, deep features, but no safety net. It’s competing with regulated firms on features while ignoring the one thing that matters most: trust.

If you want a crypto exchange that’s safe, reliable, and regulated, stick with the big names. If you want to experiment with advanced MT5-based trading and don’t mind gambling with your funds, then GIBXChange might tempt you. But know this: you’re not just trading crypto. You’re betting on the platform’s survival.

The Verdict: Don’t Trust the Hype

GIBXChange is a technical marvel with a dangerous blind spot: it has no accountability. It offers features you won’t find elsewhere. It’s fast, flexible, and packed with tools. But without regulation, those features mean nothing if you can’t get your money out.

It’s been nominated for industry awards like “Best Cryptocurrency Trading Platform” at the Forex Awards 2025. But awards don’t protect your funds. Licenses do.

For every positive review praising the AI system or the low spreads, there’s a Reddit thread from someone who lost weeks waiting for a withdrawal. For every article calling it “world-leading,” there’s a watchdog report calling it “high-risk.”

Choose your priorities. If safety and transparency matter, walk away. If you’re chasing high leverage and advanced tools and you’re okay with the possibility of losing everything - then go ahead. Just don’t blame anyone but yourself when things go wrong.

Is GIBXChange regulated by any official financial authority?

No. GIBXChange claims to comply with FCA, ASIC, and NFA, but there is no verifiable evidence of registration or licensing with any of these agencies. Independent watchdogs like WikiFX and Forex Wikibit confirm the platform operates without recognized regulatory oversight, making it a high-risk option for traders.

Can I trust GIBXChange with my crypto deposits?

You can’t truly trust it. While GIBXChange uses cold storage and multi-factor authentication, there are no public audits, reserve proofs, or insurance policies. Without regulation, there’s no legal requirement for them to safeguard your funds. If the platform shuts down or gets hacked, you have no recourse.

What are the main complaints about GIBXChange?

The most common complaints are delayed withdrawals (sometimes over 7 days), account verification issues, and lack of transparency. Users report difficulty reaching support, inconsistent communication, and no clear explanation for frozen funds. Social media sentiment analysis shows 58% negative sentiment, mostly due to regulatory concerns and withdrawal problems.

Does GIBXChange offer better fees than Binance or Coinbase?

GIBXChange has competitive spreads - as low as 0.3 pips on forex pairs and no fixed trading fees on crypto. But fees aren’t the only factor. Binance and Coinbase offer lower withdrawal fees, faster processing, and built-in insurance. With GIBXChange, you’re paying for speed and features, but risking your entire deposit on an unregulated platform.

Is GIBXChange good for beginners?

No. The platform is designed for experienced traders familiar with MetaTrader 5, grid trading, and leverage. Beginners will find the interface overwhelming and the risks too high. Without regulation, even small mistakes can lead to total loss with no safety net. Stick to beginner-friendly platforms like Coinbase or Kraken if you’re new to crypto.

What happens if GIBXChange shuts down?

If GIBXChange shuts down, you likely lose your funds. There’s no deposit insurance, no regulatory body to file a complaint with, and no legal obligation for them to return your assets. Unlike regulated exchanges, which are required to keep client funds separate and insured, GIBXChange operates without any such protections.

Are there any legitimate alternatives to GIBXChange?

Yes. For crypto and forex trading in one platform, consider regulated brokers like eToro (for crypto and CFDs) or Interactive Brokers (for stocks, forex, and crypto). For pure crypto trading, Binance, Kraken, and Coinbase are all regulated, audited, and offer better security and customer support. You don’t need to sacrifice features for safety - the top platforms offer advanced tools too.

ty ty

November 12, 2025 AT 07:52tom west

November 13, 2025 AT 19:39Johanna Lesmayoux lamare

November 14, 2025 AT 09:26BRYAN CHAGUA

November 15, 2025 AT 02:54Debraj Dutta

November 15, 2025 AT 12:29dhirendra pratap singh

November 16, 2025 AT 23:05Arthur Coddington

November 17, 2025 AT 19:45Phil Bradley

November 18, 2025 AT 10:51Stephanie Platis

November 18, 2025 AT 22:03Michelle Elizabeth

November 20, 2025 AT 06:08Joy Whitenburg

November 22, 2025 AT 03:50Kylie Stavinoha

November 22, 2025 AT 15:44Diana Dodu

November 23, 2025 AT 22:27Raymond Day

November 24, 2025 AT 00:26Noriko Yashiro

November 24, 2025 AT 17:27Atheeth Akash

November 25, 2025 AT 13:28James Ragin

November 26, 2025 AT 05:57