Crypto Exchange Red Flag Checker

How to Use This Tool

Check if a crypto exchange is legitimate by evaluating key criteria from real-world examples like EOSex. This tool helps you identify red flags that indicate potential scams or abandoned projects.

Red Flag Checkpoints

Results

Back in 2018, EOSex promised something no other crypto exchange dared to: 100% of its profits going straight to EXP token holders. No shareholders. No hidden fees buried in fine print. Just you, your tokens, and a share of the trading revenue. It sounded too good to be true-and in many ways, it was.

The Promise: A Fair Exchange for the EOS Community

EOSex wasn’t built to compete with Binance or Coinbase. It was built for the EOS community. Launched in late 2018, the platform positioned itself as the first hybrid exchange connecting EOS, TRON, and Ethereum networks. That meant users could trade across blockchains without jumping between platforms. For EOS holders, that was a big deal. At the time, EOS was one of the top blockchains by active addresses, and users wanted a dedicated, fast, low-cost trading spot.

The real hook? Profit-sharing. Every dollar the exchange made from trading fees, withdrawal fees, or listing fees was distributed to EXP token holders. No middlemen. No corporate profits. The idea was simple: if you helped grow the platform by holding EXP, you got paid. It wasn’t just a token-it was a stake in the business.

That model was rare. Most exchanges kept profits for themselves. Even decentralized exchanges like Uniswap didn’t pay users back. EOSex claimed to be different. It called itself a "distributed governance system," where token holders could influence decisions. That sounded like the future of finance-decentralized, transparent, and fair.

The Reality: A Platform Frozen in Time

But here’s the problem: no one’s heard from EOSex since 2019.

Check their website today. It’s either down, or it loads with outdated content from six years ago. Their Steemit posts-once the main hub for updates-are silent. The EXP token? No active trading pairs on major exchanges. No price data on CoinGecko or CoinMarketCap. Even CoinCodex, which lists historical info, shows no recent activity.

There’s no mobile app. No API documentation. No customer support channels. No new team announcements. No roadmap updates. Not even a tweet since 2020.

This isn’t just a quiet project. This is a ghost. And the evidence is everywhere:

- ICO timestamp: October 19, 2018 (1539900255 Unix time). That’s the last verifiable date.

- Latest community post: A bounty campaign announcement from 2018, cut off mid-sentence.

- No Reddit threads, no Trustpilot reviews, no user testimonials-just promotional content from the team itself.

- No regulatory disclosures. No KYC/AML info. No withdrawal limits. Nothing.

Even the "hybrid" model-meant to blend the speed of centralized exchanges with the security of decentralized ones-never got proven. No benchmarks. No uptime stats. No trading volume numbers. How could they claim to be "the best crypto exchange of 2019" if no one was using it?

Why Did It Fail?

EOSex didn’t die because it was a bad idea. It died because it had no real foundation.

First, the team disappeared. No GitHub commits. No LinkedIn profiles. No public interviews. When a project relies on trust and transparency, but offers zero visibility into who’s behind it, you’re already on shaky ground.

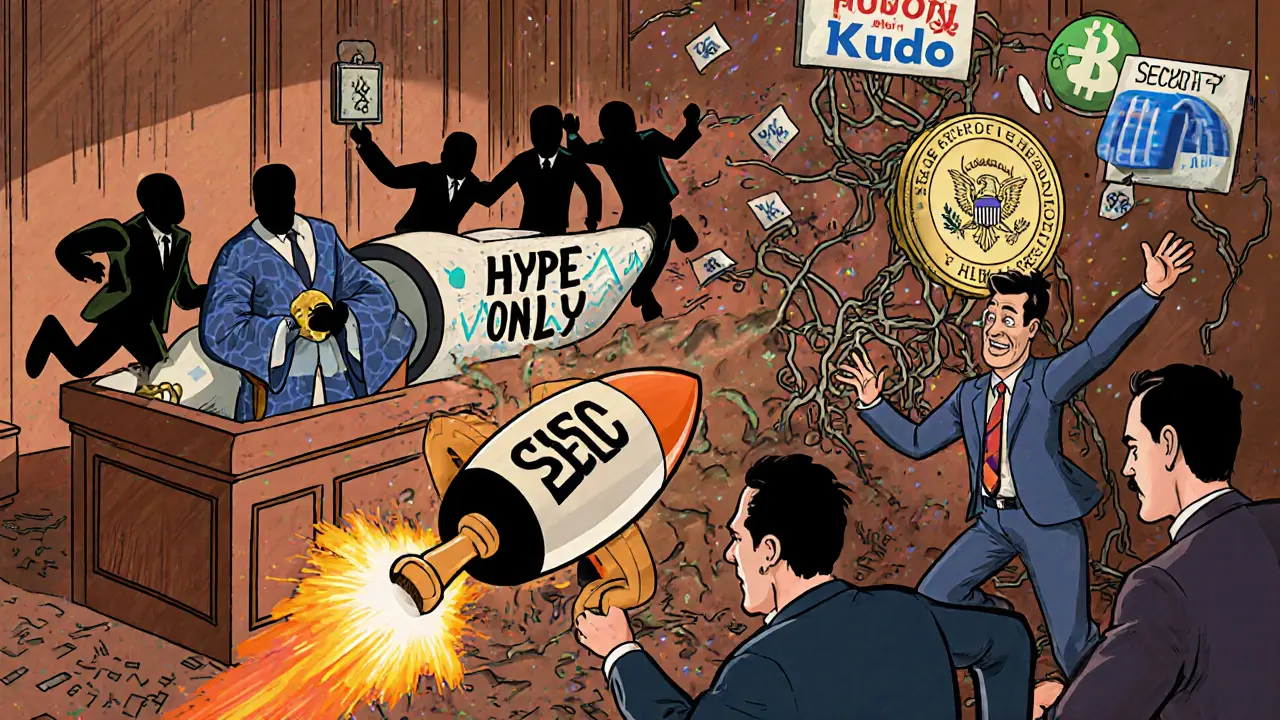

Second, the profit-sharing model was legally risky. In the U.S., the SEC has long said that if a token gives you a share of profits from someone else’s business, it’s likely a security. EOSex didn’t file as a Security Token Offering (STO). It didn’t register. It didn’t even mention compliance. That’s not just a technical oversight-it’s a legal landmine.

Third, the market moved on. By 2020, DeFi exploded. Uniswap, Aave, and Compound were giving users real yields without needing to trust a central team. EOSex’s hybrid model felt slow, outdated, and unnecessary. Meanwhile, Binance and Kraken added cross-chain support, better UX, and real customer service.

EOSex didn’t adapt. It didn’t evolve. It just… stopped.

What Was the EXP Token Worth?

The EXP token was supposed to be the heartbeat of EOSex. Holders got paid. The more you held, the more you earned. But without trading volume, liquidity, or exchange listings, the token had no real value.

Some early buyers might have gotten in during the ICO. Others bought it on small, now-dead DEXs. Today, it’s untradeable. No wallets support it. No wallets even recognize it. You can’t send it. You can’t sell it. You can’t even check your balance on a blockchain explorer.

It’s not just worthless-it’s invisible.

Who Was This For?

EOSex targeted EOS holders. That made sense in 2018. EOS was hot. But even then, the platform didn’t offer anything unique that other EOS-based tools didn’t. Wallets like Scatter and Anchor already handled trading. Exchanges like Binance already listed EOS.

It didn’t solve a real problem. It just added another layer of complexity-without the user base to sustain it.

There’s no evidence it ever attracted more than a few hundred active users. No analytics. No growth metrics. Just promises.

Lessons from EOSex

If you’re looking at a crypto exchange today, ask yourself:

- Is there recent activity? Check their Twitter, GitHub, Discord, and official blog. If it’s been quiet for over a year, that’s a red flag.

- Can you verify the team? Look for LinkedIn profiles, past projects, public interviews. Anonymous teams = high risk.

- Is the token a utility or a security? If it promises profits, tread carefully. Regulators are watching.

- Does it have real liquidity? Look for trading volume on major exchanges. If it’s only on obscure DEXs, it’s not trusted.

- Is there user feedback? Search Reddit, Twitter, and crypto forums. If no one’s talking about it-except the team-that’s a problem.

EOSex wasn’t a scam in the traditional sense. No one stole your money directly. But it was a project that ran out of steam, ran out of people, and ran out of credibility. It’s a cautionary tale of hype without execution.

Today, there are dozens of better alternatives. KuCoin, Gate.io, and Bitget all offer cross-chain trading, low fees, and active support. If you want profit-sharing, look at staking platforms like Lido or Rocket Pool. They’re transparent, regulated, and running right now.

EOSex is a relic. A footnote. A reminder that in crypto, promises mean nothing without proof.

Frequently Asked Questions

Is EOSex still operational in 2025?

No, EOSex has not been operational since at least 2020. The website is inactive, the EXP token has no trading volume, and there have been no official updates, team announcements, or community interactions in over five years. All verifiable activity dates back to 2018-2019.

Can I still trade or withdraw EXP tokens?

No. The EXP token is not listed on any major exchange, and there are no known wallets or DEXs that support it. Even if you still hold EXP tokens, you cannot send, receive, or trade them. The token is effectively frozen and unrecognizable by current blockchain tools.

Was EOSex a scam?

It wasn’t a classic scam where funds were stolen outright. But it did make bold claims-100% profit sharing, cross-chain trading, distributed governance-with no follow-through. The team vanished, the platform stopped working, and users were left with worthless tokens. That’s not fraud-it’s abandonment. And in crypto, that’s just as dangerous.

Why did EOSex fail when other exchanges succeeded?

EOSex failed because it lacked transparency, user adoption, and technical sustainability. It didn’t have a real team, no active development, and no way to prove its claims. Meanwhile, exchanges like Binance and KuCoin invested in security, support, and liquidity. EOSex bet on hype; others bet on execution.

Are there any similar exchanges today that share profits with users?

Yes. Platforms like KuCoin (with its KCS token) and Bitget (with BGB) offer token-based profit-sharing where holders receive a portion of trading fees. These platforms are active, regulated, and transparent about their models. Unlike EOSex, they’ve maintained operations and grown their user base over time.

Should I invest in EXP tokens now?

Absolutely not. EXP tokens have no market value, no liquidity, and no support. Any site claiming to sell or trade EXP is either outdated or fraudulent. Treat it as lost. Focus on active, transparent projects with real usage and clear team identities.

Hanna Kruizinga

October 31, 2025 AT 14:12Okay but what if the whole thing was a honeypot? Like, they took everyone’s money, built zero infrastructure, and just vanished? I’ve seen this before - they even used the same font on their site as that one crypto rug pull from 2017. No team, no updates, no liquidity… classic ghosting. 🤡

David James

November 1, 2025 AT 10:21i think this is so sad. i really believed in the idea of profit sharing. i bought exp tokens and thought i was part of something real. now i just feel dumb. why dont people just be honest and say 'we need money to build this' instead of promising the moon? 😔

Shaunn Graves

November 2, 2025 AT 17:42Let’s not pretend this was an accident. This was a calculated exit scam. They knew the SEC was circling, they knew EOS was cooling off, and they knew no one could verify their ‘hybrid’ tech. They didn’t fail - they planned to disappear. The fact that no one’s been held accountable is the real crime.

Jessica Hulst

November 4, 2025 AT 13:03It’s funny how we romanticize these ‘decentralized utopias’ until the moment they stop working. We want to believe in systems that don’t need trust - but then we put all our trust in anonymous devs who never show their faces. EOSex didn’t fail because it was bad tech. It failed because it was a mirror: we wanted to believe we were building the future, but we were just buying fairy tales wrapped in whitepapers. And now we’re left holding digital ghosts. 🕯️

Kaela Coren

November 6, 2025 AT 02:28The absence of verifiable data is itself data. No GitHub commits, no domain updates, no transaction history on-chain - these aren’t oversights. They’re indicators of abandonment. The silence speaks louder than any press release ever could. This isn’t a project in hibernation. It’s a corpse with a website.

Nabil ben Salah Nasri

November 8, 2025 AT 01:23Man, this hits hard 😔 I remember when I first saw the profit-sharing model - I thought, 'Finally, something fair!' But then… crickets. No updates, no team, nothing. I still have EXP tokens in a wallet somewhere. Maybe I should just burn them for good luck? 🙏✨

alvin Bachtiar

November 8, 2025 AT 09:31This wasn't just a failure - it was a masterclass in how to build a Ponzi with a blockchain veneer. They didn't even bother hiding the fact that they had zero devs. Zero. Nada. And yet people still bought in because ‘EOS community’ sounded cool. Congrats, you got scammed by a PowerPoint deck and a Discord bot. The fact that you're still reading this means you're one of the last ones clinging to hope. Let it go. 💀

Josh Serum

November 9, 2025 AT 08:34Look, I get it - you want to believe in the dream. But if your project doesn’t have a LinkedIn page for the CEO, you’re already in trouble. And if your ‘profit-sharing’ token can’t even be traded on a DEX that’s been live for 3 years, you’re not a pioneer - you’re a cautionary tale. I’m not mad, I’m just disappointed. You had potential. You blew it.

DeeDee Kallam

November 9, 2025 AT 21:56so like… i still have my exp tokens?? like i saved them in a folder called 'future money' 😭 i thought i was smart buying them when they were cheap. now i feel like such a fool. maybe i should just delete everything and cry in peace?

Helen Hardman

November 11, 2025 AT 03:16Honestly? I still believe in the idea behind EOSex. Profit-sharing should be normal. The problem wasn’t the model - it was the execution. If they’d just had one real developer, one community call, one update… it might’ve worked. Instead, they disappeared like a ghost in a haunted blockchain. But don’t give up on the dream - look at KuCoin’s KCS. That’s what EOSex should’ve been. Keep pushing for fair models. We need more of them.

Bhavna Suri

November 11, 2025 AT 16:38This is why I don't trust crypto anymore. Everyone promises everything. No one delivers. I saw this on Reddit and thought maybe it was real. Now I see it's just another story of empty promises. I lost money. I lost trust. I lost hope. And now I just want to watch cat videos and forget all of this.

Elizabeth Melendez

November 13, 2025 AT 03:10hey i just wanted to say - i know it hurts to lose money on something you believed in. i did too with a few projects back in the day. but here’s the thing: you’re not alone. lots of us got burned. but guess what? we’re still here, still learning, still trying. maybe next time we’ll ask for more proof before we invest. maybe next time we’ll check github before we buy. i’m proud of you for not giving up on crypto entirely. keep going. 💪

Phil Higgins

November 13, 2025 AT 20:57The real tragedy isn’t the lost tokens - it’s the lost potential. EOSex could’ve been a blueprint for ethical DeFi. Instead, it became a monument to hubris. The team didn’t just vanish - they abandoned a community that trusted them. That’s not just bad business. That’s moral failure. And yet, here we are, still talking about it. Maybe that’s the only justice left: remembering, and warning others.

Genevieve Rachal

November 14, 2025 AT 00:25Wow. Just… wow. You wrote a 2000-word obituary for a project that never existed. And yet, somehow, you still managed to make it sound like it was important. Spoiler: it wasn’t. This isn’t journalism. It’s necromancy. Wake up. No one cared then. No one cares now. Stop romanticizing dead crypto ghosts.

Eli PINEDA

November 15, 2025 AT 20:57wait so exp token is just… gone? like… if i had it in my wallet do i just delete it? or is it still on the chain? i dont even know how to check… someone pls help im so confused 😅