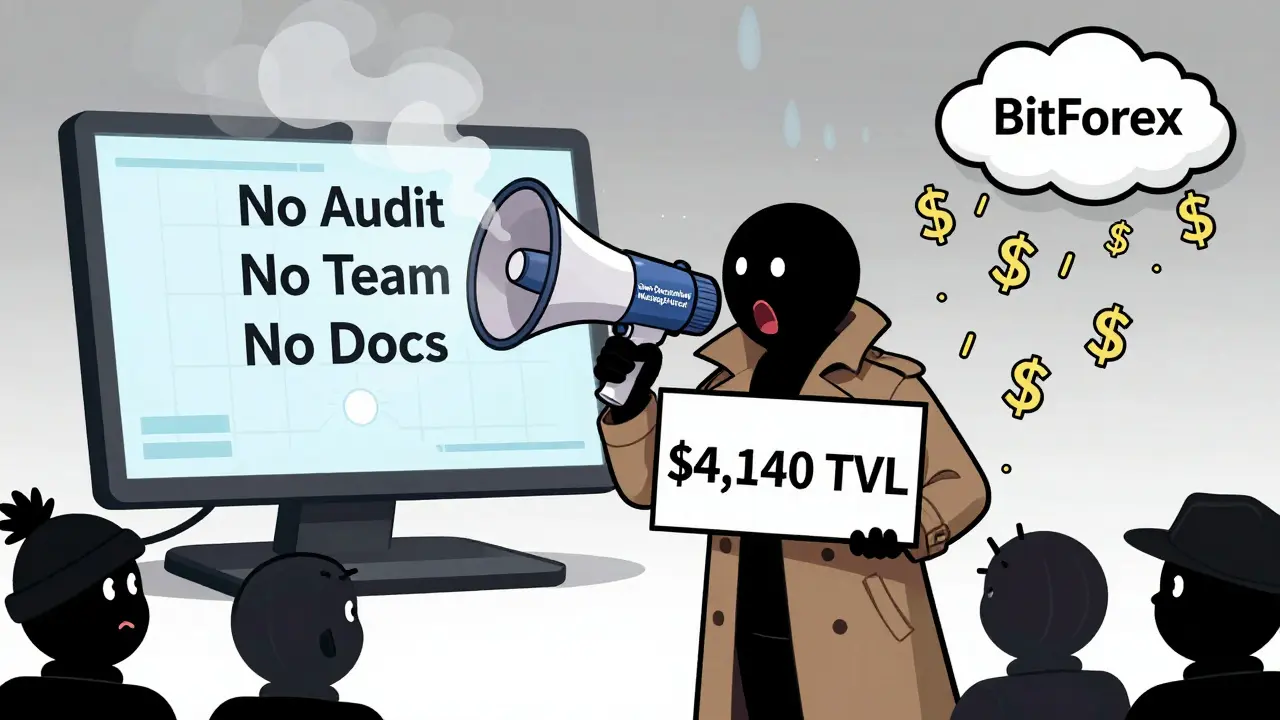

When you hear the name EazySwap, you might expect a sleek, fast, user-friendly crypto exchange that lets you swap tokens in seconds. But what you actually get is something far less impressive - a barely noticeable player in a market dominated by giants. As of December 2025, EazySwap’s Total Value Locked (TVL) sits at just $4,140 across a single blockchain network. That’s not a typo. Four thousand one hundred and forty dollars. For context, even the smallest functional decentralized exchange (DEX) typically has over $1 million in liquidity. EazySwap doesn’t just lag behind - it’s practically invisible in the crypto landscape.

What Even Is EazySwap?

EazySwap isn’t a standalone exchange. It’s a sub-platform of BitForex, a centralized exchange that ranked #37 globally in late 2025 with a 24-hour trading volume of around $150 million. EazySwap operates as an Automated Market Maker (AMM), meaning it uses smart contracts instead of traditional order books to match trades. But unlike Uniswap or PancakeSwap, which run on multiple blockchains and handle billions in daily volume, EazySwap is locked to one chain - and no one knows which one. No public documentation, no whitepaper, no GitHub repo. Just a name, a TVL figure, and a vague label: “semi-decentralized matching protocol.” That term sounds fancy, but it’s meaningless without details. What does “semi-decentralized” mean here? Is it using a centralized server to route trades? Are liquidity pools managed by a team behind the scenes? Are users’ funds ever held in custodial wallets? No one’s saying. The lack of transparency isn’t just a gap - it’s a red flag.Why the TVL Matters More Than Anything Else

TVL isn’t just a metric. It’s the heartbeat of any DEX. It tells you how much trust users have placed in the platform. $4,140 means almost no one is using it. No serious trader, no DeFi enthusiast, no yield farmer would risk their money here. Compare that to Uniswap, which holds over $10 billion, or even a niche DEX like SushiSwap, which still manages $500 million. EazySwap’s liquidity is so low that even a single large trade could wipe out its entire pool and cause massive slippage. Low TVL also means low security. DEXs with minimal liquidity are prime targets for flash loan attacks. If someone borrows $1 million in a single transaction and manipulates the price feed for a few seconds, they can drain the pool before anyone notices. With only $4,140 in the pool, the attack wouldn’t even need to be sophisticated. It would be trivial. And there’s no public audit record to prove EazySwap’s smart contracts are safe. Zero. Nada.Who’s Behind It? No One Knows

There’s no team page. No LinkedIn profiles. No Twitter account with verified status. No Telegram group with active moderators. No GitHub commits. No press releases. No interviews. Nothing. Even BitForex’s own website doesn’t mention EazySwap in its product list. The only references to EazySwap come from two obscure sources: Slashdot’s 2025 comparative articles (which repeat the same three-word phrase - “highly professional and sophisticated” - without explaining what that means) and ChainUnified’s analytics dashboard (which tracks the TVL but offers zero context). This isn’t just anonymity - it’s obscurity. Legitimate crypto projects, even small ones, usually have at least a core team, a roadmap, or a community. EazySwap has none. That raises a simple question: Is this a real project, or just a placeholder for someone trying to collect small fees from unsuspecting users?

One User Review? That’s It

The only user feedback available comes from Bestchange, a third-party exchanger listing site. One anonymous user wrote: “Excellent exchange! Although I have only been using it for a short time, it pleasantly surprised me - fast, convenient and intuitive to use.” That’s it. One review. No ratings. No follow-ups. No complaints. No discussion on Reddit. No threads on Bitcointalk. No YouTube tutorials. No Medium articles breaking down how to use it. You can’t build trust on a single sentence from someone who hasn’t even used it for a month. And here’s the kicker - if EazySwap were actually fast and intuitive, why wouldn’t more people be using it? Why wouldn’t there be dozens of reviews? Why isn’t it listed on CoinGecko or CoinMarketCap? The absence of user data isn’t an oversight. It’s a signal.No Fees. No Tokens. No Features

You’d think a platform calling itself a “crypto exchange” would at least tell you how much it costs to trade. But EazySwap doesn’t publish its fee structure anywhere. Are there maker-taker fees? Liquidity provider rewards? Withdrawal charges? Nothing. No mention of a native token. No staking. No governance. No API for developers. No mobile app. No browser extension. No documentation. Compare that to even the smallest DEXs like SushiSwap or Trader Joe. They may not be giants, but they have clear fee models, tokenomics, community governance, and developer tools. EazySwap has none of that. It’s a hollow shell.

Is It Connected to BitForex? Maybe. But So What?

Some sources claim EazySwap is a sub-platform of BitForex. If true, that might suggest access to BitForex’s user base or liquidity. But BitForex itself is a centralized exchange with a modest trading volume. It doesn’t have the kind of infrastructure or reputation to lift a tiny DEX like EazySwap into relevance. Plus, there’s zero proof that users can move funds between BitForex and EazySwap. No integration screenshots. No tutorial videos. No help articles. Even if the connection exists, it doesn’t help. If you’re looking for liquidity, you’d go to a major DEX. If you want fast trades, you’d use a centralized exchange like Binance or Kraken. EazySwap sits in a no-man’s land - too decentralized to be trusted, too small to be useful.Final Verdict: Avoid Unless You’re Experimenting With Risk

EazySwap isn’t a scam - at least, not in the classic sense. There’s no evidence it’s stealing funds or running a rug pull. But it’s also not a real exchange. It’s a ghost. A digital mirage. A footnote in a market that’s moved on. If you’re a beginner looking for a simple way to swap tokens, skip it. If you’re a seasoned trader chasing yield, don’t touch it. If you’re curious and want to throw a few dollars into a test wallet just to see what happens - fine. But don’t expect support. Don’t expect liquidity. Don’t expect it to last. The crypto world is full of noise. Most projects fail. But EazySwap isn’t just failing - it’s barely alive. And in a space where trust is everything, silence speaks louder than any marketing slogan.What Should You Use Instead?

If you need a decentralized exchange with real liquidity:- Uniswap (Ethereum) - The original AMM. Huge liquidity, audited contracts, active community.

- PancakeSwap (BSC) - Low fees, fast trades, popular for meme coins.

- Trader Joe (Avalanche) - Strong yield farming, good UI, growing user base.

- Curve Finance - Best for stablecoin swaps with minimal slippage.

- Kraken - Strong regulatory compliance, good for beginners.

- Bybit - Excellent trading tools, low fees, active support.

- Bitget - High liquidity, copy trading, mobile app.

Is EazySwap safe to use?

No, EazySwap is not safe for any meaningful amount of funds. With only $4,140 in liquidity and no public smart contract audits, it’s vulnerable to price manipulation and flash loan attacks. There’s also no customer support, no recovery options, and no transparency about who runs it. Treat it like a testnet experiment - not a real exchange.

Does EazySwap have a mobile app?

No, EazySwap does not have a mobile app, browser extension, or API. There’s no official website with clear navigation, and no downloadable software. All access appears to be through a basic web interface, which itself is hard to find. If you’re looking for a mobile-friendly DEX, use PancakeSwap or Uniswap instead.

Is EazySwap listed on CoinGecko or CoinMarketCap?

No, EazySwap is not listed on CoinGecko, CoinMarketCap, or any other major crypto data aggregator. This is a strong indicator that the platform lacks the user base, liquidity, or transparency required to meet their listing criteria. If a project isn’t listed there, it’s not taken seriously by the industry.

What blockchain does EazySwap run on?

The blockchain EazySwap operates on is not publicly disclosed. ChainUnified’s analytics show it runs on a single chain, but the name of the chain is missing from all available sources. This lack of transparency makes it impossible to verify token compatibility, gas fees, or network security - all critical factors for any crypto platform.

Why is EazySwap’s TVL so low?

EazySwap’s TVL is low because no one trusts it. Without audits, transparency, marketing, or a clear value proposition, users have no reason to lock their funds there. In crypto, liquidity follows reputation. EazySwap has none. The $4,140 figure likely comes from a handful of test wallets or bots - not real users looking to trade.

Can I earn rewards or stake tokens on EazySwap?

There is no evidence that EazySwap offers staking, yield farming, or any kind of token rewards. No native token has been identified, and no incentive program is documented. If you’re looking to earn passive income from DeFi, platforms like Aave, Compound, or even smaller ones like SushiSwap offer clear, audited reward structures - EazySwap does not.

Athena Mantle

January 27, 2026 AT 23:55Okay but like… $4,140? 😭 That’s less than my monthly Starbucks habit. I swear if I threw my crypto into a toaster and called it a ‘DEX’, I’d get more TVL. This isn’t a platform-it’s a digital ghost town with a fancy name. 🤡

carol johnson

January 28, 2026 AT 09:16YASSS. I knew it. I KNEW IT. This is what happens when you let influencers name projects instead of engineers. ‘EazySwap’? Bro. It’s not eazy. It’s a trap wrapped in a mystery inside a non-existent whitepaper. 🙃

Paru Somashekar

January 29, 2026 AT 06:26While the analysis presented is thorough and methodical, it is imperative to emphasize that decentralized finance platforms must adhere to the foundational principles of transparency, auditability, and liquidity. The absence of these elements in EazySwap renders it functionally non-viable within the broader DeFi ecosystem. One must exercise extreme caution when interacting with entities lacking verifiable on-chain footprints or institutional credibility.

Steve Fennell

January 30, 2026 AT 21:50Great breakdown. I’ve seen this pattern before-tiny DEXes with zero documentation trying to ride the DeFi wave. It’s not malicious, it’s just lazy. People think ‘AMM’ means ‘magic’ and don’t check the math. EazySwap isn’t dangerous-it’s irrelevant. And in crypto, irrelevance is the quiet killer.

katie gibson

January 31, 2026 AT 03:00ok so like… who even made this?? like i searched it and all i got was a link that 404’d and then a tweet from 2023 that said ‘coming soon’?? this feels like someone’s side project that got abandoned after the first coffee break 😴

Jonny Lindva

February 1, 2026 AT 14:55Honestly, this is why I always say: if it doesn’t have a GitHub, it doesn’t exist. I’ve tried weird little DEXes before, but if I can’t see the code, I won’t touch it. EazySwap? More like EazyScam™. Just move on. There’s better stuff out there.

Jen Allanson

February 2, 2026 AT 17:47It is unconscionable that any individual would consider depositing funds into a platform with no public audit, no team identification, and no regulatory compliance. This is not merely negligent-it is an affront to the ethical foundations of financial innovation. One must ask: who benefits from this obscurity?