If you're looking for a U.S.-regulated crypto exchange that lets you spend Bitcoin like cash, CoinZoom sounds like a solid pick. It’s got a Visa debit card, remittance tools, and claims to be secure and compliant. But here’s the catch: after digging into real user experiences, trading data, and fee structures from 2025, CoinZoom isn’t the smooth ride it pretends to be.

What CoinZoom Actually Offers

CoinZoom isn’t just another exchange. It’s trying to be your crypto bank. Launched in 2018, it’s based in Salt Lake City and registered with the SEC. That means it follows U.S. financial rules - a big deal if you’re tired of offshore platforms that vanish during market crashes.

The platform gives you three main tools: trading (via CoinZoom and CoinZoom Pro), a Visa debit card that spends crypto directly, and ZoomMe, a peer-to-peer money transfer feature. The card is the star. You can use it anywhere Visa is accepted, and you earn 3% cashback in ZOOM tokens on every purchase. That’s better than most credit cards.

They support 37 cryptocurrencies as of late 2025. That’s not much compared to Coinbase’s 214 or Kraken’s 180. But CoinZoom only lists assets that meet SEC guidelines. If you care about legal safety over variety, that’s a plus.

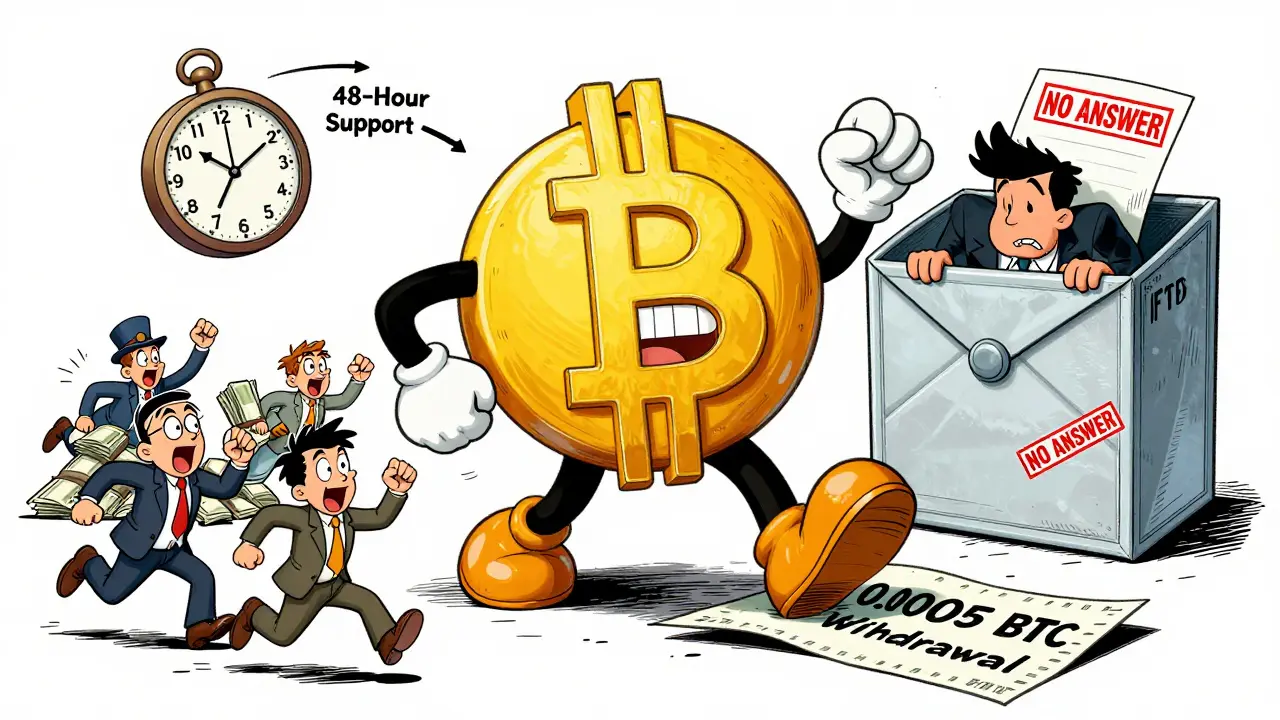

The Hidden Costs: Withdrawal Fees That Hurt

CoinZoom’s biggest flaw isn’t its interface - it’s its fees. For Bitcoin withdrawals, they charge 0.0005 BTC. That’s 116% higher than the industry average of 0.000231 BTC across 25 major exchanges.

Let’s say you want to move 1 BTC to your cold wallet. CoinZoom takes 0.0005 BTC as a fee. That’s $30+ at $60,000 per BTC. On Kraken or Binance, you’d pay under $15. For frequent traders or those moving large sums, that adds up fast.

Other fees? Not much better. Deposits via bank wire can take 2-4 days - and users report delays even when the bank says it’s sent. One user waited 14 days for a card deposit to clear, while the app showed the full balance. That’s not a glitch - it’s a systemic delay.

Two Platforms, One Messy Experience

CoinZoom runs two interfaces: the simple CoinZoom app and the advanced CoinZoom Pro. Sounds smart, right? Except they don’t work the same way.

Users report buying crypto on CoinZoom but being unable to send it from CoinZoom Pro. Or vice versa. One Reddit user said, “Unless you do it every day, you’ll get locked out of your own workflow.” That’s not user-friendly - it’s confusing.

Advanced traders might like the real-time charts and order book tools in Pro. But beginners? They get stuck. There’s no clear guide on when to use which platform. And the mobile app? It crashes more often than it should, especially during volatility.

Customer Support: Hours, Not Minutes

When things go wrong, you need help fast. CoinZoom doesn’t deliver.

On BirdEye, 35% of negative reviews mention being locked out of accounts. The fix? Sometimes 3 hours of arguing with a bot. Other times, 72 hours for a human to reply. One user said they missed a $5,000 trade because support took three days to unlock their account during a pump.

Wire transfers, card deposits, and failed transactions often sit in limbo. There’s no live chat. No phone number. Just email and a ticket system that feels like shouting into a void.

Compare that to Coinbase, where support responds in under 4 hours for most issues. CoinZoom’s average response time? 48-72 hours. That’s not acceptable for a platform that handles your money.

Security: Compliant, But Not Foolproof

CoinZoom says it uses cold storage, multi-factor authentication, and follows U.S. regulations. That’s true. And yes, it’s safer than random exchanges in the Cayman Islands.

But compliance doesn’t mean invincibility. In 2024, multiple users reported unauthorized transactions after their 2FA codes were intercepted via phishing. CoinZoom didn’t freeze the accounts fast enough. And they didn’t reimburse losses - citing “user negligence.”

They don’t offer insurance like Coinbase’s FDIC-like coverage. So if something breaks, you’re on your own. That’s a risk you should know before depositing funds.

Who Is CoinZoom Really For?

CoinZoom isn’t for everyone. Here’s who it might suit:

- You live in the U.S. and want to spend crypto daily - the Visa card is legit.

- You prioritize regulation over coin selection - 37 coins is enough if you stick to BTC, ETH, and USDT.

- You don’t trade often and don’t mind waiting days for withdrawals.

Who should avoid it?

- Active traders - high withdrawal fees and platform bugs eat into profits.

- Those who need fast support - you’ll be waiting, and you’ll hate it.

- Anyone moving large amounts - fees and delays make it impractical.

For most people, Kraken or Coinbase are better. They’re cheaper, faster, and have 10x the support staff. But if you want a crypto card and don’t mind the friction, CoinZoom still has a niche.

The Verdict: A Flawed Tool With One Great Feature

CoinZoom’s Visa card is the only thing that makes it stand out. It works. It earns rewards. It’s convenient.

But everything else? It’s broken. Withdrawal fees are sky-high. Support is slow. The two-platform system is a mess. And customer reviews are drowning in complaints.

It’s like buying a luxury car with a broken engine - looks great on the outside, but you’re stuck on the side of the road every other week.

If you’re a casual user who wants to spend crypto and doesn’t mind waiting, CoinZoom might work. But if you’re serious about trading, saving money, or moving assets quickly - look elsewhere. There are better options out there.

Is CoinZoom safe to use in 2026?

CoinZoom is one of the safer U.S.-based exchanges because it’s SEC-registered and uses cold storage. But safety isn’t just about infrastructure - it’s about reliability. The platform has had issues with account lockouts, delayed transactions, and slow support. While it’s not a scam, it’s not as secure as Coinbase or Kraken when you factor in user experience and response times.

Does CoinZoom have a mobile app?

Yes, CoinZoom has apps for iOS and Android. But users report frequent crashes, especially during high-volume trading periods. The app also doesn’t sync well with the CoinZoom Pro desktop version. If you rely on mobile trading, test it with a small amount first.

How do I withdraw Bitcoin from CoinZoom?

Go to the Wallet section, select Bitcoin, and click Withdraw. You’ll need to enter the destination address and confirm with 2FA. The fee is 0.0005 BTC per withdrawal, which is significantly higher than most exchanges. Processing takes 1-4 hours, but delays happen during high network traffic.

Can I use CoinZoom outside the U.S.?

CoinZoom is only available to U.S. residents. You need a U.S. address and Social Security Number to open an account. The Visa card works internationally, but you can’t sign up from outside the country.

What’s the difference between CoinZoom and CoinZoom Pro?

CoinZoom is the simplified version for beginners - easy to buy and hold crypto. CoinZoom Pro is for active traders, with advanced charts, order types, and real-time data. But they don’t work together. You can’t send crypto from Pro to your CoinZoom wallet. This inconsistency frustrates users and makes learning the platform harder than it should be.

Are ZOOM tokens worth holding?

ZOOM tokens give you 3% cashback on your Visa card and reduce trading fees. But they’re not listed on major exchanges, so you can’t easily sell them. Their value is tied entirely to CoinZoom’s ecosystem. If the platform declines, ZOOM tokens lose utility. Hold them only if you plan to use the card regularly.

How long does it take to verify my CoinZoom account?

Verification usually takes 1-3 business days. But users report delays up to 7 days, especially during peak times. You’ll need to upload ID and a selfie. After verification, you still can’t send crypto for another 2-5 days due to a mandatory waiting period - a major inconvenience for time-sensitive trades.