Binance TH Fee Calculator

Estimated Monthly Fees

Maker Fees: 0.00 THB

Taker Fees: 0.00 THB

Total Estimated Fees: 0.00 THB

Average Per Trade: 0.00 THB

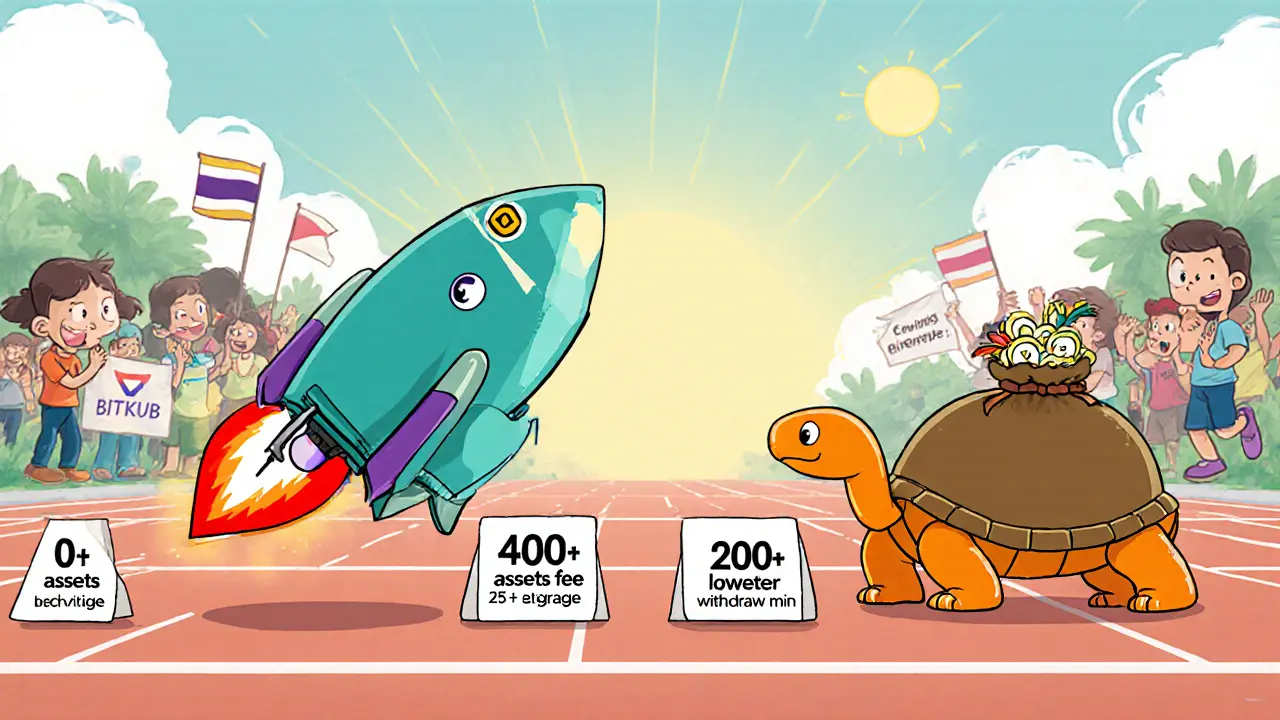

Fee Comparison: Binance TH vs. Bitkub

Binance TH

Flat Fee: 0.10% for both makers and takers

Minimum Withdrawal: 500 THB

Bitkub

Tiered Fee: 0.20–0.30% depending on volume

Minimum Withdrawal: 100 THB

Note: Binance TH offers a more predictable fee structure, while Bitkub has lower withdrawal thresholds.

If you’ve ever wondered whether Binance TH lives up to the hype, you’re not alone. Thailand’s crypto scene exploded after the SEC granted Binance a full digital‑asset licence in 2019, and today the platform boasts over 1.5million Thai users, a 400‑coin roster, and a matching engine that can crank out 1.4million orders per second. This review breaks down the fees, security, trading tools, and customer experience so you can decide if Binance TH is the right fit for your trading style.

Key Takeaways

- Binance TH offers one of the widest crypto selections in Thailand (≈400 assets) and deep liquidity, making it ideal for medium‑to‑large traders.

- Fees are flat at 0.10% for makers and takers, but withdrawal minimums are higher than local rivals.

- Security is strong - 95% of assets sit in cold wallets and 2FA is mandatory - yet past hacks remind users to stay vigilant.

- Customer support runs 9:00‑18:00 ICT only, and Thai‑language help can be slow.

- Regulatory compliance is solid; Binance TH follows Thailand SEC KYC tiers and is preparing local‑language mobile apps for Q42025.

What is Binance TH?

Binance Thailand is the localized arm of the global exchange Binance, founded by Changpeng Zhao (CZ) in 2017. After receiving a full digital‑asset exchange licence from the Thailand SEC in September2019, Binance TH launched a Thai‑centric platform that complies with local AML/KYC rules while still giving users access to the global Binance ecosystem.

Market Position and User Base

According to CryptoSiam’s Q22025 market report, Binance TH holds a 32% share of Thailand’s exchange market, trailing only Bitkub’s 48%. With over 1.5million registered users, the platform processes an average daily THB‑pair volume of US$85million, driven by both retail traders and a growing institutional segment (22% of volume in Q22025).

Trading Selection and Liquidity

Binance TH lists roughly 400 cryptocurrencies, mirroring the global catalog but filtered to meet SEC approvals. Popular Thai‑fiat pairs include BTC/THB, ETH/THB, and USDT/THB. Liquidity is deep - a user on Pantip reported filling a 500,000THB Bitcoin order with barely any slippage on 3May2025. The platform’s order‑matching engine can handle 1.4million orders per second, ensuring executions stay fast even during volatile spikes.

Fee Structure

The fee schedule, updated 1Jan2025, sets a flat 0.10% for both maker and taker trades across all pairs. This is competitive against Bitkub’s tiered 0.20‑0.30% structure. However, withdrawal fees and minimums can bite: Bitcoin withdrawals start at 500THB, whereas Bitkub allows withdrawals as low as 100THB.

Advanced Trading Features

For experienced users, Binance TH offers limit, market, stop‑limit, and OCO orders. Leverage up to 25× is available on select futures contracts, a key differentiator from domestic rivals that still lack robust derivatives. The platform also provides a fully fledged API, which algorithmic traders on Reddit’s r/ThaiCrypto praise for its reliability.

Security Overview

Security.org’s July2025 analysis scores Binance TH’s safeguards highly: 95% of funds reside in cold storage, 2FA is mandatory, and real‑time monitoring catches suspicious activity. Nevertheless, the 2019 Binance.com hack (7,000BTC) reminds users that no centralized exchange is invulnerable. Recent community reports flag a phone‑number‑porting attack in Feb2025, underscoring the need for strong account recovery practices.

KYC and Verification Tiers

All Thai users must complete KYC, which is divided into three tiers:

- Basic - 100,000THB daily withdrawal limit.

- Intermediate - 500,000THB daily limit.

- Advanced - 2,000,000THB daily limit.

Customer Support and Community Resources

Support is available via email, live chat (9:00‑18:00 ICT), and a physical office in Bangkok opened Jan2025. Average email response time sits at 72hours, while live‑chat wait times average 18minutes. Community‑driven help channels - the official Binance Thailand Telegram (≈42,000 members) and Facebook group (≈28,500 members) - often fill the gaps, sharing tutorials, API tips, and withdrawal troubleshooting.

Educational Content

Binance Academy offers 147 Thai‑language video courses covering basics to advanced trading strategies. As of May2025, the knowledge base contains 1,247 articles, and a library of 150+ video tutorials helps newcomers climb the learning curve, which typically requires 3‑5hours of hands‑on exploration.

Comparison with Bitkub

| Feature | Binance TH | Bitkub |

|---|---|---|

| Crypto selection | ≈400 assets | ≈200 assets |

| Daily THB‑pair volume | US$85M | US$70M |

| Trading fees | 0.10% flat | 0.20‑0.30% tiered |

| Withdrawal minimum (BTC) | 500THB | 100THB |

| Customer support hours | 9:00‑18:00 ICT | 24/7 |

| Leverage options | Up to 25× futures | None (as of 2025) |

| Local payment methods | PromptPay (deposits), THB‑stablepairs | TrueMoney, PromptPay, 7‑Eleven cash‑in |

Binance TH wins on asset variety, fees, and advanced trading, while Bitkub shines for beginners thanks to a simpler UI, faster support, and lower withdrawal thresholds.

Regulatory Landscape

The Thailand SEC tightened KYC rules in Jan2025, prompting a brief 72‑hour service pause while Binance TH updated its verification flow. Looking ahead, a proposed 2% transaction tax slated for Q12026 could shave 15‑20% off trading volumes, according to Binance’s internal impact assessment. Binance’s proactive engagement with regulators-evident in its PromptPay integration and forthcoming tokenized Thai government bond offering-positions it to weather these policy shifts.

Future Roadmap

June2025 announced a roadmap that includes:

- A dedicated Thai‑language mobile app by Q42025.

- Expanded fiat‑on‑ramp options via 7‑Eleven and BigC stores.

- Launch of regulated tokenized Thai government bonds by Q22026.

Pros and Cons Summary

- Pros: Vast crypto catalog, deep liquidity, low flat fees, advanced order types, strong security.

- Cons: Higher withdrawal minimums, limited Thai‑language support hours, missing some local wallets (TrueMoney), steeper learning curve.

Who Should Use Binance TH?

• Advanced traders looking for leverage, futures, and API access.

• Institutional players needing high volume and compliance documentation.

• Retail users who value a huge selection of altcoins and are comfortable navigating a feature‑rich UI.

Who Might Prefer Another Exchange?

If you trade small amounts daily, need 24/7 Thai support, or prefer ultra‑low withdrawal thresholds, Bitkub or SatangPro may suit you better.

Final Verdict

Binance TH isn’t the “best overall” exchange for every Thai trader, but it remains a powerhouse for anyone who prioritizes asset variety, deep liquidity, and advanced tools within a regulated framework. Its security measures are robust, yet users must stay alert to potential hacks and phishing attempts. We rate it 4.3/5 based on the data above.

Frequently Asked Questions

How do I verify my Binance TH account?

Upload a Thai national ID, a selfie, and a proof‑of‑address (utility bill). After the basic tier, you can submit additional documents (bank statement, source‑of‑funds) to lift withdrawal limits.

What are the trading fees on Binance TH?

Both maker and taker fees are a flat 0.10% on all spot trades. Futures fees vary by contract but start around 0.02% for takers.

Can I deposit Thai Baht directly?

Yes. Binance TH supports PromptPay deposits (average 2.3‑minute processing) and partners with convenience stores for cash‑in.

Is Binance TH safe for large withdrawals?

The platform stores 95% of funds offline and enforces 2FA. Large withdrawals trigger additional verification steps, and the tiered KYC limits help manage risk.

What’s the biggest downside of Binance TH?

Higher minimum withdrawal amounts and limited Thai‑language support hours can frustrate casual traders.

Leynda Jeane Erwin

October 10, 2025 AT 08:26The fee structure listed indicates a flat 0.10% rate across both maker and taker trades for Thai users.

Siddharth Murugesan

October 15, 2025 AT 08:26Looks like the calculator is missing actual numbers, which is typical for these flashy platforms. The UI feels half‑baked, like they rushed to launch a Thai version without proper testing. I dont trust a site that cant even handle a simple input without throwing a JS error. Also, their claim of "predictable" fees is a joke when the withdrawal minimum is 500 THB – that hurts small traders. Overall, its a red flag for anyone thinking about committing real money.

Ethan Chambers

October 20, 2025 AT 08:26Ah, the grand drama of fee comparisons! While everyone’s busy bickering, the real story is that Binance TH simply mirrors the global model, no surprises there. Yet, the narrative pushes Bitkub as the underdog, which feels contrived. In any case, the numbers speak louder than the theatrics.

gayle Smith

October 25, 2025 AT 08:26Deploying the standard 0.10% flat fee paradigm, Binance TH leverages volume‑agnostic pricing, streamlining cost analysis for institutional participants. This approach eliminates tier‑based ambiguities prevalent in regional exchanges.

mark noopa

October 30, 2025 AT 07:26When we contemplate the ontological essence of fee structures, we must first acknowledge that any monetary imposition is a manifestation of value extraction, a subtle dance between decentralization and central oversight. 😎 Binance TH’s flat 0.10% model, at first glance, appears to eschew the labyrinthine tiered systems that engender cognitive overload for traders. Yet, beneath this veneer of simplicity lies a deeper philosophical commitment to egalitarianism: every participant, regardless of volume, bears an identical marginal cost. This uniformity, while seemingly democratic, also serves as a strategic equalizer, preventing high‑frequency actors from leveraging fee arbitrage to dominate market liquidity.

Moreover, the 500 THB withdrawal floor functions as a gatekeeping mechanism, ensuring that the network’s operational overhead remains sustainable without marginalizing the low‑volume user, who, in practical terms, perceives the ceiling as a negligible barrier. In juxtaposing Binance TH with Bitkub’s tiered schema, one observes a dialectical tension between predictability and flexibility. Bitkub’s 0.20–0.30% range, modulated by trading volume, introduces a dynamic elasticity, catering to power traders seeking marginal savings, whereas Binance TH’s static rate offers deterministic budgeting for novices.

From a macro‑economic perspective, the fixed fee model may attenuate speculative churn, as traders are less incentivized to fragment orders merely to skim fee differentials. Simultaneously, this structure underscores the platform’s confidence in its liquidity pool, banking on volume growth rather than fee competition.

In essence, Binance TH’s fee architecture is not merely a numeric artifact; it is an emblem of the platform’s strategic philosophy, balancing accessibility, sustainability, and market stability. 🌟

Rama Julianto

November 4, 2025 AT 07:26For anyone diving into Binance TH, keep an eye on the withdrawal minimum – 500 THB can bite you if you’re moving small amounts. The flat 0.10% fee is straightforward, but remember to factor in network fees on top of that. If you trade often, the consistency helps with budgeting, but don’t ignore the occasional promo that might shave a few basis points. Also, the platform supports many crypto pairs, so you have flexibility beyond the Thai market.

Helen Fitzgerald

November 9, 2025 AT 07:26Hey folks! If you’re new to the Thai crypto scene, Binance TH’s simple fee model makes it easier to plan your trades. Give the calculator a spin and see how much you’d actually pay.

Brandon Salemi

November 14, 2025 AT 07:26Good point, Helen – the flat fee really cuts down the mental math.

Nina Hall

November 19, 2025 AT 07:26What a bright spot! Binance TH’s predictable fees feel like a breath of fresh air compared to the confusing tier structures elsewhere. It lets us focus on strategy rather than fee gymnastics. Plus, the UI looks clean enough for quick checks.

Mureil Stueber

November 24, 2025 AT 07:26The straightforward fee schedule helps newcomers understand costs without getting lost in jargon. Also, the minimal withdrawal threshold is decent for most users. Overall, a balanced offering.

Emily Kondrk

November 29, 2025 AT 07:26Everyone’s talking about fees while the real agenda is data harvesting. Binance TH may disguise its motives behind a “simple” fee, but every transaction feeds a larger surveillance net. Keep an eye on what metadata they collect; it’s not just about costs.

Laura Myers

December 4, 2025 AT 07:26Oh wow, look at that, another “transparent” fee – as if we haven’t seen this script before.

Leo McCloskey

December 9, 2025 AT 07:26Honestly, the whole fee battle feels like a smoke‑screen; the real issue is market manipulation-; just saying.

debby martha

December 14, 2025 AT 07:26i dont think they really care abt small traders, its all big money talk.

Ted Lucas

December 19, 2025 AT 07:26Let’s get those charts rolling! 📈 The flat fee is a game‑changer for anyone serious about scaling.

ചഞ്ചൽ അനസൂയ

December 24, 2025 AT 07:26Look, the fee simplicity can be a good foundation, but don’t forget to diversify your exchanges. A balanced approach mitigates platform‑specific risks. Keep learning, keep adapting, and the market will reward you.

Jon Asher

December 29, 2025 AT 07:26Sounds like a solid start for newcomers; simplicity is key.

Scott Hall

January 3, 2026 AT 07:26Agree, the straightforward pricing makes it easier for everyone.

Jade Hibbert

January 8, 2026 AT 07:26Oh great, another “easy fee” – because we all needed more simplicity in a chaotic market.

hrishchika Kumar

January 13, 2026 AT 07:26Embracing the clear fee structure can empower traders from all backgrounds, especially those just stepping into crypto. Let’s celebrate tools that lower barriers and foster inclusive participation.