ADEN launched on July 23, 2025, as a new player in the crowded world of crypto exchanges - but it’s not trying to be another Binance or Coinbase. Instead, it’s built for one specific group: traders who want to trade derivatives without handing over control of their funds or jumping through KYC hoops. If you’re tired of centralized exchanges freezing withdrawals or demanding personal documents just to open an account, ADEN might be worth a look. But here’s the real question: is it actually usable in early 2026, or is it still just a promising idea with little traffic?

What ADEN Actually Does

ADEN is a decentralized derivatives exchange that specializes in perpetual futures contracts denominated in USDT and USDC. That means you can go long or short on Bitcoin, Ethereum, and other major coins using leverage - without ever depositing your coins into ADEN’s wallet. Your funds stay in your own WalletConnect-compatible wallet, like MetaMask or Phantom. This isn’t just a marketing buzzword - it’s the core of how ADEN works. No custodial risk. No account freezes. No delays when markets move fast.

It runs on the Orderly Network, the same infrastructure behind ASTER, another decentralized exchange. This partnership gives ADEN access to deep liquidity pools and fast trade execution. The orderbook is shared, so even with a small user base, trades don’t suffer from slippage like you’d see on smaller DEXs. That’s a smart move. Most new DEXs fail because they can’t match the liquidity of centralized rivals. ADEN sidestepped that by piggybacking on an existing, proven network.

How It Feels to Trade on ADEN

When you first land on ADEN’s website, the interface looks almost identical to a centralized exchange like Kraken Pro or Bybit. Sliders for leverage, candlestick charts, order books - all familiar. That’s intentional. The team behind ADEN knows that most traders won’t switch from Binance unless the experience feels the same. The difference? Every trade settles on-chain. There’s no middleman holding your money. You sign each trade with your wallet, and it gets executed directly on the blockchain.

The biggest win? Gasless trading. Unlike Uniswap or dYdX, where you pay Ethereum or Solana network fees just to place a limit order, ADEN absorbs those costs. You don’t need ETH, SOL, or BNB just to trade. That removes one of the biggest friction points for new users entering DeFi. I’ve seen traders abandon DEXs after spending $15 in gas trying to open a $50 trade. ADEN fixes that.

It supports six major blockchains: BNB Chain, Arbitrum, Optimism, Base, Ethereum, and Solana. You can connect your wallet on any of them and start trading immediately. No need to bridge funds manually - ADEN handles cross-chain liquidity automatically. That’s rare. Most platforms force you to choose one chain and stick with it.

Fees: The Real Standout Feature

ADEN’s fee structure is the most aggressive in the decentralized space:

- Maker fees: 0%

- Taker fees: 0.0009% (that’s 0.09 basis points)

For comparison, Kraken Pro charges 0.02% to 0.1% for takers depending on volume. Coinbase charges up to 0.6% for crypto-to-crypto trades. Even Deribit, a top centralized derivatives platform, charges 0.02% for takers. ADEN’s fee is nearly 200 times lower than the industry average. That’s not a gimmick - it’s a real advantage for active traders. If you’re scalping or making dozens of trades a day, those savings add up fast.

But here’s the catch: ADEN doesn’t have a native token. No $ADEN coin to stake, no fee discounts for holding, no rebates. That means they’re not trying to build a token economy. They’re betting on volume alone. That’s risky. Most successful DEXs use token incentives to lure liquidity. ADEN is going all-in on price and execution.

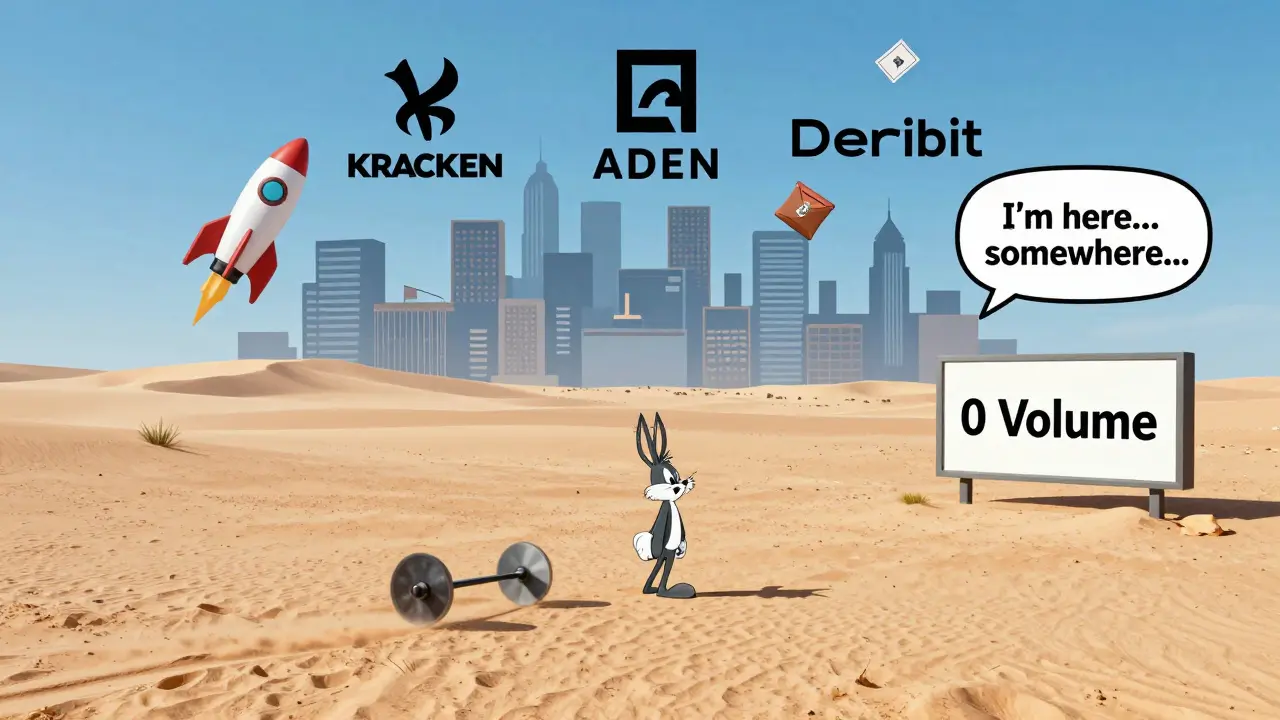

The Big Problem: No Volume

Here’s where ADEN’s story gets shaky. As of February 2026, CoinMarketCap lists ADEN as an Untracked Listing. That means no reliable volume data exists. No daily trades. No market depth. No charts. Just a blank page.

Why? Two possibilities:

- Very few people are using it.

- ADEN hasn’t integrated its data feeds properly with tracking platforms.

Given that it’s been live for over seven months, the first option is more likely. A platform with 0.0009% fees should attract traders - if they knew it existed. But most people still haven’t heard of it. The lack of visibility isn’t just a technical issue - it’s a trust issue. If you’re trading $100,000 in leverage, you want to know others are trading too. Liquidity is confidence.

Compare that to Uniswap, which handles over $2 billion in daily spot volume. Or dYdX, which still moves $300 million daily in derivatives despite competition. ADEN has no such numbers. That’s not just a gap - it’s a chasm.

Who Should Use ADEN?

ADEN isn’t for everyone. If you’re a beginner who just bought your first Bitcoin and wants to hold it, walk away. This isn’t a wallet. It’s a trading engine.

ADEN is built for three types of traders:

- Privacy-focused traders who refuse to submit KYC documents.

- Active derivatives traders who make dozens of trades a day and care about fee savings.

- Multi-chain users who already hold assets across Solana, Arbitrum, and Base and want to trade without bridging.

If you’re in the U.S., EU, or any region with strict crypto regulations, ADEN’s no-KYC model could be a red flag. Regulators are cracking down on non-compliant platforms. While ADEN is registered in Seychelles - a jurisdiction known for crypto-friendly laws - that doesn’t protect you if your home country bans access.

Also, there’s zero customer support. No live chat. No email ticket system. No phone line. If you mess up a trade or your wallet gets locked, you’re on your own. That’s fine if you’ve traded on DeFi before. Not fine if you’re still learning.

How ADEN Compares to the Competition

| Feature | ADEN | Deribit | dYdX | Kraken Pro |

|---|---|---|---|---|

| Type | Decentralized | Centralized | Decentralized | Centralized |

| Supported Assets | 12 major coins | 25+ coins | 15+ coins | 20+ coins |

| Maker Fee | 0% | 0.02% | 0.02% | 0.00% (high volume) |

| Taker Fee | 0.0009% | 0.04% | 0.05% | 0.02% |

| KYC Required | No | Yes | No | Yes |

| Gas Fees | None | None (off-chain) | Yes | None |

| Trading Volume (Daily) | Untracked | $150M+ | $300M+ | $1B+ |

| Supported Chains | 6 | 1 (off-chain) | 1 (Ethereum) | 1 |

ADEN wins on fees and decentralization. But it loses on volume, brand trust, and support. Deribit and Kraken Pro have been around for years. They’ve survived bear markets. They’ve handled massive outages. They’ve been audited. ADEN has none of that. It’s a startup with a great idea - but no track record.

Is ADEN Safe?

Technically, yes - because you never give up custody. If ADEN shuts down tomorrow, your funds are still in your wallet. That’s a huge advantage over centralized exchanges that have lost millions in hacks (see: Mt. Gox, FTX).

But safety isn’t just about custody. It’s about execution. If the Orderly Network goes down, ADEN stops trading. If the smart contracts have a bug, you could lose funds. There’s been no public audit of ADEN’s code, and no insurance fund to cover losses. That’s a red flag for serious traders.

Also, no one is monitoring ADEN’s liquidity. If a large trade hits the orderbook, it might not have enough depth to fill without massive slippage. That’s dangerous in volatile markets.

Final Verdict: Too Early to Bet On

ADEN has one of the cleanest, most user-friendly decentralized derivatives interfaces I’ve seen. The 0.0009% fee is unmatched. The gasless model is brilliant. The multi-chain support is forward-thinking.

But in early 2026, it’s still a prototype. Not a product.

If you’re curious, try it with $100. See how the interface feels. Test the execution speed. See if your wallet connects smoothly. But don’t risk more than you can afford to lose - because there’s no safety net.

For now, if you want reliable derivatives trading, stick with Kraken Pro or Deribit. If you want to experiment with decentralized trading without KYC, try dYdX or GMX. ADEN is interesting - but it’s not yet a replacement.

Watch it. Don’t fund it. Not yet.

Is ADEN a legitimate crypto exchange?

Yes, ADEN is a registered decentralized exchange based in Seychelles and built on the Orderly Network, a verified DeFi infrastructure. It doesn’t require KYC, which makes it legally gray in some jurisdictions, but the platform itself is technically legitimate. However, legitimacy doesn’t equal safety. There’s no public audit, no insurance, and no proven track record. Treat it as experimental.

Can I trade Bitcoin perpetuals on ADEN?

Yes, ADEN supports perpetual futures on major cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and others. All contracts are margined in USDT or USDC. You can trade with up to 25x leverage. The platform doesn’t list every altcoin - it focuses on high-volume assets to maintain liquidity.

Do I need to deposit funds into ADEN to trade?

No. ADEN is non-custodial. You connect your wallet (MetaMask, Phantom, etc.) via WalletConnect, and trades are executed directly from your wallet. Your funds never leave your control. You only need enough USDT or USDC in your wallet to cover margin and fees. There’s no deposit step.

Why is ADEN not showing up on CoinMarketCap with real volume?

ADEN is currently listed as an "Untracked Listing" because it hasn’t successfully integrated its trading data with CoinMarketCap’s reporting system. This could mean either very low trading activity or a technical issue with data feeds. Most reputable exchanges automatically send volume data. ADEN hasn’t done this yet, which raises questions about adoption or transparency.

Is ADEN better than Uniswap for trading?

They serve different purposes. Uniswap is for spot trading - buying and selling crypto directly. ADEN is for derivatives - betting on price movements with leverage. If you want to buy Bitcoin and hold it, use Uniswap. If you want to go long or short Bitcoin with 10x leverage, ADEN is the better tool. They’re not competitors - they’re complements.

Can I use ADEN if I’m in the United States?

Technically, yes - ADEN doesn’t block users by location. But U.S. regulators have cracked down on non-KYC derivatives platforms. Using ADEN could put you in legal gray territory. Most U.S. users avoid such platforms to prevent tax or compliance issues. If you’re in the U.S., consult a crypto-savvy tax advisor before trading.

What happens if ADEN shuts down?

If ADEN shuts down, your funds remain safe in your wallet. Since ADEN is non-custodial, it never holds your assets. You can still access your positions and withdraw funds using your wallet. However, if the Orderly Network fails or smart contracts are exploited, you could lose funds. That’s the risk of DeFi - no central authority to turn to.

Does ADEN have a mobile app?

No, ADEN doesn’t have a native mobile app. It’s a web-based platform that works on mobile browsers. You can connect your wallet using WalletConnect on your phone and trade from your browser. The interface is responsive, but it’s not as polished as apps from Kraken or Bybit. For now, desktop use is recommended for serious trading.